Interpretation of the Coin Shares 2026 report: farewell to speculative narratives and embrace the useful year

The year 2026 will be a critical year for digital assets to move from speculation to practical and from debris to integration。

Original title: Outlook 2026 The year independence wins

Source: CoinShares

Original language: Deep tide TechFlow

At the end of the year, the annual review and outlook reports of each agency were produced。

In keeping with the principle of not looking too long, we have also tried to quickly sum up and distil the reports。

The report is from CoinShare, a leading European digital asset management firm established in 2014, based in London, United Kingdom, and Paris, France, and managing assets of over $6 billion。

The 77-page Vision 2026: The Year of Practical Success Wins covers core topics such as macroeconomic fundamentals, bitcoin mainstreaming, mixed financial rise, competition on smart contracting platforms, evolution of regulatory patterns, and provides an in-depth analysis of the subdivisions of stable currencies, monetized assets, forecast markets, mining transformations, and venture investments。

The following is a compilation and summary of the core elements of the report:

I. Core theme: The advent of the year of relevance

The year 2025 was a turning year for the digital asset industry, with Bitcoin at a record high and the industry moving from speculative to practical value-driven。

the year 2026 is expected to be the "year of utility wins" and digital assets no longer attempt to replace traditional financial systems, but rather to strengthen and modernize existing ones。

The core view of the report is that 2025 marks a decisive shift in digital assets from speculative to practical value-driven, and that 2026 will be a critical year for the accelerated fall of this transition。

Digital assets no longer seek to create parallel financial systems, but rather to strengthen and modernize existing traditional financial systems. The consolidation of public block chains, institutional mobility, regulatory market structures and real economic examples is moving beyond optimistic expectations。

Macroeconomic fundamentals and market outlook

Economic environment: soft landing on thin ice

Growth expectations: The economy may avoid recession in 2026, but growth is weak and fragile. Inflation continued to ease but was not decisive, and tariff disturbances and supply chain restructuring kept core inflation high since the early 1990s。

Federal Reserve Policy: A prudent reduction in interest rates is expected and the target interest rate is likely to fall to the middle of 3 per cent, but the process is slow. The Fed's memory of the inflation boom in 2022 is still fresh, and it does not want to move fast。

Three scenarios:

• Optimistic scenario: soft landing + productivity surprise, bitcoin could break $150,000

Baseline scenario: slow expansion, bitcoin trading area $110,000-14 million

Bear market scenario: recession or stagnation, bitcoin could fall to $70-100,000

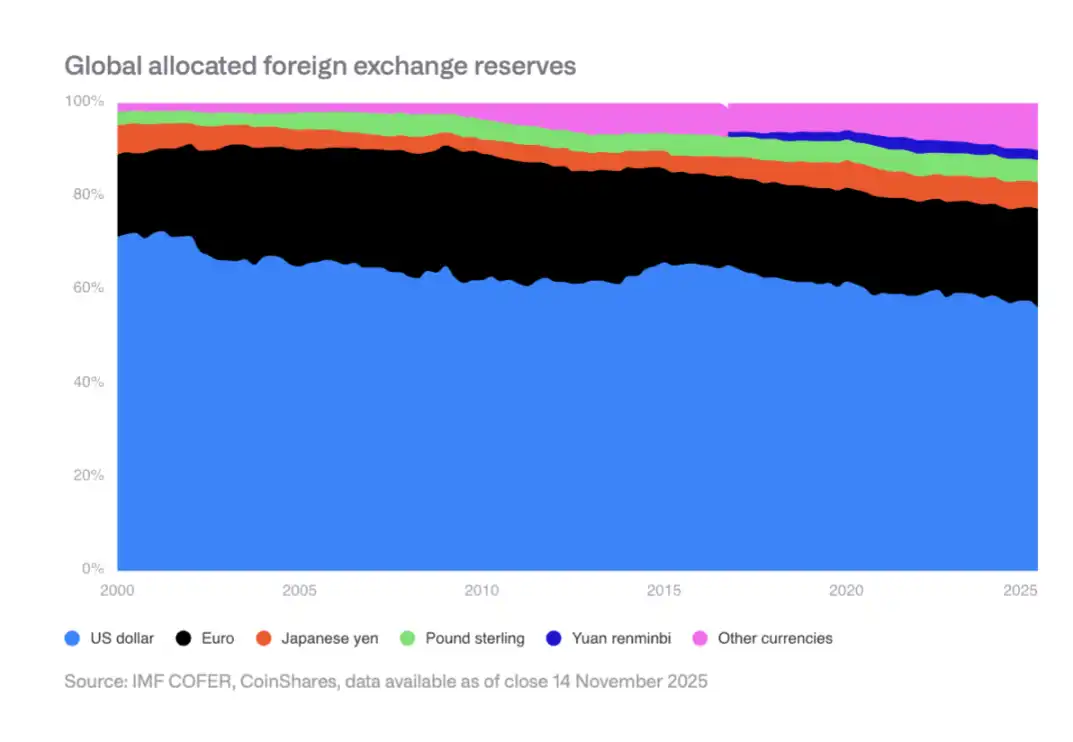

Slow erosion of the dollar reserve position

The United States dollar's share of global foreign exchange reserves fell from 70 per cent in 2000 to the current 50 per cent mid-point. The central banks of emerging markets are diversifying their configurations, increasing their holdings of assets such as renminbi and gold. This creates structural benefits for the storage of bitcoin as a non-sovereign value。

III. The mainstreaming process of bitcoin in the United States

The United States achieved several key breakthroughs in 2025, including:

• CASH ETF APPROVED AND ROLLED OUT

:: TOP ETF OPTION MARKET FORMATION

:: Elimination of restrictions on retirement plans

:: Fair value accounting rules for enterprises apply

:: The inclusion of Bitcoin as a strategic reserve by the United States Government

