This post is part of our special coverage Syria Protests 2011Thundernet

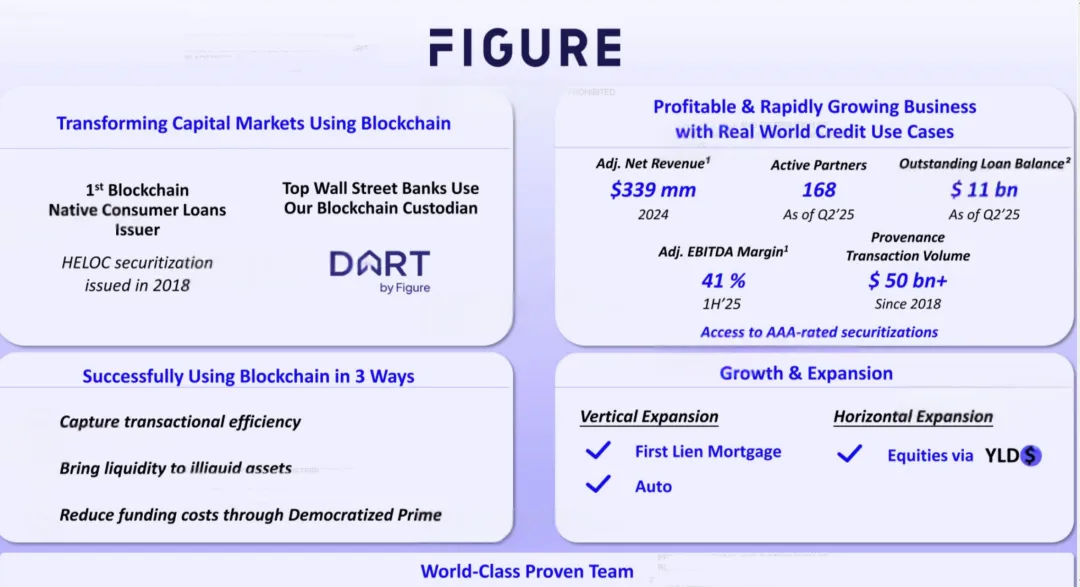

A lending company based on block-chain technology, Figure Technology Solutions Inc. (stock code: “ FIGR”) was listed yesterday in NASDAQ, United States。

The United States equity market has recovered significantly since 2025。

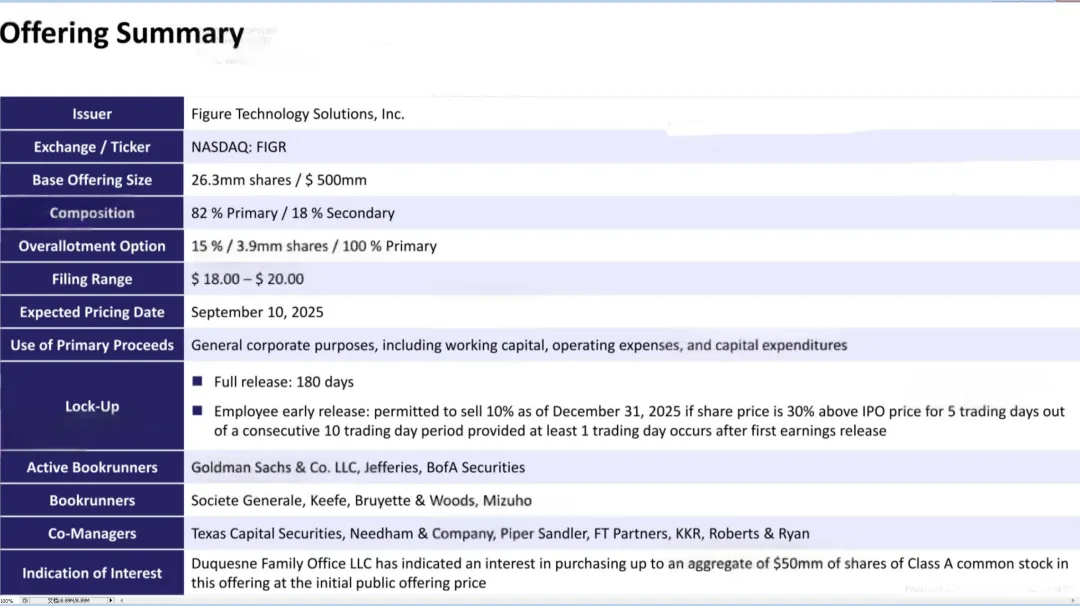

Figure increased the distribution range from $18 to $20 to $20 to $22 before listing and the distribution scale from 2.63 million to 31.5 million。

Figure's final release price was $25, and a total of $788 million was raised。

Figure opened at $36, an increase of 44 per cent over the issue price; $31.11, a 24 per cent increase over the issue price; and $6.6 billion in the company ' s market value at the offer price。

