The encryption market five years ago was actually healthier than it is now

Dorman calls for a return to the very nature of "coin as a security package" with a focus on equity assets such as DePIN and DeFi, which are capable of generating cash flows。

Photo by Jeff Dorman (Arca CIO)

Original: Deep tide TechFlow

Introduction:Is the encryption market getting more boring? The Arca Chief Investment Officer, Jeff Dorman, wrote that, although the infrastructure and regulatory environment had never been so strong, the current investment climate was “the worst in history”。

He rightly criticized the failed attempts by industry leaders to forcibly transform encrypted currency into a "macro-trading tool" that led to a high degree of convergence in asset relevance. Dorman calls for a return to the very nature of "coin packaging as a security" with interest in categories of equity assets such as DePIN and DeFi that have the capacity to generate cash flows。

This in-depth reflection article provides us with an important perspective for revisiting the investment logic of Web3 at a time when gold is rising while bitcoin is relatively weak。

The text reads as follows:

Bitcoin is facing an unfortunate situation

Most investment debates exist because people are at different dimensions of time (Time Horizons), so they are often “cock-to- duck”, although both are technically correct. Take, for example, the debate on gold and Bitcoin: Bitcoin fans tend to say that bitcoin is the best investment, because it has outperformed gold in the last 10 years。

