The night before the storm: No interest from Powell, Trump announces the new Fed Chairman

Author:GolemOdaily Daily Planet

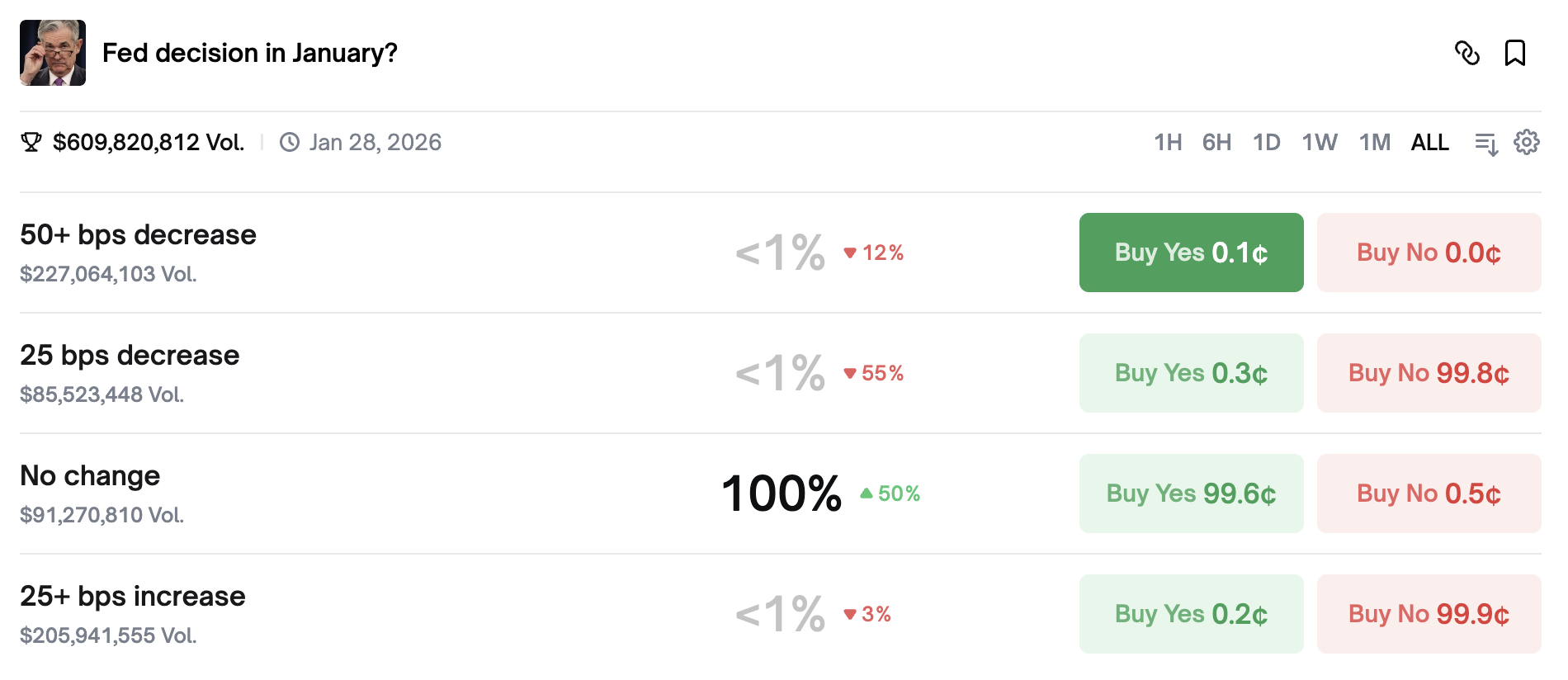

At 3 a.m. Beijing time on January 29th (this Thursday) the Fed is about to publish its first interest rate resolution in 2026; in half an hour, the current Chairman of the Fed, Powell, will hold a monetary policy press conference. However, the interest rate resolution of the Federal Reserve is not too much on hold, and there is a general consensus in the market that the Federal Reserve will make a decision to keep interest rates constant. Polymark data show that the probability of maintaining interest rates constant is close to 100 per cent。

