Opinion: Why is the encryption card doomed

@paramonoww

Photo by Peggy Block Beats

Compilers press: Encryption cards were seen as a bridge between traditional payment systems and encrypted worlds, but as the industry developed, the limitations of this model became more apparent: centralization, compliance dependency, lack of privacy, overlapping costs, and even contrary to the core spirit of encrypted currency。

This paper provides an in-depth analysis of the nature of encryption cards, noting that they are only transitional solutions and not real decentrized payment innovations. At the same time, the article suggests that EtherFi, as a few examples of encryption-compliant models, shows the possibility of deFi blending with TradFi。

The following is the original text:

My overall view is that encrypted money cards are a temporary solution to two problems that we all know well: first, to bring encrypted money to the general public; and secondly, to ensure that encrypted money is accepted as a form of payment worldwide。

Encryption cards are still cards, and if someone really agrees with the core value of encrypted money and believes that the future will be dominated by cards, you may need to rethink your vision。

All encryption card companies will eventually die

In the long run, encryption cards are likely to disappear, but not traditional cards. Encryption cards simply add an abstraction, not a purely encrypted currency application. The issuer of the card remains the bank. Yes, they may have different Logo, different designs, different user experiences, but as I said before, it's just abstract. Abstracting makes things more user-friendly, but the bottom processes do not change。

Different chains and Rollup have been obsessed with comparing their TPS and infrastructure with Visa, Mastercard. This goal has been in place for many years: either "replace" or "subversive" Visa, MasterCard, Amex and other payment processing agencies more aggressively。

But this goal cannot be achieved by encryption cards; they are not substitutes, but add value to Visa and Mastercard。

These institutions remain key “doorkeepers” who have the right to set rules, define standards of compliance and even ban your cards, companies and even banks if necessary。

A business that has been pursuing “unlicensed” and “decentralized”, why now hand everything over to the payment processing agency

Your card is Visa, not Estherum. Your cards are traditional banks, not MetaMask. You spend French money, not encrypted money。

Your favorite encryption card companies have done almost nothing but stick their own Logo on the card. They just use narratives and disappear in a few years, and those digital cards that were released in 2030 will not really work until then。

i'll explain later how easy it is to make an encryption card now; & mdash; in the future, you can even make one yourself

The same problem + additional costs

The best analogy I can think of is "applying a specific sort of ranking". Yes, the idea that applications can handle transactions and profit from them is cool, but it is only temporary: infrastructure costs are falling, communications are mature, and economic problems are at a higher level, not lower. (If you're interested, you can look at @mvyletel_jr's wonderful talk about ASS. I'm not sure

The same is true of encryption cards, which, yes, you can charge in encrypted currency and which are converted into French for payment, but problems of centralization and access remain。

It does help in the short term: businesses do not have to adopt new payment methods, and encrypted consumption is almost “hidden”。

But this is only a step towards the goal that most encrypted believers really want:

Demand: paid directly in stable currency, Solana, Etheum, Zcash

Not needed: USDT & rrr; encryption card & rrr; bank & rrr; indirect path to French currency

The addition of an abstract layer adds an additional layer of costs: price differentials, cash withdrawals, transfer charges and, in some cases, hosting gains. These costs appear to be insignificant, but they will yield dividends: a penny is a penny saved。

Using encryption cards doesn't mean you're "no bank account" or "debanking."

Another area of error I observed was the perception that the use of encryption cards was tantamount to the absence of a bank account or debanking. Of course it's not true. There is still a bank under the encryption card label, and banks have to report some of your information to the local government. Not all data, but at least some key data。

If you are an EU citizen or resident, the government will know about interest on your bank account, large suspicious transactions, certain investment income, account balances, etc. If the bottom banks are in the United States, they know even more。

IT'S BOTH GOOD AND BAD FROM A ENCRYPTION POINT OF VIEW. THE BENEFITS ARE TRANSPARENT AND VERIFIABLE, BUT THE SAME RULES APPLY TO THE USE OF STANDARD DEBIT OR CREDIT CARDS ISSUED BY LOCAL BANKS. THE BAD THING IS IT'S NOT ANONYMOUS OR PSEUDONYMIC: BANKS STILL SEE YOUR NAME, NOT YOUR EVM OR SVM ADDRESS, AND YOU STILL NEED TO DO KYC。

Restrictions remain

You might say that encryption cards are great, because they are really easy to set: download applications, finish KYC, wait for 1– 2 minutes to verify, charge encrypted currency, and then use it. Yes, it is indeed a killer-grade function that is extremely convenient, but not accessible to all。

russia, ukraine, syria, iraq, iran, myanmar, lebanon, afghanistan, and half of africa — — citizens of these countries cannot use encrypted currency for daily consumption without residency in other countries。

but hey, it's just 10 & ndash; 20 countries are not eligible, and more than 150 countries? the question is not whether the majority can use it, but the core value of encryption: a decentrized network, equality of nodes, financial equality and equal rights for all. this does not exist in encryption cards because they are not "encrypted" at all。