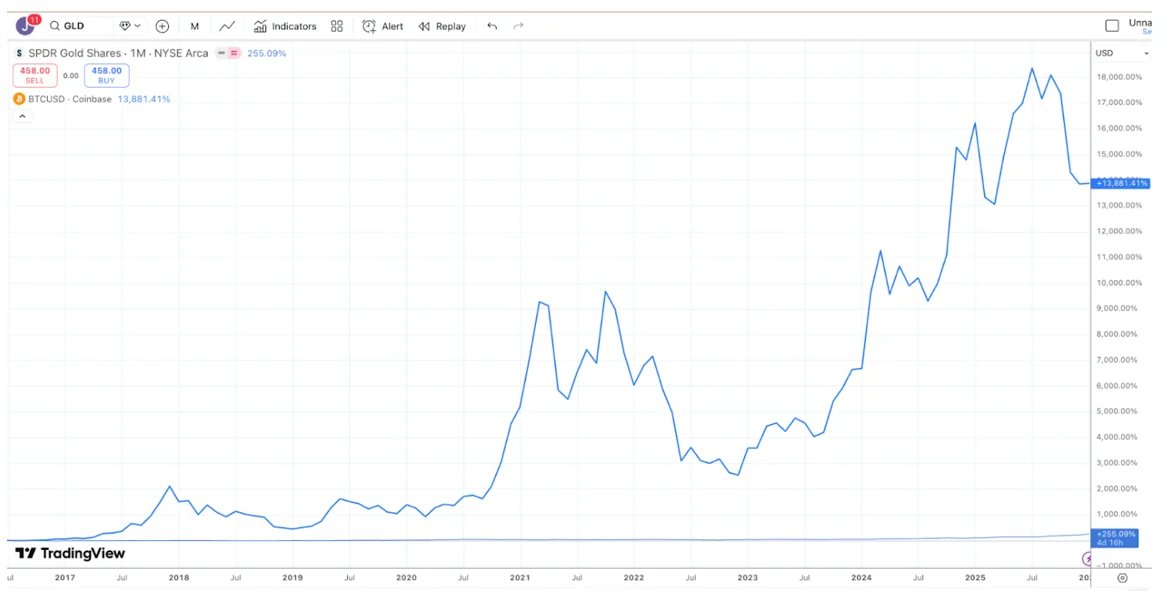

Figure : Source TradingView, 10 years before BTC versus gold

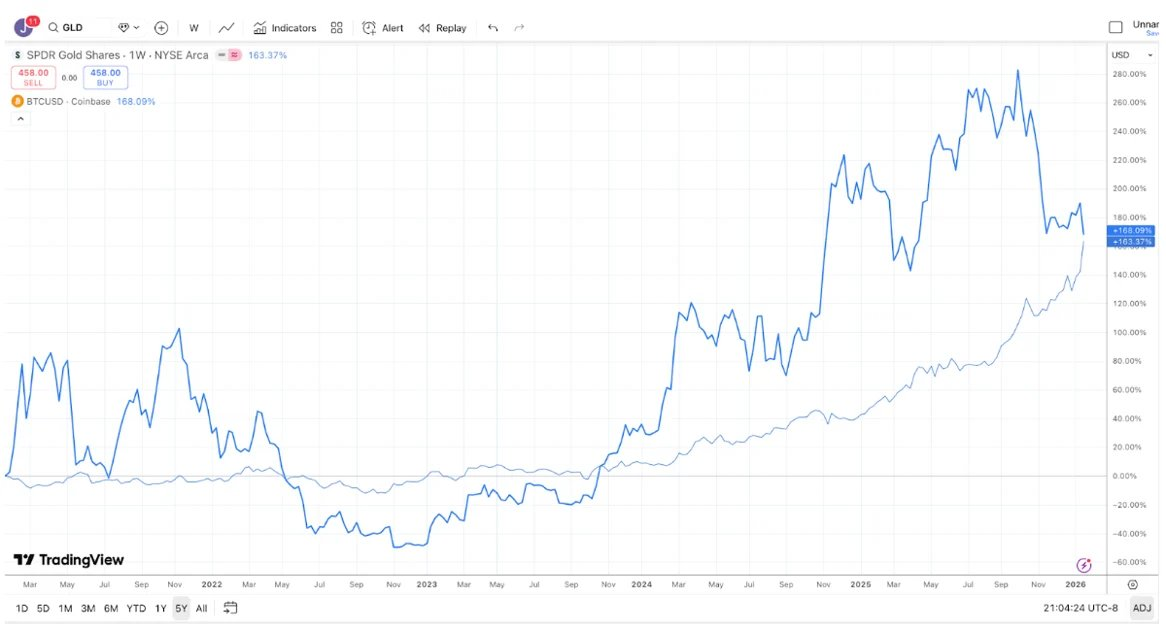

Gold investors, for their part, tend to think that gold is the best investment and have recently been "scrutinizing" about the decline in bitcoin, as gold has performed significantly better than bitcoin in the past year (and similarly in silver and copper)。

Figure : Source TradingView, BTC versus gold (GLD) returns for the past 1 year

Meanwhile, in the last five years, gold and bitcoin have generated almost identical revenues. Gold tends to do nothing for a long time, and then rushes into the sky when central banks and trend followers buy it; and bitcoin tends to rise sharply, followed by a major collapse, but eventually rises。

Figure : Source TradingView, 5 years before BTC versus gold (GLD)

So, depending on the duration of your investment, you can almost win or lose any argument about bitcoin and gold。

Even so, it is undeniable that gold (and silver) has recently shown strength relative to bitcoin. It's kind of funny in a way (or sad). The largest companies in the encryption industry have worked for the past 10 years to cater to macro investors, rather than the real basic investors, who say, "Well, let's buy gold, silver, and copper." We have long called for industry to change its thinking. It's over now$6 trillion in trust assetsThe buyer groups of these assets are much more visceral investors. Many digital assets appear more like bonds and equities, issued by companies that generate income and buy back in tokens, yet market leaders, for some reason, have decided to ignore the coin industry。

Perhaps the recent poor performance of bitcoin vis-à-vis precious metals is enough to convince large brokers, exchanges, asset management companies and other encrypted leaders that their attempts to transform encrypted money into a full-scale macro-trading tool have failed. Instead, they may turn their attention to and educate investors of a scale of $60 trillion who tend to buy cash-flow assets. For the industry, it is not too late to focus on Quasi-equity tokens that carry technology operations that generate cash flows, such as DePIN, CeFi, DeFi, and token distribution platforms。