SUCH A HIGH PROBABILITY WOULD ALSO ENABLE THE MARKET TO ABSORB IN ADVANCE THE PROFITS FROM THE FED'S ANNOUNCEMENT OF NO INTEREST RATE REDUCTION. OKX DATA SHOWS THAT THE BTC HAS ONLY DROPPED 0.39 PER CENT OVER THE PAST SEVEN DAYS AND IS BASICALLY IN A TRANSVERSE STATE, BUT THIS “QUIET PERIOD” MAY BE BROKEN TONIGHT。

On the one hand, while there is almost unanimous agreement that the Fed will maintain interest rates this week, there is considerable disagreement over the fiscal path for the remainder of 2026, and this remains an important watch-and-see meeting. Whether future key policy trends, such as the continued decline in interest rates and the frequency of interest rates in 2026, will affect the market, which could be “responding down” once Powell's statements are heard by the hawks, such as “the need to keep watching”。

On the other hand, the announcement of a successor to the Fed's President will also have a long-term impact on the market, which has now narrowed to fourTrump had previously indicated that he had a worthy candidate, but had to wait until the right time to announce it, which was most likely tonight。

The drop in 2026 is still uncertain

Since September last year, the Fed has started a new cycle of interest-rate reductions, which have taken place three times in a row, and if interest rates remain unchanged this week, they will be suspended for the first time since they began. At this point, the market is not interested in keeping interest rates constantRather, is this a short stop-and-go look, or is it the beginning of a long-term moratorium on interest-rate cuts or even interest-rate increases

Previously, the prevailing view in the market was that the year 2026 was a year of further quantitative easing by the Fed。

One reason is that the United States labour market does show signs of weakness at the data level, with only 50,000 people and 4.4 per cent of non-farm employment rising in December 2025, while there is no “large lay-offs” but still “low recruitment and a cooling of demand”; and two reasons why the Fed may still believe that Trip's tariff policy will have no long-term impact on inflation(Odaily: 2025, September September, Powell reduced interest rates based on this factor)Thirdly, Trump had stated publicly that he would choose a dove to be the next Fed Chairman。

But there is also a view in the market that there is uncertainty about the Fed’s continued interest rate reduction in 2026. According to analysts, unless the job market deteriorated significantly, it would be difficult to see a drop in interest rates before mid-year, as inflation fell at a rate that was not enough to convince the Eagle Committee。

The Fed’s task is simply to contain inflation and promote employment, but in 2025, when the United States experienced a combination of weak labour markets and rising inflation, the Fed finally chose to prioritize employment, thereby opening a cycle of interest-rate reductions. The reality, however, is that US inflation remains at 2.8%, well above the Fed’s target of 2%, which has forced the Fed to rethink the impact of tariffs on inflation. The fact that interest rates remain constant this week also suggests that the Fed is beginning to “see”。

On the other hand, while the next Federal Reserve Chairman chosen by Trump was destined to be a dove, the new rotating Chairman of the Federal Reserve's Interest Rate Policy Committee was dominated by the EaglesI don't know. At the beginning of each year, four of the 12 regional Federal Reserve chairs rotate to the interest rate decision committee and have the right to vote in the next eight policy meetings. This year's rotating entry list includes the Chairman of the Dallas Fed, Logan; the Chairman of the Cleveland Fed, Hammark; the Chairman of the Philadelphia Fed, Paulsen; and the Chairman of the Minneapolis Reserve, Kashkali。

Among them, Logan and Hammark were considered “hawks” and both had previously publicly stated that the Fed should pay attention to inflation, Paulsen was seen as “doves” and had publicly expressed “precautionary optimism” about inflation, while Kashkali was more neutral. The inclusion of the new Eagles may have upset the balance of policy preferences within the Fed in the past, and even if Trump had chosen a Dove as Chairman, it would not have influenced the entire interest rate decision-making committee。

