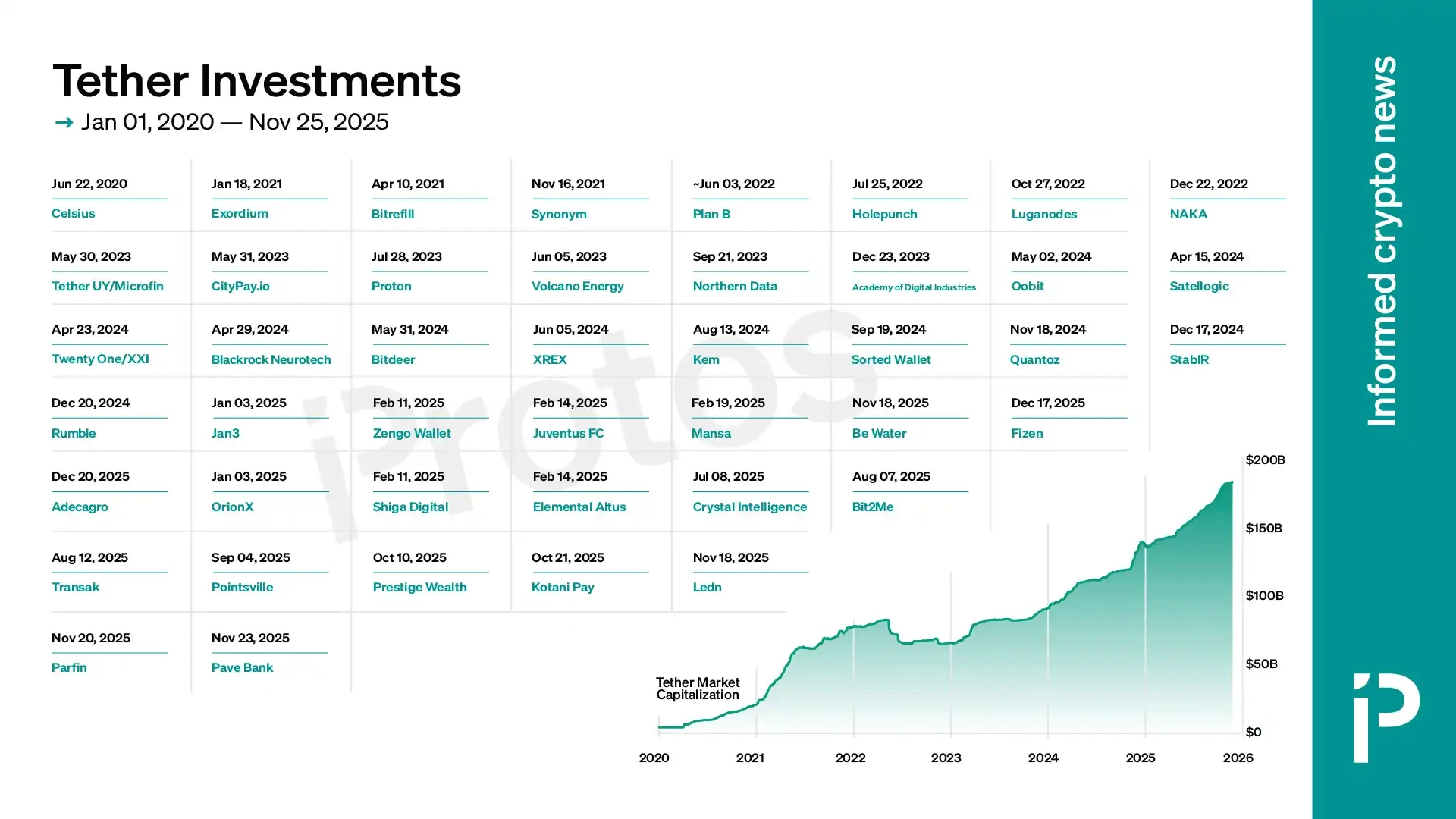

Tether's latest investment map. Encrypted tracks still dominate

There are also brain interfaces, professional football teams, space satellites and right-wing media。

There are also brain interfaces, professional football teams, space satellites and right-wing media。

Original title: What a $100 B stablecoin empire does with its products

Original by Bennett Tomlin, protos

Original: Motion work, Block Beats

Tether is now one of the most important financial groups in the world. It not only operates the most stable currency with the highest market value, but its investment map cuts further across areas such as encrypted currency, payment processing, video stream media, artificial intelligence, brain interfaces, farmland, satellites, football, etc。

