Silver in the eyes of traders is the next bitcoin

High-level transactions zoom in. Is the silver on top?

"In the last eight years, bitcoin has not won silver."

When the phrase began to circulate among traders, a re-evaluation of the value of silver had begun。

On January 27, silver prices rose by 16 per cent in the disk, touching a new high of $117.73 ounces, which over the past 12 months had increased by twice the total market value of TT。

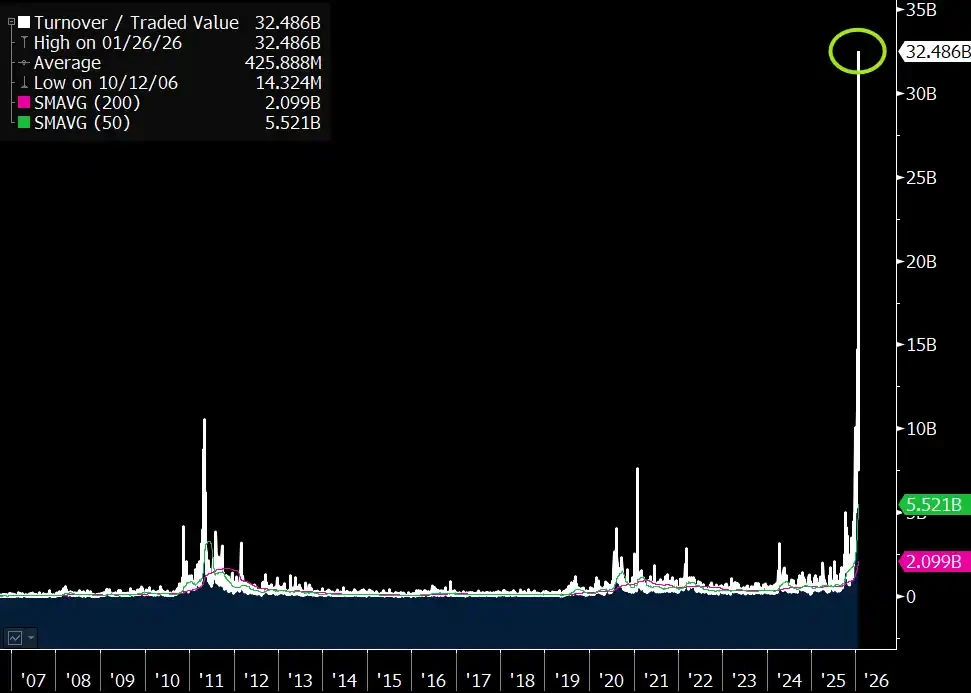

The world’s largest silver bank, ETF iShares Silver Trust (SLV), was up to $32 billion a day, 15 times its daily average, and even more than the sum of 500 ETF (SPY), NVDA and TSLA, making it the world’s largest bond。

THE AMOUNT OF SILVER ETF $ SLV IS A SINGLE-DAY EXCHANGE OF 32B YESTERDAY

Silver, an old precious metal species, has been at the bottom for almost 10 years. Why is it suddenly popular with the market? It seems that the emotional work of just precious metal plates is slightly thin。

INDEED, THE NARRATIVE OF SILVER IS SHIFTING FROM "GOLD OF THE POOR" TO "BASICS OF INDUSTRIAL GROWTH", AND ITS FUNDAMENTALS ARE UNDERGOING A PROFOUND STRUCTURAL RESHAPING. WHETHER IT COMES FROM INDUSTRIAL DEMAND, MONETARY ATTRIBUTES, INSTITUTIONAL MOVEMENTS AND THE INFLOW OF ETF, THE SILVER BANK SEEMS TO BE ON ITS "BITCOIN MOMENT"。

Industrial demand outbreak

One of the major causes of the silver boom is an ongoing and irreversible industrial revolution。

PHOTOVOLTAIC, NEW ENERGY VEHICLES, AI, THE DEVELOPMENT OF THESE NEW INDUSTRIES, DUE TO TECHNOLOGY OVERLAPS AND MARKET EXPANSION, THE DEMAND CURVE FOR SILVER HAS BECOME EVER STEEPER