Moreover, the Federal Reserve Chairman may not be in full compliance with the wishes of Trump. Trump himself appointed Powell as the Fed’s Chairman, but it appears from last year that even if Trump promoted Powell, Powell did not “reciprocate” Trump through a sustained and substantial reduction in interest rates. In United States law, the Fed is independent and can make interest rate decisions based on the economic situation rather than on the will of the Government, so that even if the new Fed Chairman promised verbally that Trump would lower the interest rate, he might “do as I wish”。

This meaningless “political promise” is also the concern of Trump. Last week, when Trump addressed the World Economic Forum in Davos, Switzerland, he said, “It is amazing that people change when they get the job”, i.e. that candidates “choice to speak” during interviews and emphasize their independence once confirmed。

IN THE LIGHT OF THE FACTORS, POWELL’S SPEECH WILL ALSO BE FOCUSED ON INVESTORS AFTER TONIGHT’S FOMC MEETING, IN SEARCH OF INDICATIONS THAT THE FED WILL SUSPEND INTEREST RATES FOR HOW LONG。

THIS WEEK, THE FOMC MEETING WILL BE ONE OF THE BEST TIMES FOR TRUMP TO ANNOUNCE HIS SUCCESSOR TO THE FED

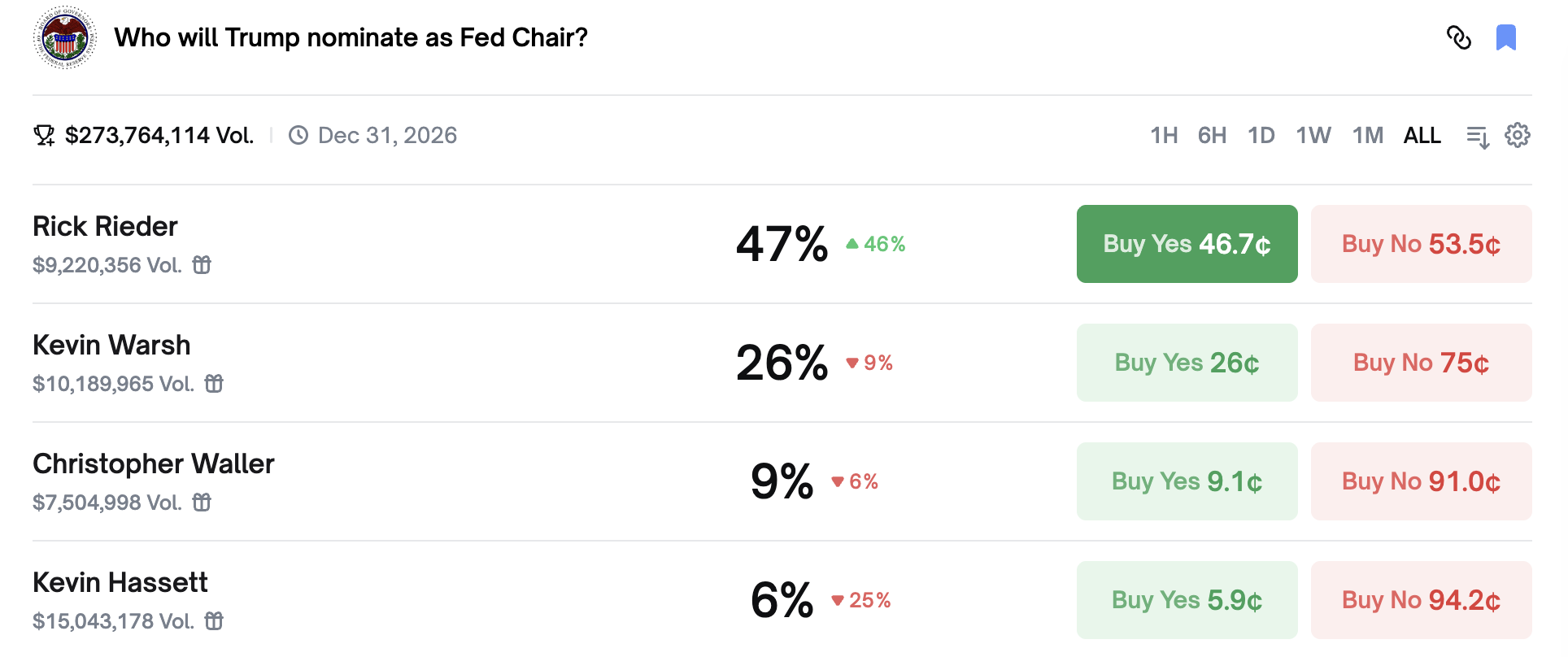

In addition to this week’s FOMC meeting, the successor to the Fed’s Chairman is a macro event that can affect the market. The current candidates have been downsized on Kevin Hassett, Kevin Walsh, Rick Rieder and Christopher Waller. According to Polymarket, Rick Rieder currently has the highest probability of being nominated by Trump, at 47 per cent; Kevin Hassett has the lowest probability of being nominated, at 6 per cent。

Rick Riedel is the Chief Investment Officer for Global Fixed Gains in Belet, who, although he does not have much government experience, has always advocated the idea of low interest rates and is based on an understanding of the market rather than on politics, a curriculum vitae that may draw attention to the fear that the new Fed’s Chairman will “do not listen” to Trump as soon as he takes office. Even the economists of Evercore ISI, including Krishna Guha, believe that “Jorik Riedel, as the new Fed's Chairman, may be advocating a three-time reduction in interest rates this year. It's not the same(Odaily note: more information about Rick Riedel can be readThe last seat on the Fed's list of candidates, Rick Rieder's encryption attitude)

