U.U. says October V.C. Monthly: Financing up 21%, Coinbase buys Echo

The author, Wu, says the block chain

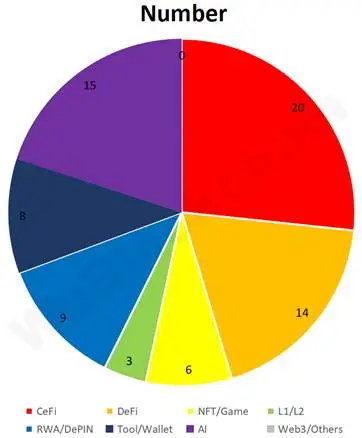

According to RootData, in October 2025 there were 75 Crypto VC open venture investment projects, an increase of 21 per cent (62 in September 2025) and a decrease of 25 per cent (100 in October 2024). Note: Since not all financing is published that month, the above statistics may increase in the future. The number of projects in each plate track is as follows:

Of these, CeFi accounts for about 26.7 per cent, DeFi for about 18.7 per cent, NFT/GameFi for about 8 per cent, L1/L2 for about 4 per cent, RWA/DePIN for about 12 per cent, Tool/Wallet for about 10.7 per cent and AI for about 20 per cent。

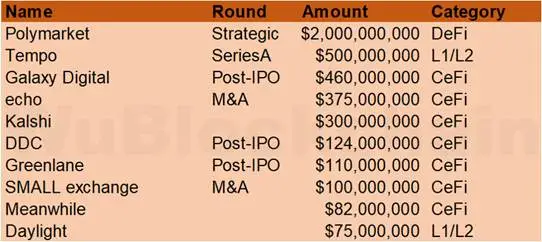

Total financing in October 2025 amounted to $4.556 billion, a decline of 11 per cent in the ring ratio ($51.2 billion in September 2025), an increase of 484 per cent over the same period ($780 million in October 2024). Of these, the 10th highest value is as follows:

ICE, the parent company of the New York Stock Exchange (NYSE), made a strategic investment of $2 billion for Polymark, with a pre-investment valuation of Polymarket estimated at $8 billion. Through this transaction, ICE will not only acquire Polymarket ' s financial share but will also become its event-driven global distributor。

Tripe-supported block chain start-up company Tempo completed $500 million in round A finance, valued at approximately $5 billion, with the participation of Thive Capital (Joshua Kushner) and Greenoaks, Sequoia, Rubbit Capital and SV Angel. Tempo was developed by Stripe and Paradigm to focus on stabilization currency payment infrastructure, with partners including OpenAI, Shopify and Visa。

Galaxy Digital entered into an investment agreement with the world ' s leading asset management company to obtain $460 million through private fundraising. The company indicated that the funds received would be used for general business purposes and to advance its Helios data centre project in Texas, which planned to deliver 133 MW of critical IT load capacity in the first half of 2026。

Coinbase has agreed to purchase approximately $375 million of block-chain-based financing platforms, Echo. The acquisition was Coinbase's eighth acquisition this year, as the company continues to expand its services in the current favourable regulatory environment under which the United States Government is in power。

The U.S. compliance forecast market platform, Kalshi, completed a funding round of over $300 million, and the valuation jumped to $5 billion. This round was led by Sequoia Capital and a16z, with old shareholders like Paradigm。

DDC Enterprise completed $124 million in equity financing, which was led by PAG Pegasus Fund and Mulana Investment Management, with the participation of OKG Financial Services, which will be used to advance its Bitcoin Reserve strategy. To date, the company has acquired 1,058 BTCs in aggregate。

Greenlane Holdings (Nasdark:GNLN) announced the completion of $110 million in private fundraising, which was carried out by Polychain Capital, Blockchain.com, Kraken, North Rock Digital, CitizenX, Dao5 etc. Greenlane will use the funds received to purchase BERA on the open market with OTC for the establishment of a reserve and liquidity operation。

IG Group Holdings plc (LSEG:IG) sold Small Exchange Inc at $100 million (£74.9 million) to Payward Inc, the home company of the encrypted currency exchange Kraken. The deal consisted of Pound24.3 million in cash and Pound50.6 million in Payward shares. The sale brought £73.3 million in post-tax revenue to the IG group and increased its regulatory capital resources by £22.7 million。

Meanwire announced the completion of US$ 82 million in financing, with the participation of Haun Ventures and Bain Capital Cripto, Pantera Capital, Apollo and others. The new funds will be used to expand its core product – life insurance in bitcoin prices – and to expand its operations globally. At present, cumulative corporate financing amounts to $143 million。

Daylight Energy announced the completion of $75 million in financing, of which $15 million was invested by Framework Ventures, a16z crypto, Ler Hippeau, M13, Coinbase Ventures, etc., and another $6 million in project financing was received from Turner Hill Capital. Daylight stimulates families to install distributed solar and storage energy through encryption networks, with sources of income including subscriptions by users and market compensation for peak transmission of electricity back to the grid. The company introduced the DayFi Revenue Agreement, which links electricity revenues to assets and provides returns。