Institutional adoption still early

Despite the removal of structural barriers, the actual use is still limited to traditional financial processes and intermediaries. Financial management channels, retirement plan providers, corporate compliance teams, etc. are still being adapted。

Projected 2026

The private sector is expected to make key progress: four major issuers open bitcoin ETF configurations, at least one major 401 (k) provider allows bitcoin configurations, at least two standard 500 companies hold bitcoin and at least two major custodian banks provide direct hosting services。

IV. MINEERS AND BUSINESS RISKS

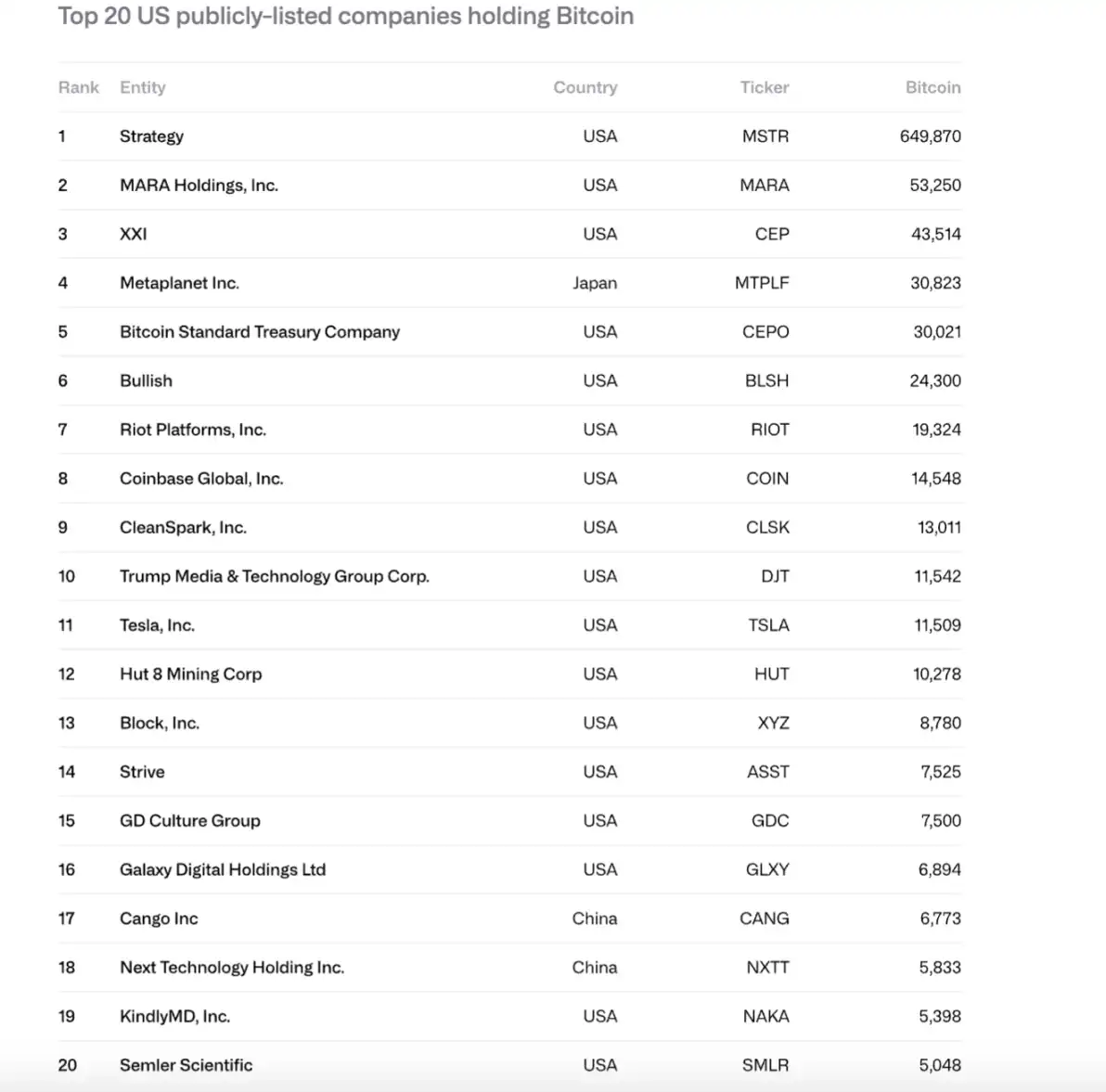

The size of corporate currency has surged

In 2024-2025, the holdings of listed companies in bitcoin increased from 266,000 to 104.88 million, with the total value rising from $11.17 billion to $90.7 billion. Strategy (MSTR) accounted for 61 per cent, with the former 10 companies controlling 84 per cent。

Potential sales risk

Strategy faces two main risks:

:: Failure to fund ongoing debt and cash flow obligations (annual cash flows close to $680 million)

:: Refinancing risk (most recently bonds due in September 2028)

If mNAV is close to 1x or cannot be refinanced at zero interest rates, it may be forced to sell bitcoin, triggering a vicious circle。