Max Karpis here explains perfectly why the "new banking" was doomed to failure in the first place。

Max Karpis believes that “new types of banks” are doomed to failure at the outset because they face multiple structural obstacles: extremely high regulatory and compliance costs, lack of scale and user trust, dependence on third parties and vulnerability of business models, high financial pressures, and difficult profits. By contrast, giants such as Revolut, with a vast user base, data advantages and compliance barriers, can quickly replicate innovation and win on a scale, making it difficult for new and original banks to survive or destabilize competition。

As a reference, I actually paid in encrypted currency when Trip.com booked the ticket. They recently added an option to pay in stable currency, which can be paid directly from your wallet and, of course, can be used by anyone around the world。

Don't use Booking, use Trip to make real encryption payments. This is my sincere recommendation。

This is a real encryption currency application and a real encryption payment. I believe that the final form will be like this: wallets will be dedicated to optimizing the user experience of payment and consumption, or (lower probability) wallets will become encryption cards if they are widely used in some way。

Encryption card functions similar to Rain

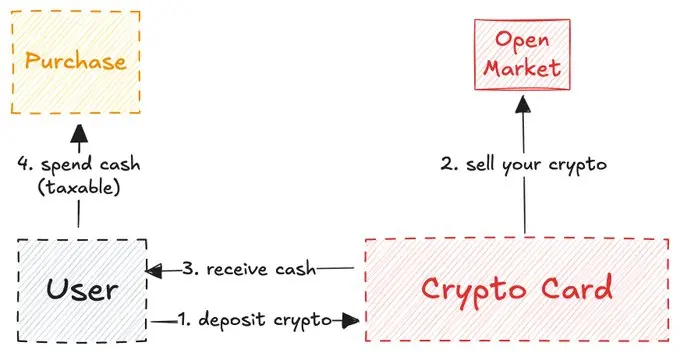

I have an interesting observation: the self-custody encryption card works very much like a cross-chain bridge。

This applies only to cards that are issued from the Centralized Exchange (CEX), which is not self-hosted, so that exchanges such as Coinbase are not obliged to allow users to assume that the funds are under their own control。

A REASONABLE EXAMPLE OF THE USE OF CEX CARDS IS THAT THEY CAN BE USED AS FINANCIAL PROOF FOR GOVERNMENT, VISA APPLICATIONS OR SIMILAR SCENARIOS. YOU'RE ACTUALLY STILL IN THE SAME ECOSYSTEM WHEN YOU USE ENCRYPTION CARDS THAT BIND CEX BALANCES。

INSTEAD OF HOSTING ENCRYPTION CARDS: THEY OPERATE LIKE MOBILE BRIDGES, YOU LOCK MONEY IN CHAIN A (ENCRYPTED BALANCES) AND UNLOCK MONEY IN CHAIN B (REAL WORLD)。

The role of the bridge in the field of encryption cards is like the Iron Bar during California’s gold rush: It is a key secure gateway to encrypted primary users and businesses that want to issue their own cards。

@stablewatchHQ is very well equipped to analyze this bridge, considering it to be essentially a card-as-a-service, CaaS mode. This is the most easily overlooked aspect of all those discussing encryption cards. These CaaS platforms provide infrastructure to enable enterprises to introduce their own brand cards。

Read about: The Crystal Payment Card Market: Bridging Digital Assemblys and Global Commerce

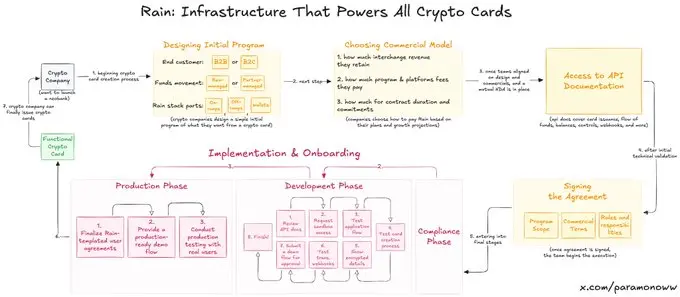

Rain: How the encryption card was born

Half of your favorite encryption card is probably supported by @raincards, and you probably never heard of it. Rain is one of the most basic protocols in the new banking system because it carries almost all the core components behind the encryption card. The rest of the company is just going to stick its Logo on it。

I made a map to help you understand how Rain works and how easy it is to set up a encryption card. Tip: Better quality after magnification。

Rain allows companies to quickly launch their encryption cards and, frankly, Rain's enforcement capacity can be sustained even beyond the encryption field. So, let's not think that teams need tens of millions of dollars to get their encryption cards out, they don't need them — — they just need Rain。

I put this emphasis on Rain because there is a general overestimation of the effort required to issue encryption cards. Maybe I'll write a separate article about Rain in the future, because it's really a severely underestimated technology。

The encryption card has no privacy and anonymity

The lack of privacy or anonymity of encryption cards is not a problem with encryption cards per se, but one that those who drive encryption cards deliberately ignore and hide behind what is called "encryption values"。