These investments are intended to increase the tentacles and influence of companies, and if they succeed, they will certainly bring significant financial returns in the future。

Tether’s CEO, Paolo Ardoino, has revealed that Tether has invested in more than 120 companies, but only 24 of them are on the “Tether Ventures” page of his official website。

The public list has also changed over time. According to a screenshot and web file published by Ardoino, the list contained OrionX at the time of the launch of Tether Ventures. In a blog post later deleted, Tether called OrionX one of Chile's leading digital asset exchanges。

Protos contacted Tether to ask why the company was removed from the website, but did not respond before sending the text。

In fact, many other investment projects have been reported by the media — and sometimes even on Tether's own website — but for some reason they are not included on this portfolio page。

The company of Samson Mow, former Chief Strategic Officer of Blockstream, has received investments from Tether on several occasions。

The first of these was Tether's involvement in the issue of Exordium securities. Exordium is the distributor behind the game "Infinite Fleet," created by Mow. Exordium uses the Holepunch technology funded by Tether to distribute its game client。

Exordium stated that its securities-type tokens were still available on Bitfinex Securities (Tether's affiliates). However, a review of the Bitfinex Securities website found that the current transaction code list did not contain the token。

Exordium is not the only company that Mow created, and Tether invested Jan3. Jan3 raised funds from Tether to "pace the development and expansion of the AQua wallet."。

In addition, Blockstream was funded by iFinex, one of the companies operating the Bitfinex platform。

Tether is also a Celsius equity investor, a secure currency lending platform that has now collapsed and is involved in massive fraud。

Celsius ' founder and former CEO Alex Mashinsky was recently sentenced to 12 years ' imprisonment。

It is also reasonable that the investment was not included on the Tether Ventures page, after all, after the collapse of the fraudulent platform, the equity had become virtually worthless。

In addition to equity investments, Tether had made loans to Celsius, the liquidation of which had been a serious issue in the Celsius insolvency proceedings. The lawsuit recently ended with a settlement of $299.5 million。

Volcano Energy, a bitcoin mining project in El Salvador, initially planned to power a series of bitcoins with volcanic geothermal energy。

Tether describes its goal as "to carry out its mission of investing in renewable energy to support and promote sustainable bitcoin mining"。

According to the project website, the focus of Volcano Energy has since shifted from volcanic geothermal to wind and solar energy. At present, the project has not yet begun digging any bitcoin。

Tether also worked with the local company Microfin to invest in mining in bitcoin in Uruguay. Tether says that this investment demonstrates "a commitment to energy innovation and the future of encrypted money"。

In September this year, there were reports that Tether was planning to abandon the project because of the failure to pay for electricity. At that time, Tether said to Cointelegraph, "Tether remains supportive of these efforts and will seek a constructive way forward, which reflects our long-standing commitment to sustainable development opportunities in the region. I don't know

However, according to El Observador, citing reports, Tether has since officially abandoned the project on the grounds that energy costs are too high to be economically profitable。

Tether also has several projects belonging to its "special project service" department, headed by Davide Rovelli。

This includes Plan B, a Swiss-based encrypted currency conference run by AltKey SA, led by Rovelli. Plan B's stated goal is to create a European encryption centre in Lugano。

One of Plan B's “presences” is Luganodes, a supplier of “staking-as-a-service”. The service provider focused mainly on the Tron network created by Sun Joo, the second largest USDT token distribution network。

2040 Energy was originally a joint project between Tether and Swan。

The project eventually evolved into a litigation dispute, accusing Tether of having induced the consultant to leave 2040 Energy and to start the Proton Management project, which was more closely related to Tether. 2040 Energy and Proton Management are funded by Tether。

Recently, Proton Management successfully applied for compulsory arbitration in the Central District Court of California. These projects represent only the growth of Tether as part of the main financier of the Bitcoin mining ecosystem。

Tether even stretched investment to space, investing in Satellogic, a company that operated satellites and sold observation data。

In a press release announcing investments, Satellogic states that these funds " will help advance our mission, and we will continue to focus on the strategic configuration of the United States, the national security market and the opportunities of global space systems. I don't know

In October, Satellogic announced that it would publicly sell some of its shares。

Tether describes Parfin in a blog post as "a platform for digital asset hosting, monetization, trading and management in Latin America."。