But then again, if you're just changing the finish line, bitcoin is still king. So it is more likely that nothing will change。

Differences in assets

The "good days" of the investment in encryption seem to have been a long time ago. Back in 2020 and 2021, it seems that every month new narratives, tracks or examples, as well as new forms of tokens, can bring positive returns across markets. Although the growth engine of the block chain has never been as strong as it is now (through legislative advances in Washington, stable currency growth, DeFi, and real asset monetization of RWA), the investment climate has never been so bad。

One sign of market health is fragmentation and lower cross-market relevance. You certainly want the health and defence units to be different from the technology and AI shares; you also want emerging market equities to be independent of developed markets. Fragmentation is usually considered a good thing。

The years 2020 and 2021 are largely remembered as "a general rise," but not entirely. At that time, it was rare to see a consistent rise and fall in the overall market. More often, when a plate rises, another plate falls. DeFi is likely to fall when the game board rises; Dino-L1 coins fall when the DeFi rises; and Web3 tracks fall when the Layer-1 board rises. A diverse and encrypted portfolio actually smooths returns and usually reduces the overall portfolio ' s Beta value and relevance. Liquidity flows with changes in interest and demand, but returns are mixed. This is very encouraging. The massive influx of funds into encrypted hedge funds in 2020 and 2021 is justified by the fact that the investible areas are expanding and the returns vary。

