By Prathik Desai

Photo by Block Unicorn

Bulldozers are idle in the heat. The land is desolate, the contract is uncertain, and the idea of transforming an encrypted money exchange company into an electric power company seems to be a dream。

A year ago, the Helios data centre in Texas was just a commitment in the desert。

Today, the situation is very different. Although the turbine was not yet operational, the contract was signed and the financing transaction was completed. Land has been leased and transformers ordered. This company, which used to benefit from volatility, is now investing in certainty。

Galaxy Digital ' s quarterly financial report as of 30 September 2025 may not have directly shown this, but a closer look at its data over the past year reveals a clear shift. Galaxy's trading department is still dealing with billions of dollars of transactions, but the movement in the coming months is clear to anyone concerned。

Every quarter and every quarter, Galaxy is becoming more like a banker than a trader。

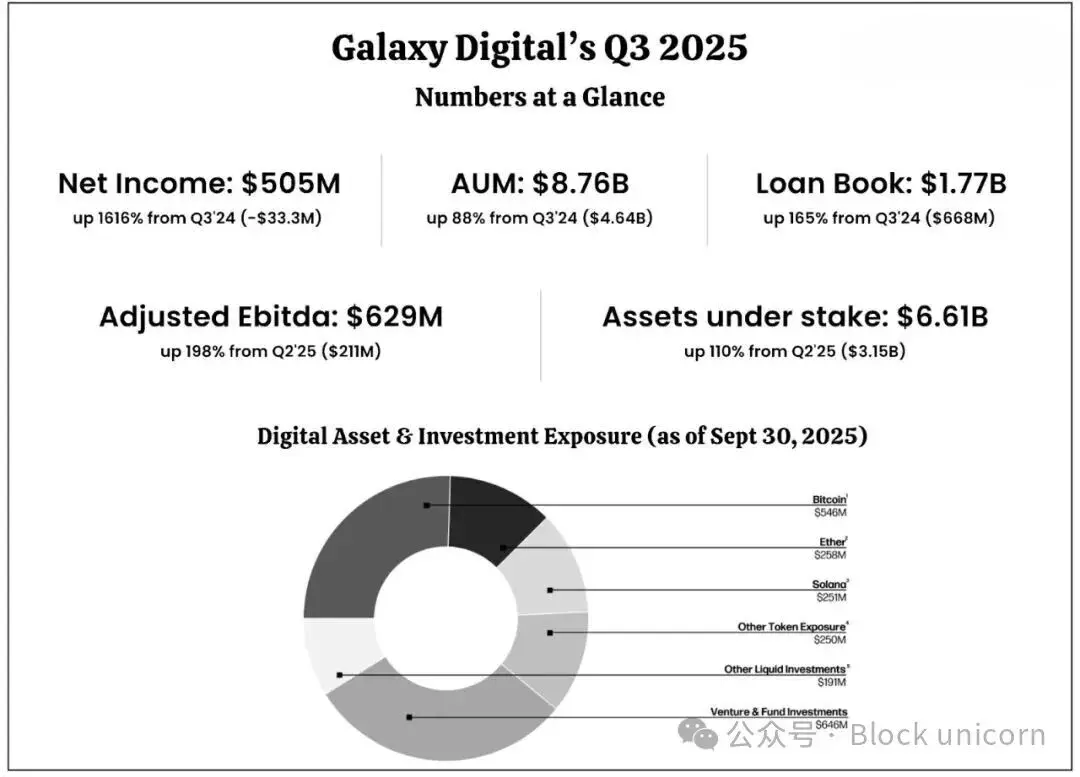

Point Snack

- Galaxy's trade volume is at an all-time high, but profits are down compared to other business blocks

- Corporate financial authority increased four times over the same year, generating $40 million in annual recurrent income, marking Galaxy ' s first predictable source of income

- Revenue from the finance and enterprise sector increased to $408 million, or 55 per cent of total adjusted gross profits

- The Helios project started as planned in the first half of 2026 and 15 years of CoreWeave lease agreement (526 MW) and $1.4 billion in project financing have been concluded

- In spite of strong profit growth, Galaxy Digital Inc.'s share price fell by more than 10 per cent

BANKER FOR DAT

More than two months ago, I discussed how the noise in Galaxy's office had changed: from the noise of traders to the soft buzz of customers keeping idle funds. Initially a side project to help issuers manage stable currency reserves, Galaxy has now been transformed into assisting enterprises to manage their digital asset bank (DAT)。

Over the past few quarters, the business sector has created reliable cash flows by providing a platform for hosting, revenue and liquidity for clients, including DAO, exchanges and start-ups. Galaxy helps these customers build their treasury and earns base point costs at each level。

Over the past 12 months, the scale of asset management in this business has increased more than fourfold, from approximately $1 billion in financial assets to more than $4.5 billion today. While revenues from this operation may be relatively moderate compared to transactions in the third quarter of 2025, it represents an important trend from a transaction-based model to a subscription-based model. The annual recurrent revenue of the enterprise ' s funds management operations is approximately $40 million, which means that it represents sustained long-term income rather than sporadic transaction gains。

However, the management of funds is not without risk or protection from market fluctuations. The Chief Executive Officer of Galaxy, Mike & Middot; and Mike Novogratz, acknowledged that the business would fluctuate with the secret currency market。

Despite these challenges, the trajectory of development is clear. Galaxy is learning every quarter how to delink income from volatility. While this is still a gradual process, the financial position of the company shows that it is on the right track。

While this is not the most exciting source of income, it is reliable and a strategic shift for a company that relies on the performance of traders to build its reputation。

