Conformity stabilizes the war. Tether issued USAT to kill America

USDT ATE ALL THE STABILIZERS FIRST, AND THIS TIME, HOW COULD USAT BREAK THE DEAL

Original Odaily Daily@OdailyChinaI'm not sure

By Azuma@azuma_ethI'm not sure

On January 27Tether officially announced that it targeted the United States market and that the new dollar stabilization currency, designed for the regulatory framework of GENIUS, USAT, was officially on line。

USAT's announcement of preheating has been long. As early as last year’s GENIUS bill broke out, Tether had determined that a dollar-stable currency would be introduced in addition to the USSDT to compete positively with other stable currencies in the US market under the compliance system; later, Tether disclosed on several occasions the details of USAT’s development process and design, which would have been online by 2025, but eventually officially landed in January this year。

USAT: MORE COMPLIANT USDT

WITH THE OFFICIAL LANDING OF USAT, THE VEIL OF THE BRAND-NEW STABLE CURRENCY WAS COMPLETELY REMOVED。

According to Tether's official statementUSAT IS DESIGNED FOR THE UNITED STATES MARKET AND WILL BE DESIGNED IN FULL COMPLIANCE WITH THE NEW FEDERAL STABILITY CURRENCY REGULATORY FRAMEWORK ESTABLISHED BY THE GENIUS ACT (WHICH YOU CAN SIMPLY INTERPRET AS A COMPLIANCE VERSION OF THE USDT)I don't know. Specifically, Tether will issue USAT through the United States Federal Chartered Bank, Cantor Fitzgerald, as the reserve fund trustee and preferred level I dealer for USAT, and Bo Hines, the former Executive Director of the White House Encryption Monetary Commission, will be in direct charge of USAT operations as CEO。

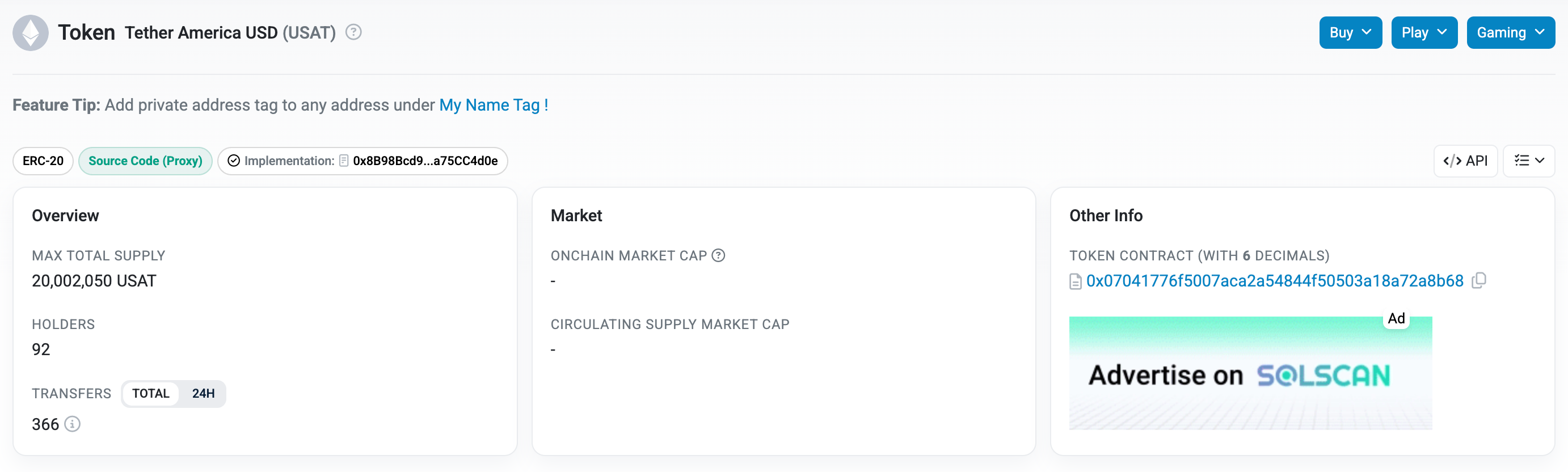

In the initial phase of the launch, USAT will be distributed only on the Taifeng Master Network, with an initial distribution of $20 million and an official contract address of 0x074776f50007aca2a5444f5003a18a72a8b68。

