FROM PROCYCLICAL EXPANSION TO CROSS-CYCLICAL SURVIVAL: 2026 DIGITAL ASSET BANK (DAT) SUSTAINABILITY OUTLOOK - ANALYSIS BASED ON DIFFERENCES IN FINANCING STRUCTURES AND CURRENCIES

Based on the market environment at the beginning of 2026, a systematic dismantling of the operating mechanisms of DAT enterprises was carried out, focusing on the dual dimensions of the “financing structure x the bottom currency” and providing an in-depth analysis of the boundaries and potential risks of DAT's “Reflexive Flyweel”。

The Digital Asset Bank (DAT) model continues to spread and evolve among globally listed companies, especially after the market rebound in the fourth quarter of 2025, when the sustainability of the business model became the focus of market attention in the next cycle. Based on the market environment at the beginning of 2026, a systematic dismantling of the operating mechanisms of DAT enterprises was carried out, focusing on the dual dimensions of the “financing structure x bottom currency” and providing an in-depth analysis of the boundaries and potential risks of DAT's “Reflexive Flywheel” operation。

The study notes that the DAT model is essentially an active balance sheet management, with value creation arising from synergy between asset end-of-side gains (beta) and capital-end operations (alpha). With regard to the financing structure, the article argues for the high dependency of equity finance (e.g. ATM, PIPE) on the valuation premium (mNAV) as the core driver of the fly-wheel, as well as the time mismatch risk introduced by debt financing (e.g., reversible) as a second tier of financing, while providing leverage efficiency. In terms of currency selection, the paper compared the financial resilience of the Bitcoin (BTC) with strong consensus, the challenge of compliance and transparency following the overlapping of interest-bearing properties of the ETH, and the aggressive liquidity transfer mechanism for small currencies to “currency equity linkages” through the SPCC channel。

In the context of the case of Strategy (formerly MicroStrategy), Core Scientific and MARA, the core sustainability assessment framework is presented in this paper, with four trends: first, the industry is now in the life-cycle phase, and the key contradiction is not to be reversed, while enterprise refinancing capacity under the finance window is triggered by the liquidity pressure of the debt service; second, the valuation logic will shift from a “channel premium” to a “capacity pricing”, with compliance configuration tools such as ETF being available, DAT finance premiums are more scarce and short-lived, and MNAVs will remain in place for a long time; third, the underlying asset differences will further widen the division of the enterprise, BTC-DAT will become more vulnerable to financial anchorage, but with a more sensitive approach to financing, the ETH-DAT ceiling will depend on the continued clear disclosure of the source of proceeds, risks, and a proven governance and enforcement record; fourth, DAT will continue as a capital market strategy, but may be centralized. This paper provides a framework for the sustainability assessment of DAT enterprises in the next cycle and a reference for the normative evolution of the DAT industry。

keyword: Digital Asset Treasury (DAT); financing structure; currency differences; mNAV; sustainability analysis

Contents Directory

Introduction

2. Concepts and definitions

2.1. Conceptual definition: definition of treasury

2.2. Explanation of terms

2.3. ANALYSIS OF THE STATUS OF THE DIGITAL ASSETS RESERVE (DAT) OF GLOBALLY LISTED COMPANIES

3. BUSINESS MODEL OF DAT

3.1. Business model positioning: active balance sheet companies

3.2. Value creation mechanisms: outcome of asset decisions, speed of financing decisions

3.3. Structural characteristics of the business model: weak profit statement, concentration of assets, ownership of finance, valuation differentiation

3.4. Sources of differences in patterns: financing structure x currency attributes

4. COMPARISON OF CORE FINANCING STRUCTURES

4.1. EQUITY FINANCING: THE CORE DRIVING FORCE OF DAT

4.2. Debt financing: second tier funding and time dimension constraints

4.3. Equity + Debt Complementation: Flying Wheels Formation and Survival Boundary

5. CURRENCY ANALYSIS: HOW CORE ASSETS ARE RESHAPING DAT ' S REVENUE SOURCES AND RESISTANCE

5.1 BITCOIN (BTC): CONSENSUS ADVANTAGE FOR MORE RESILIENT FINANCING WINDOWS

5.2. ETH: SUPERSEDING ECOLOGICAL AND PROFIT VARIABLES, WITH HIGHER REQUIREMENTS FOR TRANSPARENCY

5.3. SMALL CURRENCY “CURRENCY EQUITY LINKAGE” MODEL: ASSET MAPPING AND LIQUIDITY TRANSFER UNDER THE SPAC CHANNEL

Core mechanisms: liquidity transfer after shell listing

5.3.2. Typical path analysis: static treasury and dynamic marketing

DAT RISK ANALYSIS

6.1. DAT CYCLE PHASE AND DIVIDED PATH

6.2. Financing structural risks: the boundaries of equity and debt

6.3. CURRENCY PORTFOLIO RISK: THE MACRO-SENSITIVITY OF BTC AND THE CONFIGURATION PARADOX OF ETH

Core assessment indicators: quantifying financial health and expansion potential

Analysis of typical risk management cases

7.1. Strategy: cyclical pressure on equity arbitrage and long-term debt wall

7.1.1. Constraints on financing windows due to price volatility

7.1.2. Pressure on future-period obligations

7.2. Core Scientific: The lessons of debt accumulation and maturity mismatches

7.3. MARA: SURVIVAL GAME UNDER DILUTION OF EQUITY

8. DAT CORPORATE SUSTAINABILITY ANALYSIS AND TREND OUTLOOK

8.1. DAT CORPORATE SUSTAINABILITY JUDGEMENT FRAMEWORK: PREMIUM WINDOW, CASH BUFFER, DEBT TERM AND TERMS

8.2. Trends outlook: moving from a narrative of expansion to a survival test

8.2.1. Reinventing core propositions: moving from procyclical expansion to survival across cycles

8.2.2. Valuation model conversion: premium scarcity and functional pricing

8.2.3. BOTTOM ASSET FRAGMENTATION: CONSENSUS PRICING FOR BTC AND STRATEGIC GAINS FOR ETH

8.2.4. Industry finals: increased effects and end effects

1. & nbsp;Introduction

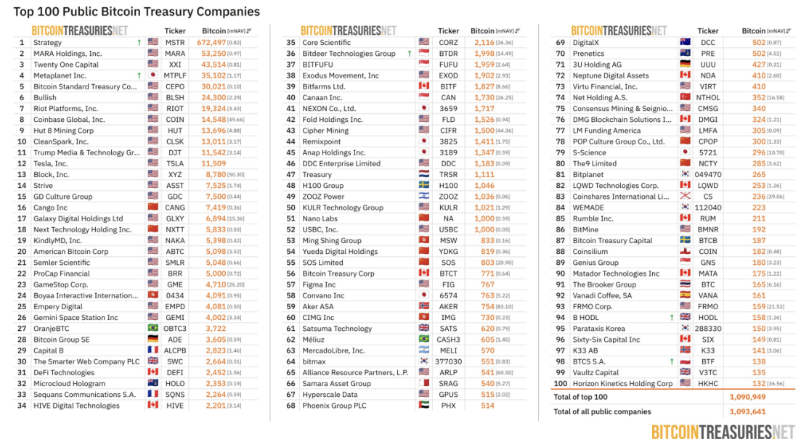

DAT (Digital Assembly Treasury, Digital Asset Treasury) usually means that enterprises (or DAO organizations) incorporate encrypted assets such as BTC, ETH and manage and configure them in a “long-term reserve” manner. Driven by the model effect of Strategy (formerly MicroStrategy), this strategy is exploring, on a case-by-case basis, the strategic options for moving towards a wider listing of companies, together with the White House support signal for “Strategic Bitcoin Reserve” in the United States. Bitwise reports that, as of 2025, 172 BTCs were held by globally listed companies, with more than 1 million warehouses. As a result, BTC-related DAT assets are over $100 billion (based on bitcoin prices at the time of the release of the Bitwise report) measured only from the public company dimension; there is still significant scope for expansion in their potential coverage and volume if other digital assets and unlisted business entities are further included。

But as BTC and ETH prices continue to weaken since Q4 in 2025, the validity of the DAT path is beginning to be more widely questioned. Cases in which the subject of “equity + claims” finance was partially used in cases where the financing model failed and the adjustment strategy was forced: Bitcoin's biggest treasury, MicroStrategy, fell by more than 50 per cent, and Bitmine's biggest treasury, by more than 80 per cent. At the same time, some small and medium-sized DAT companies have experienced tactical contractions and even suspensions, such as the BTC Treasury, which is based on the star Beckham, and the Prenetics strategy to stop it. The above changes led to a shift in the market's focus on DAT from being in currency to “how to cross the evacuation cycle”:In the context of currency reversals, the downside of stock prices and debt pressures can have a double impact — in other words, the core variable that determines whether a strategy can cross the cycle is precisely “what kind of financing + what kind of currency”。

ON THIS BASIS, THIS PAPER BUILDS ON THE CURRENT STATUS OF DAT ENTERPRISE DEVELOPMENT AND THE LATEST STRESS TESTS AT THE BEGINNING OF 2026, AND PROVIDES A FRAMEWORK ANALYSIS OF THE SUSTAINABILITY AND KEY RISK POINTS OF THE DAT ENTERPRISE STRATEGY, BASED ON THE CHOICE OF TWO MAIN LINES OF FINANCING STRUCTURE AND CURRENCY, WITH A VIEW TO PROVIDING A VERIFIABLE REFERENCE FOR SUBSEQUENT STRATEGY DESIGN AND RISK CONTROL。

2. & nbsp;Concepts and definitions

2.1. & nbsp;Conceptual definition: definition of treasury

This paper examines DAT (Digital Assembly Treasury, Digital Asset Treasury) and begins by defining its concept。

• BROAD CALIBRE: A POOL THAT INTEGRATES ENCRYPTED ASSETS INTO THE FINANCIAL MANAGEMENT SYSTEM AND HAS MEDIUM- TO LONG-TERM HOLDING INTENTIONS CAN BE CONSIDERED DAT。CATEGORIZED BY THE TREASURY CARRIER (I.E. THE SUBJECT HOLDING DAT): DAT CAN BE DIVIDED INTO TWO TYPES OF CHAIN AND LOWER。

(1)The chainMAINLY DAO ORGANIZATION AND PROJECTOR FOUNDATION

(2)Down chain(a) One is DATRO (Digital Assembly Treasury Company), which is centred on the “Tunnel”, and the other is an enterprise that has other main operations but includes encrypted assets in its asset allocation (e.g. an encrypted mine)

(3)Shell listing:IN RECENT YEARS, THERE HAVE ALSO BEEN EMERGING PATHS OF CHAIN-TO-CHAIN INTEGRATION, FOR EXAMPLE, THROUGH SHELL COMPANIES (SPAC, SPECIAL PURPOSE ACQUISITIONS) WHERE THE PROJECTER HAS BEEN ABLE TO MARKET HERSHELLS TO TAKE ON THE CHAIN OF CAPITAL AND SUB-CHAIN CAPITAL MARKETS。

• A narrow calibre: In the current market context, DAT refers mostly to DATCO (Digital Assembly Treasury Company), i.e. the company that holds and manages encrypted assets under the chain as its main business (mostly listed companies)I don't know。[2]

Based on these definitionsThe term “DAT enterprise” in this paper refers primarily to DATRO, an enterprise that operates mainly with a chain-to-storage currency (mainly listed enterprises) - of which Strategy (formerly MicroStrategy) was the founder of the modelI don't know. For enterprises (e.g., mining companies) that have a well-defined primary business and use only encrypted assets as investments, this paper does not focus on analysis。

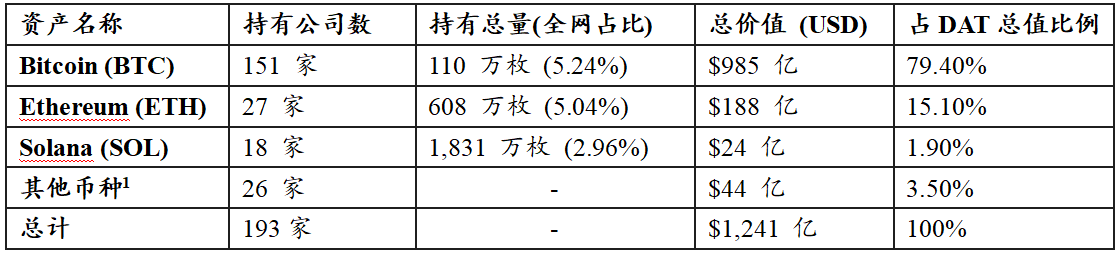

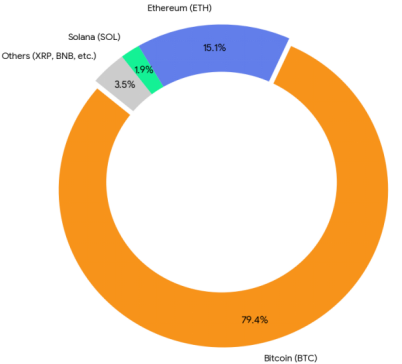

Table 1: Explanatory list of key articles

SOURCE: PKUBA

2.2 & nbsp; Analysis of the status of the Digital Assets Reserve of Global Listed Companies (DAT)