Photovolt

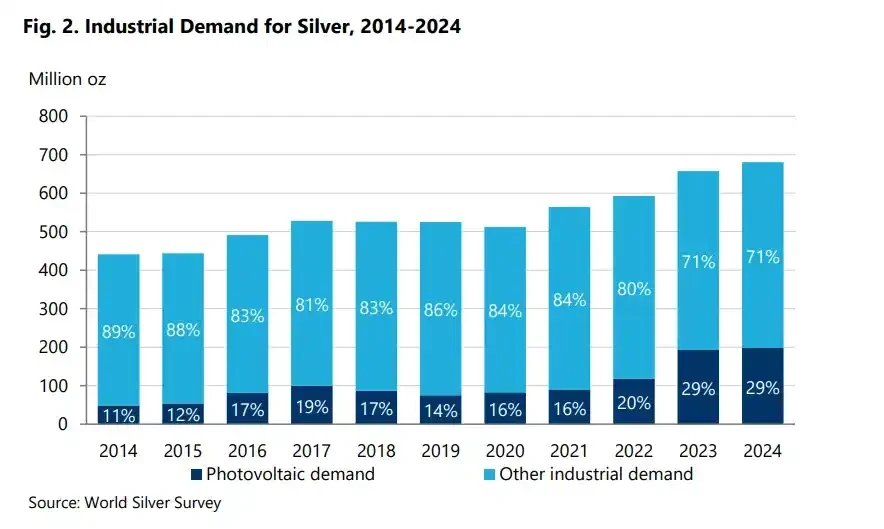

IN 2022, THE DETONATION POINT FOR THE LIGHT-VOLTAGE INDUSTRY'S DEMAND FOR SILVER CAME TO LIGHT. PRIOR TO THIS, PERC BATTERY TECHNOLOGY WAS WIDELY USED IN THE PHOTOVOLTAIC INDUSTRY, AND SILVER CONSUMPTION WAS RELATIVELY STABLE. HOWEVER, AS THE INDUSTRY TRANSITIONS TO MORE EFFICIENT BATTERY TECHNOLOGY, THERE IS A SURGE IN BATTERY DEMAND FOR SILVER PLASMA。

Moreover, conductive silver plasma is the core material of photovoltaic batteries and no alternatives are available. In 2024, global PV consumption reached 6147 tons, accounting for nearly 30 per cent of total global demand for silver, and was equal in scale to global demand for silver jewellery。

Source: World Silver Association Survey

ACCORDING TO DATA FROM THE CHINA PHOTOVOLTAIC INDUSTRY ASSOCIATION (CPIA), SILVER PLASMA COSTS HAVE ALREADY ACCOUNTED FOR 53 PER CENT OF THE NON-SILIC COSTS OF PHOTOVOLTAIC BATTERIES, MOVING FROM "BACKWOOD" TO "MAINWARE" AS IMPORTANT AS SILICON。

In the face of a sharp increase in silver prices from $25 to $115, photovoltaic companies are not insensitive. The leading companies, such as Lungi Green Energy, have made it clear in their financial statements that the rising costs of silver sour have severely squeezed profits. But the reality is that they can only be accepted passively until there are no mature alternatives (e.g., copper plating) for large-scale commercialization。

New energy cars

Electric cars are another "battery-sized household" and, after 2020, the global penetration rate of new energy vehicles has crossed the threshold from 3 per cent in 2019 to 21 per cent in 2024。

And the amount of silver per pure electric car is two to three times that of a conventional fuel truck. In the case of Biadi, it was analysed that a typical EV battery pack (100 kWh capacity, approximately 200 cores) required approximately 1 kg of silver per vehicle。

If it were to sell 4.3 million vehicles in 2025 in Biadi, the demand for silver in this enterprise alone could reach 4300 tons. In addition, the silver-based solid cell technology being advanced by Biadi may further increase silver usage in the future。