The profit problem that triggered the crisis

Most of Galaxy ' s income continues to follow the old methodology of charging fees for transactions performed on behalf of clients. However, the profitability of this cost structure remains low at less than 1 per cent。

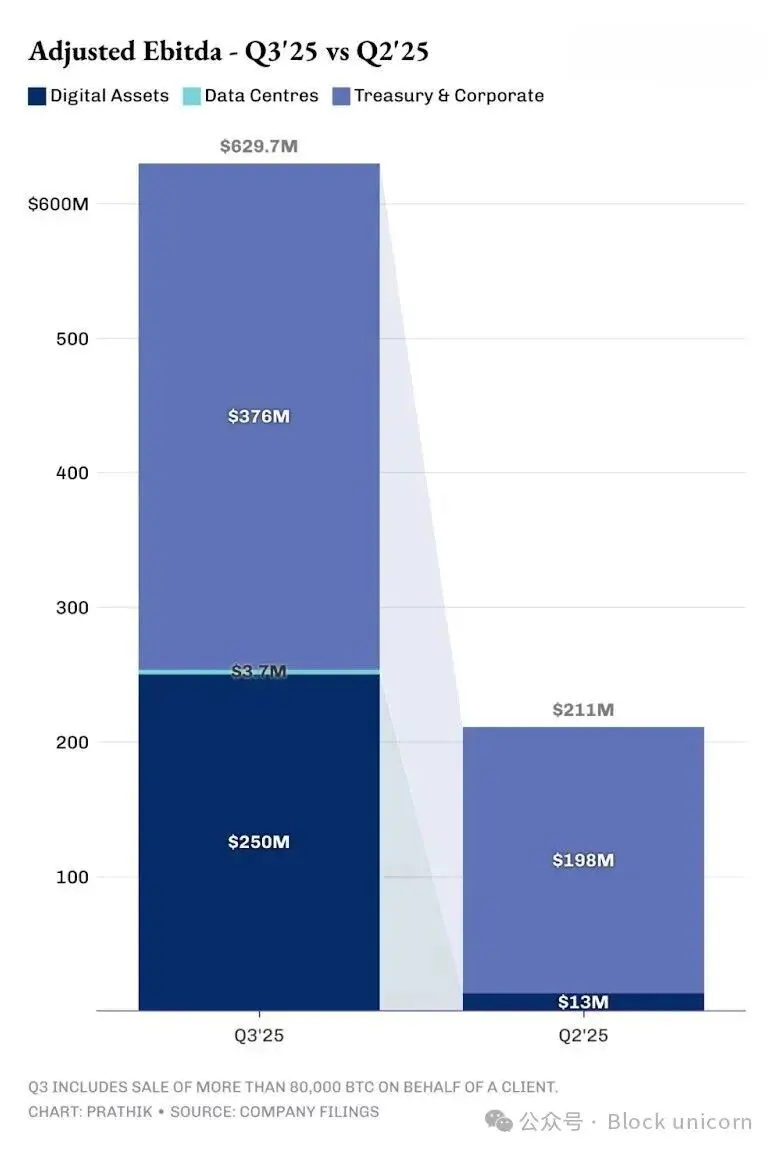

Last quarter, I wrote about the company “ the 0.15 per cent issue ” — — a record high but extremely low price. This pattern remains in place this quarter. Although the volume of spot and derivatives transactions in the digital asset sector increased by 140 per cent in the third quarter of 2025, a significant proportion came from 80,000 BTC transactions sold on behalf of clients。

During the third quarter of 2025, Galaxy over 97 per cent of the digital asset sector ' s pre-adjusted post-interest tax depreciation profit (EBITA) was only $250 million, or less than 45 per cent of the total EBITDA。

IN CONTRAST, EBITDA WAS $376 MILLION, OR LESS THAN 2 PER CENT OF TOTAL INCOME, AS A RESULT OF THE RESTRUCTURING OF THE FINANCE AND BUSINESS SECTOR。

That's the crisis Galaxy decided to deal with: the more liquidity they provide, the less profits they make。

So how do they solve this problem? Find a way to generate revenue. When other companies found stable currencies or borrowed them as collateral, Galaxy focused on building business finance management. This model does not rely as heavily on arbitrage or market timing as transactions; rather, it relies on long-term cooperative relationships, hosting and recurring costs。

This strategic shift suggests that the future growth of Galaxy will come more from market advisory services for DAT than from market fluctuations themselves. DAT ' s next heavy-pound project, — — and Helios, will bring more substantial and sustainable physical benefits, although the revenues generated by DAT are modest but stable。

Two revenue engines

In western Texas, the heat of the desert no longer means risk, but opportunity. The company, which had flourished at perfect market times, has now been awarded contracts, raised funds and entered into an agreement with CoreWeave, one of America’s leading artificial intelligence computing firms. As a tenant, CoreWeave committed to providing rent security for 15 years。

Once fully online, the Helios data centre is expected to generate more than $1 billion in annual revenue, with the EBITA profit margin of up to 90 per cent. Financial and data centre operations will gradually reduce Galaxy ' s reliance on market timing — — in the volatile area of encrypted currency, this is a luxury。

This strategic transformation is aimed at creating a stable income base free from market volatility。

Summary

Investors should note that while transactions remain at the forefront of Galaxy, cost income and future leases begin to smooth the curve。

every encrypted money company will eventually face the same dilemma: &ldquao; what will you build once the enthusiasm for speculation recedes? ”

For Galaxy, this quarter marks a turning point. The creation of the revenues that appear on time every time is perhaps the most boring idea in the company's history, but also the most transformative。

This is the end of the in-depth analysis. I'll see you in the next article。