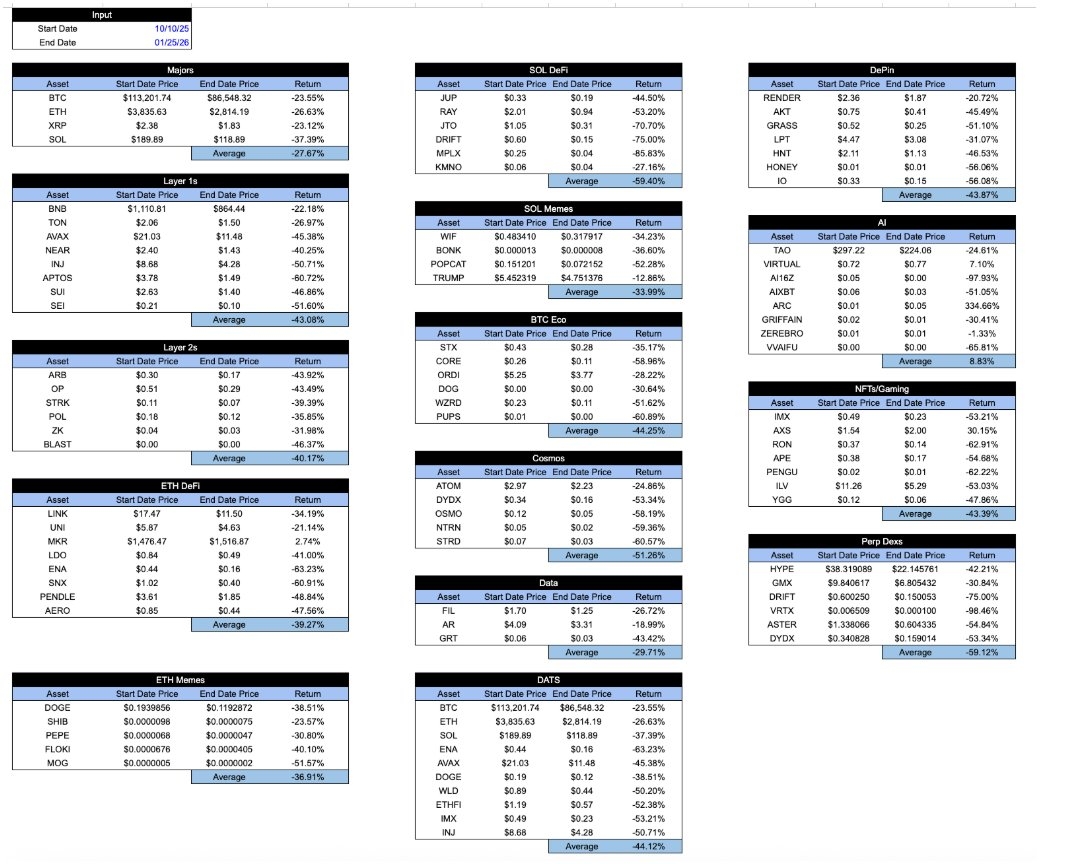

As soon as possible, all the proceeds from the "encrypted" assets appear the same. Since the collapse of October 10th, the fall of the plates has been almost indistinguishable. Whatever you hold, or how the token captures economic value, or how the project develops, the rate of return is largely the same. This is very frustrating。

Figure: CoinGecko API data for a sample of internally calculated and representative encrypted assets in Arca