This investment is part of what Artoino describes as Tether’s “convinced belief that Latin America will be one of the world’s major innovation towns”。

Among other functions, Parfin promotes its "compliance and service" management tool for other financial institutions. Parfin also launched a product called Rayls, described as a "bank-specific block chain"。

According to CoinMarketCap, the market value of the coins associated with the project was approximately $44 million。

Ledn is a bitcoin lending platform, which Ardoino claims can “expand credit channels without having to sell digital assets to individuals”。

Ledn is one of the smaller lenders that lent to Alameda Research. Following the FTX and Alameda collapses, Ledn claimed that it “has fully digested the effects of Alameda's outstanding loans” and further stated that “Ledn also held a small amount of assets on FTX, but this would not affect the customer's assets. I don't know

Ledn had also previously relied on Genesis Global Capital as a partner, but the relationship was allegedly terminated before Genesis ' collapse. These problems occurred before Tether invested in the company。

Tether describes Kotani Pay as "the access infrastructure linking Web3 users across Africa to local payment channels"。

It promotes its ability to convert local currencies into encrypted ones. In addition, it provides so-called "stabilized currency settlement solutions" designed to facilitate cross-border payments and claims to be faster than banks。

Bit2Me is described in Tether’s blog as “the leading Spanish digital asset platform”。

It provides exchange services, as well as the "Earn" product, the "Loan" product, which allows users to use encrypted monetary mortgages, and a "zone-chained stock exchange"。

It has a platform coin called B2M. According to self-reported data from CoinMarketCap, its market value has fallen from a peak of about $550 million to only $58 million。

Tether's most recent investment went to Pave Bank, a Georgian-supervised bank committed to providing “globalization, secure multi-asset banking” and “programmable banking”。

It claims that it is a “technology company” for product design and construction, and that it is a “fully regulated bank” for risk, capital and regulatory management。

Prestige Wealth (or Aurelian) is a strange company. It is similar to other digital asset bank (DAT) companies, unlike the assets it invests in are Tech Gold, a monetized version of the so-called Real World Assets (RWA)。

Tether invested in the company, which was raising funds to purchase Tether Gold. A large portion of the financing of its "private equity investment in shares of listed companies" (PIPE) is in the form of Tether (USDT) coins。

In a press release announcing this investment, Aurelian’s CEO Björn Schmidtke states: “This is not just about revenue or finance: This is about redefining how real wealth is held, transferred and preserved in the digital age. I don't know

According to the press release, Aurelian provides "proceeds, transparency, regulatory compliance and daily chain validation"。

Pointsville is another company focused on monetizing real-world assets (RWAs) and providing loyalty programs。

The company is led by Gabor Gurbacs, whose LinkedIn personal data indicate that he is the chief strategic adviser to Tether。

In a press release describing the financing, Ardoino states: "Dialition is rapidly becoming one of the most practical and influential drivers of real-world asset applications. Tether’s Hadron platform is proud to support this transition by working with the experienced team of Pointsville to provide the scale and availability needed to integrate real-world asset and loyalty plans into the digital economy. I don't know

Transak, who claims to be a "global leader of French currency to encrypted monetary infrastructure", says Ardoino, "to accelerate the spread of emerging and developed markets, close financial access gaps and create new opportunities for business and consumers."。

IT PROVIDES OFF-SITE TRADING (OTC) SERVICES AS WELL AS ACCESS MONEY SERVICES。

In contrast to the above-mentioned investments, Tether has some other important investments on the website。

When Tether first invested in Northern Data, it was also a data centre and Bitcoin mining company。

Tether soon became a major shareholder. Since then, Northern Data has split its mining operations into Peak Mining and has begun to focus heavily on artificial intelligence (AI)。

Tether also invested in Rumble, a popular video stream media site among right-wing people, especially those banned by Twitch。

Since then, Rumble has acquired Northern Data, and the deal has given Tether about 30 per cent of Rumble's equity. Besides including encrypted money in the balance sheet, Rumble introduced Tether as the main advertiser, who agreed to invest $100 million in advertising。

Rumble’s recent financial teleconference discussed the company’s intention to transform itself into an AI infrastructure company called Freedom First。

Ardoino was highlighted in a teleconference where he once claimed that "Rumble's vision is exactly the same as ours."。