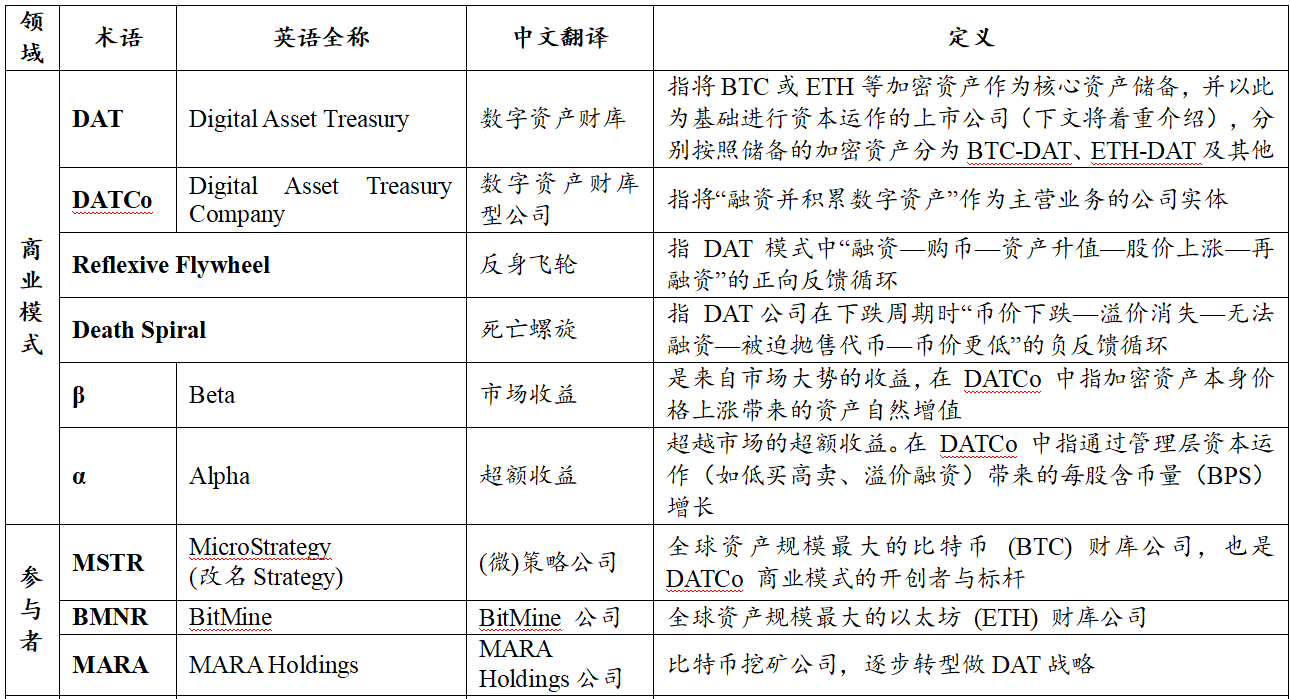

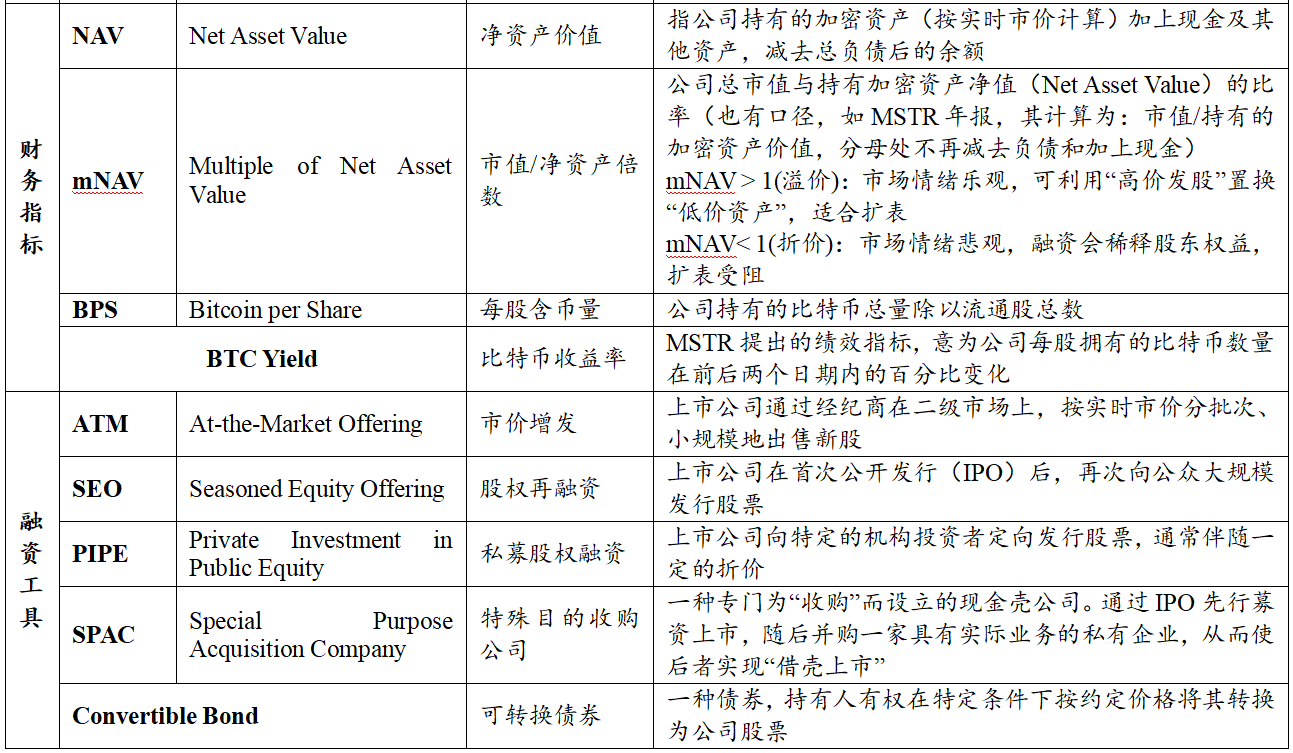

Based on Coingecko data (as of 2 January 2026), the digital asset reserve (DAT) held by globally listed companies is as follows。(Note: The statistics cover only publicly listed companies, and the holdings of unlisted enterprises are not covered by the statistics. I'm not sure

TABLE 2: LISTED COMPANY DIGITAL ASSET RESERVE (DAT) STATISTICS

Source: Coingecko, as of 2026, 2 January

NOTE: OTHER CURRENCIES INCLUDE ASSETS SUCH AS XRP, BNB, TON, SUI

FIGURE 1: VALUE OF THE DIGITAL ASSETS RESERVE (DAT) OF LISTED COMPANIES

Source: Coingecko, as of 2026, 2 January

BASED ON THE ABOVE, DAT, A GLOBALLY LISTED COMPANY, IS BASED ON THE FOLLOWING:

First, asset size and head effect: statistics show that DAT, a globally listed company, has reached its total size1,241Billion dollars. In terms of value composition, Bitcoin (BTC) has shown overwhelming dominance at 79.4 per cent; is in second place at 15.1 per cent; and Solana (SOL) and other long-tailed assets represent only the remaining 5.5 per cent。

Second, there's a difference between configuration preferences and consensus: THERE ARE SIGNIFICANT DIFFERENCES IN THE PENETRATION RATES OF THE MAJOR ASSET CLASSES IN THE ENTERPRISE'S BALANCE SHEET. THE TOTAL VALUE OF BTC RESERVES IS ABOUT 5.2 TIMES THAT OF ETH AND MORE THAN 41 TIMES THAT OF SOL. IN TERMS OF INSTITUTIONAL COVERAGE, THERE ARE 151 LISTED COMPANIES WITH BTC, WELL OVER ETH (27) AND SOL (18). THIS DATA STRONGLY SUPPORTS THE FACT THAT BTC REMAINS THE PREFERRED TARGET FOR INSTITUTIONAL FUNDING。

Third, structural characteristics of long-tail assets: in the composition of “other assets” (with 3.5 per cent), two main features are:

:: OLD INFRASTRUCTURE CATEGORY: INCLUDING OLD PUBLIC CHAINS OR EXCHANGE COINS SUCH AS XRP, LINK, TRON, BNB, ETC., MOST OF WHICH ARE ASSOCIATED BUSINESS WAREHOUSES FOR LISTED COMPANIES

• Capital operations: Some of the emerging projects (e.g. 0G, Babylon, Pump.fun, etc.) exhibit a distinct “currency equity linkage” character, reflecting some of the projecters' attempts to achieve a deep binding of shares of listed companies and the value of digital assets through capital markets。

3. DAT Business Model

3.1 & nbsp; & nbsp; business model positioning: an active balance sheet company

DAT ENTERPRISES HAVE A RELATIVELY CLEAR AND REPLICABLE BUSINESS MODEL: IT IS ESSENTIALLY A TYPE OF ACTIVE BUSINESS COMPANY WITH BALANCE SHEET MANAGEMENT AT ITS CORE, RATHER THAN AN ETF OR CLOSED FUND FOR PASSIVE TRACKING OF ASSETS。

UNLIKE TRADITIONAL FIRMS, WHICH RELY ON PRODUCTS AND SERVICES FOR THE CREATION OF OPERATING CASH FLOWS, DAT ' S CORE MOVE IS TO FINANCE THEM THROUGH CAPITAL MARKETS AND TO BUY AND HOLD ENCRYPTED ASSETS ON A LARGE SCALE AND OVER THE MEDIUM AND LONG TERM. AS A RESULT, THE ASSET END-END USUALLY PRESENTS A HIGH PROPORTION OF THE ALLOCATION OF DIGITAL ASSETS SUCH AS BTC, ETH, AND THE LIABILITY-EQUITY END-END CONSISTS MAINLY OF EQUITY FINANCING AND DEBT FINANCING; THE BUSINESS OBJECTIVE IS ALSO MORE REFLECTED IN THE CONTINUED ACCUMULATION OF DIGITAL ASSET SIZES ON THE BALANCE SHEET AND THE ENHANCEMENT OF THE EQUITY-IN-UNIT ASSET CONTENT。

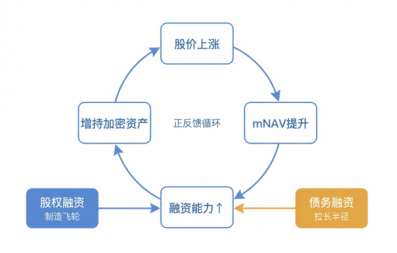

FIGURE 2: DAT COMPANY VALUE ADDED CYCLE CHART (ANTI-FLYING WHEEL CHART)

SOURCE: PKUBA

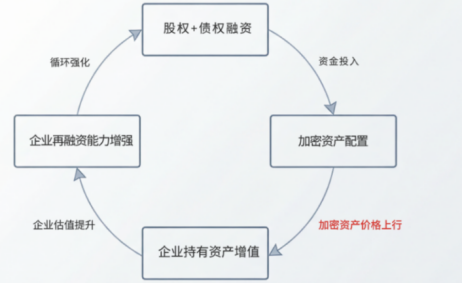

Around this pattern, DAT is often characterized as “Reflexive Flywheel”: financing - purchase currency - appreciation of assets - appreciation of market value - positive feedback on the pro-cyclicality of refinancing. The logical chain can be broken down as follows: the company obtains funds and deploys encrypted assets through equity or debt financing; when currency prices go up, the asset-end value increases drive the market to re-pricing the company ' s valuation; and the stock price increases further strengthen the refinancing capacity, thereby facilitating a new round of expansion。