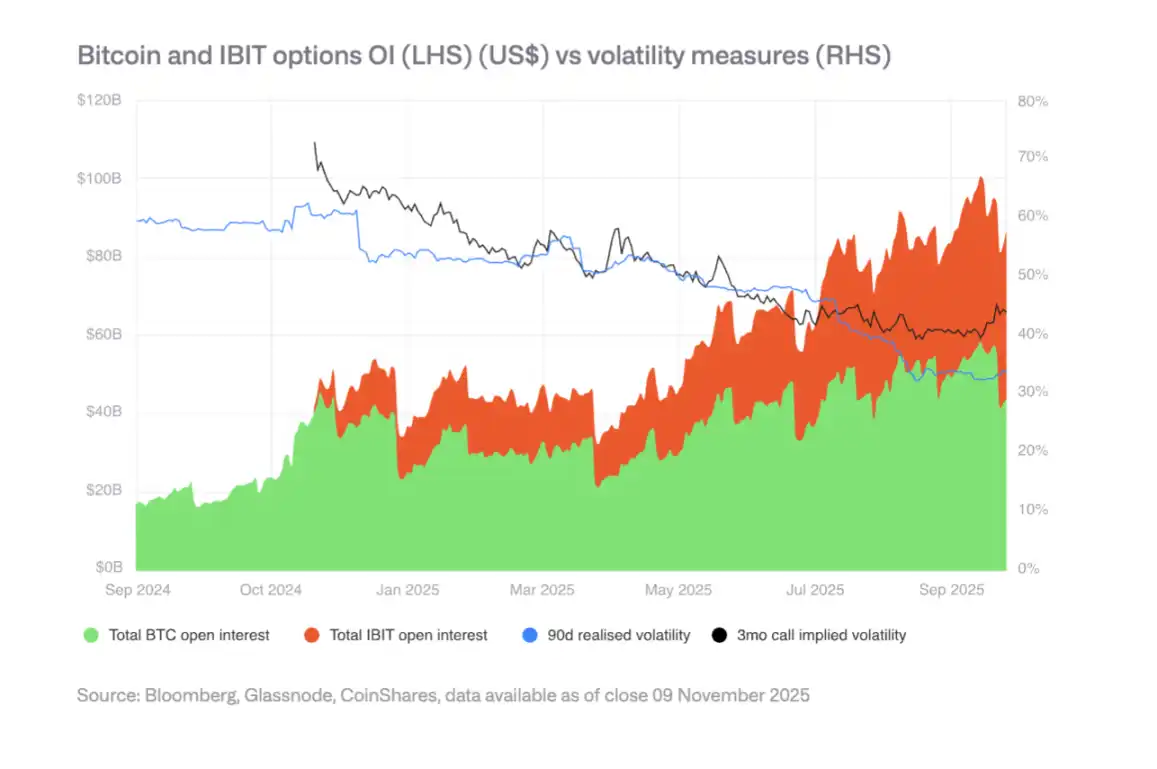

Fall in options markets and volatility

THE DEVELOPMENT OF THE IBIT OPTION MARKET HAS REDUCED THE RATE OF BITCOIN VOLATILITY, A SIGN OF MATURITY. HOWEVER, A DECLINE IN VOLATILITY COULD WEAKEN REVERSIBLE DEMAND AND AFFECT THE PURCHASING POWER OF ENTERPRISES. IN THE SPRING OF 2025, THERE WAS A TURNING POINT OF DECLINING VOLATILITY。

V. Fragmentation of regulatory patterns

EU: MiCA clarity

The EU has the most complete worldwide legal framework for encrypted assets, covering issuance, hosting, trading and stabilization currency. However, coordination restrictions were revealed in 2025, with some national regulators potentially challenging cross-border permits。

United States: innovation and fragmentation

WHILE THE UNITED STATES IS RE-ENERGIZED BY ITS DEEPEST CAPITAL MARKETS AND MATURE WIND-TO-ECOSYSTEMS, REGULATION IS STILL SCATTERED ACROSS A NUMBER OF INSTITUTIONS, INCLUDING SEC, CFTC AND THE FED. THE STABILIZATION CURRENCY LEGISLATION (GENIUS ACT) HAS BEEN PASSED, BUT ITS IMPLEMENTATION IS STILL IN PROGRESS。

Asia: towards prudential regulation

HONG KONG, CHINA, JAPAN, ETC. PROMOTE BASEL III REQUIREMENTS FOR ENCRYPTED CAPITAL AND LIQUIDITY, AND SINGAPORE MAINTAINS A RISK-BASED LICENSING SYSTEM. A MORE COHERENT REGULATORY GROUP IS EMERGING IN ASIA, WITH CONVERGENCE AROUND RISK BASES AND BANK ALIGNMENT STANDARDS。