AI DATA CENTRE

THE EXPLOSION IN THE AI DATA CENTRE ALSO ADDED NEW IMAGINATION TO THE DEMAND FOR SILVER. ACCORDING TO THE WORLD SILVER ASSOCIATION, IN 2025 AI-RELATED SILVER DEMAND SURGED BY 30 PER CENT, USING MORE THAN 1,000 TONS A YEAR。

ALTHOUGH ONLY 3 TO 6 PER CENT OF TOTAL GLOBAL DEMAND FOR SILVER, THE AI SERVER IS THE FASTEST GROWING SEGMENT OF THE DEMAND FOR SILVER, WITH ANNUAL GROWTH OF OVER 50 PER CENT. AN ENGLISH-WIDA H100 SERVER CONTAINS 1.2 KG OF SILVER, FAR ABOVE THE CONVENTIONAL SERVER OF 0.5 KG OR SO。

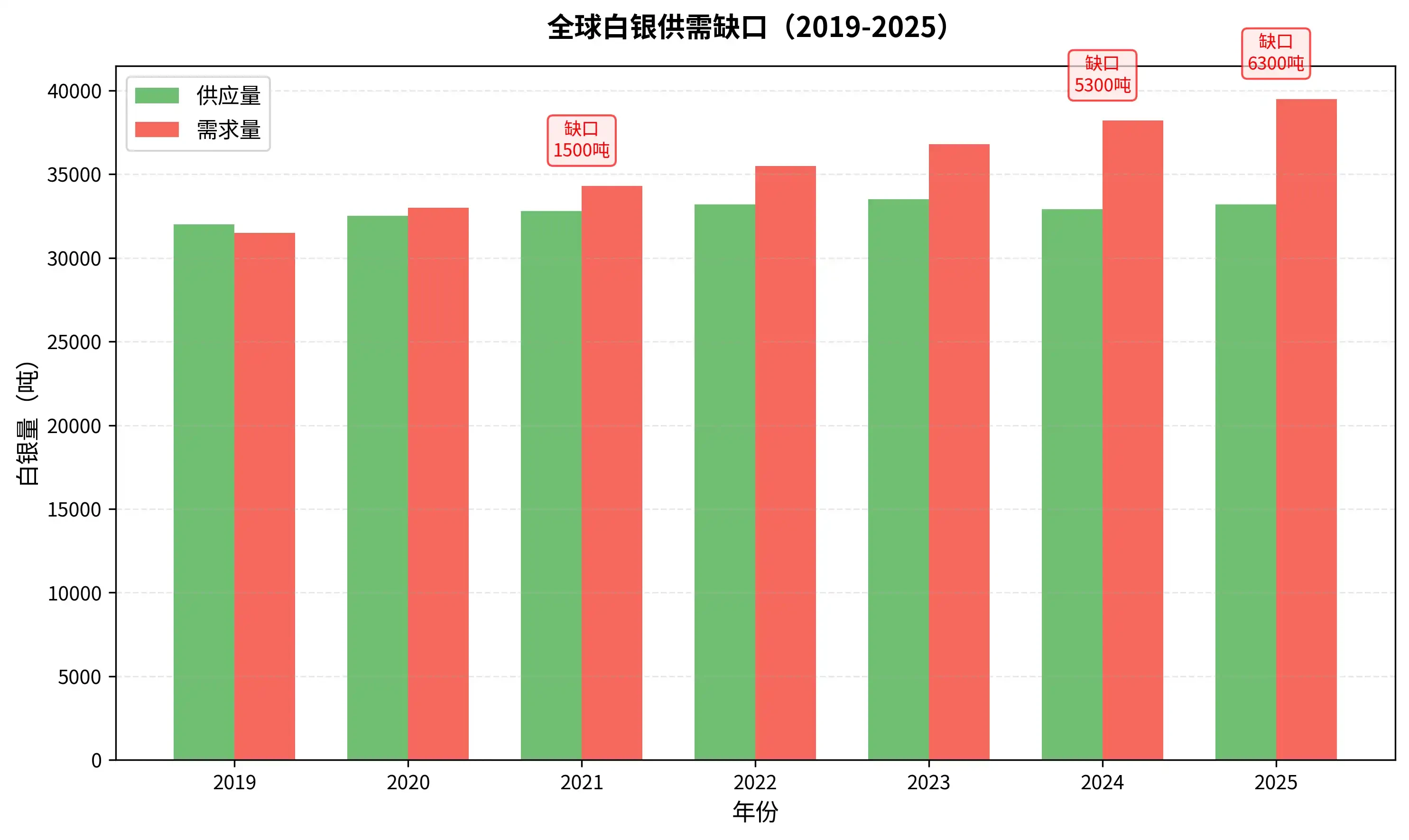

Rigorous supply

In addition, the current supply side of silver is difficult to keep pace with demand. About 70 per cent of the world's silver is by-product of mining metals such as copper, lead, zinc, which means that the supply of silver is "rigid" and cannot increase rapidly at prices。

Data show that the global silver market has experienced a structural deficit for the fifth consecutive year since 2021 and that the gap is widening. When unbridled demand encounters an inflexible supply, the sharp price rise is only a matter of time。

The awakening of monetary attributes

Gold and silver

In addition to industrial demand, long-depressed monetary attributes of silver and silver are being revived by the market. The key to understanding this is the gold and silver ratio, that is, how much ounce of silver is needed to buy an ounce of gold。

The value of gold is almost entirely supported by its monetary attributes, while silver is combined with industrial and monetary attributes. In the traditional economic cycle, when industrial demand shrinks in economic downturns, the price of money is pushed up by risk-averse demand, leading to higher prices。

For example, in the aftermath of the 2008 financial crisis, global industrial production stagnated, demand for silver fell sharply in such industries as automobiles and electronics, and the influx of investors to avoid gold led to a breakthrough of 80. Conversely, when the economy recovers, the recovery in industrial demand will drive up and down silver prices. After the 2020 epidemic, global manufacturing recovered, and the silver-to-gold ratio fell from 123 to 65。

But this pricing logic is undergoing a profound shift. Against the backdrop of the global weakening of the United States dollar-based, statutory monetary credit system, the "integrity" properties of precious metals have been reactivated。