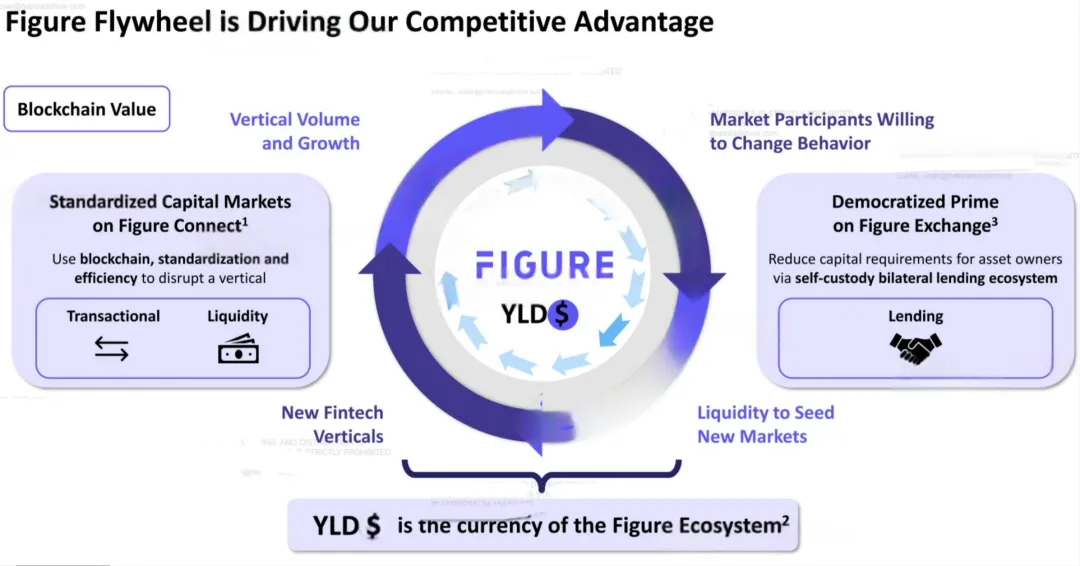

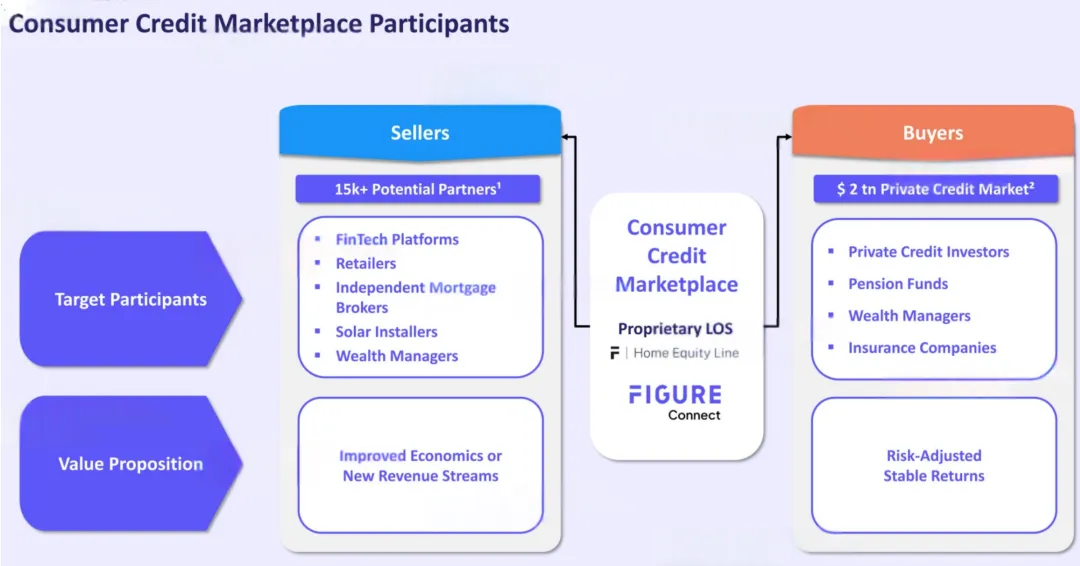

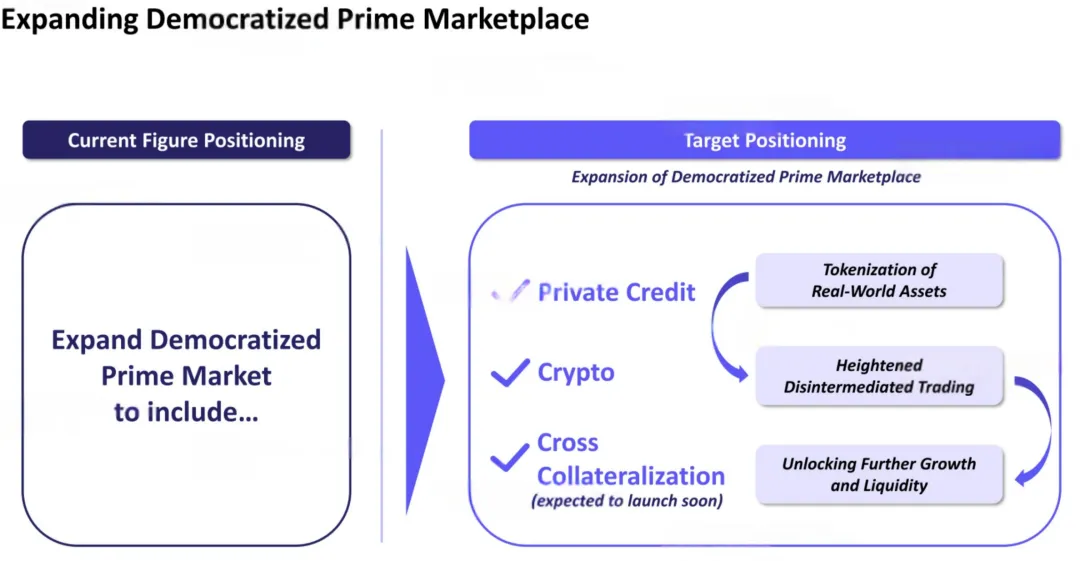

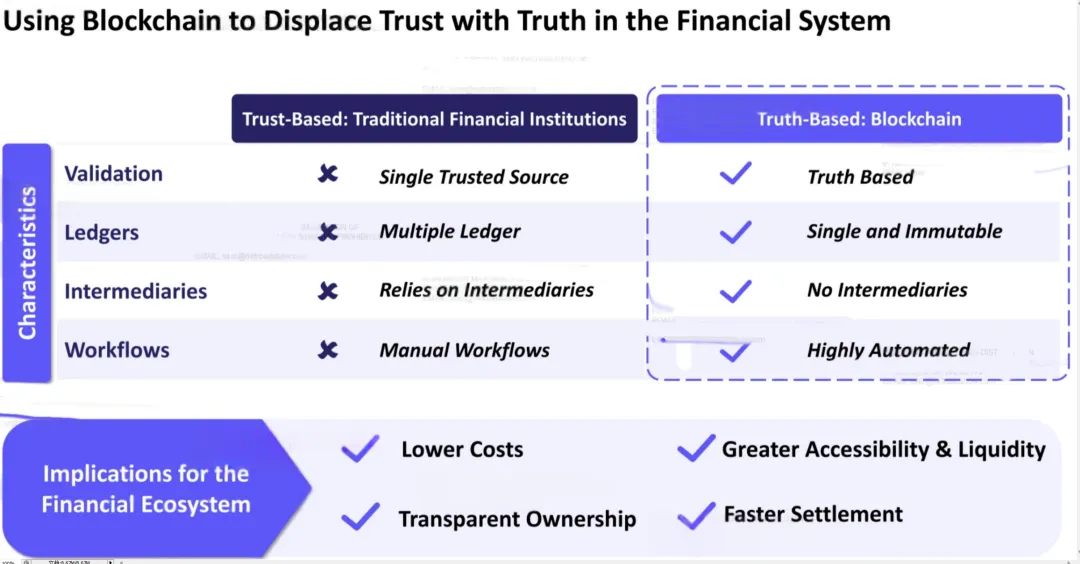

The co-founder of Figure, Mike Cagney, said that his block chain business was ready for major opportunities. “ If you think of the stock market, there are seven parties involved in each transaction. The block chain can reduce participants to two. ”

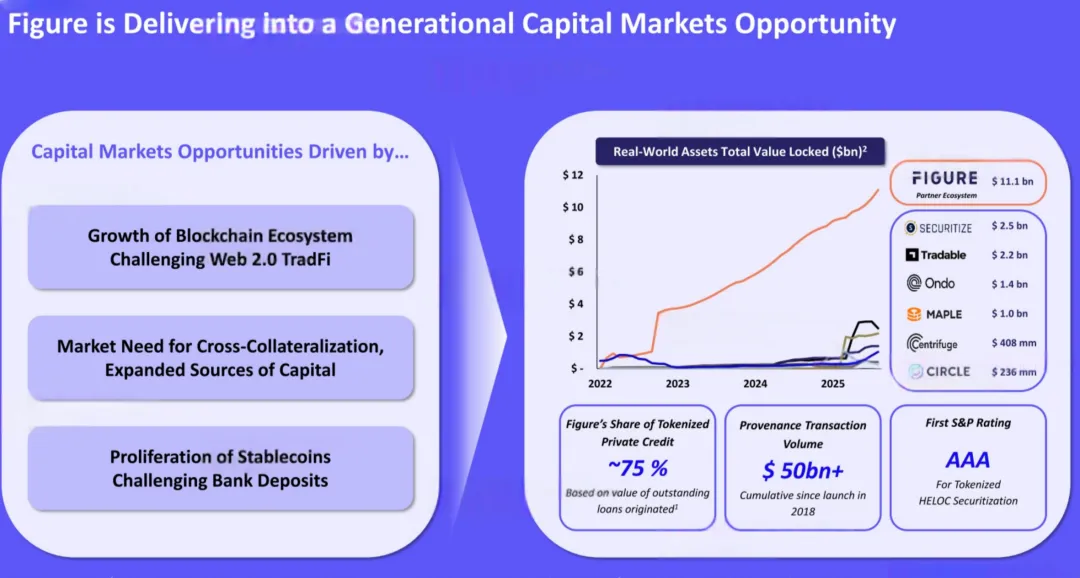

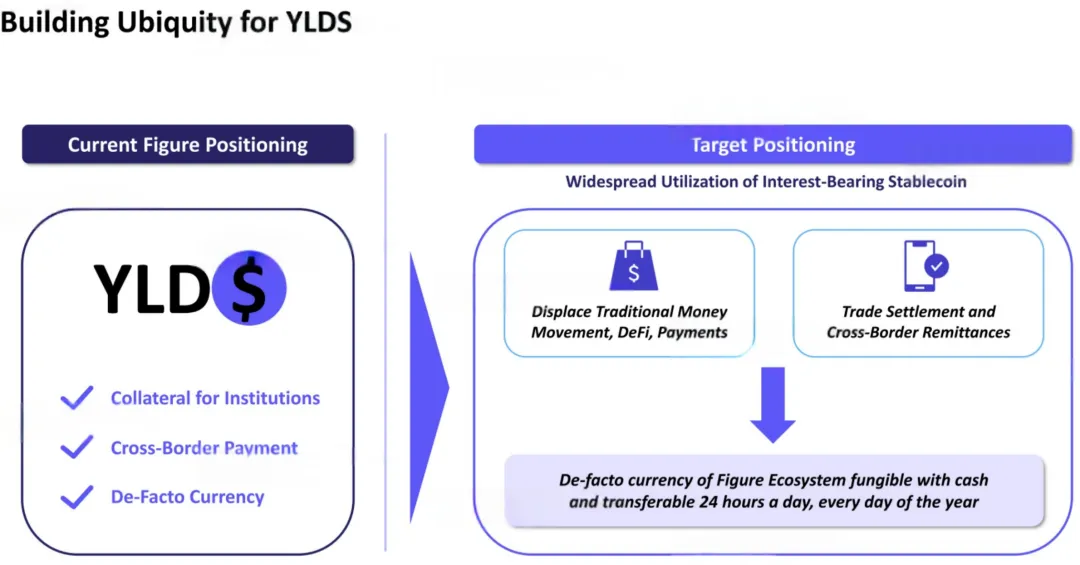

This was followed by the first share of the Stabilisation Currency, Circle, and the first share of the Compliance Exchange, Bullish. The encrypted currency exchange Gemini will be listed tonight in NASDAQ。