Rumble CEO Chris Pavlovski also stated at the conference that Rumble would be promoting its encryption-based Rumble wallet to all its user groups this month. Donald Trump Jr., a partner in venture capital 1789 Capital, also invested in Humble。

Jihan Wu has a long history of mining in Bitcoin, co-founder and former CEO of Bitmain。

Now, he leads Bitdeer, a company that was cut off from Bitland and publicly listed in NASDAQ. Tether invested in Bitdeer, with the highest shareholding of over 20 per cent, and then reduced it to about 18 per cent。

CityPay.io, a Georgian-based company, focuses on helping businesses to accept payments in encrypted currency。

When Tether invested in the company, he said it would be part of its “widening its influence in Georgia”. According to Ardoino, Tether "is pleased to work with CityPay.io to bring greater innovation and efficiency to Georgia's payment industry." I don't know

Fizen, in Tether’s blog post, is described as a “company focusing on hosting encrypted wallets and digital payments”。

Fizen's website promotes its ability to make "profits on the move" and promotes its ability to "take advantage wherever and whenever."。

Ardoino states that this investment " underlines our commitment to expanding global access to efficient and reliable digital finance solutions, thereby promoting the wise and responsible use of digital assets in everyday life. I don't know

Kem is described in Tether's blog post as "a platform designed specifically for money transfers and financial management", mainly in the Middle East and North Africa. According to Ardoino, this investment strengthens Tether's commitment to promoting financial inclusion and stability。

Kem’s website describes it as “the first encrypted currency bank”. Although it seems that Kem is not actually a bank, and it certainly is not the first bank to try to serve the encryption industry。

However, its website does state that “Kem operates through Kemfinity s.r.o. (company No. 221 62 194), an entity with VASP licence plates in the Czech Republic. I don't know

Sorted Wallet is described by Tether as a platform for "safe, easy and encrypted money transactions to bridge the gap between populations without bank accounts and underserved banking services in developing regions"。

IN ADDITION TO PROVIDING WALLETS, IT PROMOTES THE USE OF USDT TO HELP USERS "LIST USDT TO BANK, TELEPHONE OR MOBILE CURRENCY ACCOUNTS"。

Ardoino claims that "by supporting Sord Wallet, we have unlocked new opportunities for individuals with basic mobile phones to participate in the financial system. Our goal is to ensure that everyone, wherever and whatever mobile phones are used, safely manages and uses encrypted money, empowers them to build a safer financial future and actively participates in the evolving digital economy. I don't know

Synonym, a Bitcoin wallet provider with a lightning network function, is listed on its website as "a Tether Company"。

In addition to the wallet, the company is also the backstop of Pubky, whose website describes Pubky as an application driven by a "new decentrization protocol, which contains social tags and social programming."。

In addition, it provides Atomicity, described as a "P2P mutual trust system" aimed at "business and collaboration beyond big bank credit cards"。

Shiga Digital, in Tether’s blog post, is described as “a modern platform that provides a way to reach a pan-African block chain financial solution that can be used in the real world and easily accessible. Shiga Digital provides virtual accounts, OTC services, fund management and foreign exchange services for African enterprises. I don't know

On its website, it proposes "to use decentralised banking solutions to empower your business". Shiga claims to be a virtual EU-owned asset service provider, but does not appear to be a literally bank。

XREX is described on the Tether Ventures page as "a USDT-based cross-border B2B payment provider for emerging markets", while on its official website it is described as "changing the future of the banking sector"。

Its website claims to be a money service company regulated by FinCEN, Singapore's main licensed payer and Taiwan's VASP anti-money laundering registry. Its website does not appear to mention any bank plates。

Tether’s article on the investment states that it will enable XREEX to “promote compliance-based cross-border B2B payments in emerging markets”. In addition, the article states that "XREX will launch XAU1 in collaboration with the Unitas Foundation, a dollar-linked unitized stabilization currency supported by Tech Gold (XAUt). I don't know

StablR is launching a stabilization currency in Europe that aims to comply with the Mirca framework and relies on the Hadron monetization platform created by Tether。

Quantoz is another company that intends to use the Tether Hadron platform to launch stabilization currency in Europe that meets the MiCA standards. Tether had provided its own euro peg stabilization currency, EURT, but the project had been shut down。

Maybe the strangest investment for Tether is Blackrock Neurotech, a company dedicated to developing brain interfaces。

