Is it possible that Strategy could be excluded from the NASDAQ 100 index

Although there are problems on mNAV, the exclusion of the NASDAQ 100 may not happen this year。

Although there are problems on mNAV, the exclusion of the NASDAQ 100 may not happen this year。

Although there are problems on mNAV, the exclusion of the NASDAQ 100 may not happen this year。

Submitted by Eric, Foresight News

After 30 days of local U.S. time, Bitcoin DAT's first share of Strategy published the third quarter of the financial paper. According to the financial statements, Strategy received $3.9 billion in the third quarter, with a net profit of $2.8 billion and a diluted share of $8.42。

As at 26 October 2025 local time, Strategy held a total of 640,808 bitcoin, with a total value of $47.440 billion, and the cost per bitcoin rose to $74032. At the beginning of 2025, the rate of return in bitcoin to date was 26 per cent, reaching $12.9 billion. According to Andrew Kang, Chief Finance Officer, Strategy, based on a projected end-of-year projection of $1.55 million in Bitcoin, 2025 Strategy earned $34 billion in operating revenue, $24 billion in net profit and $80 per share after dilution。

Strategy’s data are largely open and do not cause too much resonance in the market, but based on the impact of Bitcoin’s today price rebound and corporate optimism, Strategy’s stock price rebounded after yesterday’s round and before today’s round. As at the time of writing, the MSTR price had rebounded from the closing price of $254.57 in the previous day to the close of $272.65 in front of the disk。

According to the financial statements, Strategy earned a total of $5.1 billion in net gains through the General Unit, STRK, STRF, STRD and STRC sales unit schemes during the three-month period ending 30 September, while Strategy still had $42.1 billion in financing lines as at 26 October。

It is worth noting that the current price of bitcoin is more than 40 per cent higher than the location of the year, while the closing price of MSTR yesterday was about 6 per cent lower than that of the year. While yesterday’s and today’s stock price movements represent short-term market acceptance of the financial statement, investors are actually beginning to worry about Strategy, or DAT’s model。

According to StrategyTracker, Strategy's mNAV (i.e., the value of market value versus the value of holding bitcoin) has arrived at 1.04, which is only 1.16, which is very close to 1. And if the mNAV came to one or even to one, it meant that the purchase of the company's shares was no longer directly worth buying the corresponding encrypted currency。

