Twelve billion dollars of false prosperity? Figure and DefiLlama's "RWA Data Falsification"

A CONFRONTATION AROUND RWA TRANSPARENCY AND DATA STANDARDS HAS OPENED UP A GREATER VEIL。

A CONFRONTATION AROUND RWA TRANSPARENCY AND DATA STANDARDS HAS OPENED UP A GREATER VEIL。

Original Odaily Daily@OdailyChinaI'm not sure

Author Ethan@ethanzhang_web3

In the DeFi world, TVL is the key data -- it's both a symbol of protocol power and a barometer of user trust. However, a controversy about the target of $12 billion in RWA assets quickly ripped off user trust。

September 10, Figure co-founder Mike Cagney on platform XFire firstI don't knowPublicly accusing the data platform DefiLlama of refusing to show her RWA TVL, simply because of the “no more social platforms” and questioning its “decenterization criteria” impartiality。

A few days later, DefenseLlama co-founder 0xngmiThe Problem in RWA MediaBy article, Figure claims that the data behind the $12 billion scale is abnormalUnverifiable data on the chain, lack of true transfer paths for assets, even suspected of circumventionI don't know。

As a result, a war of trust over “valitableness on the chain” and “sub-chain logic” broke out。

This storm's fuse comes fromFigure co-founder Mike CagneyA tweet。

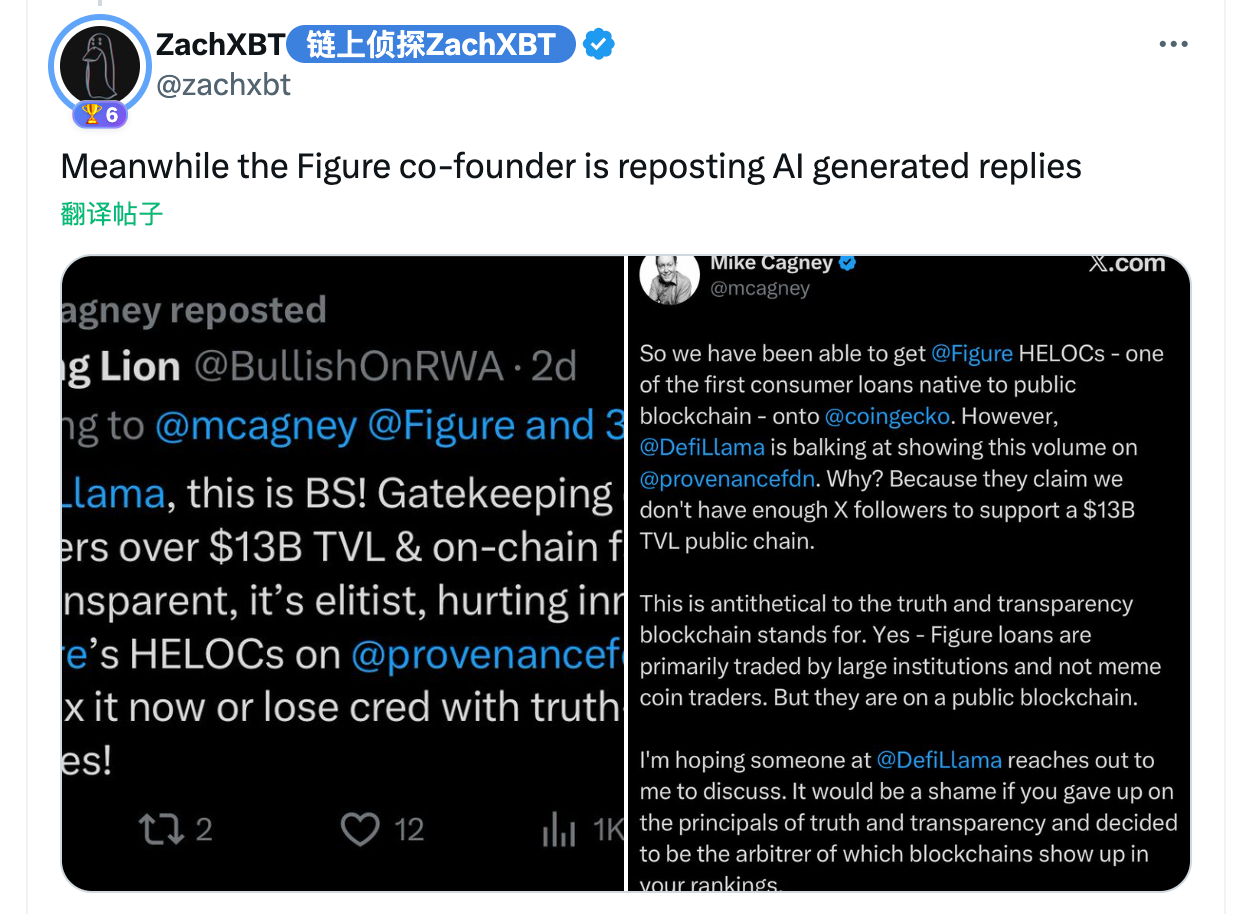

On September 10th, he announced on platform X that Figure's home net worth credit product (HELOCs) had successfully landed in CoinGecko, but at the same time accusedDefiLlama refused to show $13 billion TVL on the Figure chainI don't know. He pointed directly at the “review logic” of DefiLlama, even stating that the other side had rejected it on the grounds that there were “x fans”。(Odaily) Here Mike Cagney is talking about $13 billion, and there's an asymmetrical of the 12 billion in the later 0xngmi response. I'm not sure