This investment belongs to the "Tether Evo". Tether Evo claims: "Tether is at the intersection of innovation and human potential and is committed to bringing humanity into a future where technology and human capabilities are integrated in an unprecedented way. I don't know

Tether also invested in Academy of Digital Industries, an online training and education platform based in Georgia. The investment allegedly added courses on "bitcoin, stability currency, point-to-point technology and artificial intelligence"。

Be Water is described in Tether's announcement of investment as "an innovative media company that focuses on producing and distributing audio, video, film and live content". According to Ardoino, this investment is in line with Tether's belief in the importance of independent media in shaping an informed society。

Tether's investment in the block chain analysis company Crystal Industries seems to be in line with its desire to “combating the use of illegal currency stabilization by supporting law enforcement and establishing a safer and more resilient digital asset ecosystem”. Tether also worked with Crystal Industries' competitor Chainalysis to integrate it into the Tether Hadron platform。

Tether also invested in Elemental Altus, a precious metals royalties company. Ardoino states that this investment is in line with Tether's long-held belief that tangible assets such as bitcoin and gold will support the most durable form of digital value. I don't know

Tether and his sister company, Bitfinex, are also behind Holepunch, a encrypted point-to-point communication platform providing Keet video chat applications. Ardoino is also Chief Strategic Officer of Holepunch。

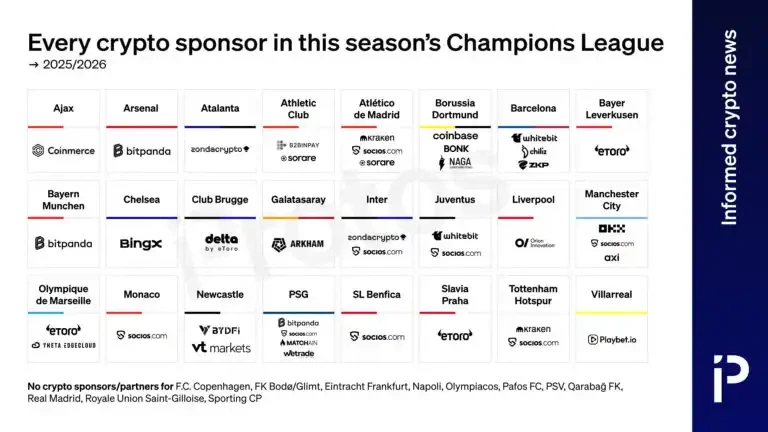

One of the most incomprehensible investments is the Juventus Football Club, Tether, which attempts to describe it as an opportunity to "integrate its futureist portfolio into the sports industry." This shows that Tether wants to take this opportunity to integrate "stable currency, digital assets and people-centred technologies into everyday life"。

Tether describes Zengo as "the leading self-hosted encryption wallet, known for its safety and ease of use", and further claims that Zengo has served 1.5 million users, "there has been no hacking, cyber fishing or takeover of the wallet."。

Zengo is a multi-counting (MPC) wallet that will protect your encrypted currency's key fraction stored between your own mobile device and Zengo's server。

Mansa claims to provide a revolving credit line to the paying company to help facilitate the settlement of transactions and the rapid liquidity of customer accounts. In addition, its website describes other services it provides, including off-site foreign exchange transactions and "virtual card processing"。

Tether describes Oobit as a mobile payment application. According to Ardoino, Tether's investment is part of Tether and Oobit's "a shared vision that promotes the widespread adoption of encrypted currencies worldwide"。

Adecoagro is an agricultural group that invests in energy production. After Tether acquired most of the company's shares, it announced a memorandum of understanding “to explore strategic cooperation focused on mining bitcoin”。

NAKA is a company that claims to be dedicated to the development of “self-hosted payment cards”. Crunchbase shows that Tether has invested in it。

Finally, Twenty One, a digital asset bank (DAT) owned by Tether and led by Jack Mallers, was launched in collaboration with the top custodian of Tether Cantor Fitzgerald。

Twenty One claims that it currently holds 43,514 bitcoins。

Protos can confirm only about a quarter of Tether's investments (assuming that what Ardoino calls "120+" is still accurate)。

The confirmed investment shows that it is a far-reaching financial company, both inside and outside the encrypted money industry, while the vast majority of the remaining investments remain unknown, making it virtually impossible to assess Tether ' s full impact and coverage。

I'm sorryOriginal LinkI don't know