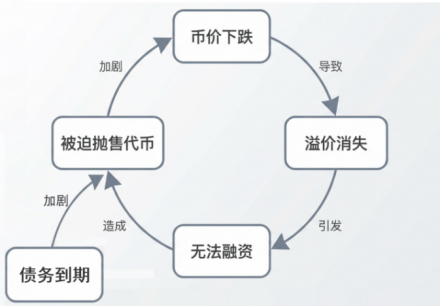

By contrast, DAT may fall into a “Death Spiral” in the next cycle: the decline in currency prices – the disappearance of premiums – the inability to finance – the more negative feedback of lower currency prices, i.e. the decline in base assets (currency prices) leads first to a shrinking company’s balance sheet; the erosion of asset end value leads to the loss of equity premiums and to the loss of valuations, leading to the rapid closure of external financing windows; and the risk of liquidity depletion or default forcing companies to sell their currencies at a low level, thus further pressuring currency prices and exacerbating new contractions。

FIGURE 3: DAT COMPANY DECLINE CYCLE CHART (DEATH HELIX)

SOURCE: PKUBA

THIS POSITIVE AND NEGATIVE TWO-WAY CYCLE ALLOWS THE DAT MODEL TO BE EXTREMELY PROCYCLICAL IN A HIGHLY VOLATILE ENCRYPTION MARKET. THE STABILITY OF ITS FINANCIAL STRUCTURE IS HIGHLY DEPENDENT ON THE PRICE MOVEMENTS OF THE UNDERLYING TOKENS, AND ONCE IT ENTERS THE DOWNWARD ROUTE, COMPANIES THAT LACK EXTERNAL LIQUIDITY ARE VULNERABLE TO BEING CAUGHT UP IN IRREVERSIBLE ASSET SALES AND VALUATIONS。

THUS, THE SPEED OF EXPANSION OF THE DAT SCALE DEPENDS ON THE FINANCING WINDOW, BUT THIS IS INFLUENCED BOTH BY THE ENCODED ASSET CYCLE AND THE ABILITY OF MANAGEMENT TO COMPLETE THE FINANCING AND CONFIGURATION AT A BETTER VALUATION STAGE. THE ABILITY TO MANAGE FORWARD-LOOKING ASSETS AND LIABILITIES, RESERVE CONTINGENCY LIQUIDITY AND DYNAMIC ADJUSTMENT SILOS IS KEY TO DAT ENTERPRISE ' S CYCLICAL CONTINUITY。

3.2 & nbsp; value creation mechanisms: outcome of asset decisions, speed of financing decisions

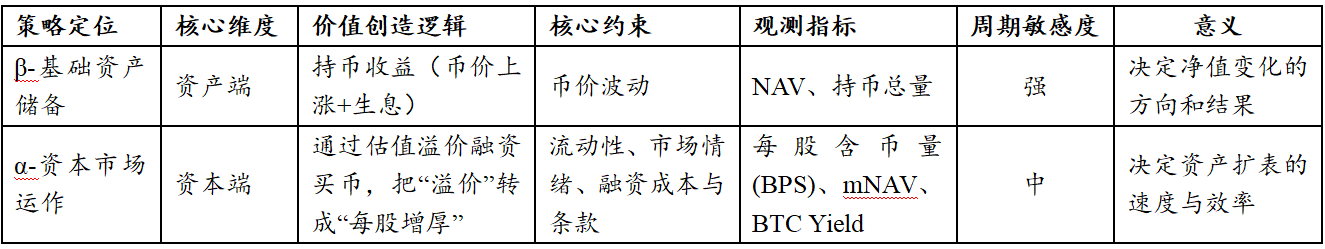

At the institutional level, DAT value creation can be grouped into two main lines: asset end beta determines the direction and outcome of net value changes, capital end alpha determines the speed and efficiency of the asset scale。

l asset end-bate: proceeds from changes in the price of the encrypted asset and pledges (if applicable)

l capital-end alpha: from valuation premiums, more favourable financing and increased efficiency。

On this basis, companies also cooperate with the use of leverage instruments (e.g., reversibility, mortgage financing, etc.) to increase efficiency and liquidity in the use of funds — up-to-date steps to scale up gains, but at the same time to increase sensitivity to the terms of currency withdrawal and refinancing。

TABLE 3: DAT COMPANY VALUE SOURCES AND MECHANISMS FOR DISMANTLING

SOURCE: PKUBA

In summary: beta is more manifested in changes in size of NAV and currency holding; the key to alpha is whether the firm can stabilize valuation advantages into BPS improvements when the mNAV is at a favourable level; and “tool-level” arrangements (debts, mortgages, etc.) more influence implementation elasticity and restraint。

3.3 & nbsp; structural features of the business model: weak profit statement, concentration of assets, ownership of finance, valuation differentiation

Within the framework of the `beta decision results, alpha decision velocity', DAT's business model usually presents four types of structural characteristics, corresponding to evaluation systems, asset structure, financing structure and valuation mechanisms。

First, the evaluation framework shifted from a profit statement to a balance sheet。DAT ' s core business activities do not rely on products or services to generate traditional revenue, but rather manage balance sheets around the holding and expansion of encrypted assets. As a result, indicators such as revenue collection, Māori rates and net profits have limited capacity to interpret the quality of operations; a more interpretive indicator system tends to shift to the number of currencies held and their changes, to the level of the premium (mNAV) per currency (BPS) and relative net assets at market value to measure the effectiveness of the scale and whether the unit equity counterpart assets have achieved a substantial increase。

Second, assets are highly concentrated and net assets are highly sensitive to currency fluctuations。DAT ' S ASSET STRUCTURE IS USUALLY CHARACTERIZED BY HIGH CONCENTRATION, WITH A HIGH SHARE OF ENCRYPTED ASSETS, LEADING TO SIGNIFICANT FLUCTUATIONS IN NET ASSETS IN RESPONSE TO CURRENCY FLUCTUATIONS. CASH IS USED MORE TO ASSUME A LIQUIDITY BUFFER TO COVER INTEREST EXPENDITURE, FINANCE WINDOW PERIODS AND OPERATING SECURITY UNDER EXTREME CONDITIONS. OVERALL RISK-RETURN PERFORMANCE IS THUS MORE “NON-LINEAR”: NET ASSET ELASTICIZATION IN THE TOP-LINE PHASE IS MAGNIFIED; NET ASSET CONTRACTION IN THE BOTTOM-LINE PHASE, VALUATION COMPRESSION AND REDUCED FINANCING CAPACITY ARE OFTEN SYNCHRONIZED。

Thirdly, financing is equity-based, debt-backed, and the structure determines the capacity to carry over time。DAT ' S LIABILITY BASE CONSISTS MAINLY OF EQUITY FINANCING, DEBT FINANCING AND A SMALL NUMBER OF SHORT-TERM BORROWING OR BUY-BACK STRUCTURES. IN PRACTICE, COMPANIES OFTEN MOVE FORWARD WITH THE SCALE AT A MORE FAVOURABLE STAGE OF VALUATION THROUGH SUCH INSTRUMENTS AS ATM, SEO, PIPE, ETC., WITH THE INTRODUCTION OF SECONDARY SOURCES OF FINANCE SUPPORTED BY INSTRUMENTS SUCH AS REVERSIBLE DEBT, PREFERENTIAL EQUITY, PAPER, ETC. TWO TYPES OF FINANCING ARE NOT SIMPLE ALTERNATIVES: EQUITY FINANCE IS MORE DEPENDENT ON VALUATION AND ABSORPTIVE CAPACITY; DEBT FINANCING IS MORE SUBJECT TO CURRENCY RETRENCHMENT AND REFINANCING CONDITIONS, AND THE STRUCTURE OF DIFFERENT PROVISIONS SIGNIFICANTLY ALTERS THE EXPOSURE OF COMPANIES TO FINANCIAL PRESSURES AND RISKS ACROSS CYCLES。

Fourth, valuations are sensitive to expectations and mNAVs under the same asset may still be divided over the long term。DAT share prices not only reflect the value of the assets at the bottom, but also add to the combined expectations of the market regarding its financing capacity, management decisions and the sustainability of the scale. Thus, even if they hold encrypted assets of similar size and structure, the mNAVs of different DATs may be subject to long-term differences; the differences are more due to market sentiment, corporate governance and financing path choices。

IN CONCLUSION, THE RISK-BENEFIT CHARACTERISTICS OF DAT ARE NOT DETERMINED BY A SINGLE FACTOR, BUT ARE OFTEN SHAPED BY A COMBINATION OF “ASSET CONCENTRATION + FINANCING STRUCTURE + MARKET EXPECTATIONS” AND AMPLIFIED OR WEAKENED IN DIFFERENT MARKET ENVIRONMENTS。

3.4 & nbsp; sources of differences in patterns: financing structure x currency attributes

IN TERMS OF BUSINESS MODEL STRUCTURE, DAT DIFFERENCES ARE CONCENTRATED ON TWO DIMENSIONS: FINANCING STRUCTURE AND CORE ASSET SELECTION。

In terms of the financing structure, the dominant DAT in MNAV>1 phase could be achieved by increasing the scale, but the ability to finance may rapidly weaken when valuation falls; the DAT, which has a high share of debt financing, can increase the efficiency of asset expansion through instruments such as reversibility, priority equity, etc., but is more sensitive to currency price reversals and the deterioration of refinancing conditions. In particular, the duration structure, the level of interest rates and the existence of mandatory provisions directly affect their ability to survive in the bear market。

ON THE ASSET END, CURRENCY SELECTION IS ANOTHER KEY VARIABLE DETERMINING THE STABILITY OF THE MODEL. DAT, WITH BTC AS ITS CORE ASSET, RELIES MORE ON SCARCITY AND MARKET CONSENSUS; DAT, WITH ETH OR OTHER PLATFORM TOKENS AS ITS CORE ASSET, ADDS UNCERTAINTIES SUCH AS TECHNICAL ROUTES, ECOLOGICAL COMPETITION AND CHANGES IN RETURN PATTERNS, IN ADDITION TO TAKING RISKS OF PRICE VOLATILITY. DIFFERENCES BETWEEN CURRENCIES IN VOLATILITY, FALLBACK AND NARRATIVE STABILITY CAN BE TRANSMITTED TO SHAREHOLDERS THROUGH BALANCE SHEETS, SIGNIFICANTLY CHANGING THE RISK CURVE。

AS A RESULT, DAT DOES NOT HAVE A UNIFORM “BEST BUSINESS MODEL” AND ITS SUSTAINABILITY DEPENDS MORE ON THE MATCHING OF FINANCING MODALITIES WITH MONETARY ATTRIBUTES; THE MORE RADICAL FINANCE IS, THE HIGHER THE UNCERTAINTY ABOUT CORE ASSETS, THE GREATER THE DEPENDENCE ON THE MARKET ENVIRONMENT. THE LATTER CAN BE DERIVED FROM TWO SEPARATE LINES OF DIFFERENCE BETWEEN THE FINANCING STRUCTURE AND THE CURRENCY。

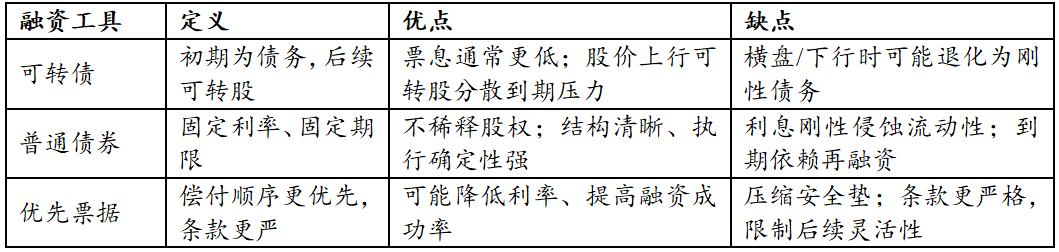

4. DAT Core Financing Structure Differences

BASED ON THE ABOVE-MENTIONED JUDGEMENT ON “FINANCING STRUCTURE TO DETERMINE SCALING-UP EFFICIENCY AND CROSS-CYCLICAL PRESSURES”, THIS SECTION FURTHER DISMANTLES DAT COMMON FINANCING INSTRUMENTS AND COMPARES THEIR APPLICABILITY AND CONDITIONALITY AT DIFFERENT MARKET STAGES。

4.1 & nbsp; equity financing: core driver of DAT

Of the main financing modalities, equity finance is the most strategic for DAT: under certain valuation conditions, equity finance not only does not necessarily dilute the value of the equity unit, but may increase the number of encrypted assets per share. It is established on the assumption that the company ' s share price is higher than the underlying net asset value, i.e. mNAV>1. At this point, the company issues new shares, which can be configured at the end of the asset in a relatively “discounted” manner, creating structural conditions “for the size of the asset in return for valuation advantage” and constituting the core source of positive feedback for the flyer。