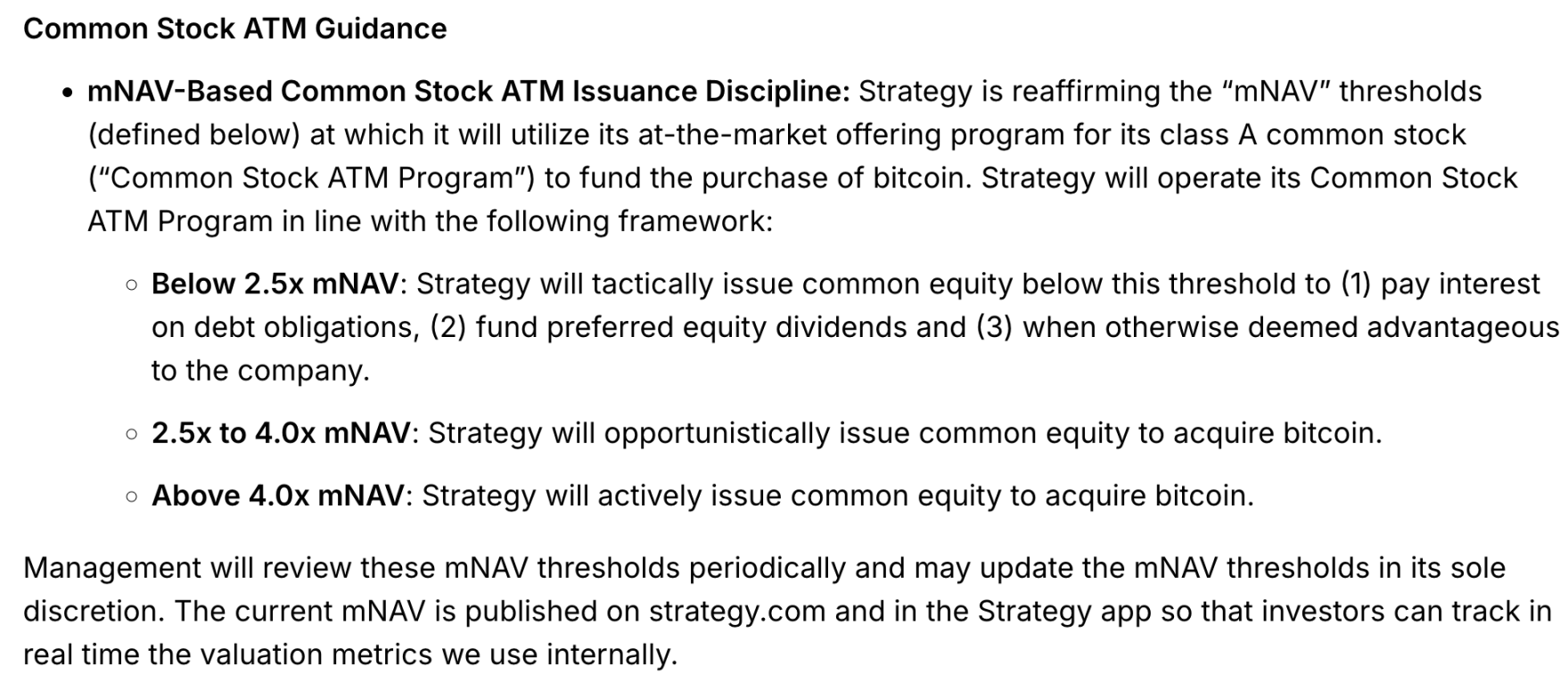

Strategy promised at the press conference at the end of July this year that "no additional MSTR general shares will be issued at mNAV below 2.5 times unless they are intended to pay for preferential dividends or debt interest." But only two weeks later, in the 8-K file submitted, it removed the restriction and added an exception to the clause. If the company considers the increase to be favourable, it can continue to issue shares less than 2.5 times the mNAV. I don't know

In a recent financial paper, Strategy has also re-explained the rules of regular stock ATM issuance:

Although the issuance of regular shares at mNAV is still given priority to the payment of interest on debt and the priority dividends, the reality is that it is now also possible to purchase Bitcoin with regular equity ATM finance when at mNAV is below 2.5, and that the current method of financing for the purchase of bitcoin is more than just regular equity ATM. Strategy calculated the mNAV in official data at 1.25, which is higher than third-party statistics and, although it is more complex in its own way, in practice ordinary investors value the ratio of simple total market value to the total value of holding bitcoin, i.e. 1.04。

In addition, Strategy retains the possibility of adjusting the mNAV baseline, which undoubtedly adds more variables. Strategy bought 81785, 69140 and 42706 in the first three quarters of the year. Bitcoin went up with a steady decline in purchases, and Strategy saw potential problems。

If Strategy's mNAV falls one, it could have a bigger impact on the value of DAT as a whole. A few days ago, ETHZilla, a Taifeng DAT company, chose to sell $40 million worth of shares in the Taifeng for repurchase in order to pull back the mNAV values. On the same day, the second-largest Bitcoin DAT company in the world, the Japanese-listed company Metaplanet, announced a stock buy-back scheme that, while not involving the sale of held bitcoin, mNAV pressures have slowed down the first two world-opened bitcoin buyers。

Just yesterday night in Beijing, on the American stockboard, some of the investors in the Web3 community speculated that Strategy might be kicked out of the NASDAQ 100 index by the end of the year in response to the recent weak MSTR。

Strategy was officially selected for the NASDAQ 100 index unit in December last year, also resulting in short-term stock prices of up to $500. After that, although the price of bitcoin was much higher, MSTR did not break the previous high。

