Integration: Tim, PANews

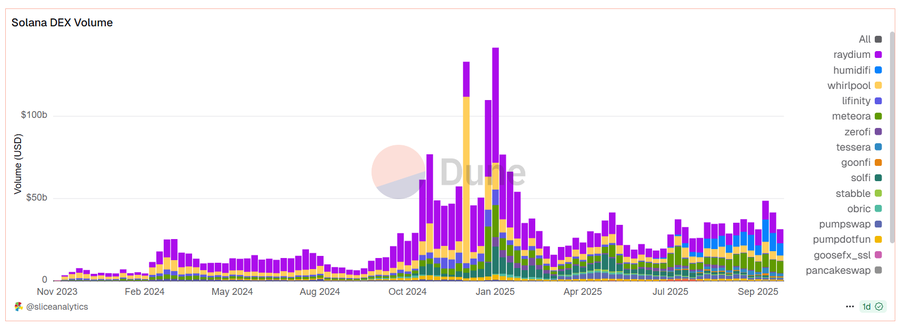

Editor of PANews by: PANews Quick 3 November & mdash; —HumidiFi, 30 days of trading beyond Meteora and Raydium, leading the Solana DEX marketI don't know. Most of the market has little knowledge of HumidiFi and only 12,000 followers of project officials are concerned. For this “ the Invisible Champion ” and PANews collated and compiled the content of the two authors TATO, Azsui, including the presentation of the HumidiFi project and the forthcoming ICO0 event。

Text:

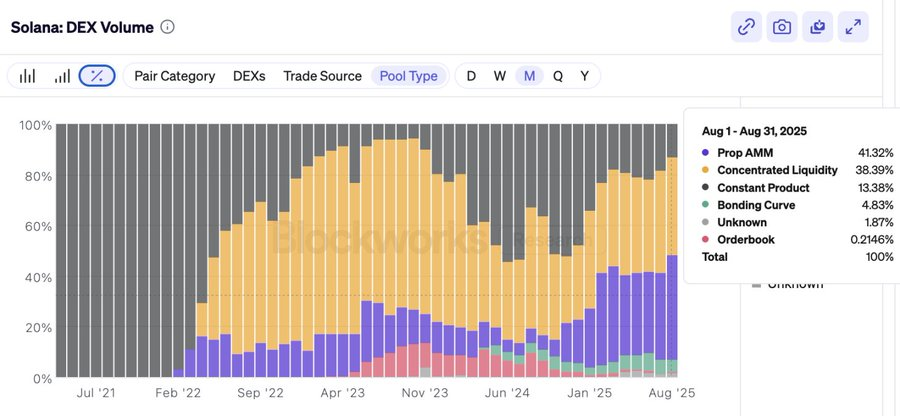

What's Prop AMM

AMM:

& bull; allows any user to inject mobility & rar; to get the fee returns

& bull; using passive pricing mechanisms (x*y = k constant product formula)

& full; takes TVL for deep mobility

& Bull; Liquidity Provider (LP) is at risk of erratic loss

Prop AMM:

& bull; provide full mobility by professional business

• pricing policy updated on a continuous basis and not related to user transactions

• algorithms manage inventory as actively as the central exchange does

& Bull; Undisclosed Liquidity Provider (LP) = no variable loss to the dispersed household

Core features of HumidiFi:

& bull; expedition update, multiple pricings per second

& bull; private order stream mechanisms reduce volatility and run-away risks

& bull; efficient utilization of capital through accurate concentration of liquidity in areas of highest demand

& full; running through chain algorithms

& full; access only via the Jupiter route

It can be understood as a chained version of Citadel Securities, a market-based solution based entirely on block-chain technology without a permit。