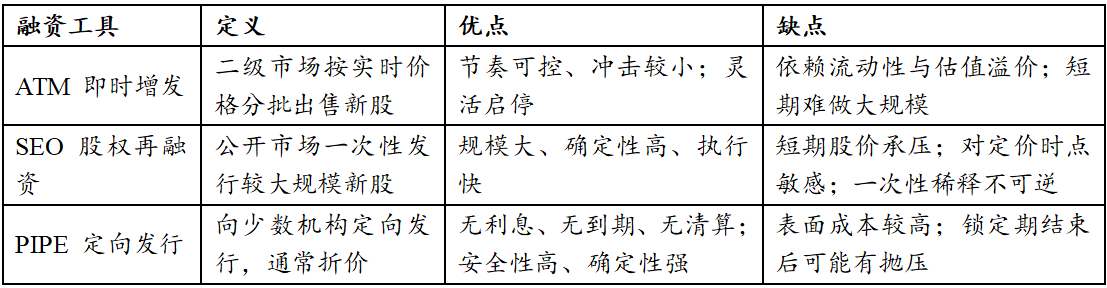

At the tool level, depending on the mode of financing, three approaches can be divided into ATM (At-the-Market Offering, Immediate Growth), SEO (Seasoned Equity Offering, Equity Refinancing), PIPE (Private Investment in Public Equity, Targeted Distribution)。

Table 4: Comparison of three major equity financing instruments

Source: Paramita Venture [3]

ATM (IMMEDIATELY INCREASED) IS CONSIDERED THE MOST DESIRABLE EQUITY FINANCING INSTRUMENT. THE ADVANTAGE LIES NOT IN THE SIZE OF THE FINANCING, BUT IN THE HIGHLY FRAGMENTED PACE OF FINANCING, WHICH CAN ADVANCE IN PARALLEL WITH THE MOVEMENT OF SECONDARY MARKETS. DAT CAN TRANSFORM STOCK PRICE INCREASES THEMSELVES INTO BUY-IN BTC / ETH WITHOUT SIGNIFICANT DISTURBANCE OF STOCK PRICES BY COMPLETING THE BUILD-UP IN THE OPEN MARKET IN A CONTINUOUS, DECENTRALIZED MANNER. HOWEVER, THIS MODEL IS EXTREMELY DEMANDING FOR THE MARKET ENVIRONMENT AND THE FEASIBILITY OF ATM WILL QUICKLY DISAPPEAR AS TRANSACTION LIQUIDITY DECLINES OR VALUATION PREMIUMS CONTRACT。

SEO (EQUITY REFINANCING) IS MORE PHASED. BY COMPLETING LARGER-SCALE FINANCING ON A ONE-TIME BASIS, DAT CAN SIGNIFICANTLY EXPAND THE BTC / ETH HOLDOUT IN A SHORT PERIOD OF TIME, BUT AT THE COST OF SHORT-TERM STOCK PRICE CONTAINMENT AND HIGH RELIANCE ON ISSUANCE POINT JUDGEMENT. IF THE MARKET MOVES FAST AFTER DISTRIBUTION, THE OPPORTUNITY COSTS FOR SEOS WILL BE MAGNIFIED。

PIPE (DIRECTED ISSUANCE) IS MOSTLY A DISCOUNT ISSUE AND, DESPITE APPARENT INCREASES IN FINANCING COSTS, IS ONE OF THE MOST ROBUST SOURCES OF FUNDING FOR DAT IN TERMS OF BALANCE SHEET SECURITY. AS THERE IS NO INTEREST BURDEN, MATURITY PRESSURE OR CLEARING MECHANISM, PIPE TRANSFERS THE FULL UNCERTAINTY TO EQUITY INVESTORS, ENABLING DAT TO MAINTAIN SUFFICIENT TIME OPTIONS IN A VOLATILE ENVIRONMENT. DAT, WHICH USES PIPE FINANCE, IS USUALLY NOT SUBJECT TO PASSIVE DELEVERAGING DUE TO MARKET FLUCTUATIONS. THIS IS ALSO WHY PIPE IS OFTEN A REALISTIC OPTION FOR DAT AT A TIME WHEN VALUATION IS NOT STABLE AND THE MARKET ENVIRONMENT IS UNCERTAIN。

4.2 & nbsp; debt financing: second tier funding and time dimension constraints

Debt financing, in contrast to equity financing, usually does not directly provide positive feedback, but can be significantly scaled up at a particular stage, thereby increasing the efficiency of asset expansion, and can be considered a “second tier of funding”。

AMONG THEM, DEBT CONVERTIBILITY IS WIDELY USED IN DAT FINANCING STRUCTURES, WITH THE ADVANTAGE OF COMBINING DEBT CERTAINTY AND EQUITY ELASTICITY. WHEN EQUITY PRICES PERFORM WELL, DEBT SWAPS CAN ABSORB DEBT SERVICE PRESSURES THROUGH SWAPS; WHEN MARKETS DO NOT PERFORM WELL, INTEREST COSTS ARE USUALLY LOWER THAN ORDINARY DEBT, PROVIDING SOME BUFFER SPACE FOR DAT. HOWEVER, IF THE ENCRUCIATING ASSETS ARE HELD ACROSS THE BOARD FOR A LONG TIME AND STOCK PRICES REMAIN UNATTRACTIVE TO THE TERMS OF THE TRANSFER, THE REVERSIBLE DEBT WILL ULTIMATELY REMAIN A RIGID DEBT SERVICE PRESSURE。

In addition, heavy reliance on debt-transferable finance can trigger a further “down spiral” led by arbitrage agencies - – That is to say, agencies hedge bond risks by making empty stocks – and when stock prices fall, they mechanically increase their effort to maintain hedge ratios, thereby accelerating the collapse of stock prices and closing down financing windows. This mechanism, embedded in the capital structure, would have the effect of passively magnifying the drop in the next cycle of DATRO, deepening the “death spiral” and leading to financing capacity ahead of asset values. [4]

Note: The reference to a “falling spiral” is not equivalent to a “death spiral” that has been reversed by a “backward wheel”, but it will serve as an accelerator, further deepening the “death spiral” and accelerating its collapse。

RISKS FOR DEBT INSTRUMENTS SUCH AS GENERAL BONDS AND PREFERENTIAL INSTRUMENTS DO NOT ARISE FROM SHORT-TERM PRICE FLUCTUATIONS, BUT MORE FROM TIME DIMENSIONS. UNLIKE CHAIN LEVERAGE, DAT CREDITORS OFTEN DO NOT HAVE THE POWER TO DEAL DIRECTLY WITH BTC/ETH, WHICH MEANS THAT THE COMPANY WILL NOT BE IMMEDIATELY EVEN BY FALLING CURRENCY PRICES. THE REAL RISK LIES IN THE STRUCTURAL PRESSURES OF ACCUMULATION OF INTEREST EXPENDITURE, MATURITY OF DEBT CONCENTRATION AND DETERIORATING REFINANCING CONDITIONS。

Table 5: Comparison of Debt Financing Instruments

SOURCE: PKUBA

4.3 & nbsp; equity + debt co-operation: flying wheels formation and survival boundary

Ideally, DAT does not rely on a single tool, but rather builds and strengthens positive feedback through a phased alignment of equity and debt: The increase in equity prices led to an increase in mNAV and increased financing capacity; the proceeds were used to increase BTC/ETH and to further increase flexibility against currency prices, which were eventually reflected in the re-entry of stock prices。

IN THIS PROCESS, EQUITY FINANCING IS RESPONSIBLE FOR “MANUFACTURING FLYING WHEELS” AND DEBT FINANCING IS RESPONSIBLE FOR “EXTENSION OF FLYING WHEEL RADIUS”. THE FORMER DETERMINES WHETHER DAT HAS A STRUCTURAL ADVANTAGE, WHILE THE LATTER DETERMINES WHETHER IT WILL LAST LONG ENOUGH UNTIL THE SHIP IS FULLY ESTABLISHED AND WHETHER IT WILL EXPAND ITS SIZE。

FIGURE 4: DAT SHIP FORMATION

SOURCE: PKUBA

FROM THE POINT OF VIEW OF RISK-BENEFIT-COST, THE DIFFERENCES BETWEEN DIFFERENT FINANCING MODALITIES ARE NOT GOOD OR BAD, BUT RATHER THEIR IMPACT ON THE BOUNDARIES OF EXISTENCE. DAT FOR PIPE FINANCING IS NOT VULNERABLE TO FAILURE DUE TO STRUCTURAL PROBLEMS BECAUSE OF ITS CLEAR COST AND THE ABSENCE OF A MANDATORY EXIT MECHANISM; DAT FOR DEBT FINANCING USUALLY DOES NOT GO OUT IMMEDIATELY BECAUSE CREDITORS LACK THE AUTHORITY TO DISPOSE OF CORE ASSETS. WHAT REALLY REQUIRES VIGILANCE IS THE INTRODUCTION OF SHORT-TERM FINANCING STRUCTURES WITH LIQUIDATION OR PARITY CLAUSES, WHICH CAN DIRECTLY UNDERMINE DAT'S CONTROL OVER TIME。

IN GENERAL, DAT ' S FINANCING STRUCTURE DOES NOT SIMPLY PURSUE HIGH LEVERAGE OR ELASTICITY, BUT IS STRUCTURED AROUND A CORE OBJECTIVE: IN A HIGHLY VOLATILE ENCRYPTION MARKET, WHERE POSSIBLE, THE HOLDING OF CORE ENCRYPTION ASSETS IS EXTENDED THROUGH A REASONABLE CAPITAL STRUCTURE DESIGN AND THEIR POTENTIAL FOR RETURN IS AMPLIFIED WITHIN THE APPROPRIATE PERIODIC WINDOW。

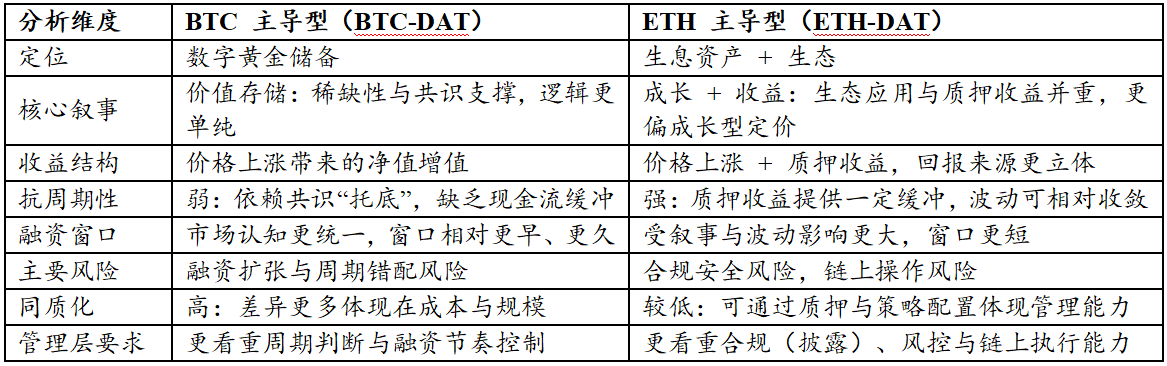

5. & nbsp; currency analysis: how core assets are reshaping DAT ' s source of proceeds and resistance

In the framework of the “financing structure x currency attributes”, the choice of assets is far from simple bets who will increase more. It actually determines three things at the same time: the pattern of fluctuations in the net asset end value, the ease and cost of access to finance for companies, and the tolerance of the market to the company ' s valuation premium. Thus, when the focus of the market is shifted from mere “whether or not to hold the currency” to “how to cross the cycle”, the currency configuration becomes the key variable determining the success or failure of the strategy。

THE CURRENCY OF THE CURRENT MAINSTREAM DAT INSTITUTION WITH ENCRYPTED ASSETS IS SHOWN IN FIGURE 1: BITCOIN ACCOUNTS FOR ABOUT 80 PER CENT OF THE TOTAL, TOKYO 15 PER CENT AND THE REST ABOUT 5 PER CENT. THIS CONCENTRATION OF HEADS REFLECTS THE FACT THAT INSTITUTIONAL FUNDS ARE STILL HIGHLY PROFICIENT FOR THE INTERPRETABILITY AND LIQUIDITY OF ASSETS. ON THIS BASIS, THIS SECTION DIVIDES THE EVOLUTION PATH OF DAT INTO BTC AND "ETH" MODE. THE TYPICAL CASE OF SMALL CURRENCY “CURRENCY EQUITY INTERCONNECTION” WILL BE FURTHER EXPLORED AFTER THE OPERATIONAL LOGIC OF THE TWO CORE ASSETS HAS BEEN DEEPENED。

TABLE 6: COMPARISON OF BTC LEADING AND ETH LEADING DAT ENTERPRISE CHARACTERISTICS

SOURCE: PKUBA

5.1 & nbsp; Bitcoin (BTC): consensus advantage in exchange for a more resilient financing window