The rise of mixed finance

Infrastructure and settlements

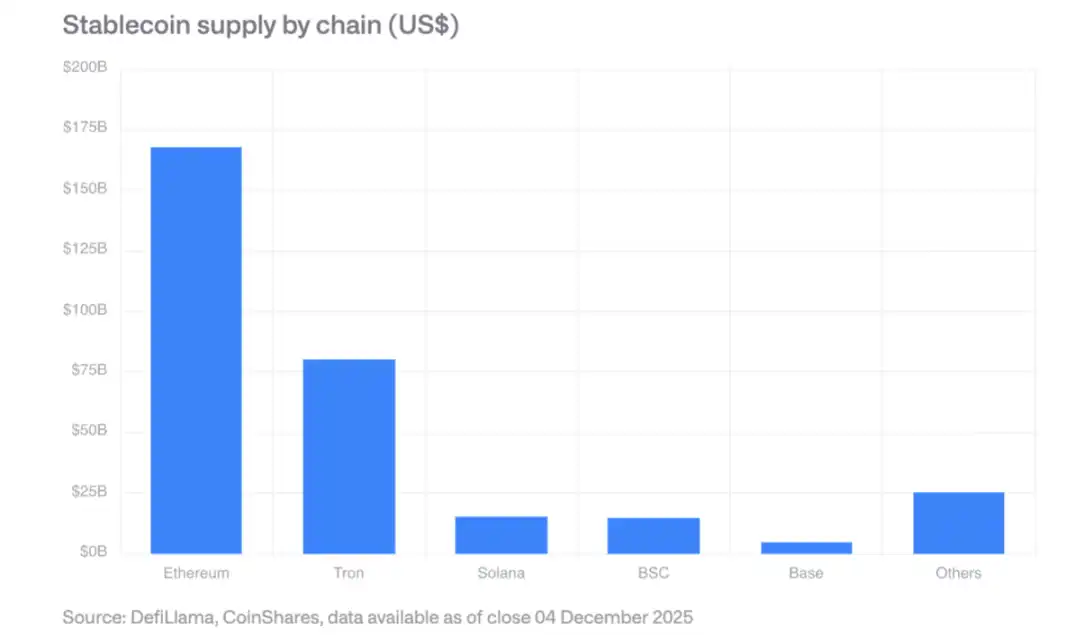

Stable currency: Market size is over $30 billion, with the largest share of the house, and Solana is the fastest growing. The GENIUS Act requires compliance issuers to hold United States Treasury reserves and create new demand for national bonds。

Go to centralized trading platforms: monthly trading volumes exceed $60 billion and Solana handles $40 billion a day。

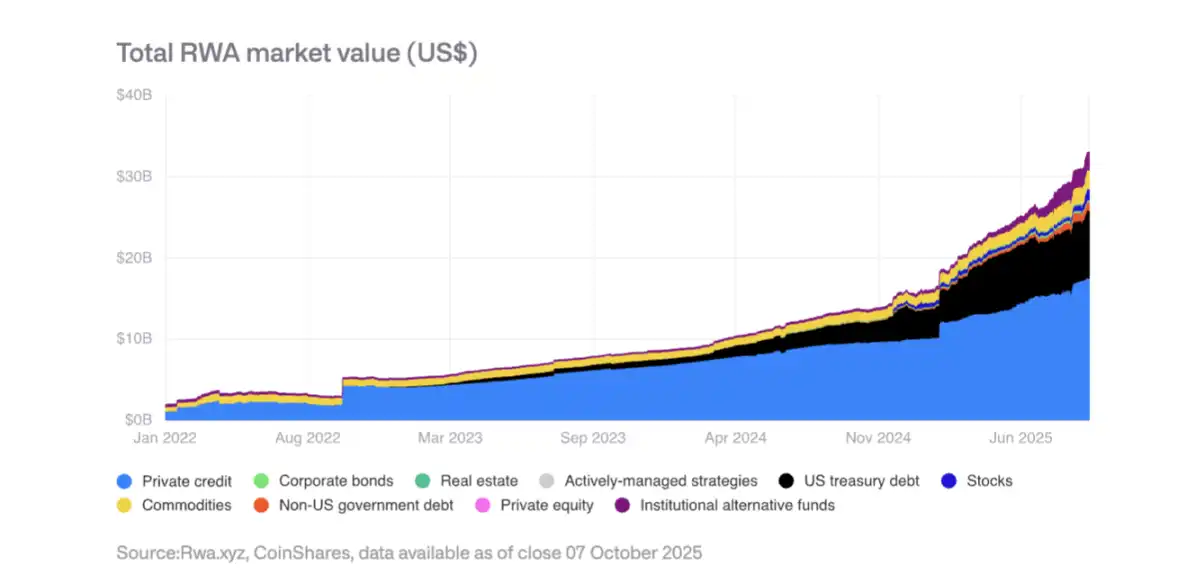

CURRENCYIZATION OF REAL WORLD ASSETS (RWA)

The total value of monetized assets increased from $15 billion at the beginning of 2025 to $35 billion. Private credit and United States Treasury debt have grown fastest, with gold coins exceeding $1.3 billion. BlackRock's BuIDL Fund assets expanded significantly, and Morgan Chase launched JPMD deposits on Base。