The first half of the year received $341 million

It was described that Figure was founded in 2018 by Mike Cagney, co-founder of Sofi. Mike Cagney was a founding member of SoFi, the online lending platform, and served as CEO until 2018. This context has brought to Figure a deep financial technology gene。

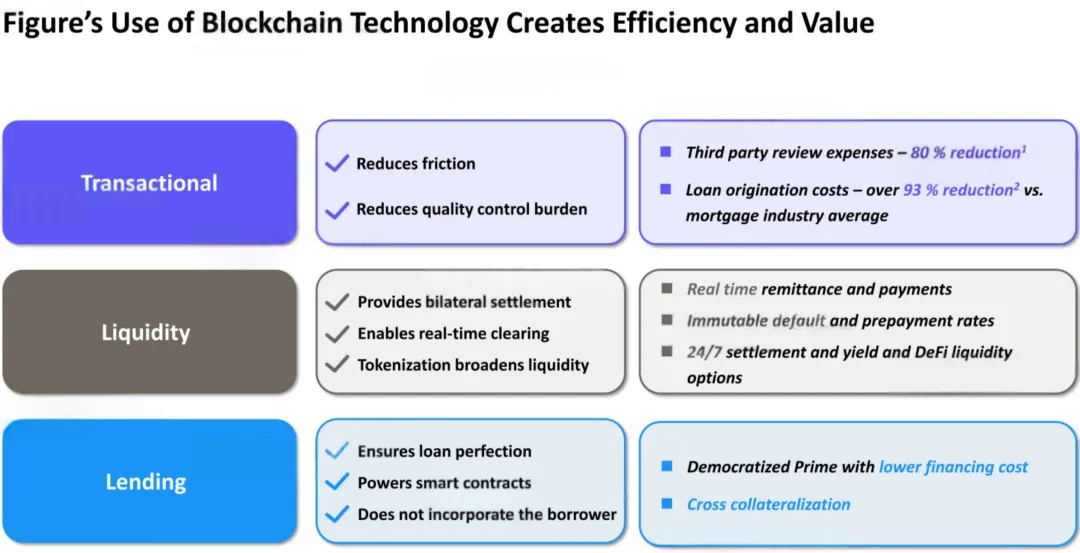

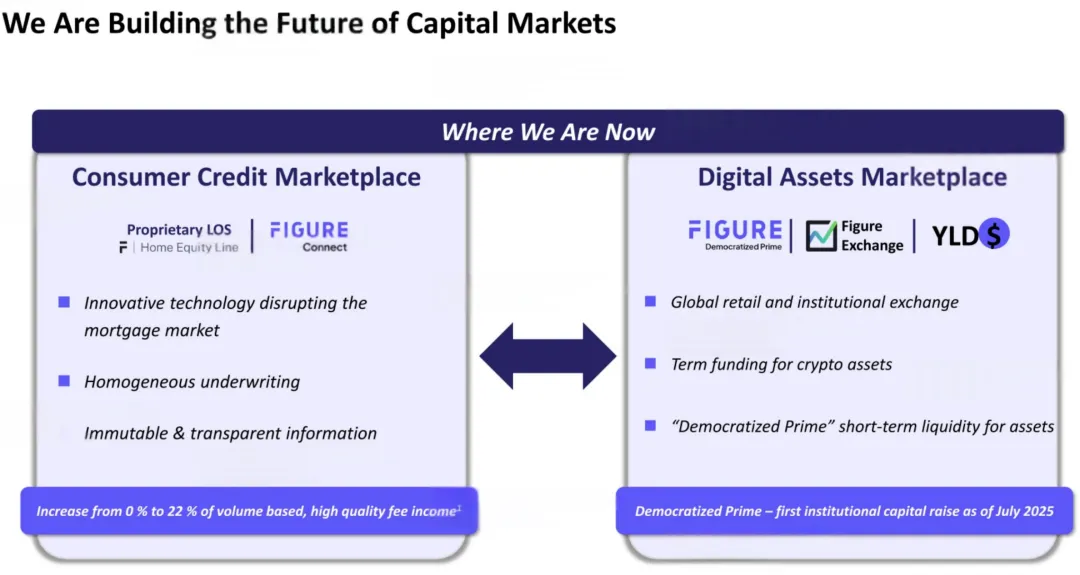

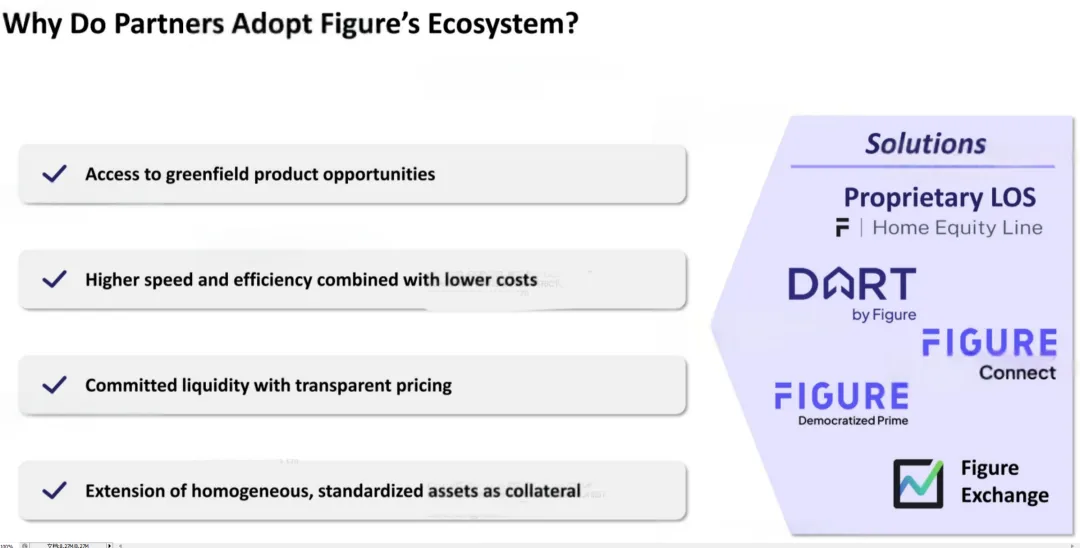