What HumidiFi did

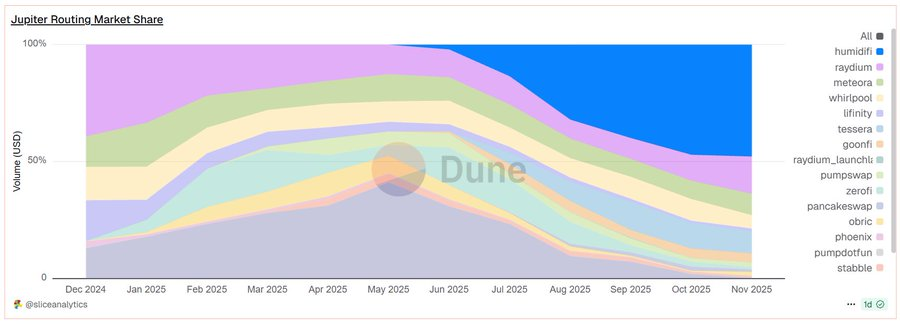

Trade volume dominance

& bull; achieving about $100 billion in total transactions within five months

& Bull; 35% of total transaction volume of Solana Chain DEX

& bull; steady daily turnover at us$ 1-19 billion

& Bull; transactions amounted to $34 billion last month (over the sum of Raydium and Meteora)

Quality of implementation

& Bull; SOL/USDC is narrower than currency

& full; more compact quotes & rar; lower slide point, price impact near limit minimization

& bull; 99.7% turnover (almost zero trade failures)

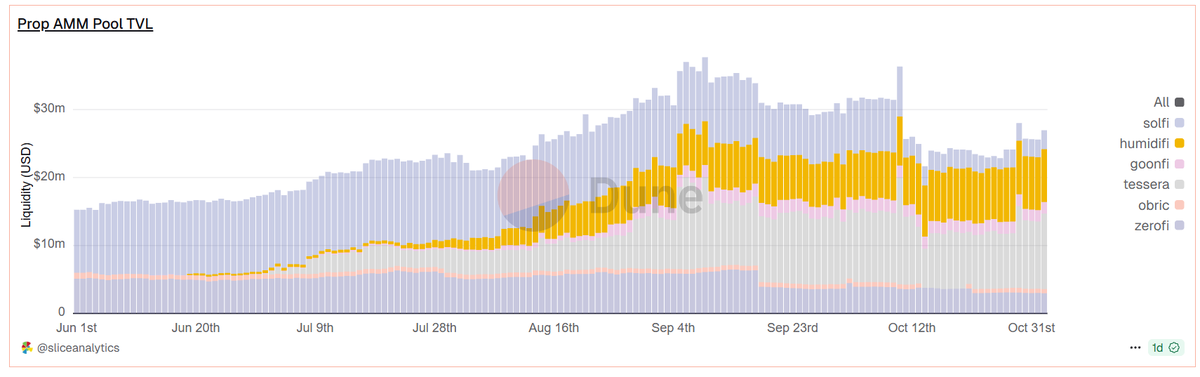

The Miracle of Capital Efficiency

& Bull; processing $819 million a day of transactions on $5.3 million TVL alone

& Bull; 154 times capital efficiency (approximately 1 times traditional AMM)

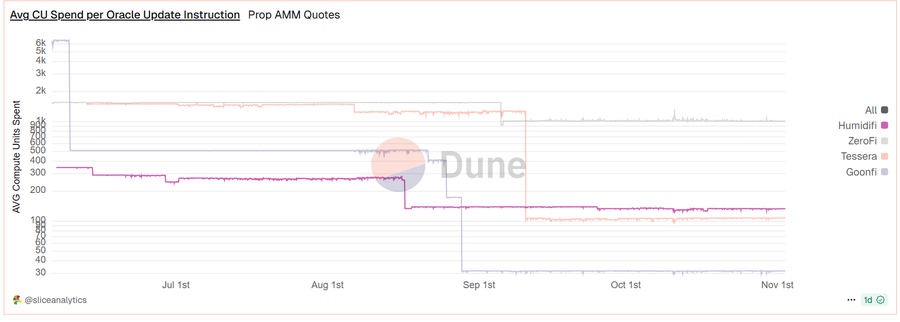

• predictive machine update only 143 units (about 1,000 times less than normal exchange)

The result? Users receive better prices, even without knowing that HumidiFi is operating behind them。

Why HumidiFi

Technical advantages

the • superweight prophecies require only 143 computing units

& bull; subsecond price refreshed (15-30 seconds for competitors)

