$180 million in experiences and lessons: Web3 is not socializing, it's a wallet

This cumulative financing of $180 million, valued at nearly $1 billion in star projects, has provided an important note of the entry dispute in the Web3 industry in a near-mistake stance。

Recently, Dan Romero, the founder of the Farcaster, who was sent to Web3 with high social expectations, made it clear in his open letter that after 4.5 years of exploration, he was able to find out what he was doingThe "social priority" route has proved to be unworkable, and the future will be fully focused on the development of wallet productsBecause "every new and retained wallet user is the new user of the protocol."。

This cumulative financing, $180 million, valued at nearly $1 billion in star projects, provides an important note on the entry to the Web3 industry in a near-mistake stance。

This shift mirrors the core difference between Web3 and Web2, and in the Internet age, socialization is undoubtedly the super-port to the convergence of flows。

Facebook connects 2,9 billion users worldwide through social networking links, Twitter draws on social networking as the cornerstone of a whole-of-the-horizon service of payment, office, etc., and social identity becomes the "flow cornerstone" of Internet products。

But at the heart of Web3 is the interaction of values rather than the transmission of informationThe primary need for users to access ecology is to manage digital assets and complete chain activities。

This makes the wallet that carries the private key management, asset interactivity, a natural entry product for Web3, and today the transformation of Farcaster is essentially an endorsement of this logic, but is it really the end of the Web3 entrance?

Why is the wallet getting more important

The core value of the wallet derives from its irreplaceable role as an interactive entry into the chain。

Unlike the account code system for Internet products, Web3 in the worldThe wallet address is the only identifier of the user and the private key is the document of ownership of the asset。

Whether it is to configure encrypted assets, participate in DeFi, or use a chain application, all operations must be signed through a wallet, which makes the wallet the user's first door into the Web3 ecology。

EspeciallyThe explosive growth of users in the two-year chainThe strategic value of the wallet is further amplified。

The number of active users in the chain continues to grow with the maturity of the L2 technology and the revival of the Solana ecology, as well as the entry of traditional financial institutions。

This post is part of our special coverage Syria Protests 2011In the third quarter of 2025, there were 830 million encrypted wallets in the worldOf these, 82% of the addresses were traded in chains within 30 days, while the number of DApps connected to wallets was 117% higher than last year。

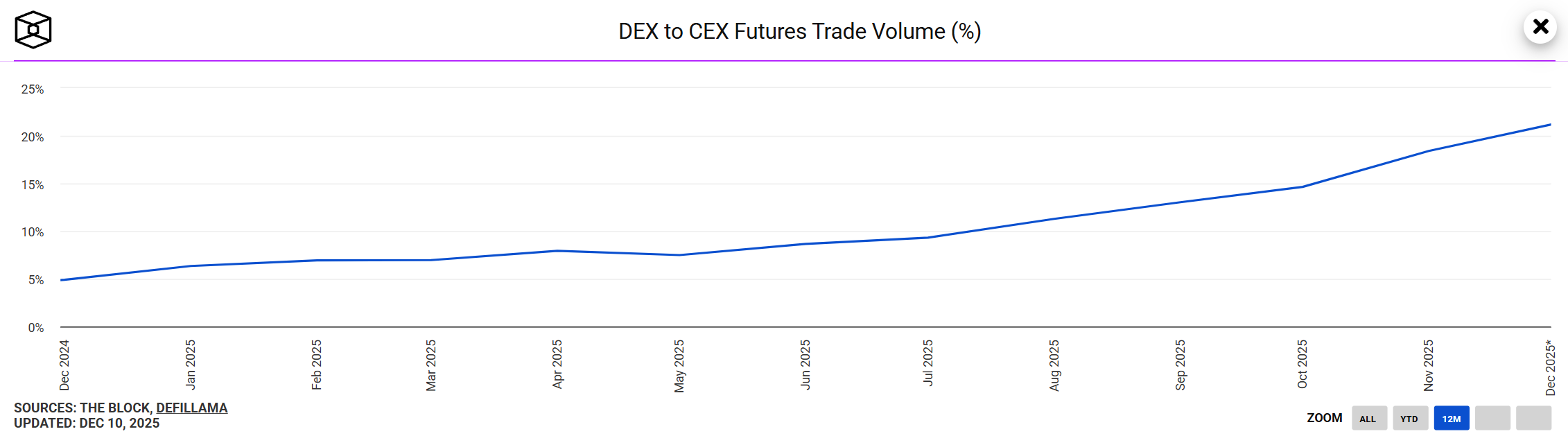

AT THE SAME TIME, THE RISE OF DEX AND THE SHARE OF CEX HAVE BEEN ENCROACHED ON, HIGHLIGHTING THE IRREPLACEABLE NATURE OF THE WALLET。

Since 2025DEX MARKET SHARE ROSE FROM 10.5 PER CENT AT THE BEGINNING OF THE YEAR TO 19 PER CENT AT THE END OF THE THIRD QUARTERFutures markets also increased from 4.9 per cent to 13 per cent。

THE THIRD QUARTER OF THE WORLD'S DEX SPOT TRADE AMOUNTED TO US$ 1.43 TRILLION, AND IT WAS THE THIRD QUARTER OF THE YEARThis is an increase of 43.6 per cent over the previous quarterIt's a new record。

THE CORE LOGIC OF THIS SHIFT IS THE PURSUIT OF OWNERSHIP OF ASSETS BY USERS, WHICH IS ACHIEVED BY LINKING THEM TO DEX THROUGH WALLETS, WITHOUT THE NEED FOR USERS TO TRUST ASSETS WITH THE EXCHANGE"I'm in charge of my assets."This trend is promoting the upgrading of wallets from tools to ecological portals。