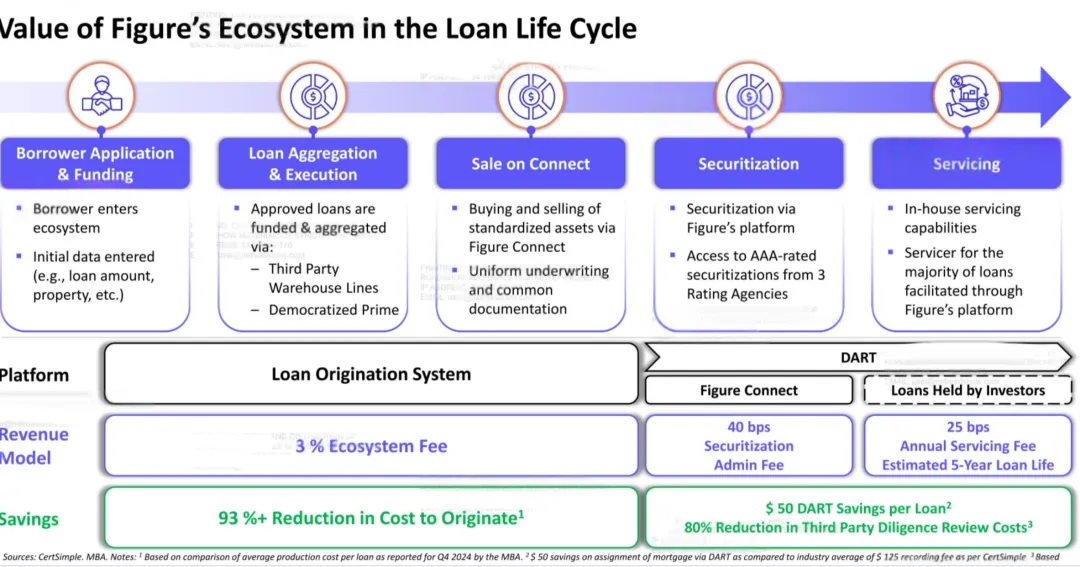

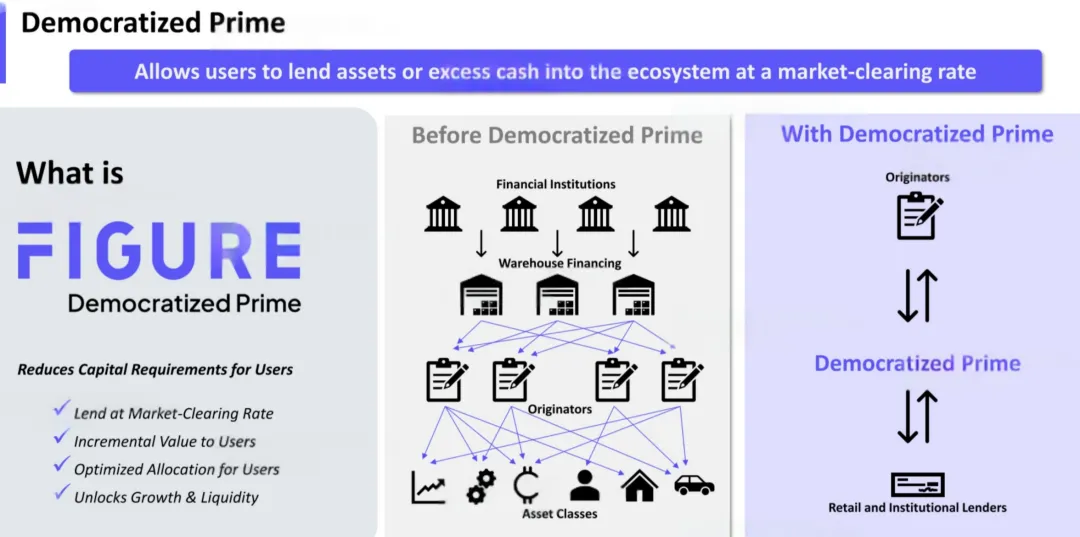

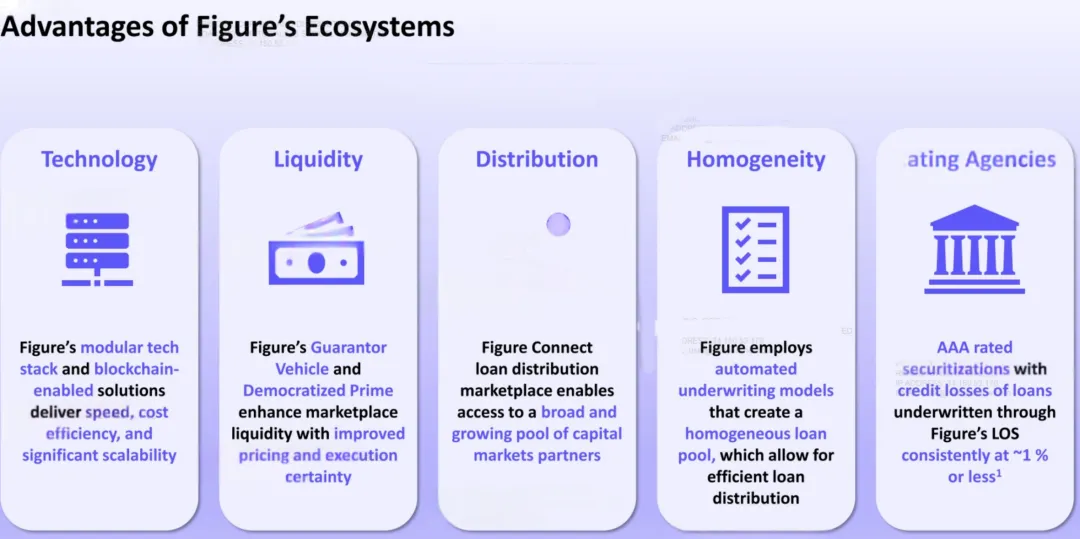

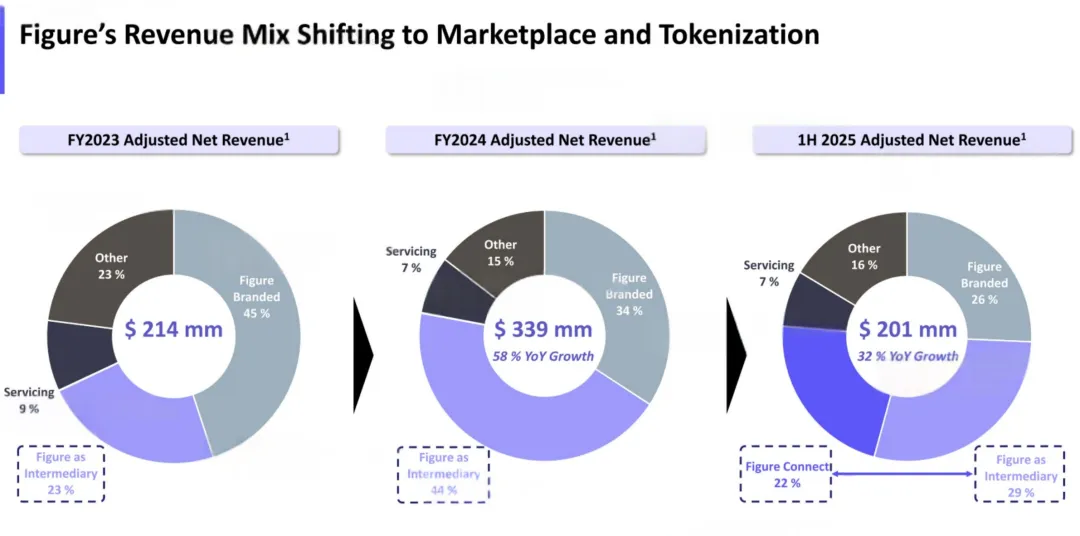

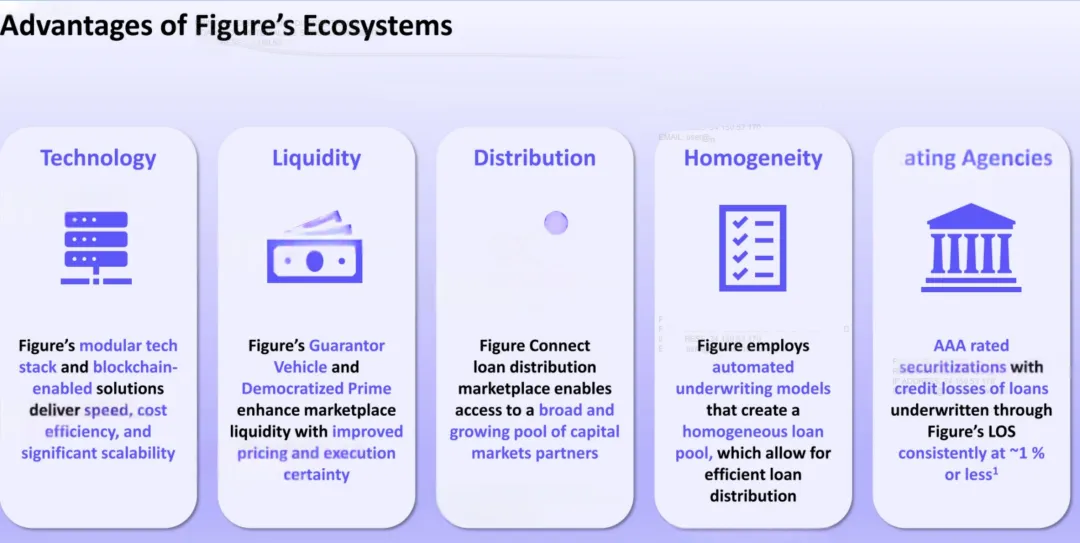

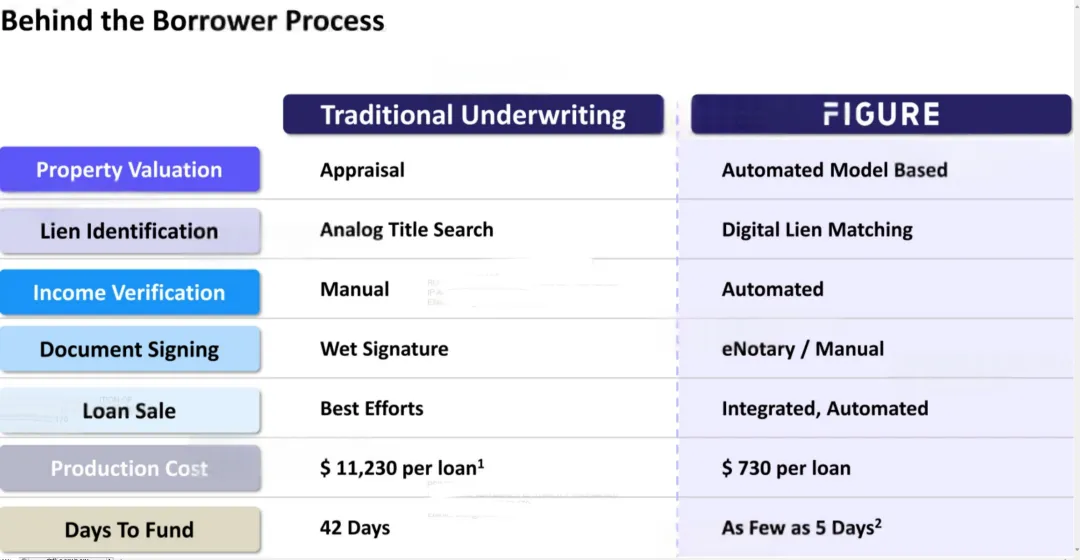

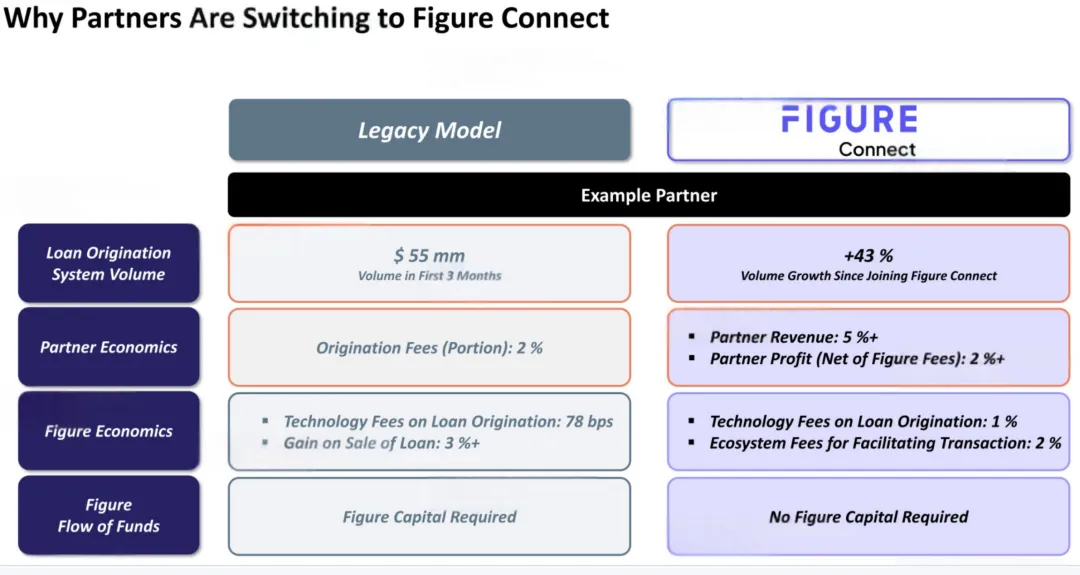

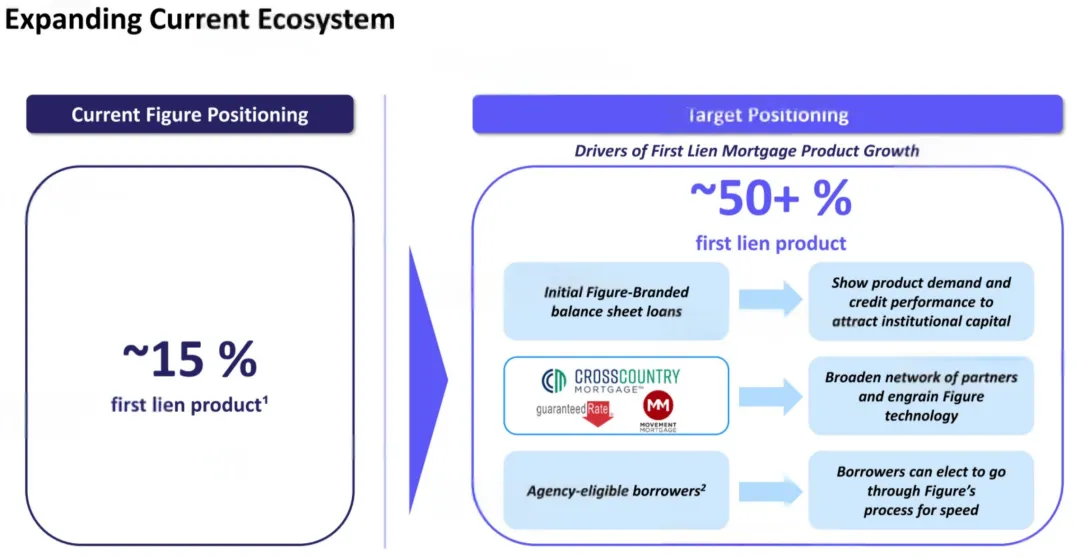

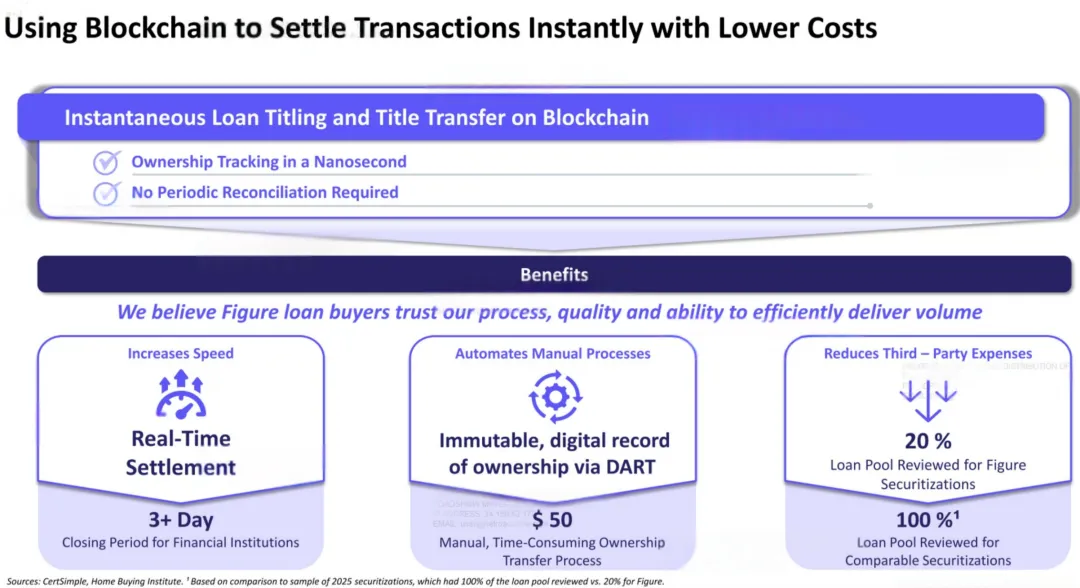