Gold versus silver

Now, gold and silver are down 50, more than last year's 103rd was cut straight to the bottom, down by almost 14 years. Historically, the long-term average of the gold and silver ratio was between 60 and 70, falling 50, a clear sign of the revaluation of the silver and silver value

Investors buy gold and silver, not only for traditional risk avoidance or industrial applications, but also for the risk of devaluation of the currency. The monetary properties of silver are being activated in step with industrial attributes, and together with gold, they are media for value storage。

Precious metal, Dragon Two

The sharp decline in the ratio of gold and silver, in addition to the need for its own fundamentals, is also driven by the funding rotation effect。

In precious metal plates, gold is a well-deserved "lead" and silver is a much more resilient "long two". When monetary attributes become the main line of market pricing, lower prices and historically more volatile silver will naturally attract funds seeking higher returns。

According to data from the Chicago Merchandise Exchange (CME Group) for nearly 50 years, six major repairs to the gold-and-soldier ratio took place, five times in the gold market。

When the gold cow market is established, money tends to rotate to more flexible silver in pursuit of excess earnings. This was confirmed by the perfect performance throughout 2025: gold rose by 67.5 per cent, while silver rose by as much as 175 per cent, 2.6 times the former。

The sharp fall in the gold-and-silver ratio is a reflection of the movement of market funds from gold to silver. Investors are not only buying precious metals to hedge risks, but also pursuing higher potential returns from silver versus gold。

Biggest multiple head: Morgan Chase

THE MOST INTERESTING SIGNAL ON THE MARKET COMES FROM MORGAN CHASE. IT WAS FINED $920 MILLION PER DAY BY THE UNITED STATES DEPARTMENT OF JUSTICE AND THE COMMODITY FUTURES TRADING COMMISSION (CFTC) IN 2020 FOR LONG-TERM MANIPULATION AND DEPRESSED SILVER PRICES。

The main method of manipulation is to create a false image of demand or supply in the market through the issuance of a large number of false purchase orders, to influence prices before the bill is withdrawn quickly and to profit from reverse transactions。