The core logic of the BTC-type DAT is its extremely low cost of interpretation. The market tends to define BTC as a digital gold reserve. Even if the company itself lacks operating cash flows, investors can easily establish a clear pricing model through the size of the currency holding, the rate of increase and the amount of money per share. This strong consensus has created two main financing advantages for companies:

:: The asset-end pricing framework is clear, resulting in a long window dividend for the upper cycle: THE MARKET RECEIVED THE HIGHEST ACCEPTANCE OF BTC RESERVES IN THE EARLY DAYS OF THE CATTLE MARKET DUE TO CLEAR ASSET ATTRIBUTES. THIS ALLOWS COMPANIES TO OBTAIN VALUATION PREMIUMS MORE QUICKLY, THUS SECURING ADEQUATE TIME WINDOWS AND OPERATING SPACE FOR SUBSEQUENT REFINANCING (E.G., ADDITIONAL OR REVERSIBLE)。

• Low level of asset-end uncertainty, so that discounts in the next cycle are manageable:& nbsp; When the market retreats, although the premium will be reduced, the investor's assessment logic, based on the location of the BTC mainstream asset, will remain within the “net value-pricing-financing capacity” framework without easily questioning the zero risk of the asset itself. This clear valuation anchor effectively avoids the collapse of narratives。

Figure 5: Bitcointreasures Global Top100 BTC Treasury listed company statistics

Source: Bitcointreasures, as of 2 January 2026

However, BTC-type DAT is not a natural safe haven, and its "high beta" properties also pose hidden structural risks:

First, the lack of primary income pathways is extremely sensitive to the pace of financing: DUE TO BTC'S LACK OF ORIGINAL PLEDGE-PROCEED MECHANISMS, TREASURY PERFORMANCE IS ENTIRELY DEPENDENT ON CURRENCY PRICE INCREASES AND FALLS. THIS HAS RESULTED IN ENTERPRISES LOSING THE MEANS OF SMOOTHING THEIR CYCLES AND IN EXTREMELY DEMANDING CONTROLS OVER “FINANCING-BUY-IN” TIMES. ONCE THE HIGH LEVEL OF FINANCING IS MATCHED TO THE HIGH LEVEL OF ASSETS, AND THEN CURRENCY PRICES FALL, THE ENTERPRISE WILL FACE A SERIOUS TIME MISMATCH RISK — THE DIFFERENCE BETWEEN INTEREST ON RIGID DEBT AND THE SHRINKING OF ASSETS。

Second, homogenizing competition reduces premium capacity: When most DAT companies adopt a single strategy of “tunnel currency”, business models inevitably fall into homogeneity. It is difficult for the market to give a higher management premium to a particular company, and stock prices may end up being the shadow ETF of the BTC. This places higher demands on management: how to create Alpha through “financial techniques” in a homogenous competition through precise macrotimes or innovative financing architecture designs。

IN SUMMARY, WHILE THE BTC PROVIDES A STABLE NARRATIVE, IT IS EXTREMELY VULNERABLE TO PASSIVE CONTRACTION IF THE COMPANY SUFFERS FROM A LACK OF INTEREST-BEARING BUFFERS AND MISCALCULATION OVER THE FINANCING CYCLE, ONCE THE DECLINE IN VALUATION TRIGGERS THE DEPLETION OF FINANCE。

5.2. & nbsp; ETH: superseding ecological and profit variables with higher requirements for transparency

UNLIKE BTC'S PURE RESERVE PROPERTIES, ETH HAS THE DUAL ATTRIBUTES OF “INTEREST-BEARING MECHANISMS + ECOLOGICAL GOVERNANCE”. THIS MEANS THAT ETH-TYPE DAT FACES MORE COMPLEX PRICING MODELS — MARKETS NOT ONLY FOCUS ON PRICE TRENDS, BUT ALSO INCORPORATE WEB-BASED ECOLOGICAL PROSPERITY, TECHNOLOGICAL UPGRADING ROUTES AND CHAIN RATES OF RETURN INTO VALUATION CONSIDERATIONS。

This complexity has provided the DAT strategy with a tool for smoothing the cycle and opportunities for inter-firm differentiation. The company may use part of ETH for pledge or participation chain DeFi to produce a stable holding period return. This allows the Treasury narrative to be upgraded from a single currency to a “manageable portfolio of interest-bearing assets” that provides a certain buffer of cash flows in Bear City. Further, this model gives companies the space to “actively manage” — the allocation of pledge ratios, the layout of nodes validation and the design of liquidity release mechanisms, all of which can be key indicators for horizontal comparisons。

Figure 6: Strategicethreserve Global Top100 ETH Treasury Listing Company Statistics

Source: Strategicethereserve, as of 2 January 2026

BUT THE OTHER SIDE OF THE PROCEEDS IS THE EXTREME DEMAND FOR WIND CONTROL AND TRANSPARENCY: GIVEN THAT ETH'S PLEDGE MECHANISM MAY TOUCH THE SENSITIVE NERVES OF SECURITIES REGULATION (E.G. US SEC) AND CHAIN INTERACTION INVOLVES COMPLEX AUDITING ISSUES. IF THE COMPANY IS UNABLE TO DISCLOSE THE ORIGIN OF THE PROCEEDS CLEARLY OR TO PROVE THE INDEPENDENCE OF THE ASSET CUSTODIAN, THE MARKET WILL HAVE DIFFICULTY IN PROVIDING FAIR PRICES, WITH A SERIOUS VALUATION DISCOUNT. ONLY THROUGH THE COMPLETION OF HIGH-TRANSPARENT AUDITS CAN INVESTORS BE REASSURED ABOUT COMPLIANCE。

FINALLY, THE VOLATILITY OF ETH IS MORE PRONOUNCED THAN THE BTC'S STRONG PERIODICITY, RESULTING IN A “SIMPLE BUT FAST” FINANCE WINDOW. THE WINDOWS ARE OFTEN OPENED AND CLOSED QUICKLY, AND THE ABILITY TO FINANCE AND CONFIGURE IN A SHORT PERIOD OF TIME WILL DIRECTLY SHAPE THE BALANCE SHEET PATTERN FOR SUBSEQUENT QUARTERS. IN OTHER WORDS, THE ETH TREASURY IS A “WINDOW-OF-OPPORTUNITY” STRATEGY: WHEN IMPLEMENTATION AND GOVERNANCE CAPACITY ARE NOT IN PLACE, ITS COMPLEXITY IN TURN INCREASES UNCERTAINTY。

5.3 & nbsp; "currency equity association" model in small currencies: asset mapping and liquidity transfer under the SPAC channel

IN ADDITION TO MAINSTREAM ASSETS, SMALL MARKET-MARKET CURRENCIES ARE EXPLORING A MORE RADICAL “CURRENCY EQUITY LINKAGE” PATH. UNLIKE TRADITIONAL BUSINESS SUPPORT STOCK PRICES, THE MODEL USES SPAC (SPECIAL PURPOSE ACQUISITION CORPORATION) AS A PUBLICLY AVAILABLE VEHICLE, COMBINING FINANCING INSTRUMENTS SUCH AS PIPE, ATM AND SO FORTH, TO CREATE A TRANSMISSION MECHANISM LINKING UNITED STATES SHARE LIQUIDITY TO CHAIN ASSETS。

In short, it's not like it's happeningThis is not simply a “shell listing”, but rather a “buy-a-pledge” plan with chain tokens to seal up as tradable NASDAQ equity assets, thus placing the project party's assets in a deep tie to secondary market funds。

5.3.1. core mechanism: liquidity transfer after shell listing

On the face of it, this is a “shell listing” for the projecter, but from a substantive analysis of operations: it is a liquidity transfer centred on capital operations — so that the stock market can quickly and directly channel its funds to the currency market. The operation consists of two key elements:

l SPC to provide compliance access: use shell companies to address the main compliance issues and access layers of dollar liquidity

l Financing instruments provide additional funds: through tools such as PIPE (private equity investment), debt transferable or ATM (market price issuance), ensure that listed companies have sustained access to low-cost finance and create a continuous buyout of chain coins。

UNDER THIS STRUCTURE, THE PRICING LOGIC OF STOCK PRICES HAS CHANGED: THE MARKET NO LONGER ANCHORS MARKET MARGINS (P/E), BUT FOCUSES INSTEAD ON NET CURRENCY ASSETS (NAV) AND REFINANCING CAPACITY. STOCK PRICES HAVE IN FACT BECOME A LEVERAGE MAP OF TOKEN PRICES。

5.3.2. typical path analysis: static treasury and dynamic marketing

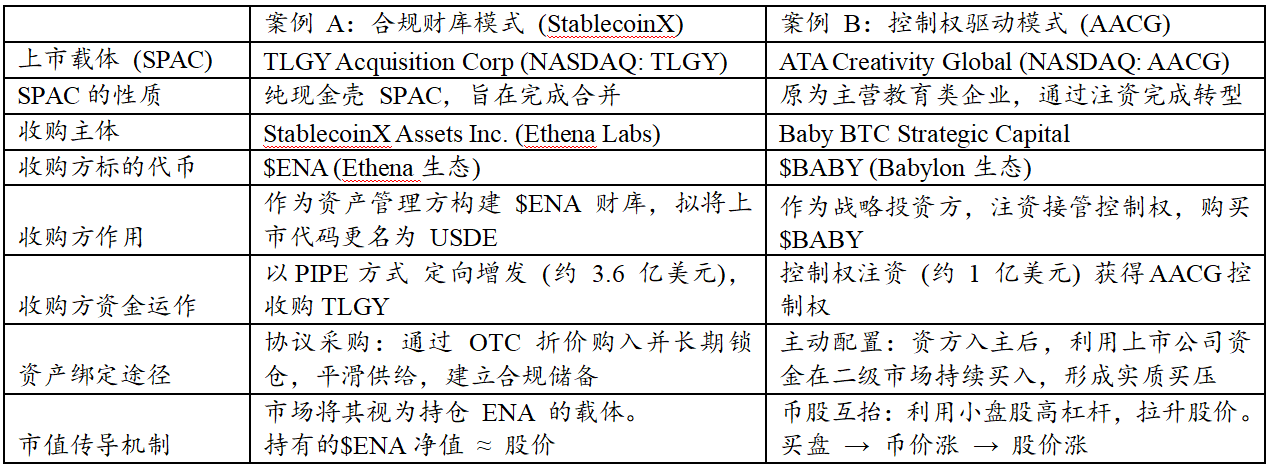

Depending on the extent of project participants ' involvement in listed companies and their operational objectives, the association model for small currencies presents two different paths: one is a compliance treasury model, focusing on asset holding, and the other is a control-driven model, focusing on capital games and subjective marketing。

As analysed in the table below, StablecoinX (TLGY) adopted a structured asset mapping model. The essence of this is to build a high-transparent treasury in NASDAQ. Funds are purchased and locked in coins, mainly through off-site discounts, thus avoiding direct shocks to secondary markets. Under this model, stock price fluctuations are relatively smooth and mainly reflect the true net value of the assets targeted (NAV). The aim of the project is to use United States equity compliance to provide a low-threshold channel for traditional institutional funds to deploy encrypted core assets to facilitate auditability and supply lock-in。

Table 7: Comparison of typical paths of small currency denominated dividends

SOURCE: PKUBA

The case of AACG (Baby) represents the marketing of proactively managed capital, that is, capital-driven liquidity management. External capital quickly converts book money into the purchasing power of currency by investing in the control of listed companies. Owing to the small turnover of small currencies, the concentration of purchases by listed companies can significantly improve the supply of and demand for coins, which in turn can drive stock revaluation through higher currency prices. This is a more radical strategy that seeks to use the liquidity premium in the capital market to reverse the chain of assets。

Both models, although different paths, are essentially securitization of asset allocation using the listed route. But that logic is not impeccable. The key risk of small-currency equity linkages lies in whether the positive cycle of assets and finance is closed. If listed companies are reduced to one-way buying machines, the high premium will collapse quickly if the secondary market finance window is closed or currency prices are sharply reversed。

The most robust end, therefore, should be for listed companies not only as buyers of tokens but also as ecological builders. Only through governance structures that bind corporate strategies to ecological long-term values can stock prices be transformed from simple speculative leverage to compliance shadow indicators of ecological prosperity。