The core business of Figure is the development of block chain technology to facilitate lending。

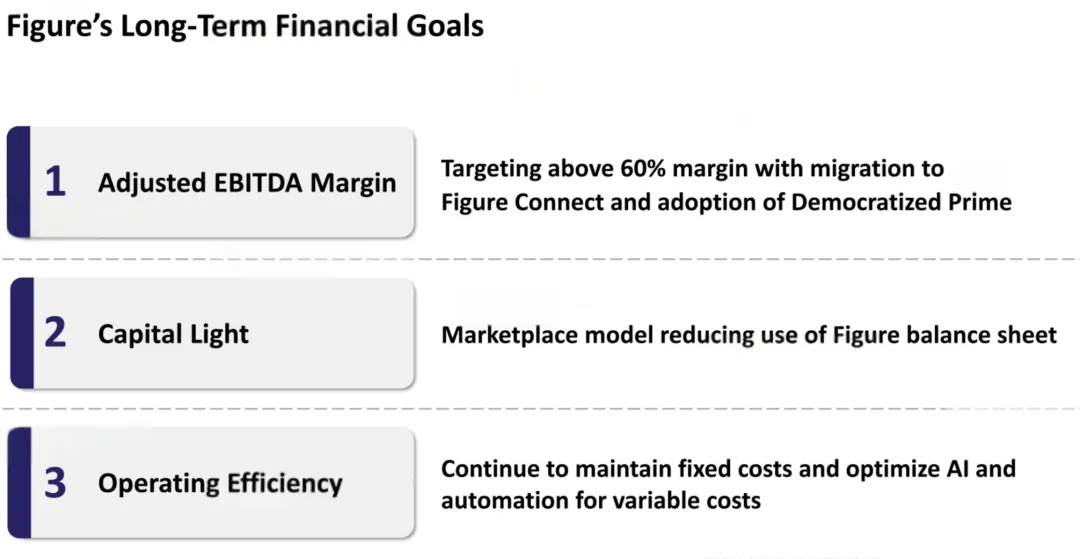

At the technology application level, Figure is optimizing business processes using artificial intelligence technology. The company uses OpenAI technology to assist in the assessment of loan applications and deploys Gemini-driven chat robots on the website, driven by Google parent Alphabet。