Privacy is not a widely used function in the field of encryption, and pseudonyms (simplified anonymity) do exist because we see an address, not a name. However, if you are ZachXBT, Igor Igamberdiev from Wintermute, Storm from Paradigm, or any other person with a strong analytical capability on the chain, you can significantly reduce the real identity of an address。

OF COURSE, THE SITUATION OF ENCRYPTION CARDS IS NOT EVEN AS HYPOCRITICAL AS THAT OF TRADITIONAL ENCRYPTED CURRENCY, BECAUSE WHEN YOU OPEN AN ENCRYPTION CARD YOU HAVE TO COMPLETE KYC (IN FACT, YOU OPEN A BANK ACCOUNT INSTEAD OF AN ENCRYPTION CARD)。

If you are in the EU, the company providing the encryption card will still send some of your data to the government for tax or other purposes that the government needs to know. Now you've given the regulator a new opportunity to track you: connect your encrypted address to the real identity。

Personal data: future currency

Cash is still available (the only form of anonymity, except the seller can see you) and will be available for a long time. But eventually, everything will be digital. The current digital system does not benefit consumers in terms of privacy: the more you spend, the more you pay, the more they know about you in exchange. It's a good deal

Privacy is a luxury that will continue in the area of encryption cards. One interesting idea is that if we achieve real privacy and even let businesses and institutions pay for it (not like Facebook, but with our consent), it could become the currency of the future, even the only currency in a world that is not working and is driven by AI。

If everything is doomed, why build Tempo, Arc Plasma, Stable

the answer is simple — — locking users in the ecosystem。

Most non-trust cards choose L2 (for example, MetaMask uses @LineaBuild) or stand alone L1 (for example, Plasma Card uses @Plasma). Due to high cost and finality issues, the ETA or Bitcoin usually does not apply to such operations. Some cards use Solana, but this remains a minority。

Of course, companies choose different block chains not only because of infrastructure but also because of economic interests。

MetaMask uses Linea not because Linea is the fastest or safest, but because both Linea and MetaMask belong to ConsenSys ecosystems。

I specifically used MetaMask as an example because it used Linea. You know, almost no one uses Linea, which is far worse in the L2 competition than Base or Arbitrum。

But ConsenSys made a smart decision to put Linea on the bottom of their cards because it locks users into the ecosystem. Users are accustomed to good user experience, not through daily use. Linea naturally attracts mobility, turnover and other indicators, rather than relying on mobile mining or begging users to cross the chain。

This strategy is similar to that followed by apples when they launched iPhone in 2007, leaving users on iOS to become accustomed to moving to other ecosystems. Never underestimate the power of habit。

EtherFi is the only valid encryption card

After all these reflections, I came to the conclusion that @ether_fi might be the only encryption card that really fits the encryption spirit (this study is not sponsored by EtherFi, even if I do)。

In most encryption cards, the money that you fill in is sold and your balance is replenished with cash (similar to the mobility bridge I described earlier)。

Most common encryption cards

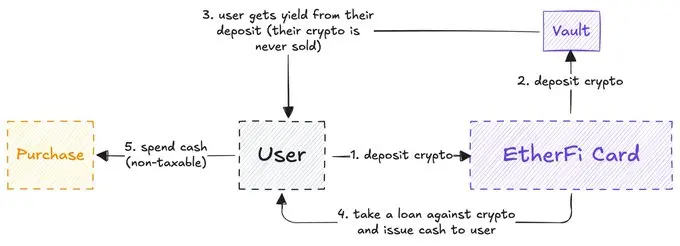

And EtherFi is different: the system never sells your encrypted currency, but gives you a cash loan and uses your encrypted assets to earn money。

The otherFi model is similar to Aave. Most DeFi users dream of being able to secure cash from encrypted assets seamlessly, and this ability has emerged. And you might ask, "Isn't this the same?" I can charge encrypted money and use it as a regular debit card. I don't know

EtherFi mechanism (simplified version)

The problem is that the sale of your encrypted currency is a taxable event, sometimes more easily taxed than daily consumption. And in most of the cards, each of your operations may be taxed, leading to more tax payments (emphasis added, the use of encryption cards does not mean debanking)。

EtherFi solved the problem in a way, because you didn't really sell encrypted money, just mortgage it。

With this alone (and the fact that the United States dollar is free of foreign exchange charges, refunds and other benefits), EtherFi is the best example of DeFi’s interaction with TradFi。

Most of the cards try to pretend that they are encryption products, but they're actually just mobile bridges, while EtherFi is really open to encryption users, not simply to get encrypted money to the public: It allows encrypted users to consume locally until the public realizes how cool this is. Of all the encryption cards, EtherFi may be the only project that will survive in the long term。

I think encryption cards are an experimental site, but unfortunately most of the teams you see are using narratives without giving the bottom systems and developers the recognition they deserve。

Let us see where progress and innovation will take us. At present, we are witnessing the globalization of encryption cards (horizontal growth), but the lack of vertical growth, which is precisely what this payment technology requires at an early stage。