By: Seed.eth

& ldquo; u.s.s. & rdquo; is not a new concept, but this track is still a hot field of trading against the backdrop of the continued weakness of the encryption market and the lack of clear direction of the mainstream currency in the recent past。

over the past year, many projects in the market have attempted to link us equity indices, national debt gains and even single stocks, yet most of these products have remained in &ldquao; shadow assets &rdquao; stages: either price sources are over-reliant on prognostics, or trade depth is inadequate, or there is still a significant price gap with traditional markets, which can be considered a real &ldquao; alternative markets &rdquao。

The HIP-3 upgrade in Hyperliquid, which technically allowed the unlicensed creation of a permanent market for order bookings in the original chain, has to some extent ended the reliance of traditional asset transactions in the chain on synthetic assets or prophecy-driven models, offering another possibility to build an independent market with self-price discovery capabilities in the chain。

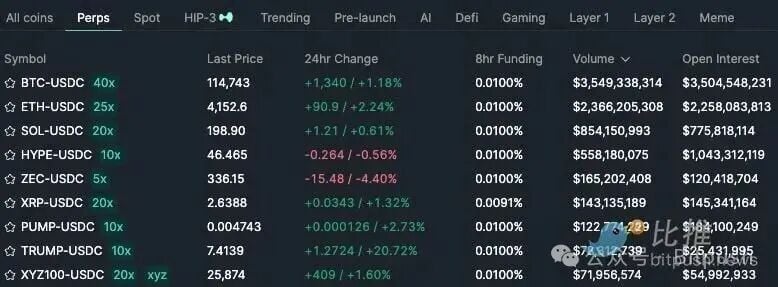

Take the example of XYZ100, launched by TradeXYZ: its turnover has continued to climb up to date, its single-day turnover has stabilized at tens of millions of dollars, and the ceiling for unwinding volumes has been raised from the initial $25 million to $60 million。

Background

TradeXYZ, as the original protocol for Unit ecology to hatch on Hyperliquid, focuses on introducing real-world assets (RWA) & mdash; — e.g., U.S. stock, index, etc. — — by monetizing into the chain. The agreement also supports two types of trading model for spot and durable contracts and addresses the liquidity and settlement of spot assets through integration of Unit Protocol. Users can use USDC for deposits, cash withdrawals and transactions, and its core product is a permanent equity contract based on HIP-3 standards, designed to bridge traditional financial markets and decentrize trading experiences。

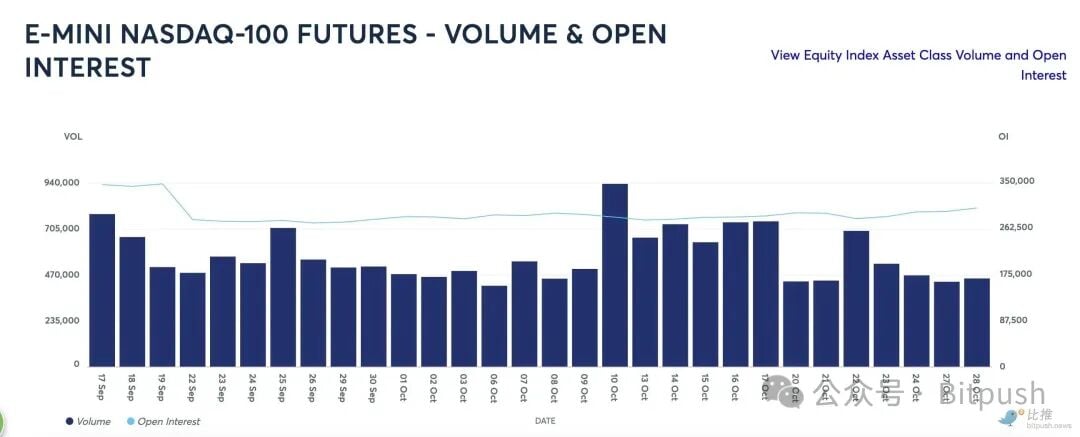

XYZ100 is a chain-wide CLOB model that supports up to 20 times leverage, 24/7 transactions. Prices are anchored through NASDAQ futures at CME (Chicago Commodity Exchange) oracle, using 8 hours of EMA (indicator moving average) smoothing of prices over non-trading periods to avoid sharp fluctuations。

HIP-3 was officially launched on or about 13 October 2025, and TradeXYZ almost synchronized the launch of XYZ100, with access to alpha only for the first 100 white list users (with cumulative transactions exceeding $5 million on Hyperliquid)。

IN JUST TWO DAYS, XYZ100 TRADES BROKE 63 MILLION DOLLARS, AND OI REACHED 15 MILLION DOLLARS, FAR MORE THAN OTHER RWA SUSTAINABLE CONTRACTS DEX。