Hasset was considered the most likely candidate for the new chair of the Fed, with a probability of over 80 per cent. But Hassett was the economic adviser to Trump, who was previously questioned that Trump’s nomination of Hassett would undermine the Fed’s independence, as well as the fact that Trump had publicly stated that he did not want to lose Hassett in his own government, which reduced Hassett’s chances of being elected, although it was also argued that Hassette’s nomination was still higher than 6 per cent。

Trump has repeatedly publicly announced that he will announce his nomination in January. At the end of December 2025, in his address to the press in Florida, Trump stated that he would announce the next Fed Chairman at some point in January; on 14 January 2026, when Trump received a Reuters interview, he said that he would do so in the next few weeks; and two weeks later, on 27 January, when Trump spoke in Iowa, he said that he would soon announce a new Fed Chairman, but that it had not yet been announced。

WHILE TRUMP'S ANSWERS ARE VAGUE EACH TIME, IT IS CERTAIN THAT THERE IS A HIGH PROBABILITY THAT THE NOMINATION WILL BE ANNOUNCED IN JANUARY, AND THAT EVEN THE BEST OPPORTUNITY FOR THE NOMINATION WILL BE ANNOUNCED DURING THE FOMC MEETING THIS WEEKI don't know。

AS NOTED EARLIER, POWELL'S SPEECH TONIGHT WILL BE THE FOCUS OF INVESTORS' ATTENTION, AND IT IS CLEAR THAT IF POWELL DOES NOT HAVE A PRO-DOVE SPEECH, THE FINANCIAL MARKETS MAY BE HIT, WHICH TRUMP WOULD NOT HAVE WANTED. SO IF TRUMP WANTED TO DIVERT MARKET ATTENTION FROM THE UNCERTAIN POWELL, TRUMP MIGHT ANNOUNCE HIS NEXT FED PRESIDENT’S NOMINATION AT THE FOMC MEETING THIS EVENING, FREEING THE MARKET OF THE “DOVE CHAIRMAN” AND REDUCING THE MARKET’S INTEREST IN POWELL’S SPEECH OR ITS POSSIBLE NEGATIVE MARKET IMPACT。

Tonight, we'll see

RECOMMENDED READING:

AFTER THE PREMIUM HAS BEEN RESET, MTR IS COMING IN

Delphi Digital: What is the future of encrypted money

Pantera Capital Partner: Status and Future of the Internet Capital Market

Three-year valuation of $2 billion. How does Redotpay play

a16z depth longitude: how to understand correctly the threat of quantum calculations to block chains