At the distribution level, Bybit, Cripto.com, Kraken, OKX and Moonpay will be the first support platforms for USAT, which are now online。It is interesting to note that there are no coins and Coinbase in the first platforms, and that the former is now looking at World Liberty Financial (USD1), while the latter has long-term interests tied to Circle (USDC), choosing not to support USAT。

Tether 's Future: Two Tracks Parallel

USAT IS ONLINE AND DOES NOT MEAN THAT THE USDT STATUS WILL BE REPLACED。

As a matter of fact, Tether has made several statements about USDT and USAT, stressing that the future will be a parallel development model of two stable currencies --USAT FOCUSES ON THE UNITED STATES MARKET, COMPETING WITH RIVALS SUCH AS USDC WITHIN THE COMPLIANCE SYSTEM TO ROB INSTITUTIONAL CUSTOMERS OF TRADITIONAL FINANCIAL MARKETS; USDT WILL FOCUS ON OFFSHORE MARKETS AND CONTINUE TO SERVE AS THE BACKBONE OF LIQUIDITY IN ENCRYPTED CURRENCY MARKETS。

In yesterday's USAT bulletin, Tether again referred to the progressive compliance strategy of USDT: “USDT will continue to operate on a global scale and will lead the market as the world's largest stable currency, while moving towards compliance with the GENIUS Act.”

Within a short period of time, USDT will still be the main business position for Tether, which USAT can hardly replace at the scale level, but it can be expected that Tether will have some resources in favour of USAT to boost the early growth of the stable currency。

From the first to the second, Tether, how do we break this

ONCE USAT ENTERS THE MARKET, THE STABLE CURRENCY COMPETITION PATTERN IN THE UNITED STATES MARKET IS BOUND TO RISE AGAIN。

In the light of the current developments, there is a need for a better understanding of the situationCircle (USDC)’s temporary lead position is not strong, and the global currency-stable market is dominated by Tether (USAT), World Liberty Financial (USD1), the Internet giants represent Paypal (PYUSD), and USDtb in Ito Belet ... The rivals are attacking them。