Figure's first entry point was a net worth loan (HELOC). This is the type of financing most commonly used by United States residents, but traditional processes take on average more than 40 days. Figure reduced the approval cycle to about 10 days through a self-study Provence block chain。

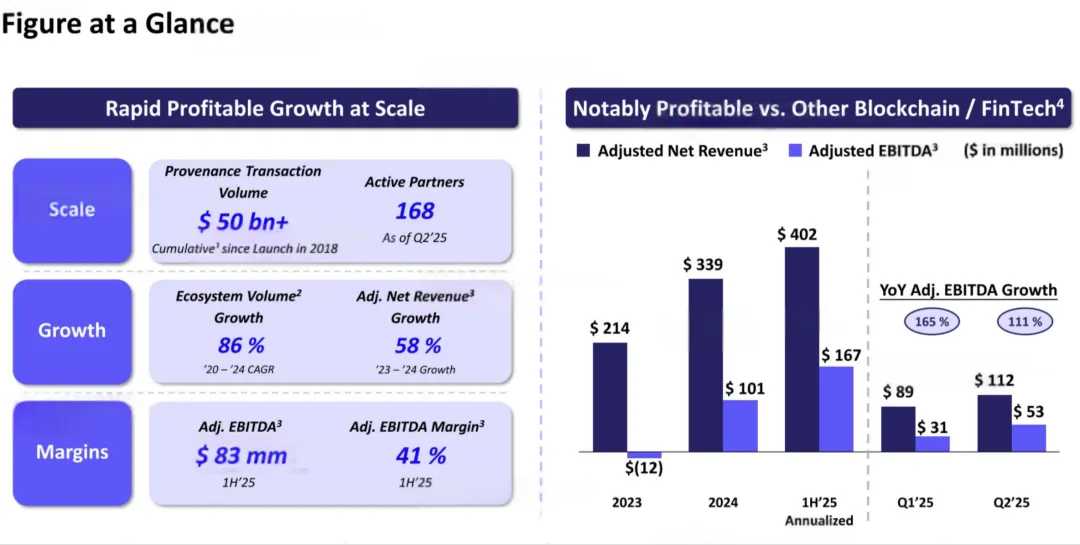

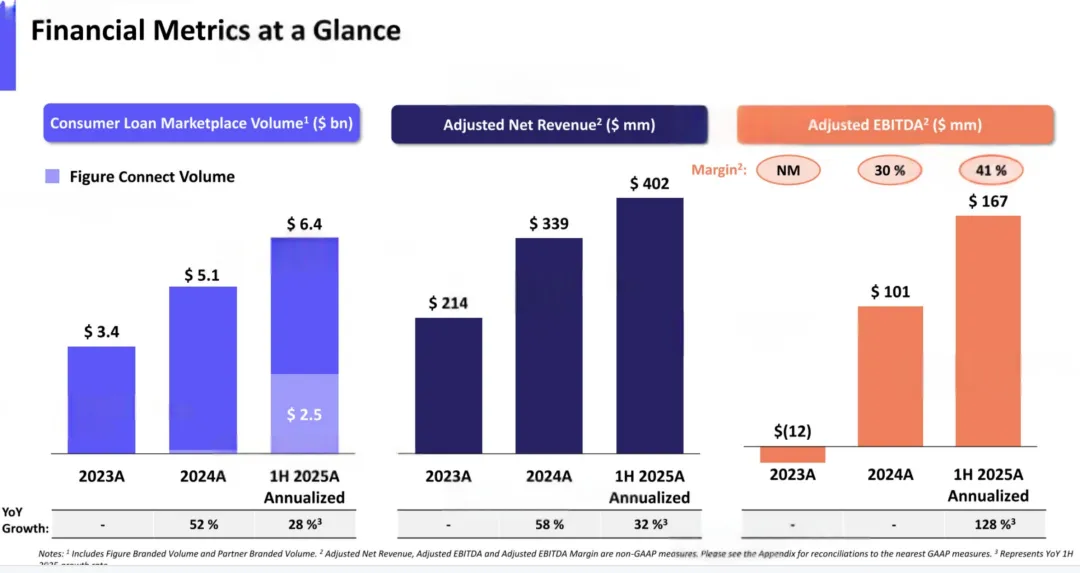

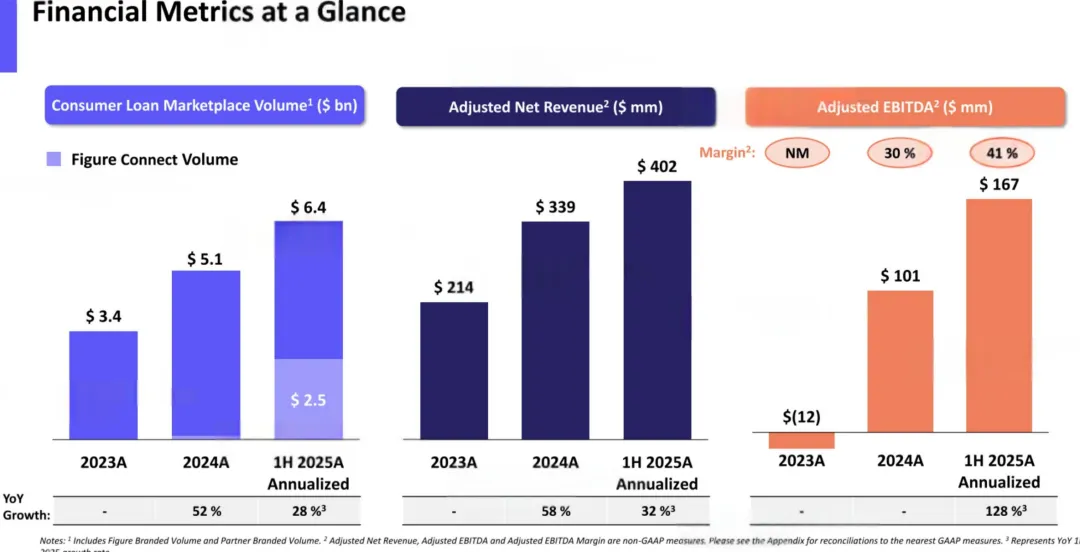

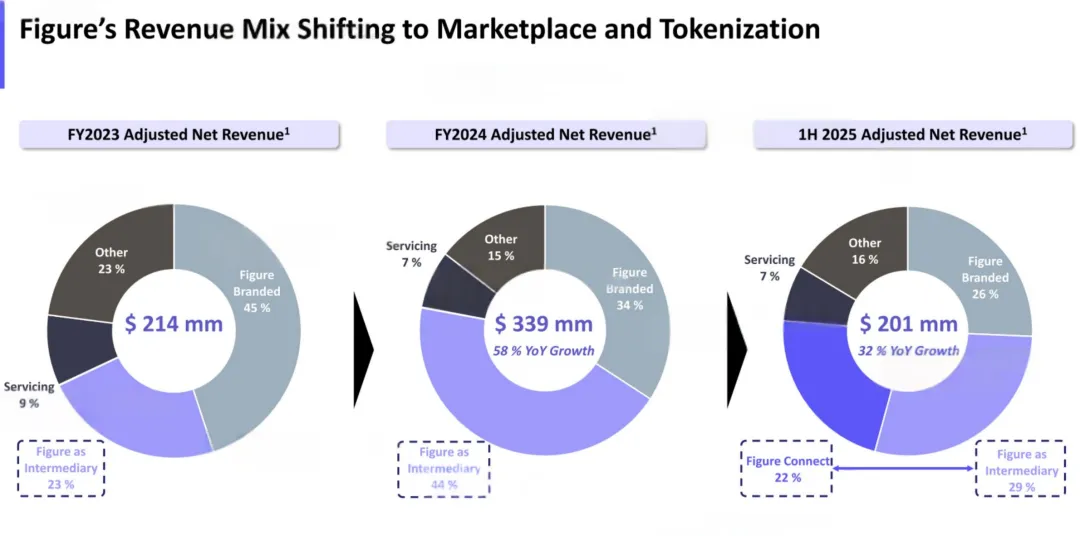

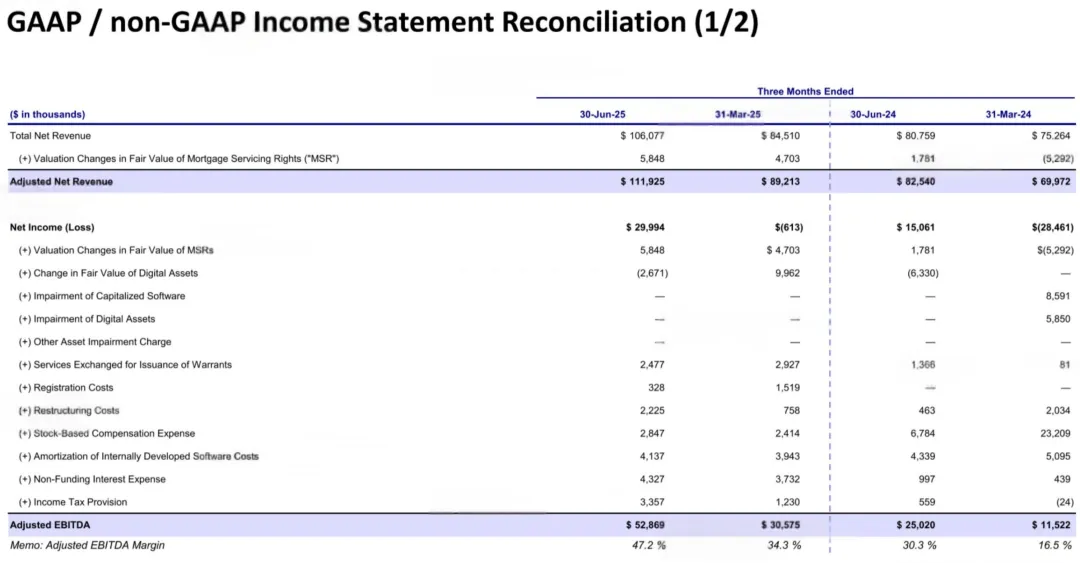

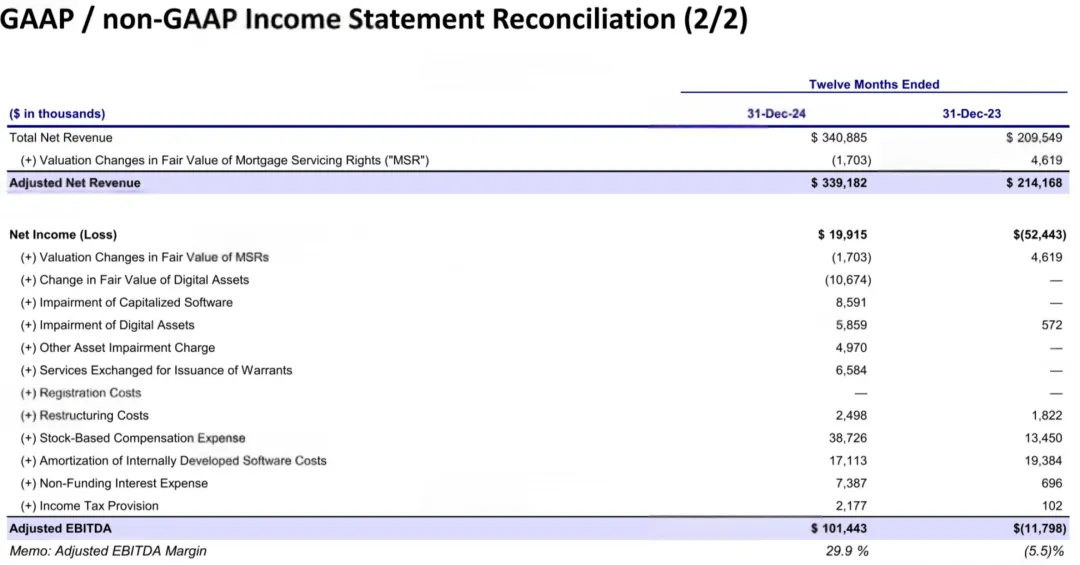

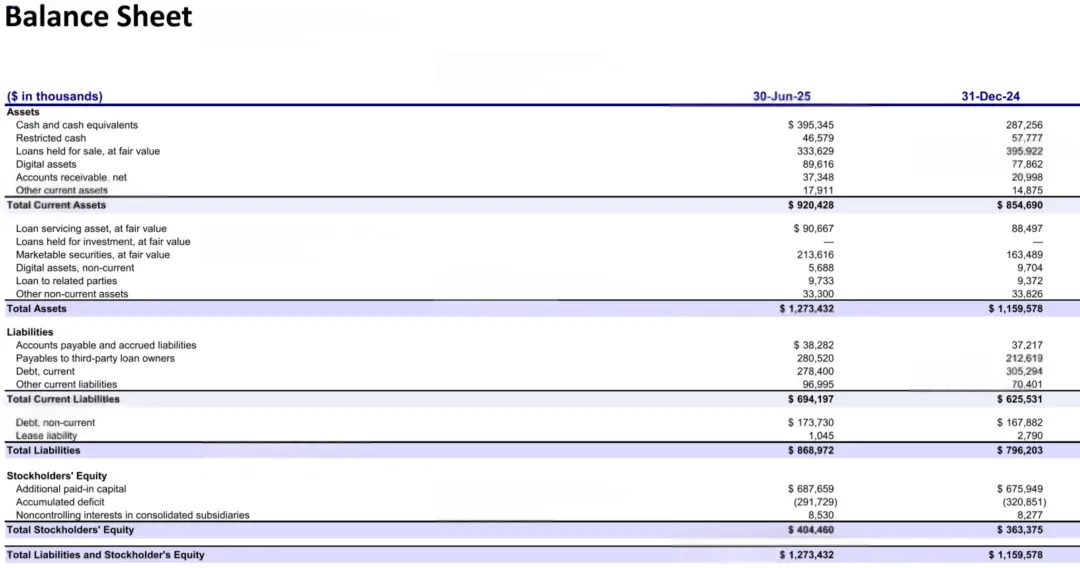

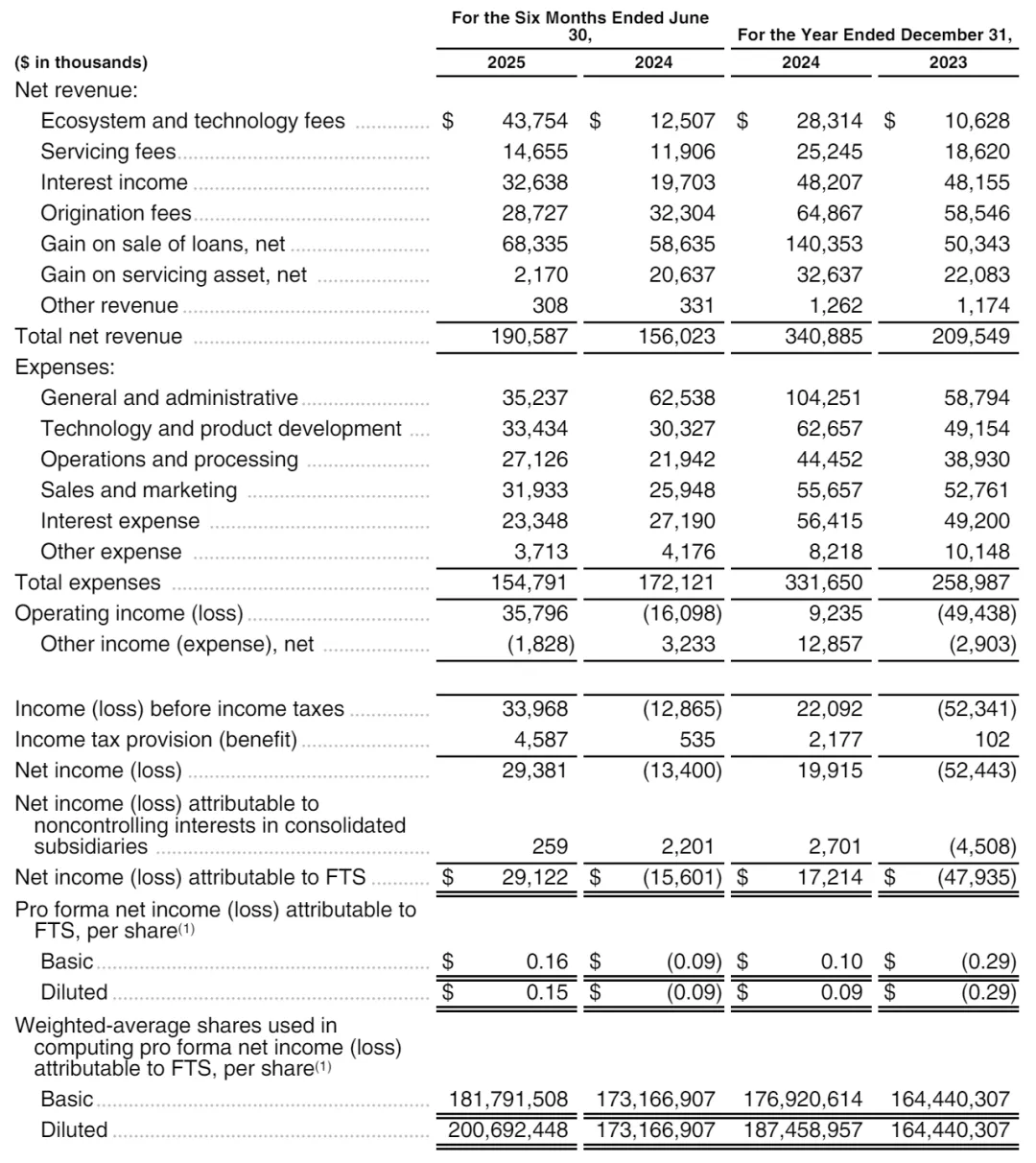

According to the equity book, Figure received $210 million in 2023 and $341 million in 2024; operating profits of $4.94 million and $9.24 million, respectively; and net gains of $52.44 million and 1992 dollars, respectively。

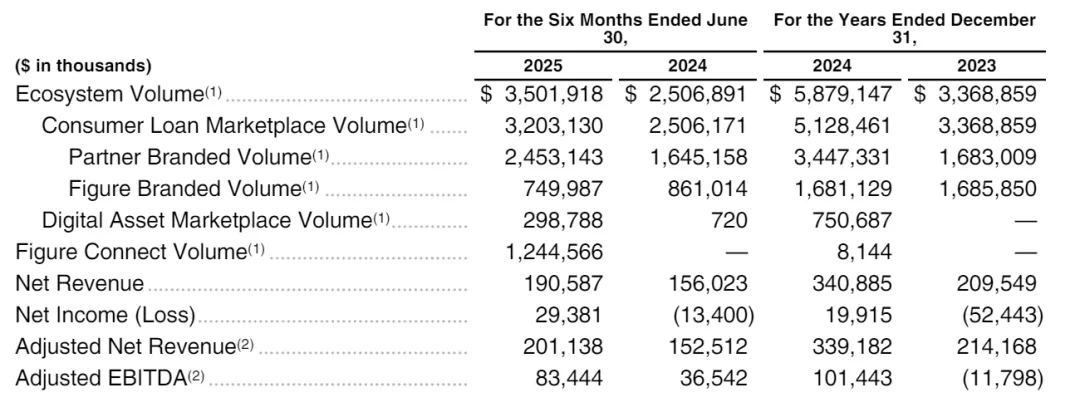