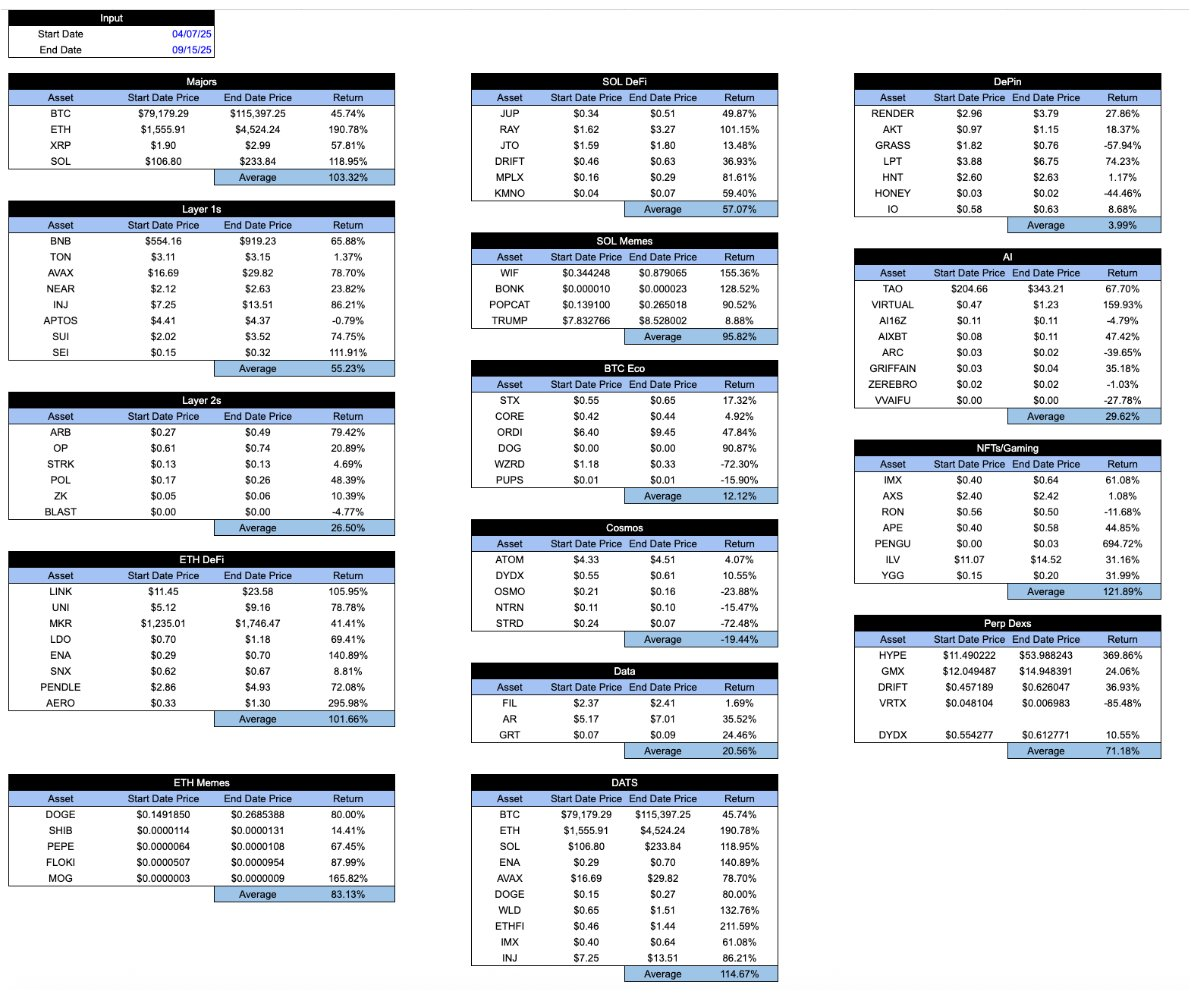

This table appears to be somewhat encouraging during the boom. "Good" tokens often perform better than bad" tokens. But a healthy system should be the opposite: you want the good tokens to behave better in bad times, not just in good times. The following is the same table from the low of April 7th to the high of September 15th。

Figure: CoinGecko API data for a sample of internally calculated and representative encrypted assets in Arca

Interestingly, when the encryption industry was still in infancy, market participants had tried very hard to distinguish between different types of encrypted assets. For example, I'm hereAn article was published in 2018, where I divide encrypted assets into four categories:

- Encrypted currency/currency (Cryptocurrence/money)

- Go to Centralize Agreements/platforms

- Asset-backed tokens

- Pass-through securities

At that time, the classification was unique and attracted many investors. Importantly, encrypted assets are evolving from only bitcoin to smart contract agreements, asset-backed stables, to type-penetrating securities. The study of different areas of growth was the main source of excess earnings (Alpha), and investors would like to understand the range of valuation techniques needed to assess different types of assets. Most encrypted investors at the time did not even know when the unemployment benefit data would be published, or when the Federal Reserve (FOMC) meeting would be held, and rarely looked for signals from macrodata。

After the collapse in 2022, these different types of assets remained. The essence has not changed. But there have been significant changes in the way the industry is marketing. The gatekeepers think bitcoin and stability coins are the only things that matter; the media think they don't want to write anything but TRUMP tokens and other memecoins. Not only has Bitcoin performed better than most other encrypted assets in the past few years, but many investors have even forgotten the existence of these other asset types (and tracks). The business model of the bottom companies and the agreements has not become more relevant, but the relevance of the assets themselves has indeed become higher as investors flee and marketers dominate price movements。

That's whyMatt Levine's latest article on tokensThis is so surprising and popular. In just four paragraphs, Levine accurately describes the differences and nuances between the various tokens. This gives me some hope that such analysis will remain viable。

The leading encryption exchanges, asset management companies, market traders, off-site trading (OTC) platforms and pricing services still refer to everything other thanbitcoin as "Altcoin" and appear to be writing only macro studies, with all "encrypted money" tied together as a huge asset. You know, Coinbase, for example, seems to have a small research team headed by a leading analyst, David Duong, whose focus is mainly on macro-level research. I have no comment from Mr. Duong — his analysis is excellent. But who's gonna go to Coinbase for macroanalysis

Imagine if the leading ETF providers and exchange were to write a general article about ETF and say, "ETF is falling today!" "ETF reacts negatively to inflation data." They'll be laughed to the ground. Not all ETFs are the same, just because they use the same "Wrapper," and those who sell and promote ETFs understand that. ETF is the most important internal assembly, and investors seem wise enough to distinguish between ETFs, mainly because industry leaders help their clients understand this。

Similarly, Token is just a "package". As Matt Levine eloquently described, what's inside the token is important. The type of token is important, the track is important, and its attributes (inflation or amortization) are also important。

Maybe Levine wasn't the only one who understood that. But he did better than those who actually profited from it in explaining the industry。