6. DAT risk analysis

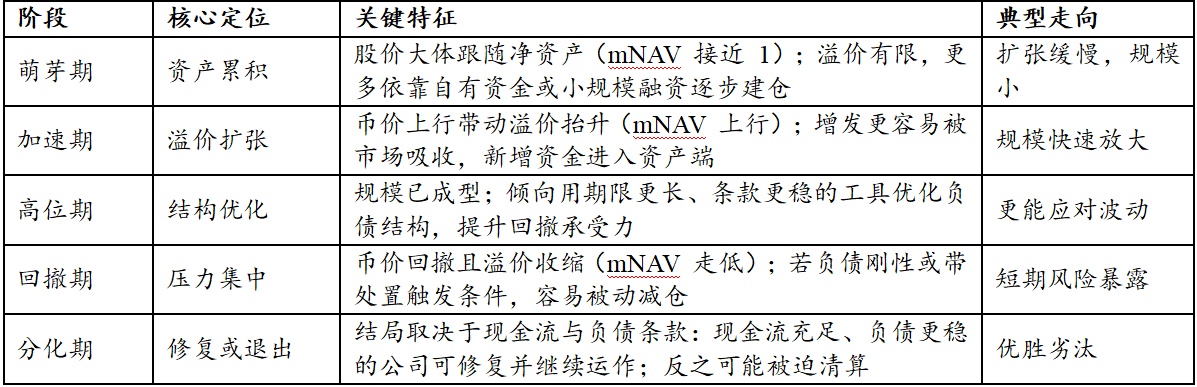

6.1 & nbsp; DAT cycle phase and split path

DAT OPERATIONS ARE NOT STATIC MODELS, BUT ARE INFLUENCED BY TWO MAJOR FACTORS: (I) PERIODIC FLUCTUATIONS IN THE PRICE OF ENCRYPTED ASSETS, AND (II) THE LEVEL OF THE PREMIUM ON SECONDARY MARKETS FOR CURRENCY HOLDERS. THEREFORE, THE DETERMINATION OF WHETHER A DAT COMPANY IS SUSTAINABLE IS NOT THE FOCUS ON WHETHER IT IS HOLDING A CURRENCY, BUT ON WHAT STAGE OF ITS LIFE CYCLE IT IS AT AND WHETHER THE BALANCE SHEET LEAVES ENOUGH ROOM FOR SAFETY FOR THE NEXT STAGE

THE TABLE BELOW SHOWS THE FULL LIFE CYCLE CHANGES OF DAT. FROM A LIFE-CYCLE PERSPECTIVE, THE KEY TO SUCCESS OR FAILURE IS OFTEN NOT THE ABILITY TO EXPAND IN A PRO-CYCLICAL FASHION, BUT RATHER THE RESULT OF FRAGMENTATION DOWN THE LINE: IN A PRO-CYCLICAL CYCLE, PREMIUM FINANCING IS EASIER TO OPEN, AND DAT COMPANIES CAN GENERALLY USE MARKET ABSORPTIVE CAPACITY TO COMPLETE THE SCALE; BUT ONCE BACKSLIDING, CURRENCY PRICES TEND TO CONTRACT IN PARALLEL WITH PREMIUMS, AND FINANCING WINDOWS NARROW OR EVEN CLOSE. AT THIS POINT, ONLY COMPANIES WITH A MORE STABLE DEBT STRUCTURE AND LOWER SHORT-TERM RIGID DEBT SERVICE PRESSURES ARE MORE LIKELY TO RESIST VOLATILITY AND REMAIN VIABLE; CONVERSELY, COMPANIES WITH A MORE FRAGILE FINANCIAL CHAIN AND TRIGGER CONDITIONS FOR DISPOSAL MAY BE FORCED TO REDUCE THEIR SUSPENSE BETWEEN UNFAVOURABLE PRICE ZONES TO MEET DEBT SERVICE OR TERM REQUIREMENTS, THEREBY INCREASING CYCLE VOLATILITY TO LIQUIDATION RISK。

TABLE 8: COMPARISON OF DAT CYCLE STAGES

SOURCE: PKUBA

6.2 & nbsp; financing structural risk: the boundaries between equity and debt

THE FINANCING STRUCTURE DETERMINES DAT ' S SPEED OF EXPANSION AND CAPACITY TO CONTAIN PRESSURES IN DIFFERENT MARKET SETTINGS. SOUND FINANCING ARCHITECTURE DESIGN IS, TO A LARGE EXTENT, KEY TO DAT RESPONDING TO DOWNWARD PRESSURE ON MARKETS. IN THE UPPER STAGES, THE EQUITY PREMIUM IS EASIER TO OPEN UP TO THE GROWTH WINDOW, AND THE ADDITIONAL FUNDS CAN MOVE TO THE ASSET END AT LOWER COST, THEREBY ACCELERATING EXPANSION; BUT ONCE THE PREMIUM FALLS, THE EFFICIENCY GAINS WILL DECLINE SIGNIFICANTLY AND THE EXTERNAL FINANCING WILL CONTRACT, THE EXPANSION WILL HAVE TO SLOW DOWN。

The core risk of equity financing is therefore that premiums are unsustainable. As compliance channels such as ETF become more sophisticated, investor tolerance of DAT premiums is more dependent on information disclosure, governance and discipline, rather than just on the scarcity of channels; when mNAV returns to the vicinity of 1 or even converts to discounts, continued growth tends to lead to greater dilute pressure。

The risk of debt financing is mainly reflected in the accumulation of interest burdens and maturities. While increased leverage can magnify gains when available in the market, in long-term adjustments, shifting refinancing conditions may force companies to sell encrypted assets in exchange for debt-servicing funds, turning book fluctuations into real savings. In addition, where debt financing consists of liquidation or mandatory silo arrangements, or is dominated by short-term, more rigid structures, it is easier to trigger passive disposal in the next row, thereby magnifying liquidity pressures and price shocks。

It is worth noting that, in the next cycle, enterprises over-dependent on “debt-transferable financing” are vulnerable to arbitrage, creating an additional push on equity prices. The mechanism is that arbitrage agencies usually use a “buy-and-pay-out” strategy to hedge. When equity prices fall, arbitrage agencies tend to be passive in scaling up to maintain established hedge ratios. This mechanical dumping magnifies short-term downward pressure, accelerates the decline in stock prices and triggers a “down spiral” of feedback。

THUS, WHEN DESIGNING FINANCING STRUCTURES, DAT COMPANIES MUST FIND A DYNAMIC BALANCE BETWEEN EQUITY AND DEBT AND AVOID THE RISK OF EXPANSION STAGNATING OR CHAIN REACTION DUE TO EXCESSIVE RELIANCE ON SINGLE FINANCING。

6.3 & nbsp; Currency portfolio risk: macro-sensitivity of BTC and configuration paradox of ETH

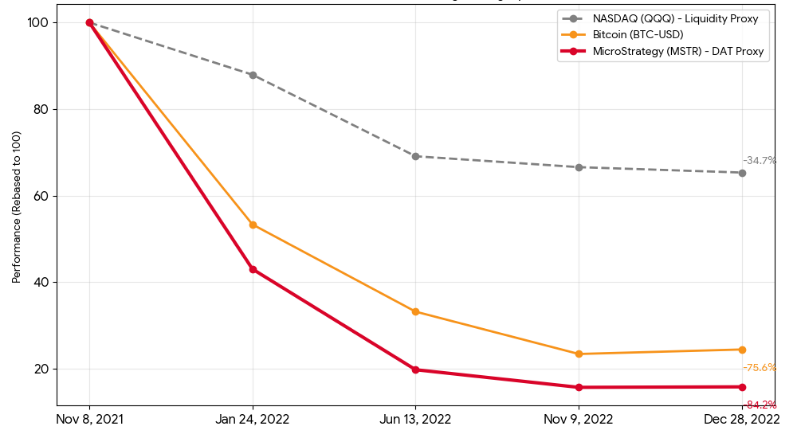

AS A CORE ASSET ON THE CURRENT DAT CORPORATE BALANCE SHEET, BITCOIN HAS LONG BEEN DETACHED FROM ITS EARLY INDEPENDENCE AND HAS SHOWN A HIGH DEGREE OF RELEVANCE TO THE FED’S LIQUIDITY POLICY, AS SHOWN IN THE FIGURE BELOW, WHICH SHOWS A CORRELATION BETWEEN MSTR AND BTC PRICES, WHICH ARE SUBJECT TO CYCLICAL CHANGES IN LIQUIDITY。

FIGURE 7: PERFORMANCE OF BTC AND HOLDING COMPANIES IN THE FED ' S AUSTERITY CYCLE (2021/11-2022/12)

Source: Yahoo Finance Historical Data

THIS CORRELATION IS A DOUBLE-EDGED SWORD FOR THE BTC-DAT ENTERPRISE, WHICH IS HOLDING A WAREHOUSE FOR HIGH CONCENTRATIONS. IT IS AN ACCELERATOR OF ASSET VALUE ADDITION IN THE EASING CYCLE; BUT IN THE TIGHT LIQUIDITY CYCLE, ENTERPRISES WILL FACE A MORE SEVERE DAVIS DOUBLE-KILLING EFFECT. WHEN A DROP IN A BITCOIN PRICE RESULTS IN A SHRINKING NET ASSET VALUE, THE MARKET ' S TOLERANCE OF A FIRM ' S PREMIUM WILL DECLINE SIMULTANEOUSLY, LEADING TO A STOCK PRICE DECLINE THAT IS OFTEN MUCH HIGHER THAN THAT OF THE BITCOIN ITSELF. EVEN MORE PROBLEMATIC IS THE FACT THAT THE ORIGINAL BITCOIN IS A ZERO-INTEREST ASSET AND DOES NOT GENERATE AN OPERATING CASH FLOW. THIS MEANS THAT, DURING THE PERIOD OF THE DEBT, THE ENTERPRISE CANNOT RELY ON ASSET-END EARNINGS TO COVER INTEREST EXPENDITURE ON THE LIABILITY, AND THE ABSENCE OF SUCH CASH FLOWS SIGNIFICANTLY REDUCES THE RISK RESILIENCE OF THE ENTERPRISE IN THE NEXT CYCLE。

In contrast, the primary challenge facing ETA has long been to focus on regulatory characterization. Until the end of July 2025, with a substantial change of attitude at the United States regulatory level, the SEC Chairman, Paul Atkins, informally confirmed that the Ether Workshop was not part of the securities category, and that legal sword, which had long been hanging over the head of the institution, was lifted. But its logic as a reserve asset remains ambivalent:

· & nbsp; bitcoin is a scarce digital gold in terms of asset attributes, and the taifeng is more like a highly volatile, growing technology asset. but there is an inherent contradiction in the logic of the value of the taifeng: as technology upgrades and network efficiency increases, consumption in the taifeng is likely to decline, and the deflationary effects of this technological advance weaken price support。

· & nbsp; the more central contradiction lies in the pledge dilemma: if the pledge is not made, the utco will be fully suppressed by the risk-benefit ratio of the evacuees holding zero gains; if they take part in the pledge to capture 3-4 per cent of the proceeds, they will face liquidity locking, nodes forfeiture and complex tax compliance challenges. This retreat has made it difficult at this stage to replace Bitcoin as a ballast for DAT。

6.4 & nbsp; core assessment indicator: quantified financial health and expansion potential

TO CAPTURE THE REAL VALUE CREATION CAPABILITIES AND RISK THRESHOLDS OF DAT COMPANIES, THERE IS A NEED TO ESTABLISH AN ASSESSMENT SYSTEM THAT GOES BEYOND TRADITIONAL FINANCIAL REPORTING, FOCUSING ON THREE CORE DIMENSIONS:

First, market value to net assets ratio (mNAV): barometer of financing efficiency。 mNAV is not only a valuation indicator, but also a precursor to the opening of the financing window. When the mNAV is significantly greater than 1, it is clear that the market provides a sufficient premium and that companies can achieve a positive capital cycle of “pricing-for-assets” by raising funds efficiently through ATM (market price issuance) or by increasing them and increasing assets at a cost below the market's implied value. Conversely, if mNAV is in a long-term state of discount, meaning that external low-cost financing channels are closed, the business model will lose the momentum for expansion and even risk a shrinking stock。

Second, bitcoin content per share (BPS, BTC per Share):REAL SCALE OF SHAREHOLDER VALUE. THIS IS THE ULTIMATE CRITERION FOR DETERMINING WHETHER THE DAT MODEL IS EFFECTIVE AFTER REMOVING THE DILUTED IMPACT OF EQUITY. UNLIKE THE GROWTH OF A MERE TOTAL HOLDING SCALE (AUM), THIS INDICATOR REFLECTS WHETHER MANAGEMENT ' S CAPITAL OPERATIONS ACTUALLY CREATE INCREMENTAL VALUE FOR SHAREHOLDERS. A HEALTHY DAT MODEL MUST ENSURE THAT THE COMPOUND ACCELERATION OF THE BITCOIN WAREHOUSE CONTINUES TO WIN THE EXPANSION OF EQUITY. THE “GROWTH-FOR-GROWTH” MODEL ESSENTIALLY DESTROYS SHAREHOLDER VALUES IF THE PURCHASE OF THE MONEY RESULTS IN A REDUCTION IN THE AMOUNT OF THE CURRENCY PER SHARE。