Figure received $191 million in the first half of 2025, an increase of 22.4 per cent from $156 million in the same period of the previous year; the main income was from the proceeds from the sale of loans, with the proceeds from lending of $6.834 million in the first half of 2025 and $5.864 million in the same period of the previous year

Figure incurred $4.375 million in ecosystem and technology costs in the first half of 2025, compared with $12.51 million in the same period of the previous year; interest income amounted to $32.64 million, compared with $1.7 million in the same period of the previous year。

Figure had a net gain of $29.38 million in the first half of 2025, compared with a net loss of $13.4 million in the same period of the previous year; the adjusted EBITDA was $8.344 million, compared to $3.54 million in the same period of the previous year。

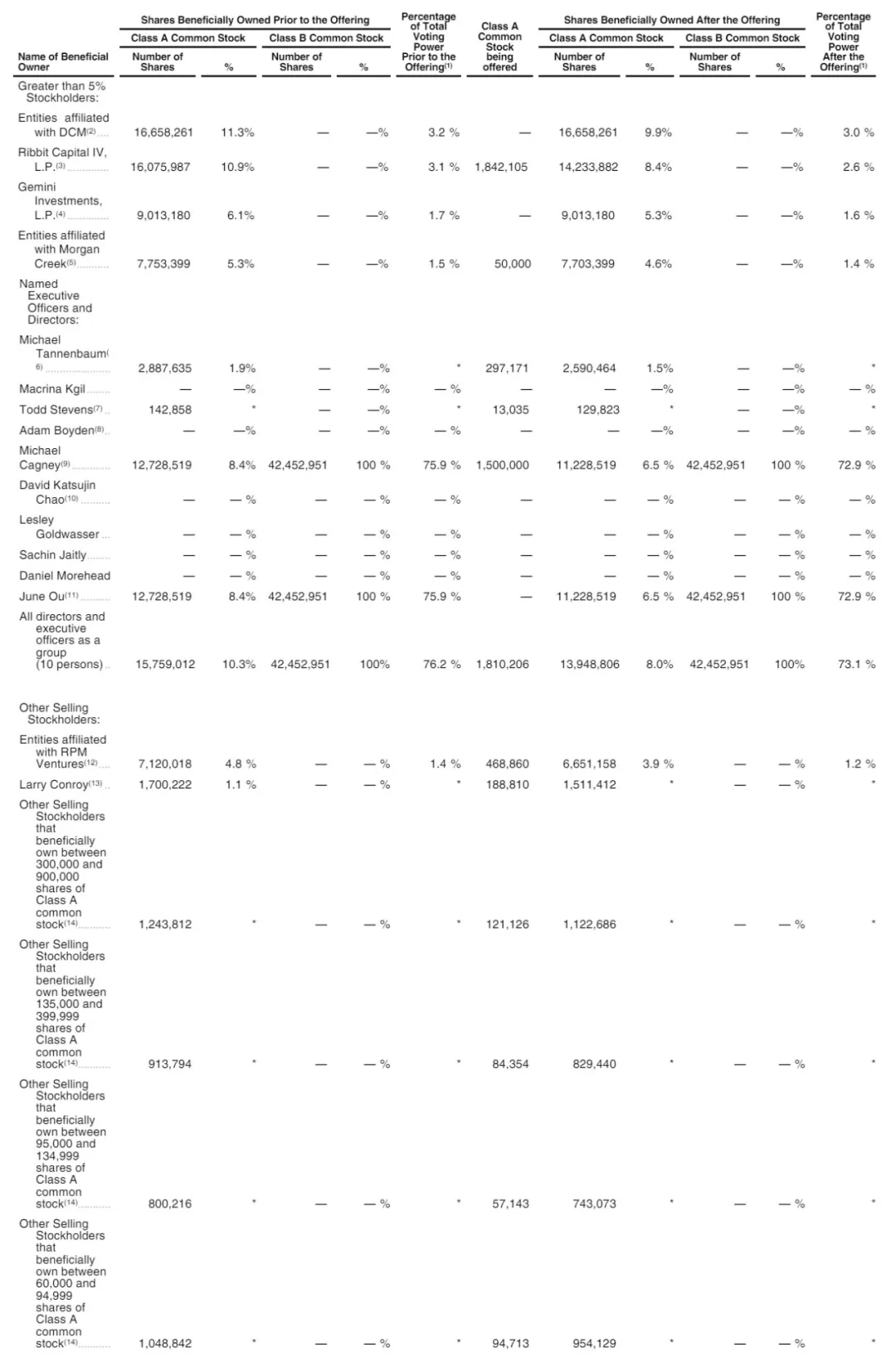

DCM and Ribbit Capital are shareholders

Before IPO, DCM held 11.3 per cent of category A shares and 3.2 per cent of voting rights; Ribbit Capital held 10.9 per cent of category A shares and 3.1 per cent of voting rights

Gemini Investments holds 6.1 per cent of category A shares and 1.7 per cent of voting rights; Morgan Creek holds 5.3 per cent of category A shares and 1.5 per cent of voting rights。

Michael Cagney holds 8.4 per cent A and 100 per cent B and 75.9 per cent voting; RPM holds 4.8 per cent A and 1.4 per cent voting; and Larry Conroy holds 1.1 per cent A。

After IPO, DCM held 9.9 per cent of category A shares with 3 per cent voting rights; Ribbit Capital held 8.4 per cent of category A shares with 2.6 per cent voting rights

Gemini Investments holds 5.3 per cent of category A shares and 1.6 per cent of voting rights; Morgan Creek holds 4.6 per cent of category A units and 1.4 per cent of voting rights。

Michael Cagney holds 6.5 per cent of A and 100 per cent of B and 72.9 per cent of voting rights; RPM holds 3.9 per cent of A and 1.2 per cent of voting rights。

Figure Road PPT