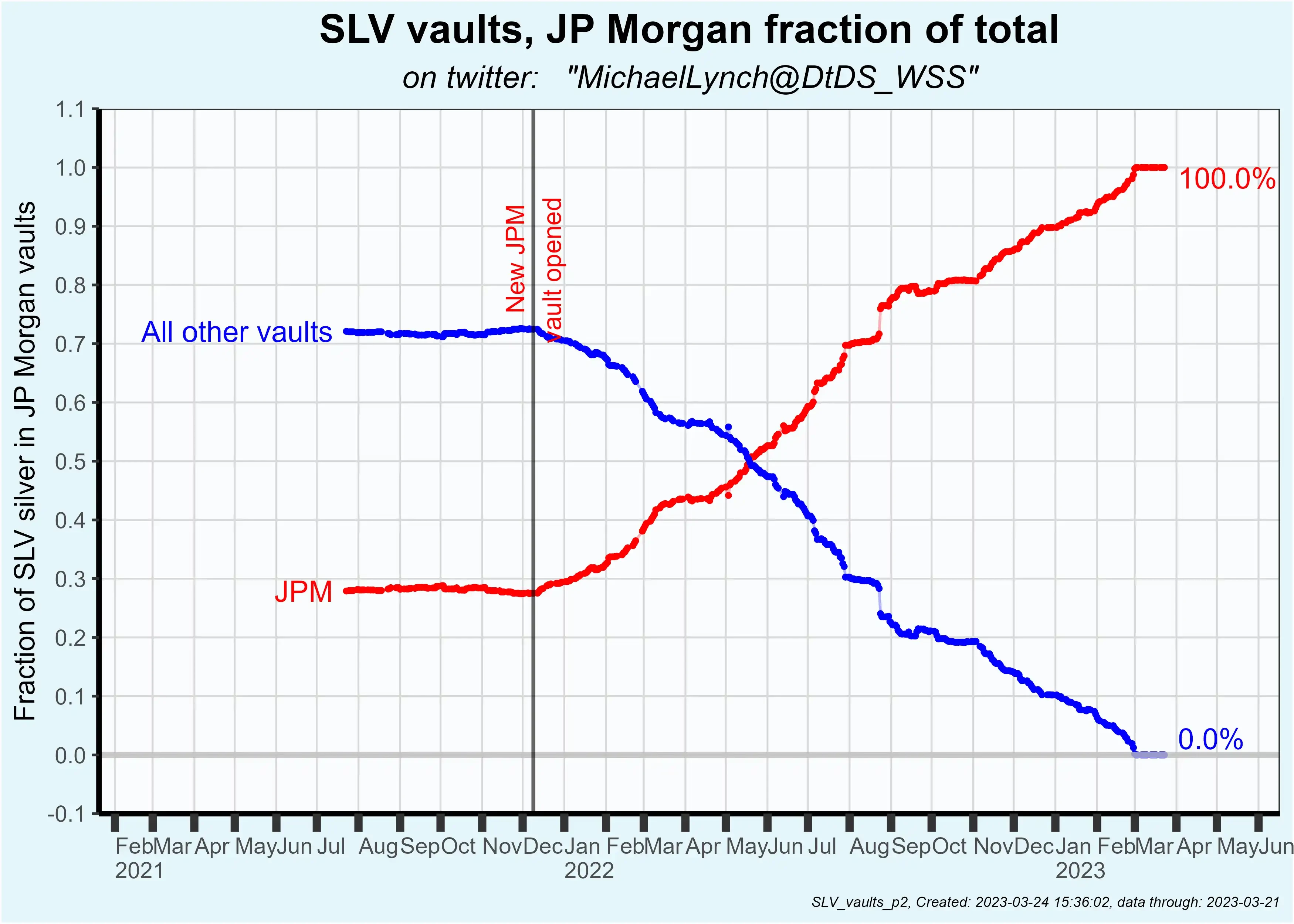

HOWEVER, JUST AFTER BEING PUNISHED, CHASE MORGAN TURNED AWAY FROM LONG-TERM PAPER AND BEGAN TO BUILD UP A MAD ACCUMULATION OF REAL SILVER. ACCORDING TO MULTIPLE SOURCES, MORGAN CHASE CURRENTLY HOLDS MORE THAN 750 MILLION OUNCES OF PHYSICAL SILVER INVENTORY, THE LARGEST IN THE WORLD AND EVEN MORE THAN THE WORLD'S LARGEST SILVER ETF (SLV) HOLD。