IN ADDITION, THE LAYOUT OF TRADITIONAL FINANCIAL INSTITUTIONS REINFORCES THE POSITION OF PURSES IN TRADE. FOR EXAMPLE, THE MELON BANK IN NEW YORK HAS INTRODUCED MPC (MULTIPLE CALCULATION) HOSTING WALLETS TO PROVIDE SECURE ASSET STORAGE SERVICES FOR INSTITUTIONAL CLIENTS。

Bérédé is even more forthrightThe company ' s goal is to copy all of today ' s traditional finance into digital wallets。

The entry of these traditional institutions has not only brought an incremental user base to the wallet track, but also promoted the wallet as a central bridge between traditional finance and Web3。

Giant competition: layout of wallet track and game

Faced with the strategic value of the wallet track and the challenges faced by CEX, the encryption giants have launched a comprehensive layout in which Coinbase, Binance and OKX's development paths form a new picture of the industry。

Coinbase, the U.S. compliance pole, has a purse product deep-seated to its own exchange ecology, and users can seamlessly implement the close-ring operation of "purchase-chain-interactive-assets back"。

With this year's reform of the Base chain, Coinbase's wallet has become the main interface in the chain, attracting developers and users, for example, through fee subsidiesA holistic platform was formed for the integration of finance, messaging, content creation and decentrization。

And Binance was built on the advantage of scale"The Panorama Wallet Ecology"Its wallet products are integrated into the public chain interface, pledge, Launchpad, etc。

Inspired by the Open Ecology of OKX, Binance introduced CEX-DEX ' s seamless trading function in August 2025, which allows users to call the related DEX mobility directly through their wallets, without the need to move assets across platforms.

IN THE PURSE LAYOUT OF THE THREE GIANTS, OKX IS THE MOST LEADING STRATEGY. AS EARLY AS 2023, OKX JUMPED OUT OF A SINGLE PUBLIC CHAIN AND ESTABLISHED A “MULTI-CHAIN PRIORITY” DEVELOPMENT STRATEGY。

Its wallet has been steadily supporting 130 public chains of asset storage and interaction, and it has been able to reach the end of the centuryIt is one of the most widely supported wallet products in the industry。

At the same time, with the OKX wallet core code fully hosted in GitHub, open source transparency has gained global developer confidence by opening standardized API interfaces。

Thousands of decentralized applications have been accessed to form ecological matrices covering almost all chain activities, and open sources have become new trends in the industry。

OKX WAS ALSO THE FIRST TO SUPPORT THE DIRECT ASSOCIATION WALLET OF THE EXCHANGEIt was reported that hundreds of technical teams were built that year, spending millions a month to build this very popular wallet。

It also broke into the already crowded wallet track in a dustless posture and became the head product of Web3 and had to say that such forward looking and boldness was rare。

It is thanks to the early layout of OKX that Coinbase and Binance also saw the opportunity, choosing strategies to follow upThis is also the highlight of this year's major exchanges。

Virtually all of them now have their own purse ecology to meet the growing demand for economic activity in the chain, which also contributes to the expansion of their ecological status。

Web3 entrance is set? I don't know

Although the wallet is now at the heart of the Web3 portal, it is too early to assert that the “big picture” is set and that there are still some variations in the current Web3 entrance pattern。

Recalling industry developmentsTwo key migrations have been completed at the entry centre:THE EARLY USER DEMAND WAS CONCENTRATED ON THE EXCHANGE, AND CEX, WITH ACCESS MONEY ADVANTAGES, BECAME AN ABSOLUTE ENTRY POINT, ONCE MONOPOLIZING TRADE FLOWS。

And with the emergence of the Taifeng smart contract, DeFi and NFT ecological eruptions, the demand for asset autonomy has driven the focus of the entry to the wallet, which gradually takes on core functions such as DApp interaction and asset management。

Today, this pattern is still evolving。

In the future, access patterns may evolve further as technology overlaps。THE COMBINATION OF AI AND THE WALLET IS ALREADY IN ITS INFANCYSome products can achieve natural language interaction and smart risk warning through AI Agent, bringing wallets closer to ordinary user needs。

In the meantimeThe abstract penetration of accounts may lower the threshold for wallet useDrive the entrance further down。

The Web3 industry is still in its early stages, and the evolution of technology and demand may still lead to new entry patterns。

It is certain, however, that the core value of the wallet will continue to strengthen against the backdrop of a clear trend in the financial chain。

As OKX CEO Star stated in his recent appearance at the Abu Dhabi Finance Week, the Internet generation is creating a new chain economy, and it is a new oneOver the next few decades, about 50 percent of global economic activity will be on the block chain。

CorrespondingThe volume of encryption assets held by traditional financial institutions increased 120 per cent during the year。

Behind these data is the continuing boom in economic activity in the chain, and the wallet, as a central tool for asset management and interaction, will directly benefit from this trend。

Of course, looking back at Farcaster's transformation is not the end, but the beginning of the return of the Web3 industry to the nature of value。

The Internet portal is connected to people, andThe access point for Web3 is connecting people to valuesThis core difference determines the non-replaceability of the wallet。

For industry participants, either to continue deep-farming wallet technological innovations, or to explore the integration of wallets with other scenarios, the focus needs to be on user asset security and optimization。

The debate over the entrance to Web3 may not have endedHowever, by virtue of its unique value, the wallet has become the most established winner of the track at this stage。

So, who's the next winner