Thirdly, the ratio of unencumbered debt to interest coverage: the bottom line of viability。 In a highly volatile environment of encrypted assets, the security of the balance sheet depends on the severity of the liability. The highly viable DAT financial structure should strictly restrict asset mortgages with compulsory flatlines (Margin Call) to rely primarily on uncollateralized convertible Notes or long-term credit debts. As long as the cash flow of the company's main business is sufficient to cover interest expenditure and the debt clause does not include an early repayment trigger mechanism for falling currency prices, the company will be able to maintain its “time-for-space” initiative during the asset-price recovery cycle and avoid being forced to fall before dawn due to the depletion of liquidity。

7. analysis of typical risk management cases

7.1 & nbsp; Strategy: cyclical pressure on equity arbitrage and long-term debt wall

The business model of Strategy is essentially based on the establishment of a cross-market capital arbitrage mechanism, which operates using the price differential between the inefficiencies of the French-currency bond market and the high volatility of digital assets. Its core strategy is to use long-term mortgage-free swaps to lock down very low financial costs during a stable market period and to safely pass the down-cycle on the terms of exemption from forced silos; and to use high-priced ATM (market-issued) stock additions to purchase bitcoin to increase the currency content and enhance financing capacity。

While this bonding mechanism has helped companies to successfully cross the previous cycle, it has essentially shifted market risk to two key variables: “prime-rate sustainability” and “future debt payment”。

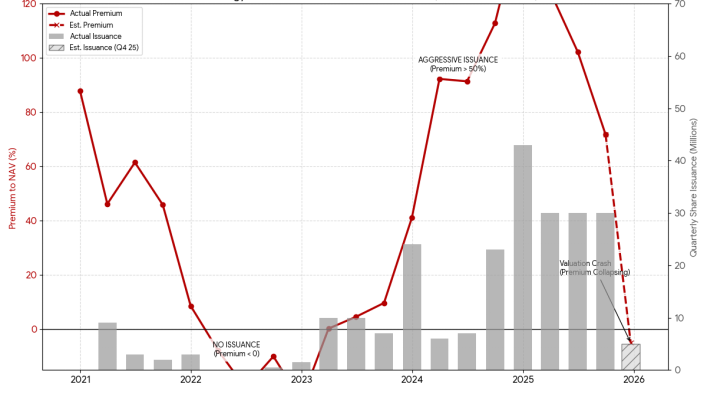

7.1.1. constraints on financing windows due to premium fluctuations

The management ' s capital operations are highly disciplined, and their growth tempo is clearly and positively correlated with the premium to NAV premium in secondary markets. Historical data show that when the premium is high, the company's distribution surges. For example, when the premium was over 100 per cent at the end of 2024, its quarterly distribution reached a record high. Conversely, when premiums are cut or even depreciated (e.g. in 2022 and in the second half of 2025), firms decisively suspend or significantly reduce increases。

Figure 8: Strategy Profit Ratio Relation to Distribution (2021-2025)

Source: Strategy News and Press Release Archive, SEC

At present, Strategy is facing the challenge of a significant downturn in the premium rate, with stock prices having dropped from high to close to 60%. Based on past patterns of behaviour, it is expected that the company will cease large-scale growth in the last quarter of 2025. This means that the positive cycle that underpins the expansion of corporate assets faces a temporary halt, and that companies must wait for market sentiment to be repaired to drive the premium back, during which time their balance sheet expansion capacity will be significantly curtailed。

7.1.2. pressure on forward obligations

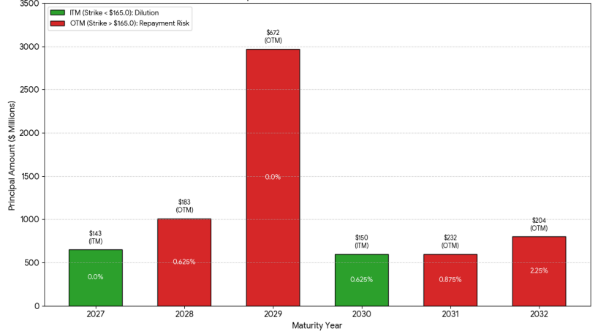

Although Strategy has no debt-servicing pressure in the short term, the company will face a huge cash repayment challenge as the maturity of the debt approaches, when weak equity performance does not trigger a creditor transfer。

Specifically, the carry-over-equity prices of US$ 143 and US$ 150, respectively, that are due in 2027 and 2030, are below the current equity value of about US$ 165 and are in a relatively safe area; without a significant fall in the equity price, these two debt ratios would be converted to equity, which would dilute shareholder interests but protect corporate cash flows。

Figure 9: Strategy Distribution of current obligations due

SOURCE: SEC

However, the risk is concentrated on two debts that fell due in 2028 and 2029. The two debts originated in 2024 with high issuances of up to $183 and $672, respectively, of which the size of the latter amounted to $2.97 billion. Although these debts currently enjoy a nominal interest rate of 0%, Strategy may face a serious debt overhang if, after four years, the stock price fails to achieve a significant increase, taking into account the huge gap between the right price and the current equity price。

7.2. & nbsp; Core Scientific: The lessons of debt accumulation and maturity mismatches

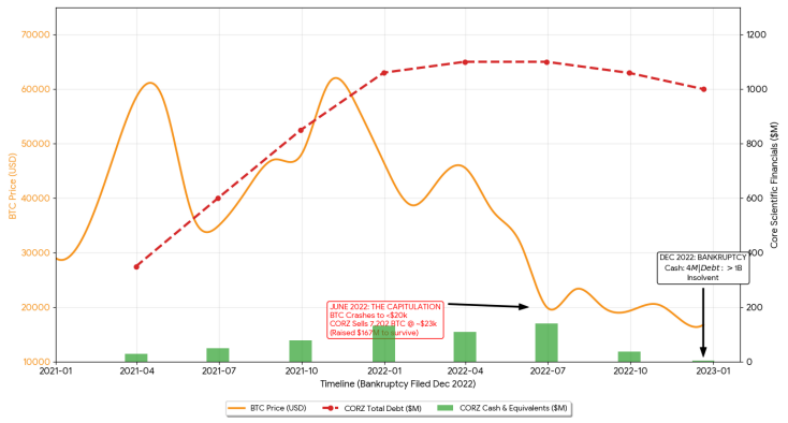

Unlike Strategy's mortgage-free financing, the Core Scientific case reveals the devastating consequences of radical leverage and maturities. As the largest bitcoin mine in North America, the company had been able to expand rapidly in the previous period by relying on high leverage strategies. The structural weakness of its balance sheet is that the debt end consists mainly of high equipment financing at floating interest rates and contains strict mandatory silo provisions, while the asset end consists of rapidly depreciated, less liquid miners and highly volatile bitcoins. [5]

Figure 10: Comparison of Core Scientific and BTC price trends

Source: Business Quant, Digtl Infra, SEC

in in the cattle market in 2021, the size of corporate debt grew rapidly from around $350 million to year-end $1.06 billion during this period, the company has hardly sold the bitcoin recovered and has relied entirely on external financing to cover operating costs and capital expenditures. however, this radical strategy has resulted in a year-end cash reserve of only about $130 million, which is extremely weak in relation to its huge debt。

The risk was finally concentrated in June 2022. With the price of bitcoin falling at $20,000, creditor pressure forced Core Scientific to carry out panic sales at the bottom of the market. The company was forced to clear 7,202 bitcoins at an average price of US$ 23,000, returning only to approximately US$ 167 million. [6] While this move has temporarily eased the liquidity crisis, it has also completely drained the company ' s core assets. By the end of 2022, when the application for insolvency protection was made, corporate debt remained high, with only $4 million in carrying cash remaining, ultimately beyond debt. [7]

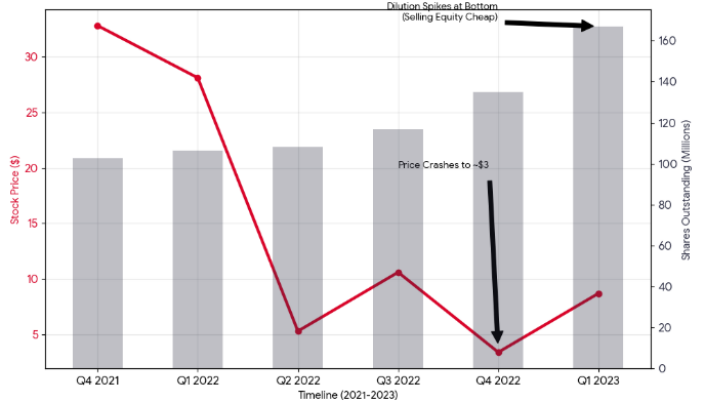

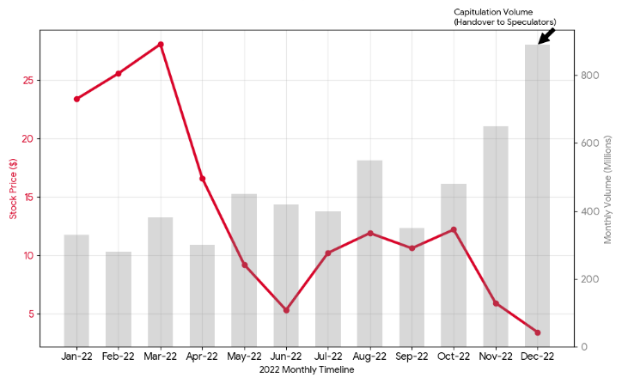

7.3 & nbsp; MARA: survival game under diluted equity

The MARA (formerly Marathon Digital), also a Bitcoin mining company, shows another path to survival: survival by dilution of extreme shares. Unlike the debt collapse of Core Scientific, MARA has adopted the immediate (ATM) incremental equity financing strategy of obtaining cash through continued stock increases in secondary markets to cover hard expenses such as electricity charges and the purchase of bitcoin。

FIGURE 11: PRESENTATION OF MARA STOCK PRICES AND NUMBER OF NEGOTIABLES

Source: Yahoo Finance Historical Data, SEC

EVEN IN THE EXTREME CIRCUMSTANCES OF 2022, WHEN THE BITCOIN FELL AND THE EQUITY PREMIUM ALMOST DISAPPEARED, THE MARA INSISTED ON INCREASING IT IN EXCHANGE FOR LIQUIDITY. WHILE THIS PRESERVES THE COMPANY ' S CONTINUING BUSINESS CAPACITY, THE ORIGINAL SHAREHOLDERS ' INTEREST HAS BEEN COMPLETELY DILUTED. THE DATA SHOW THAT IN THE FOURTH QUARTER OF 2022, DESPITE A 95 PER CENT DECLINE IN STOCK PRICES OVER 2021, THE NUMBER OF COMPANIES IN CIRCULATION ROSE SHARPLY: FROM 116 MILLION IN THE LAST QUARTER TO 135 MILLION IN THE LAST QUARTER, AND FURTHER EXPANDED TO 167 MILLION IN THE FOLLOWING QUARTER, AN INCREASE OF NEARLY 60 PER CENT OVER THE SAME PERIOD。

FIGURE 12: COMPARISON OF MARA SHARE PRICES AND MONTHLY TRADE

Source: Yahoo Finance Historical Data

THE PRICE OF THIS “EQUITY-FOR-EQUITY” IS A TOTAL BLOOD CHANGE IN THE SHAREHOLDER STRUCTURE. MOST OF THE OLD LONG-TERM SHAREHOLDERS CHOSE TO STOP THEIR LOSSES AND TO REPLACE THEM WITH HIGH-FREQUENCY TRADING ALGORITHMS, MARKET DEALINGS, QUANTITATIVE FUNDS AND SPECULATION. THE HUGE TRADE-OFF RECORDED AT THE END OF 2022 IS THE TRUE PICTURE OF THIS STOCKHOLDERS ' STRUCTURE SHUFFLE. THE MARA CASE SHOWS THAT IN THE NEXT CYCLE OF LACK OF DEBT FINANCING CAPACITY, EQUITY FINANCING, WHILE THE LAST RESORT, IS AT THE EXPENSE OF EACH SHARE OF VALUE AND LONG-TERM SHAREHOLDERS。

8. DAT Corporate Sustainability Analysis and Trends Outlook

8.1 & nbsp; DAT Corporate Sustainability Assessment Framework: Premia Window, Cash Buffer, Debt Duration and Terms