And Morgan Chase closed about 200 million ounces of paper empty in June-October 2025, and then in just six weeks between November and December 2025, 21 million ounces of real silver were added。

AFTER OPENING A NEW WAREHOUSE IN NOVEMBER 2021, MORGAN CHASE GRADUALLY TOOK OVER ALL THE SILVER INVENTORY OF SLV

CFTC DATA ALSO CONFIRM THIS SHIFT. IN JANUARY 2026, THE NET STOCK OF SILVER AND NON-COMMERCIAL HOLDINGS ROSE TO A HIGH, WITH MORGAN CHASE ACCOUNTING FOR A SIGNIFICANT SHARE OF NET STOCK HOLDINGS。

With regard to the reasons for Morgan Chase ' s shift, it is widely recognized that Bloomberg and Reuters ' s analysis is partly due to the fact that they were informed in advance, through customer transactions, of the huge and rigid demand for silver from China ' s light voltage and new energy enterprises。

At the end of 2025, Chase Morgan moved its core precious metals trading team to Singapore and built a large-scale local bank。

This series of operations has been interpreted by the market as the best "smart money" on Wall Street, and has been bet on a silver-coloured epic world. When manipulators who used to lower prices became the largest holders, silver opened the bulls' market。

From Digital Assets to Physical Assets

While the silver base is ever stronger, the once-digital gold bitcoin appears to be facing a crisis of trust. In contrast, a "wheeling" from digital to physical assets is happening。

THE ETF FLOWS IN JANUARY 2026 SHOW THE MOST INTUITIVE DISPLAY OF THE WHEEL. ON THE ONE HAND, THE REAL BITCOIN ETF NET OUTFLOWS OF $1.7 BILLION OVER 11 TRADING DAYS; ON THE OTHER HAND, THE MONEY IS POURING INTO SILVER ON AN UNPRECEDENTED SCALE。

On January 27th, the world's largest silver ETF iShares Silver Trust (SLV) soared to $32 billion a day, at the top of the world's ETF every day。

Market fanaticism goes beyond that. ProShares Ultra Silver (AGQ), twice as silver as a lever for ETF, is in the fifth place。

This suggests that the influx of silver is not only for funds that seek to be well allocated, but also for speculative forces that seek high multiplier returns。

JANUARY 27, RANKING OF ETF TRANSACTIONS

The enthusiasm of the diaspora had risen before. According to VandaTrack, in the 30 days of January 15th, the bulk traders invested more than $920 million in the silver-related ETF, the largest single-month inflow since the record。

FUNDS ARE BEING WITHDRAWN FROM BITCOIN ETF, WHICH IS POURING INTO PRECIOUS METALS, BOTH GOLD AND SILVER. BEHIND THIS IS A REASSESSMENT BY INVESTORS OF THE RISK-BENEFIT RATIO BETWEEN THE TWO ASSETS。

There are rumours explaining the inflow of such funds, as the United States Government broke the Bitcoin wallet by crashing, and 127,000 bitcoins were transferred directly into the United States Government's wallet, valued at about $15 billion。

In short, this part of the funding considers Bitcoin unsafe. Adding news, such as quantum calculations, could break the bitcoin algorithm, prompting funds to accelerate the selection of gold and silver。

In terms of prices, the marginal effect of the increase in bitcoin every four years has decreased, while silver has just emerged from the bottom of a decade. In 2025, against the backdrop of a 175 per cent increase in the price of silver, the price of bitcoin fell from a high to more than 30 per cent. In 2026, the trend became more pronounced。

When bitcoin's narrative began to shake, when money started looking for a new direction, the silver was becoming the pet of the age with its fundamental changes