Income generation chain application

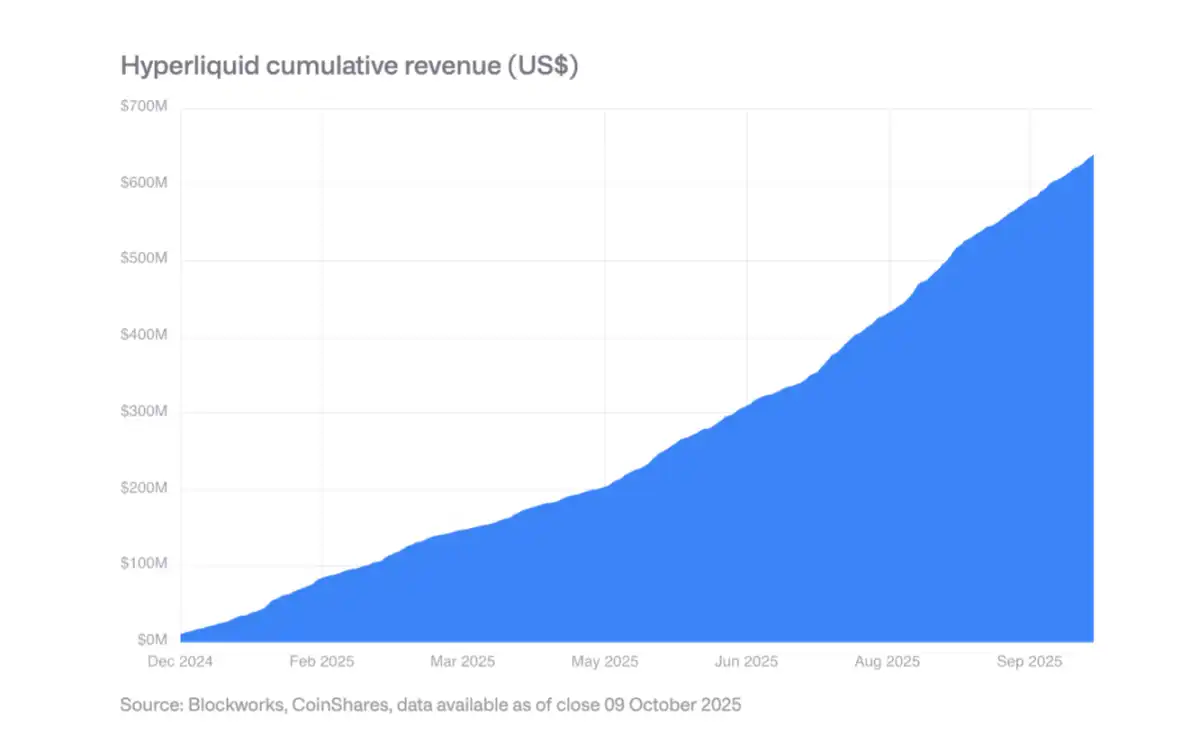

An increasing number of agreements generate hundreds of millions of dollars of annual income and are distributed to token holders. Hyperliquid uses 99% of the income to repurchase tokens every day, and Uniswap and Lido have similar mechanisms. This marks a shift in tokens from purely speculative assets to class equity assets。

VII. Leveraging the stabilization currency and its adoption by enterprises

Market concentration

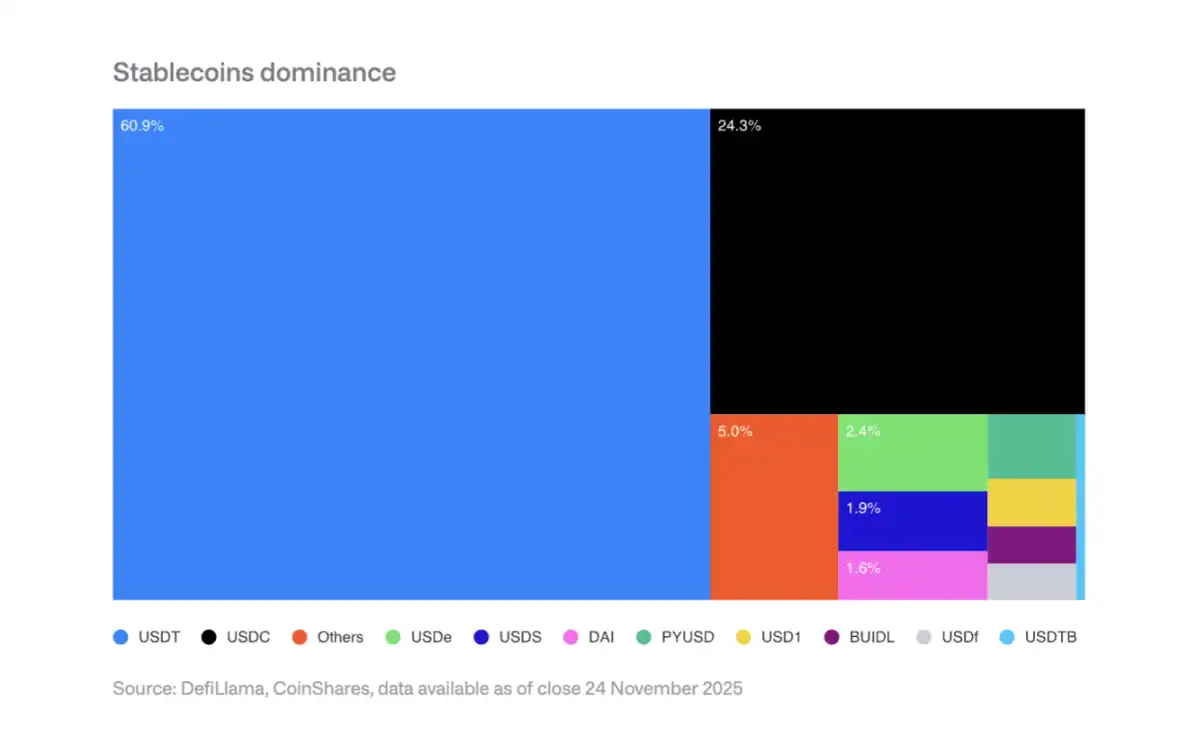

Tether (USDT) accounts for 60 per cent of the stable currency market, while Circle (USDC) accounts for 25 per cent. New entrants such as PayPal's PYUSD face the challenge of cyber-impacting the double oligarchy。

Businesses adopt expectations in 2026

Payment processors: Visa, Mastercard, Stripe etc. have the structural advantage of moving to stable currency settlement without changing the front-end experience。

Banks: JPM Coin of Morgan Chase has demonstrated potential, Siemens has reported savings of 50 per cent on foreign exchange and reduced the settlement time from days to seconds。

Electrician platform: Shopivy has accepted the USDC settlement and the Asian and Latin American markets are piloting stable currency payments。

Income impact

Stabilizer issuers are at risk of falling interest rates: if the Fed interest rate drops to 3 per cent, an additional $88.7 billion in stabilization currency will be required to sustain current interest income。

