BitMart Market Performance Weekly (12.09-12.15)

Macro-uncertainty continues to limit short-term access, but regulatory clarity and increased institutional involvement are laying the groundwork for medium- and long-term inflows。

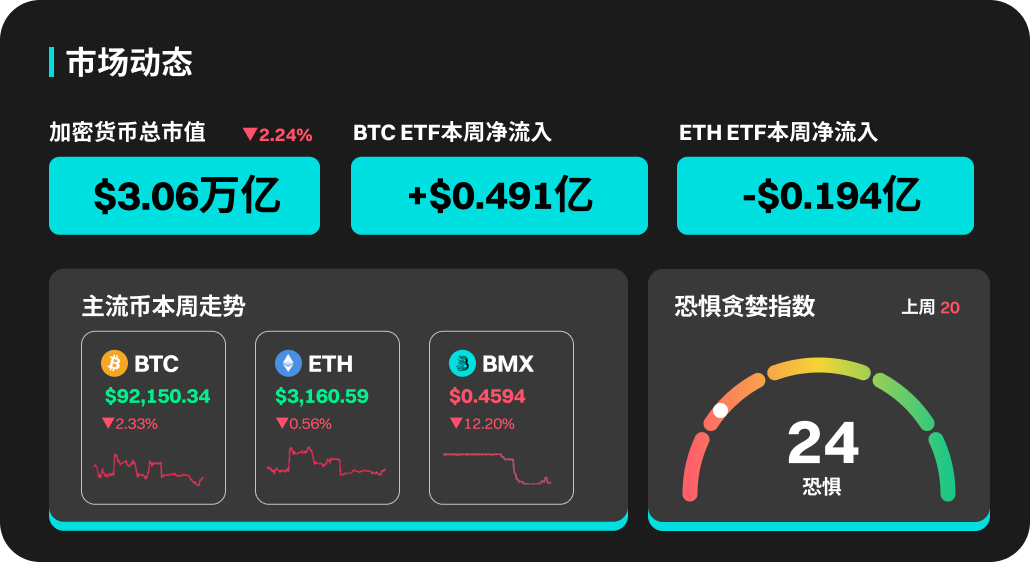

According to the BitMart Market Performance Report of 15 December, the total market value of encrypted currencies over the past week was 3.06 trillion, a decline of 2.24 per cent compared to the previous week。

Encrypt market dynamics this week

This week, the encrypted market maintained a high-level shock, and the BTC fluctuated within 8.82-943 million United States dollars (US$) and was affected by macro-signal fragmentation as a whole. The Federal Reserve set interest rates at 25bp in December, but at the same time released the hawk guide, implying that interest rates would be reduced in 2026 or only once; and announced that $40 billion in short-term national debt purchases would be started each month starting in mid-December (some markets are interpreted as “QE-Lite”). Against a backdrop of inflation still above target (about 3 per cent) and unemployment rising to 4.4 per cent, stagnating fears of rising temperatures, risk asset moods are cautious and hedge funds continue to flow to gold and silver. Despite relatively flat price performance, there have been positive developments at the sectoral level. On the regulatory front, the Abu Dhabi Global Marketplace (ADGM) issued key licences to Binance and Circle, creating an institutional-level portal to the Compliance Exchange + the issuer of the compliance and stability currency, which significantly increased the attractiveness of the Middle East region to institutional funds. In terms of institutional dynamics, Citadel has been involved in Ripple $500 million in financing to boost market confidence under strict buy-back and income-guarantee provisions; at the same time, XRP ETF has been more prominent than other mainstream encryption ETFs since its listing。

In general, macro-uncertainties still limit short-term access, but regulatory clarity and increased institutional involvement are laying the groundwork for medium- and long-term inflows。

It's a hot week

M, MERL, MYX, MNT AND XMR ALL SHOWED A REMARKABLE PERFORMANCE, WITH THE HIGHEST PERCENTAGE INCREASE. M PRICES INCREASED THIS WEEK 35.48 PER CENT. MERL PRICE INCREASE 30.04%. MYX PRICE INCREASE 25.59 PER CENT. MNT AND XMR INCREASED BY 13.01 AND 7.72 PER CENT RESPECTIVELY THIS WEEK。

U.S. Market Board and Hot News

The overall performance of the United States market this week has been smooth and risky. The US stock grew slightly, and the scale of temperature and increase in the scale 500 and N.P. was recorded, but it was clear that the technology plate was under pressure and that the Oracle had fallen by 11 per cent less than expected in one day, and that the major AI concepts such as Nvidia and Alphabet had been reversed. With regard to foreign exchange, the Federal Reserve has confirmed on schedule that the dollar index has weakened throughout the month of December, following a decline in interest rates. In the case of large commodities, crude oil is expected to go down with a slowdown in demand in 2025, especially as Chinese demand is expected to peak, increasing market concern; small gold surges and precious metals as a whole are still supported by macro-uncertainty. The performance of the bond market has been relatively smooth, and interest rate volatility has been limited in the context of the split between the Fed ' s interest rate reduction and the Japan Central Bank ' s interest rate hike. The continued fall in market volatility and the fall and lack of surprise of the Fed resolution have stabilized the equity sentiment. On the whole, risk assets remain cautious, “light stagnation” at the macro level coexists with economic fragmentation, and markets remain highly sensitive to future policy paths。

ON 15 DECEMBER, THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (SEC) ENCRYPTED CURRENCY WORKING GROUP WILL HOLD AN OPEN ROUND TABLE ON FINANCIAL REGULATION AND PRIVACY。

On 17 December, Coinbase Global Inc. will announce the launch of forecast markets and tokenized shares this week。

ON DECEMBER 17TH, HASHKEY PLANS TO RAISE UP TO HK$1.67 BILLION AND IS EXPECTED TO BE LISTED FOR SALE ON DECEMBER 17TH。

ON DECEMBER 18TH, THE US BUREAU OF LABOR STATISTICS WILL PUBLISH THE NOVEMBER CPI REPORT AND CANCEL THE OCTOBER CPI RELEASE。

On December 19, the Central Bank of Japan will issue an interest rate resolution on December 19。

Unlock the item

Starknet (STRK) will unlock 127 million tokens at 8 a.m. on 15 December, Beijing time, with a value of 5.07 per cent of the volume in circulation of approximately $13.2 million。

The Sei Network (SEI) will unlock approximately 5.55.6 million tokens at 8 p.m. on 15 December, Beijing time, at a ratio of 1.08 per cent to circulation, valued at approximately $7.1 million。

Arbitrum (ARB) will unlock approximately 9,265 million tokens at 9 p.m., Beijing time, 1.90 per cent of the value of the volume in circulation, valued at approximately $7.7 million。

LayerZero (ZRO) will unlock the contract at 7 p.m. on 20 December, Beijing time

Lista DAO (LISTA) will unlock approximately 3,344,000 tokens at 5 p.m. Beijing time on 20 December, at a margin of 6.85 per cent of the volume in circulation, valued at approximately $5.5 million。

Risk tips:

The risk of using BitMart services is entirely on your own. All encrypted currency investments (including returns) are inherently highly speculative and involve significant loss risks. Past, hypothetical or simulated performance does not necessarily represent future results。

The value of digital currencies may rise or fall, and there may be significant risks in purchasing, selling, holding or trading digital currencies. Carefully consider whether the transaction or holding of a digital currency is appropriate for you, depending on your personal investment objectives, financial position and risk tolerance. BitMart does not provide any investment, legal or tax advice。