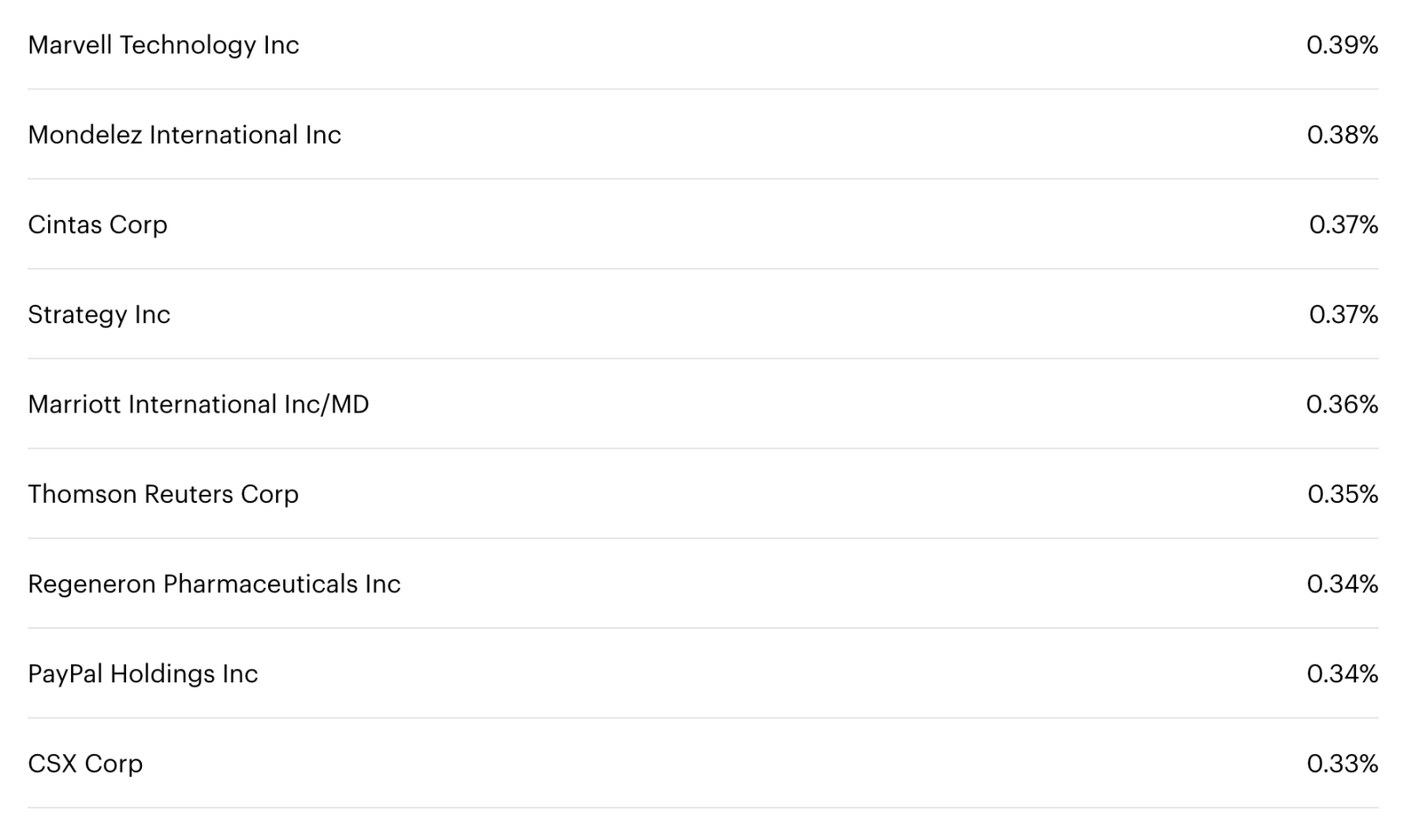

But the fact is that Strategy is out of the NASDAQ 100 unit this year is almost zero. Apart from the fundamentals of converting to a financial firm, replacing the place on the market, insufficient liquidity or violating the listing rules, the component shares were excluded, except for the fact that the market value ranking fell directly by 125 or continued to be 100, or that the weight was below 0.1 per cent of the total market value of the index for two months in a row, with the right replacement。

According to the QQQ holdout, Strategy currently has a weight of about 0.37 per cent, and the market value has not fallen by 100. The index adjustment at the end of the year is based on data at the end of October, so it seems that this year Strategy remains safe。

THERE WAS A BOOM IN DAT COMPANIES IN THE MARKET THIS YEAR, BUT I NEED TO REMIND YOU THAT THE PRACTICES OF SUCH COMPANIES ARE ESSENTIALLY BASED ON A MARKET CONSENSUS RATHER THAN A FINANCIAL MECHANISM, AND THAT THE MARKET VALUE OF COMPANIES CANNOT BE LOWER THAN THE VALUE OF ASSETS HELD BY COMPANIES. AN ARTICLE PUBLISHED IN THE DAILY ECONOMIC NEWS IN AUGUST OF THIS YEAR SHOWS A GOOD EXAMPLE: THE EARLY "RESOLVED" OF THE INTERNET, A SEARCH FOR FOXES, WHOSE MARKET VALUE FOR A LONG TIME HAS NOT BEEN IN THE HANDS OF COMPANIES WITH MUCH CASH OR THE VALUE OF OFFICE BUILDINGS BUILT BY COMPANIES。

Strategy can still continue to play the game on the basis of DAT’s ongoing involvement with new entrants and its status as a “nose-grandfather” has led to a large number of vested interests, but if the market suddenly abandons the “play mechanism” of this kind, investors can buy new shares continuously through the firm’s market value to stabilize the margin of holding bitcoin values and set them up at a higher level, with risks that may be greater than most people think。

Even if such a mechanism were to continue, the constant and frenzy of attention and funding that AI could cause the price of bitcoin to weaken would multiply the pressure on Strategy in the short term. DAT can continue to have a considerable positive impact on industry development, but it is also important to prevent short-term risks from stress testing at all times。

After all, $2.8 billion in profits is just the return on investment, which has never prevailed over generals。