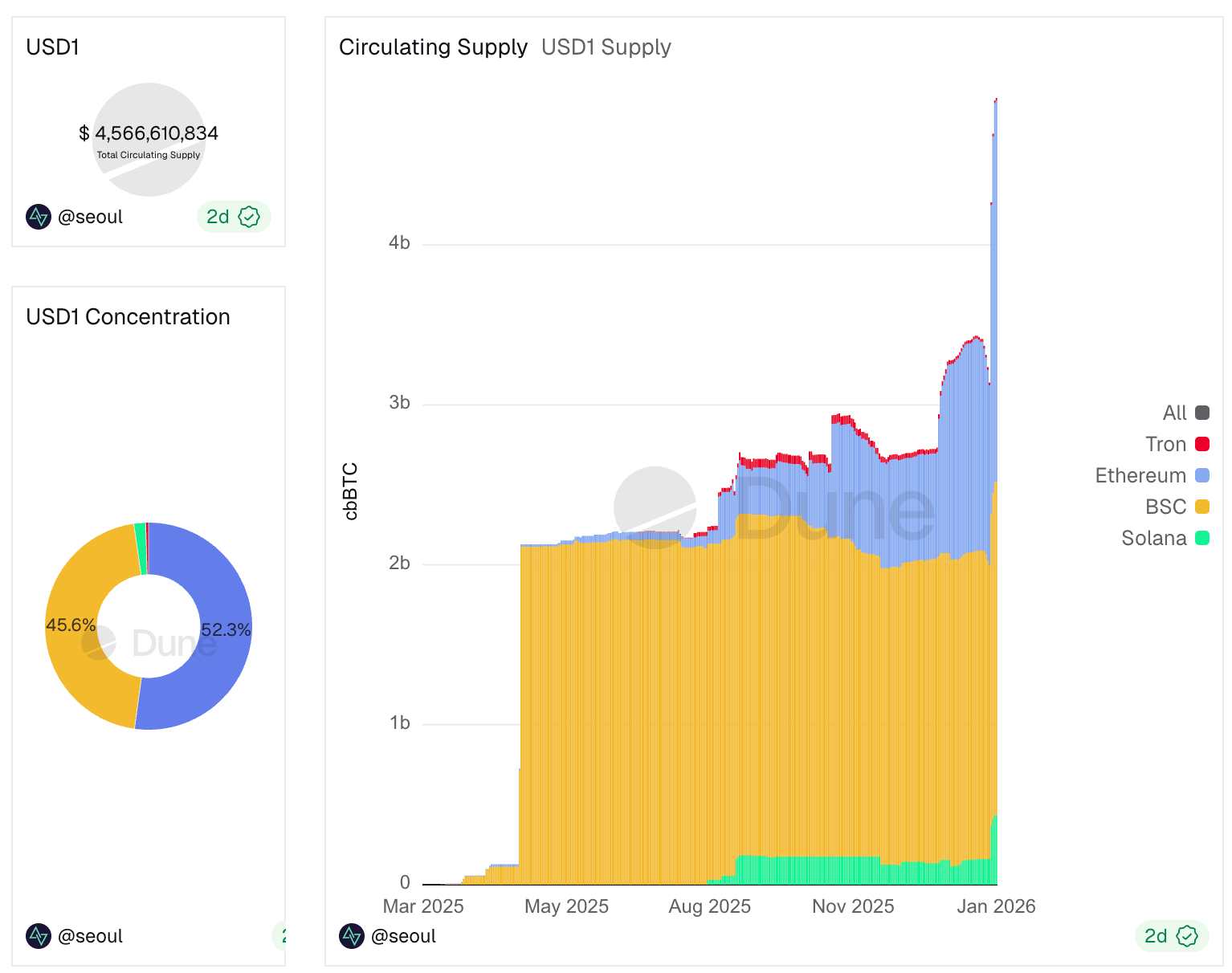

A MORE TYPICAL CASE IN POINT IS THAT SINCE THE INTRODUCTION OF JOINT SUBSIDY ACTIVITIES (INCLUDING CLOSED CURRENT FINANCES AND ONGOING AIR-DROP SUBSIDIES) IN DECEMBER 24TH LAST YEAR, THE SUPPLY OF USD1 HAS GROWN BY MORE THAN $2 BILLION, WHILE THE SUPPLY OF USDC HAS SHRUNK BY MORE THAN $5 BILLION OVER THE SAME PERIOD – AND THERE IS LIKELY TO BE SOME CORRELATION。

Similar cases do not exclude the fact that, as late-stable currency, Tether would clearly be the most efficient measure if it were to stimulate its supply growth. As ordinary users, we naturally also want to see the major stabilization currencies roll over to stimulate war。

There is no doubt that in 2025, Tether made billions of dollars in profits in just three quartersBut the problem here is that Tether has long been opposed to income subsidies。Tether CEO Paolo Ardoino has made it clear last year that he is dissatisfied with the industry’s pursuit of interest-rate stabilization coins, and that this is a “bad idea” so that future future future future growth options like USD1 will remain unknown。

This is a problem left to Tether -- in the course of the development of the stable currency, Tether used the USDT to take advantage of the pre-emptive advantage, and this time, as a back-to-back chaser, Tether's strategy is worth looking forward to。