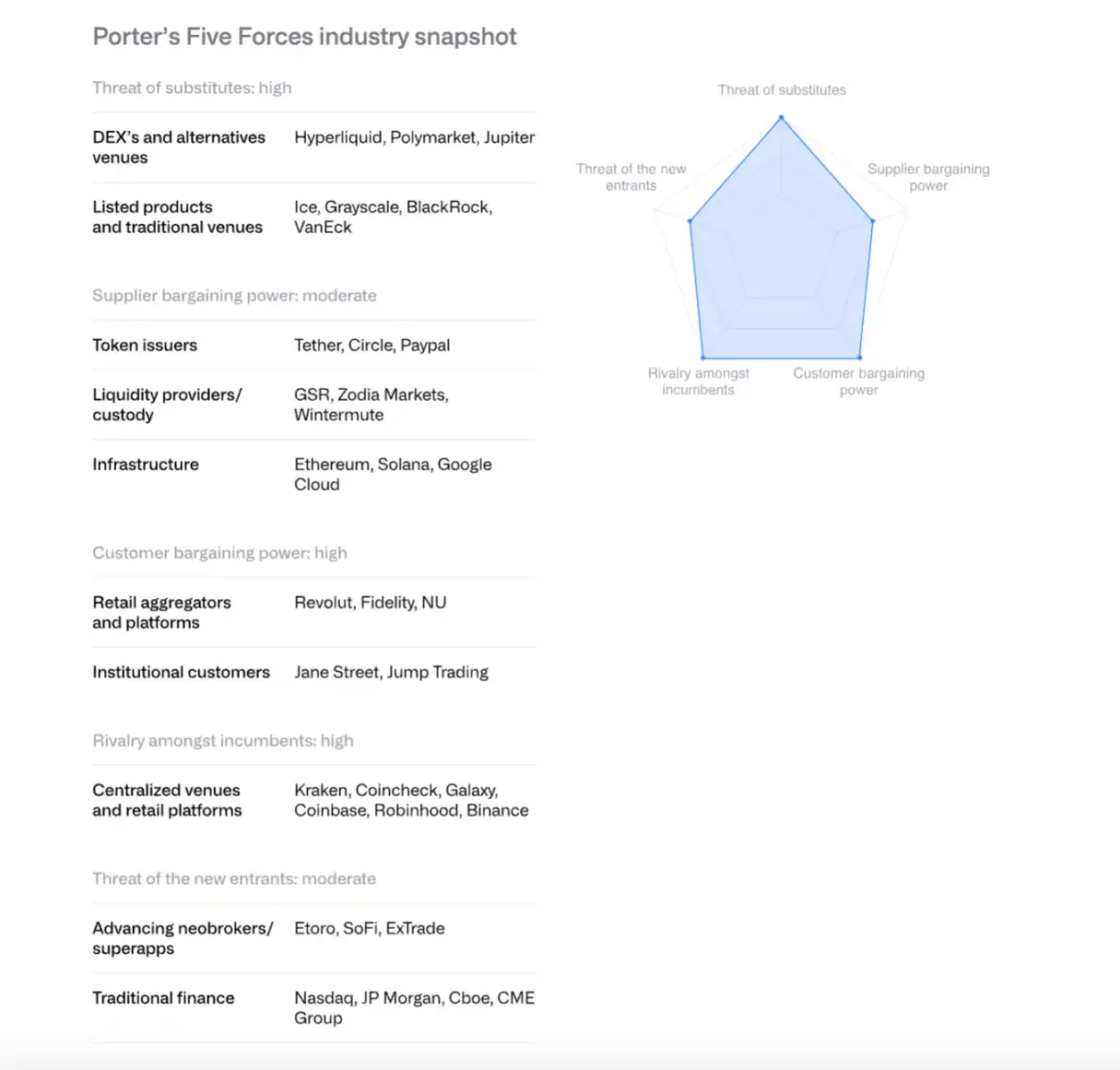

VIII. Analysis of trading platform competition patterns using the Porter Five Model

Existing competitors: competition is intense and intensified, and the rate of formalities is reduced to a low-digit base point。

NEW ENTRANTS ARE THREATENED: TRADITIONAL FINANCIAL INSTITUTIONS SUCH AS MORGAN STANLEY E*TRADE AND CSA ARE READY TO ENTER BUT DEPEND ON PARTNERS IN THE SHORT TERM。

Vendor bargaining power: Stabilizer issuer (e.g., Circle) enhances control through Arc backbone. Coinbase's USDC income-sharing agreement with Circle is crucial。

Customer bargaining power: Institutional clients account for over 80 per cent of Coinbase transactions and have strong bargaining power. Retail users are price-sensitive。

Alternative threats: Decentralised trading platforms such as Hyperliquid, prognosis markets such as Polymucket, CME encryption derivatives constitute competition。

Industry integration is expected to accelerate in 2026, with trading platforms and large banks acquiring customers, licences and infrastructure through mergers and acquisitions。

IX. COMPETITIVENESS FOR A SCIENTIFIC CONTRACT POSITION

Etherwood: From sandbox to institutional infrastructure

It was expanded through the Rollup Centre Road Map, with the number of Layer-2 throughput increasing from 200 TPS a year ago to 4800 TPS. The certifier is promoting a higher base level Gas limit. The U.S. F. ETF attracts about $13 billion in inflows。

In terms of institutional monetization, BlackRock's BuIDL Fund and Morgan Chase's JPMD demonstrate the potential of Taifung as an institutional platform。

Solana: High performance paradigm

Solana emerges from a single-sided, highly optimized implementation environment, accounting for about 7 per cent of DeFi total TVL. The stable currency supply exceeded $12 billion (up from $1.8 billion in January 2024), the RWA project expanded, and the BUIDR of BlackRock increased from $25 million in September to $250 million。

Technical upgrades include Firedancer client, DoubleZero certifier communication network, etc. The spot ETF launched on 28 October has attracted a net inflow of $382 million。

Other high-performance chains

The new generation of Layer-1, Sui, Aptos, Sei, Monad, Hyperliquid, and others, competed through structural differences. Hyperliquid focuses on derivatives trading, accounting for more than one third of total block chain income. However, the market is heavily fragmented and EVM compatibility is competitive。