& bull; liquidity is closely focused on predictive price concentration = extreme capital efficiency

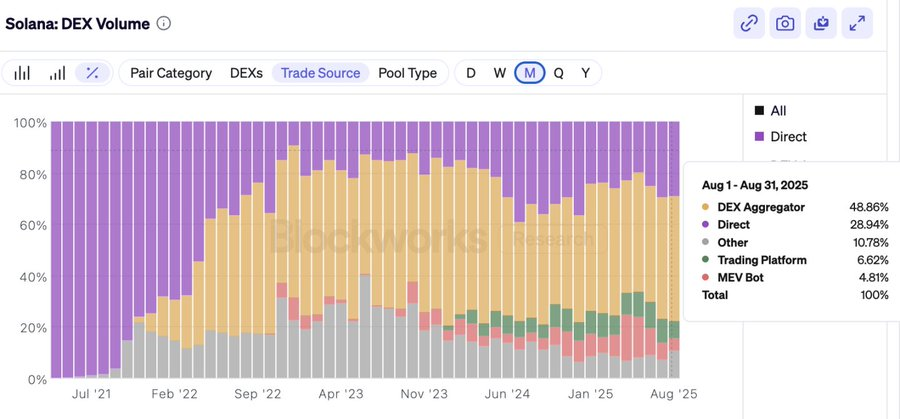

Jupiter's ecological integration advantage

& Bull; Jupiter handles 80% + exchange flows for Solana

& Bull; HumidiFi owns the 54.6% share of Jupiter's professional business

& bull; better price & rarr; more route options & rarr; higher trade & rarr; enhanced price advantage (flying wheel effect)

Invisible advantage

& bull; no frontend

& Bull; Private order flows reduce the risk of MEV attacks

& bull; operation anonymous = reduced regulatory target risk

First scale effect

When competitors targeted millions, HumidiFi directly achieved a billion-degree breakthrough. In the DeFi market, liquidity attracts liquidity, and they have taken the lead。

The future has come: HumidiFi will lead Solana DeFi's development

In short, it always offers you the best offer. For the users, that is our core need。

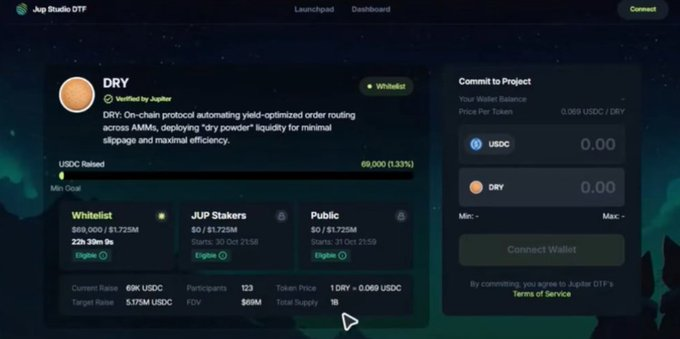

HumidiFi will issue its governance, practical WET in November (on a date to be determined) on the latest launch of the Jupiter DTF Launchpad。

This sale will be made at a fixed price and in three stages。

- White List Phase

- US$JUP PLEDGER PHASE

- Public sales phase

THE POINT IS THAT THE WET TOKEN HAS NOT BEEN INVESTED BY ANY VENTURE CAPITAL。

THIS MEANS THAT IF A WINDFALL AGENCY INTENDS TO BUY IT, IT WILL HAVE TO TAKE PART IN THE SUBSCRIPTIONS DURING THE ICO PERIOD OR TO PURCHASE IT FROM THE SECONDARY MARKET AFTER THE CURRENCY IS PUBLICLY AVAILABLE。

Once the sale has been completed, the $WET will open the transaction in a mobile pool on the Meteora platform。

Concluding remarks

- HumidiFi is a professional AMM agreement that accounts for more than 50 per cent of all DEX transactions。

- Wet will be the first ICO project on the Jupit DTF Launchpad platform。

- THE US$JUP PLEDGEER WILL BE ABLE TO PARTICIPATE IN THIS ICO SUBSCRIPTION。