Looking back at the previous cycle, many companies did not start with a decline in asset prices, but with a mismatch between the maturity of the debt and the sustainability of the cash flow: price reversals turned “book fluctuations” into “fund constraints” and eventually into passive asset disposal and overall credit contraction。THUS, THE MOST EFFECTIVE POINT TO JUDGE WHETHER A DAT COMPANY CAN OPERATE ACROSS A CYCLE IS NOT THE SIZE OF THE CURRENCY, BUT THE THREE HARD CONSTRAINTS — THE PREMIUM, CASH AND FINANCING CLAUSES。

First, the premium window: mNAV determines the speed of expansion and the sustainability of financing。mNAV is not only a valuation indicator, but more directly reflects whether equity refinancing is economic. When mNAV is clearly above 1, the company can issue equity instruments at relatively advantageous prices to convert external funds into new assets, thereby maintaining the scaling-up pace; when mNAV is approaching for a long time,1 it even converts to discounts, it continues to grow, often closer to diluting stock shareholders, and marginal returns on finance have declined significantly, and expansion has naturally shifted to conservative. At the same time, market tolerance of DAT premiums has become more dependent on information disclosure, quality of governance and enforcement discipline, and is no longer supported by mere narratives of “reduced channels of compliance”, following the gradual spread of compliance instruments such as the ETF。

Second, the cash buffer: the ability to cover interest and necessary expenses is more critical than the carrying currency。THE ROLE OF CASH IS NOT TO INCREASE RETURNS, BUT TO ALLOW COMPANIES TO REMAIN SAFE IN THE CLOSING OF FINANCING WINDOWS OR EXTREMES AND TO MEET INTEREST AND NECESSARY EXPENSES ON SCHEDULE. FOR DAT, THE CORE TEST OF “SURVIVAL” OFTEN OCCURS AFTER A PERIOD OF TIME — I.E., WHETHER THERE IS ENOUGH CASH AND CREDIT AVAILABLE TO SUSTAIN FIXED EXPENDITURE AND WHETHER INTEREST AND OPERATING PRESSURE FORCE THE DISPOSAL OF CORE ASSETS AT A LOWER LEVEL. THE AVAILABILITY OF CASH AND CREDIT DETERMINES WHETHER THE COMPANY IS REACTIVE OR ACTIVE DURING THE WITHDRAWAL PERIOD。

Third, duration and terms: whether the debt leaves the company time to repair。Debt risk arises not only from the level of interest rates, but also from the concentration of maturity, the deterioration of refinancing conditions, and the existence of trigger arrangements such as liquidation, compulsory disposal: (1) the pressure on ordinary debt arises mainly from the uncertainty of interest accumulation and maturity refinancing; and (2) the risk that reversible debt may lose the expectation of reequity at the cross-board or downward stage, thus posing pressure closer to “facility payments”. The duration structure and trigger clauses often determine whether the company can survive the cycle during the withdrawal period or is forced to dispose of core assets at a lower level。

TAKEN TOGETHER, DAT, WHICH IS MORE VIABLE, TENDS TO HAVE TWO POINTS IN COMMON: FIRST, THE LIABILITY SIDE AVOIDS MORTGAGES WITH A MANDATORY DISPOSAL TRIGGER MECHANISM AS MUCH AS POSSIBLE, AND RELIES MORE ON UNCOLLATERALIZED DEBT OR EQUITY FINANCING TO ENSURE THAT CORE ASSET DISPOSITIONS ARE NOT SQUEEZED BY THE TERMS; AND SECOND, THE CASH FLOW END IS EITHER SUSTAINABLE IN THE MAIN BUSINESS, OR FUNDS OF LONGER DURATION AND LOWER COST ARE LOCKED IN AN ENABLING ENVIRONMENT, SO THAT INTEREST EXPENDITURE DOES NOT QUICKLY SWALLOW CASH. IN THE FINAL ANALYSIS, THE LONG-TERM COMPETITIVENESS OF DAT IS MORE MANIFESTED IN FINANCIAL MANAGEMENT CAPACITY: A FINE MANAGEMENT OF CAPITAL COSTS, TERM STRUCTURE AND LIQUIDITY。

8.2 & nbsp; trends outlook: moving from expansionary narrative to survival test

DAT ENTERPRISES FACE THE TEST OF SURVIVAL AS THE INDUSTRY ENTERS ITS FULL EXIT CYCLE IN 2026. BASED ON ITS CURRENT STATE OF EXISTENCE, THIS PAPER OFFERS THE FOLLOWING FOUR PERSPECTIVES。

8.2.1. core proposition reshaping: moving from cyclical expansion to survival across cycles

THE RETREAT SINCE THE SECOND HALF OF 2025 BROUGHT DAT'S FOCUS BACK FROM A “CYCLICAL SCALE-UP” TO A “CROSS-CYCLE OPERATION”. WHEN CURRENCY PRICES SHRINK IN STEP WITH VALUATION PREMIUMS, THE PRESSURE ON THE ENTERPRISE IS NOT PRIMARILY DUE TO BOOK LOSSES, BUT RATHER TO A COMBINATION OF LIQUIDITY AND CONSTRAINTS: INTEREST EXPENDITURE AND MATURITY STRUCTURES DETERMINE THE ELASTICITY OF THE FINANCIAL CHAIN, AND TIGHTENING REFINANCING CONDITIONS TRANSLATES PRICE VOLATILITY INTO A REAL RISK OF PASSIVE DISPOSAL OF ASSETS. THE WATERSHED IN COMPETITION AT THIS POINT LIES NOT IN THE SIZE OF THE CURRENCY HELD, BUT RATHER IN THE ABILITY TO MAINTAIN OPERATIONAL SPACE AT THE TIME OF THE DECLINE IN VALUATION, TO MAINTAIN OPERATIONS DURING THE FINANCING WINDOW AND TO AVOID BEING FORCED TO DISPOSE OF CORE ASSETS AT A LOWER LEVEL。

Under this framework, sustainability judgements can lead to three more operational questions: first, whether cash and available funds cover fixed expenditures for a future period, particularly interest and necessary operating costs; second, whether liabilities are pooled to maturity and whether there are triggers that are highly sensitive to price declines, thereby increasing the risk during the fallback period; and third, whether companies still have an enforceable financing and asset management programme when mNAV starts approaching 1 or is converted to discounts, rather than waiting for a retrogression. Only when these three points are established simultaneously will the company have the basic qualification of “to the next window”。

8.2.2. valuation model conversion: premium scarcity and functional pricing

DAT'S ROLE AS A “COMPULSORY CURRENCY CHANNEL” IS WEAKENED BY THE SPREAD OF SPOT ETF, AND THEREFORE DAT'S VALUATION PREMIUM IS EVEN MORE SCARCE. DAT ENTERPRISES THAT WISH TO MAINTAIN A MARKET VALUE PREMIUM MUST PROVIDE ELEMENTS THAT ETF CANNOT REPLACE: MORE CREDIBLE ORGANIZATIONAL CAPACITY FOR FINANCING, CLEARER ASSET MANAGEMENT DISCIPLINE, MORE VERIFIABLE RISK CONTROL AND DISCLOSURE. SUBSEQUENT DAT COMPANIES ARE MORE LIKELY TO HAVE SHORTER PREMIUM WINDOWS AND LONGER DISCOUNT PERIODS, WITH PREMIUMS MORE LIKELY TO STABILIZE ONLY WHEN GOVERNANCE, TRUSTEESHIP, DISCLOSURE AND FINANCE DISCIPLINES ARE CONSISTENTLY RECOGNIZED BY THE MARKET。

At the same time, even when the bottom assets are similar in size, the mNAVs of different firms will be divided over a long period of time, as the market will factor “corporate quality” directly into prices: reliability of financing capacity, restraint in decision-making, sound capital structure and transparency in implementation will translate into valuation differences. The lack of a clear value-added path for companies that exist only as “shadow ETF” tends to disappear and to slide more easily towards discounts; it is more likely that the financing window will be preserved if they are more mature in terms, duration and tool selection, and if they maintain the subject of transparent disclosure and verifiable processes。

8.2.3 & nbsp; bottom asset fragmentation: consensus pricing for BTC and strategic gains for ETH

IN TERMS OF ASSET ATTRIBUTES, THE BTC-TYPE DAT HAS THE ADVANTAGE OF EXPLAINING LOW COST AND A MORE UNIFORM PRICING FRAMEWORK, THUS MAKING IT EASIER TO OBTAIN LONGER FINANCING WINDOWS; AT THE FALLBACK STAGE, THE MARKET HAS RELATIVELY FEW CHALLENGES TO THE BOTTOM ASSETS. BUT IT IS ALSO MORE STRAIGHTFORWARD: THE LACK OF PRIMARY REVENUE PATHWAYS MAKES COMPANIES MORE SENSITIVE TO THE PACE AND PERIODICITY OF FINANCING; AND THE DURATION AND CASH FLOW PRESSURES ARE MORE LIKELY TO BE CONCENTRATED WHEN HIGH-LEVEL FINANCING IS SCALED UP AND THEN PRICES ARE WITHDRAWN. AT THE SAME TIME, STRATEGIC HOMOGENIZATION WOULD COMPRESS THE MANAGEMENT PREMIUM AND MAKE STOCK PRICES MORE VULNERABLE TO DEGRADATION TO A MAGNIFYING MAP OF THE VOLATILITY OF THE BOTTOM ASSETS。

THE ETH DAT-TYPE SPACE COMES MAINLY FROM BENEFITS AND STRATEGY CHOICES, BUT IS ACCOMPANIED BY HIGHER COMPLIANCE, DISCLOSURE AND ENFORCEMENT REQUIREMENTS. THE MARKET WILL BE MORE CONCERNED WITH THE CLARITY OF THE HOSTING ARRANGEMENT, THE TRACEABILITY OF THE SOURCE OF THE PROCEEDS, THE ADEQUACY OF RISK SEGREGATION AND THE VALIDATION OF CHAIN OPERATIONS. THE MORE COMPLEX THE ASSETS, THE HIGHER THE REQUIREMENTS FOR TRANSPARENCY AND PROCESS PROBABILITY; THE ABILITY TO ARTICULATE AND SUSTAIN “HOW THE ASSETS ARE MANAGED, HOW THE PROCEEDS ARE GENERATED, HOW THE RISKS ARE MANAGED” WILL DIRECTLY DETERMINE THEIR PRICING SPACE AND THE AVAILABILITY OF FINANCING。

8.2.4. industry finals: increased and end-out effects

DAT, AS A CAPITAL MARKET STRATEGY, WILL NOT DISAPPEAR, BUT THE WINNER WILL MOVE FROM “IS IT SUSTAINABLE TO BUY” TO “IS IT POSSIBLE TO MAINTAIN THE CHOICE IN DIFFERENT MARKET SITUATIONS”。

When premiums become more scarce and financing more selective, size and credibility translate into real advantages: headmasters are easier to finance when windows are opened, are more likely to have longer durations, and are better placed to delay pressure through a more robust mix of tools and improve survival across cycles. Conversely, tail companies that rely primarily on sustained growth to maintain liquidity, even in the short run, often at the expense of each share of value, lead to frequent stockholders' structures turnover, increased difficulties in valuation restoration and, ultimately, greater market marginalization。

ULTIMATELY, COMPANIES THAT ARE ABLE TO CROSS THE CYCLE ARE OFTEN NOT THE MOST AGGRESSIVE EXPANSIONARIES, BUT RATHER MORE RESTRAINED WHEN PREMIUMS ARE HIGH, MORE ROBUST WHEN PREMIUMS ARE LOW: THE FINANCING TEMPO IS NOT OVERSPREAD, THERE IS ROOM FOR DEBT AND CASH FLOW MANAGEMENT, AND TRUST AND CHAIN OPERATIONS ARE TRANSPARENT AND VERIFIABLE. FUTURE MARKETS WILL CONTINUE TO SELECT A SMALL NUMBER OF DAT COMPANIES WITH LONG-TERM SUSTAINABILITY USING STRICTER TERMS AND LESS EMOTIONAL PREMIUMS。

References

[1] Bitwise Assembly Management & Hougan, M. (2025, October 17). Cripto Market Review (Q3 2025). Bitwise Investments.

Owens, W. (2025, July 30) The rise of digital assasury companies.https://www.galaxy.com/insights/research/digital-asset-treasury-companies

TechFlow.https://www.techflowpost.com/zh-CN/article27575

M, M.

Core Scientific Documentation

Core Scientific sold 7,202 bitcoin in June, creating 167 million.

Zhang, M.