X. MINING TRANSFORMATION HPC (HIGH PERFORMANCE COMPUTING CENTRE)

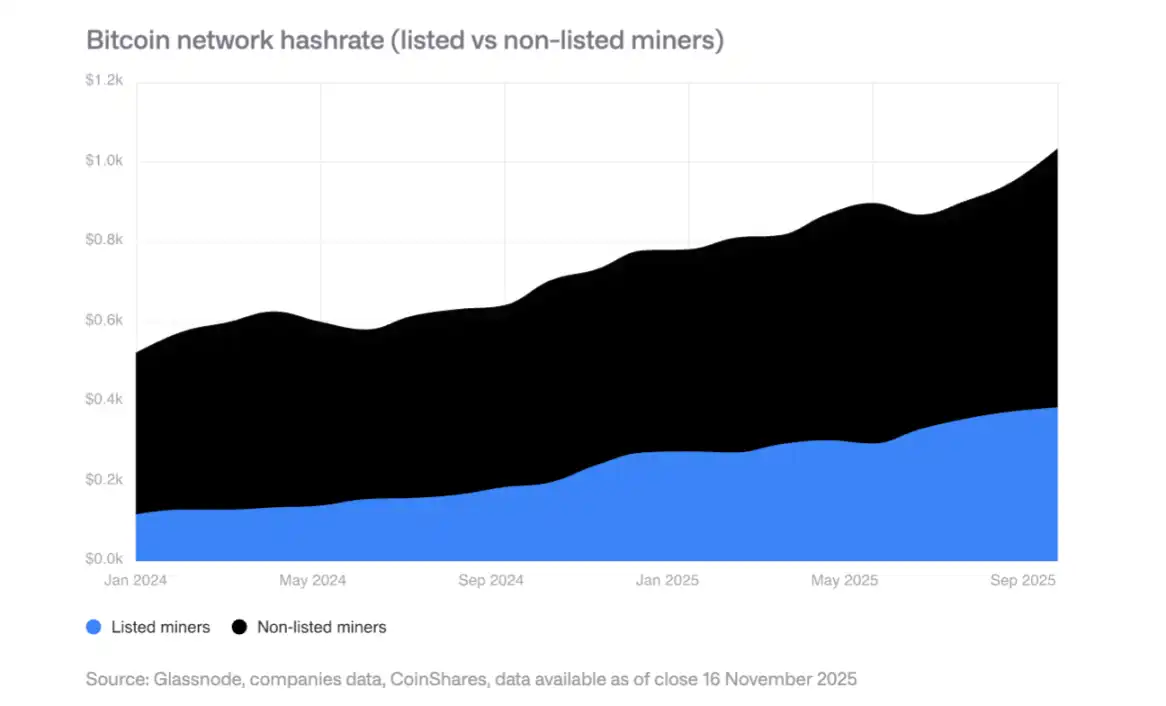

In 2025, expansion

Listed miners calculate their power growth 110 ETH/s, mainly from Bitdeer, HIVE Digital and Iris Energy。

HPC TRANSFORMATION

MINERS ANNOUNCED CONTRACTS WORTH $65 BILLION FOR HPC, AND IT IS EXPECTED THAT BY THE END OF 2026 THE SHARE OF MINING REVENUES FROM BITCOIN WILL FALL FROM 85 PER CENT TO LESS THAN 20 PER CENT. HPC HAS A PROFIT MARGIN OF 80-90 PER CENT FOR OPERATIONS。

Future mining patterns

IT IS EXPECTED THAT FUTURE MINING WILL BE DOMINATED BY THE FOLLOWING MODELS: ASIC MANUFACTURERS, MODULAR MINING, INTERMITTENT MINING (WHICH COEXISTS WITH HPC) AND SOVEREIGN MINING. IN THE LONG TERM, MINING MAY RETURN TO SMALL-SCALE AND DECENTRALIZED OPERATIONS。