This post is part of our special coverage Syria Protests 2011About an hour laterI don't knowProvence Blockchain CEO Anthony Moro(Investigation without a complete background from the context)DefiLlamaI have no trust in you

Then Figure co-founder Mike Cagney added that he understood the development costs of integrated new L1 but also said thatCoinGecko and DefiLala never asked Figure for fees or tokensIn order to clarify its “pays up” implication。

On 12 September, the co-founder and CEO Jon Ma of the L1 data dashboard Artemis (who also appeared to have fully known the details of the dispute) threw out the olive branch publicly。

In this period of timeThere's a clear tendency for love, Figure— A number of viewers pointed at DefiLlama's “credibility and neutrality”。

Until September 13, the co-founder of DefiLlama, 0xngmi, published a long paperThe Problem in RWA Metrics"the systematic disclosure of its findings and its four-point challenge has only begun to reverse the narrative, followed immediately by expressions of solidarity from opinion leaders such as ZachXBT, stressing that "These indicators are not 100% verifiable on the chainThere was wider support for the position of DefiLala。

YesThe Problem in RWA MetricsIn which 0xngmi published the DfiLlama team ' s due diligence results for Figure, listing several anomalies by article:

There's a serious discrepancy between the scale of the chain and the declared scale

Figure claims that the RWA issued on its chain has reached its scale$12 billion, but only about the assets that can actually be verified on the chain$5 MILLION BTCand$4 MILLION ETHI DON'T KNOW. OF WHICH BTC'S 24-HOUR EXCHANGE IS EVEN LIMITED2000 US$I don't know。

Insufficient supply of stable currency

Figure issues its own stabilization currencyYLDSTotal supply only20 millionTHEORETICALLY, ALL RWA TRANSACTIONS SHOULD BE BASED ON THIS, BUT THE SUPPLY IS FAR FROM ENOUGH TO SUPPORT THE SCALE OF $12 BILLION。

Suspicious asset transfer patterns

MOST TRANSFERS OF RWA ASSETS ARE NOT INITIATED BY THE ACTUAL OWNER OF THE ASSETS BUT ARE OPERATED THROUGH OTHER ACCOUNTS. MANY OF THE ADDRESSES THEMSELVES HAVE LITTLE OR NO CHAIN INTERACTIONIt's probably just a database mirrorI don't know。

Lack of links to pay marks

The vast majority of Figure's loan processes are still completed in French currency, and there are virtually no corresponding payments and repayment records in the chain。

"We don't know how Figure's $12 billion asset size is traded. Most holders do not seem to have moved these assets with their own keys — do they just map their internal databases into the chain?”

As the wind spreads, community opinion almost flattened in favour of DefiLlama, but in the process there were also voices from different angles。

DirectlyFigure's operation is "public pressure"And it made it clear, "No, your company is trying to put pressure on participants like DefiLlama, who are proven to be honest, using indicators that are not 100% legible."

♪ And then put ♪They're pointing at people who don't know what they're talking aboutI was lobbied by Figure and questioned privately by DefiLlama’s institutional figures. He wrote, "I have received private contacts from a lot of people from large encrypted money agencies and venture capital companies, and from our partners. Each of these people needs to be named in person and asked how they can work in this industry if they can't even verify it themselves.”

Conor spoke with many voices:The credibility of these institutions on RWA and DeFi tracks will be compromised if they don't even complete the basic chainI don't know。

And oneMore technical recommendations, it is thought that DefiLlama could add a new indicator for "active TVL" to the existing TVL tracking to show the actual rate of RWA movement over time. He took the example of: "Examples: two DApps each made $100 billion worth of TVL. DApp 1 has $100 billion just idle, possibly only 2 per cent of the capital flow, generating $2 billion of active lock value, while DApp 2 has 30 per cent of the capital flow, generating $30 billion of active lock value (15 times the DApp 1).”

IN HIS VIEW, SUCH DIMENSIONS WOULD SHOW BOTH THE TOTAL SIZE AND THE AVOIDANCE OF “SUSPENSION OR DISPLAY TVL”。

In the meantimeZachXBT also notes that the co-founder of Figure, Mike Cagney, continues to transmit some of the suspected AI auto-generated Solidarity ReviewsAnd it's taken public notice of this, and it's further agitating to Figure's public opinion。

Figure's dispute with DefiLlama, which seems to be a single wave, hit the core soft side of the RWA track -What is a chain assetI don't know。

The core contradiction of this wave is, in factthe logic of the chain-based fundamentalism vs-linkI don't know。

So called $12 billion, if you can't prove it on the chain, it's 0。

IN AN INDUSTRY WITH TRANSPARENCY AND PROBABILITY AS THE BOTTOM LINE, ANY ATTEMPT TO BYPASS THE CHAIN TO VERIFY AND IMPERSONATE TVL WITH DATABASE NUMBERS WILL ULTIMATELY REVERSE USER AND MARKET TRUST。

THIS DISPUTE MAY BE JUST THE BEGINNING. IN THE FUTURE, WITH MORE RWA PROTOCOLS, SIMILAR PROBLEMS WILL CONTINUE TO ARISE. THERE IS AN URGENT NEED FOR A CLEAR AND UNIFORM CERTIFICATION STANDARD FOR THE INDUSTRY, OR THE “VIRTUAL TVL” WILL EXPAND AND BECOME THE NEXT MINE THAT PIERCES TRUST。