Why did the encrypted traders turn to America

First, encrypted “ high volatility and low certainty ” being covered by US equity “ steady growth ” crushing: BTC has institutional accumulation signs but 10.11 “ leverage crash ” and has left a surplus on the loose。

THE CURRENT RISE IN THE UNITED STATES STOCK MARKET HAS BEEN SUCH THAT THIS WEEK, THE BP500, DOW JONES AND NASDAQ INDICES HAVE BEEN UP TO THREE CONSECUTIVE TRADING DAYS. AT THE SAME TIME, THE CHAIN-BASED TRADING PLATFORM IS ATTRACTING GLOBAL INVESTORS WITH ITS UNIQUE ADVANTAGE: USERS FROM DIFFERENT TIME ZONES, SUCH AS ASIA AND EUROPE, ARE ABLE TO ADJUST THEIR POSITIONS AT ANY TIME, FREE OF TRADITIONAL MARKET T+1 SETTLEMENT MECHANISMS AND WEEKEND BREAKOUTS THROUGH 24/7 UNINTERRUPTED TRANSACTIONS, WITHOUT KYC CERTIFICATION AND UP TO 20 TIMES LEVERAGE。

However, the conventional NASDAQ E-mini futures are still on the order of hundreds of billions of dollars in CME, and the chain size of assets is still in contrast to “ the number after decimal points &rdquo。

The race on the American stock track

As the tide rises, the United States stock ecology is rapidly evolving throughout the chain, with many agreements coming into the market from different angles:

In Solana and BNB Chain, xStocks provides over 80 United States dollar/ETF spot transactions through its Alliance Ecology, supporting users to mortgage apples or Teslacoconets directly. The cumulative volume of transactions under the agreement is over $2 billion, representing 58.4 per cent of the transactions of monetized stocks in the 2025s, with an average daily active user of over 30,000, and is gradually dividing the retail share of Robinwood。

Derive.xyz focuses on multi-chain rights and sustainable contracts, covering bitcoin, the ETA and parts of the RWA index, and attracts progressive players with its institutional tools and real-time prognosis machines. Despite the high cost and steep learning curve, the total volume of transactions has reached $18.6 billion, and the RWA market has maintained its average monthly turnover at $500 million。

Kraken xStocks obtained initial approval from the SEC on the basis of an exchange endorsement and is moving to a second-tier network, such as Arbitrum, to increase portfolioability. Its cumulative volume of transactions exceeded $5 billion, with unique holders exceeding 37,000, covering more than 60 assets, although there was a risk of centralization of the informal chain hosting model。

Vest Markets has a different path, focusing on reducing the slide point of weekend transactions through the RFQ filling mechanism, with a 24-hour volume of $3.40 million. Despite its innovative model of block chain auditing and LP incentives, the current market depth remains inadequate。

Ostium, based on Arbitrum, provides a chain-wide experience of the Synthetic RWA contract renewal, extending from the US share to commodities such as crude oil and gold. The agreement, which increased by 150 per cent and the Q1 perpetuity contract volume of $2.36 billion, provided an important option for zero KYC entry users。

Risks and challenges

Of course, this is not without controversy。

The co-founder of Ostium Labs, Kaledora, noted that the chain-based model of order book re-establishing market depth was more applicable to encrypted primary assets than to traditional financial assets, which had a more stable, centralized and deeper liquidity structure. In Kaledora, it appears that the preferred solution is “ the chain voucher model ” and: direct reference to the price depth of the TradFi market, access via the chain channel, rather than attempting to re-establish a CME-competing order book on the chain。

Oracle & Manipulation risks, where chain prices rely on algorithms to smooth the movement during non-trading times, but this is not a loss. The PAXG gold contract had previously led to the liquidation of millions of dollars in positions due to abnormal price fluctuations, which had sounded alarm bells — &mdash for all RWA products; there was a real risk of price deviation when the market closed and the chain was still traded。

Regulatory uncertainty is also a concern. The USSRC is examining the compliance of U.S. stock products in these chains, and if they are ultimately characterized as securities, the existing DeFi agreement may need to be matched by a licence. While many projects are already exploring the path to compliance, most are still in the regulatory grey zone。

Summary

The encrypted world used to entertain itself in its own circles: new chains, new currencies, new stories, new narratives. But true financial power comes from a market in which global capital really wants to participate。

And NASDAQ is always there, where trillions of dollars flow, where the world's most valuable companies trade。

Thus, the real circle players never cared where the battlefield was, but only where the opportunity was。

Statement: This paper is for information-sharing only and does not constitute any investment proposal. Investment needs to be prudent, informed by rational decision-making and risk-taking。