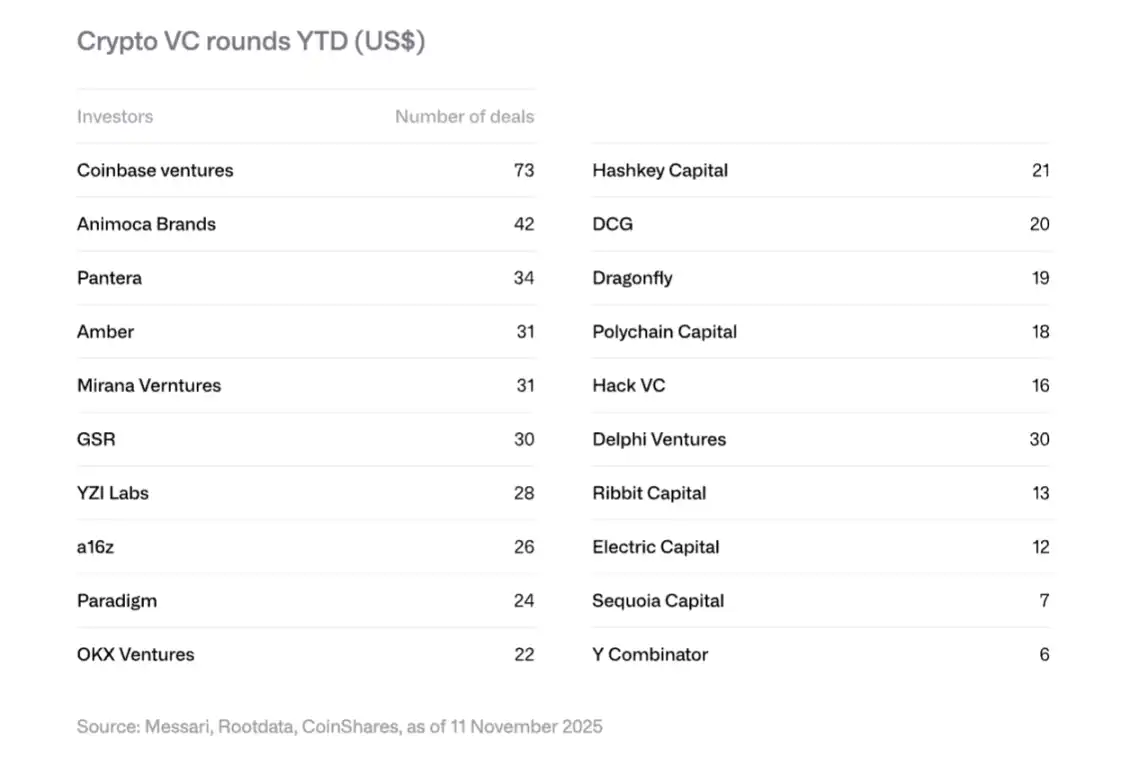

XI. Venture investment trends

2025 Recovery

Cryptography financing amounted to $18.8 billion, exceeding the full year of 2024 ($16.5 billion). Mostly driven by large transactions: Polymarket received $2 billion in strategic investments (ICE), Tripe's Tempo received $500 million and Kalshi received $300 million。

Four major trends in 2026

RWA tokenization: SPAC for Securitize, $50 million for Agora, etc. show institutional interest。

AI COMBINED WITH ENCRYPTION: USE OF AI PROXY, NATURAL LANGUAGE TRADE INTERFACE, ETC。

Retail investment platforms: Echo (buyed by Coinbase for $375 million), Legion, etc., have emerged as a central angel investment platform。

Bitcoin infrastructure: Layer-2 and Lightning Network related projects received attention。

Predicting the rise of markets

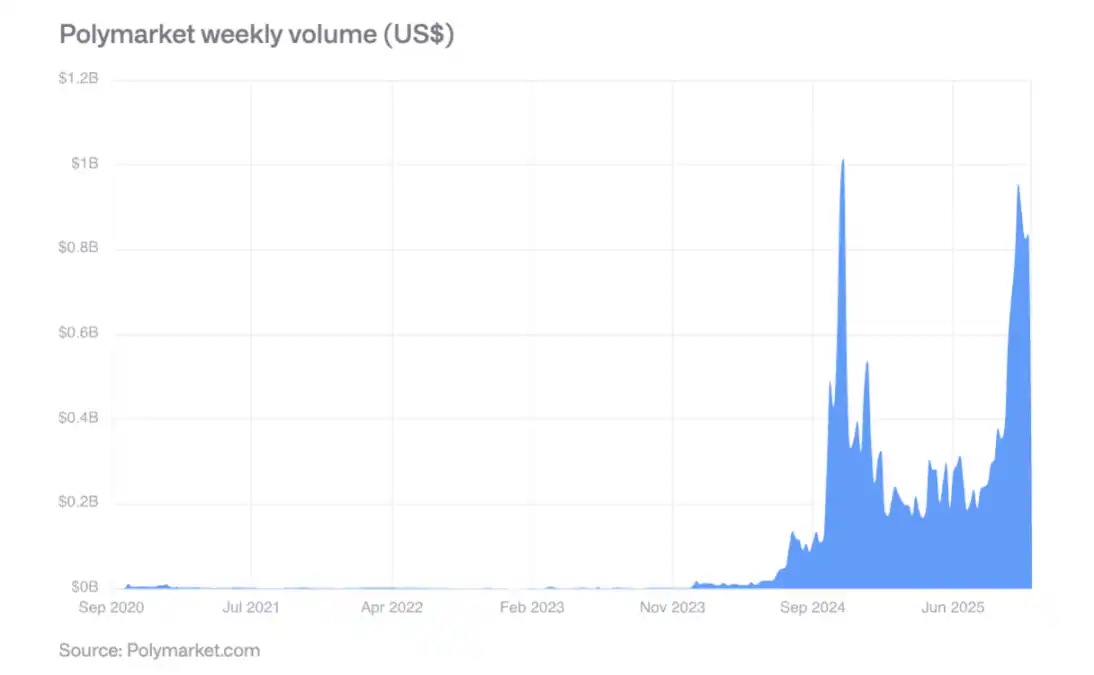

Polymarket traded more than $800 million per week during the 2024 elections in the United States and maintained strong post-election activity. The accuracy of its predictions is verified: 60 per cent of probability events occur, and 80 per cent of probability events occur, about 77-82 per cent。

In October 2025, ICE made strategic investments of up to $2 billion to Polymark, marking the recognition of mainstream financial institutions. It is expected that the weekly trade volume in 2026 could exceed $2 billion。

XIII. Key findings

Accelerated maturity: digital assets are moving away from speculative to practical values and cash flows, and tokens are increasingly like equity assets。

Mixed financial rise: The integration of public block chains with traditional financial systems is no longer a theory, but is evident through strong growth in stable currencies, monetized assets and chain applications。

Regulatory clarity: The US GENIUS Act, EU MiCA, Asian prudential regulatory framework provides the basis for institutional adoption。

Institutional adoption has been gradual: while structural barriers have been removed, actual adoption will take several years, and 2026 will be a year of incremental progress for the private sector。

Competition patterns have been reshaped: EVM compatibility has been a key advantage when it has remained dominant but faced high performance chain challenges such as Solana。

Risks go hand in hand with opportunities: high levels of currency holding by enterprises pose a risk of being sold, but emerging areas such as institutional monetization, stable currency adoption, and forecasting markets offer significant growth potential。

Overall, 2026 will be a critical year for digital assets to move from marginal to mainstream, from speculation to practical and from debris to integration。