The data measure Polymarket's annual income at billions, assuming that..

Polymarket has demonstrated his ability to make blood by moving from “free play” to “test-off” for three weeks。

Original Odaily Daily@OdailyChinaI'm not sure

By Azuma@azuma_ethI'm not sure

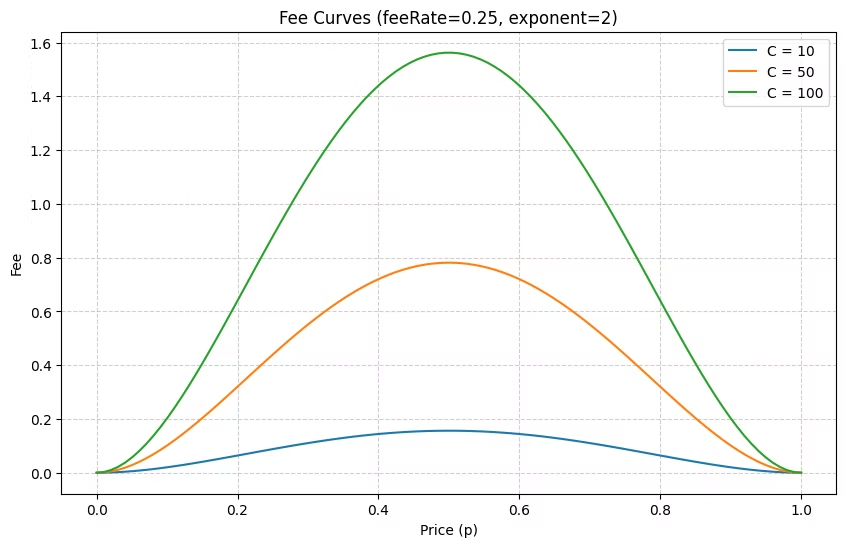

On January 6, this year, Polymarket officially began to levy transaction charges on the market for “15 Minutes of Secret Currency Rising and Decline” that will vary with the market's real-time rate of compensation, which is close to 0% or 100%, and lower; the counter-compensation rate is close to 50%, and the fees are higher at 1.56%。

This is in addition to the US market (Polymark will charge 0.01 per cent of the US market), which for the first time stopped the full free model and started charging transaction fees for a particular type of market。Now that three weeks have passed and a sample of observable data is available, it is time to make a rough estimate of Polymarket ' s collection capacity。

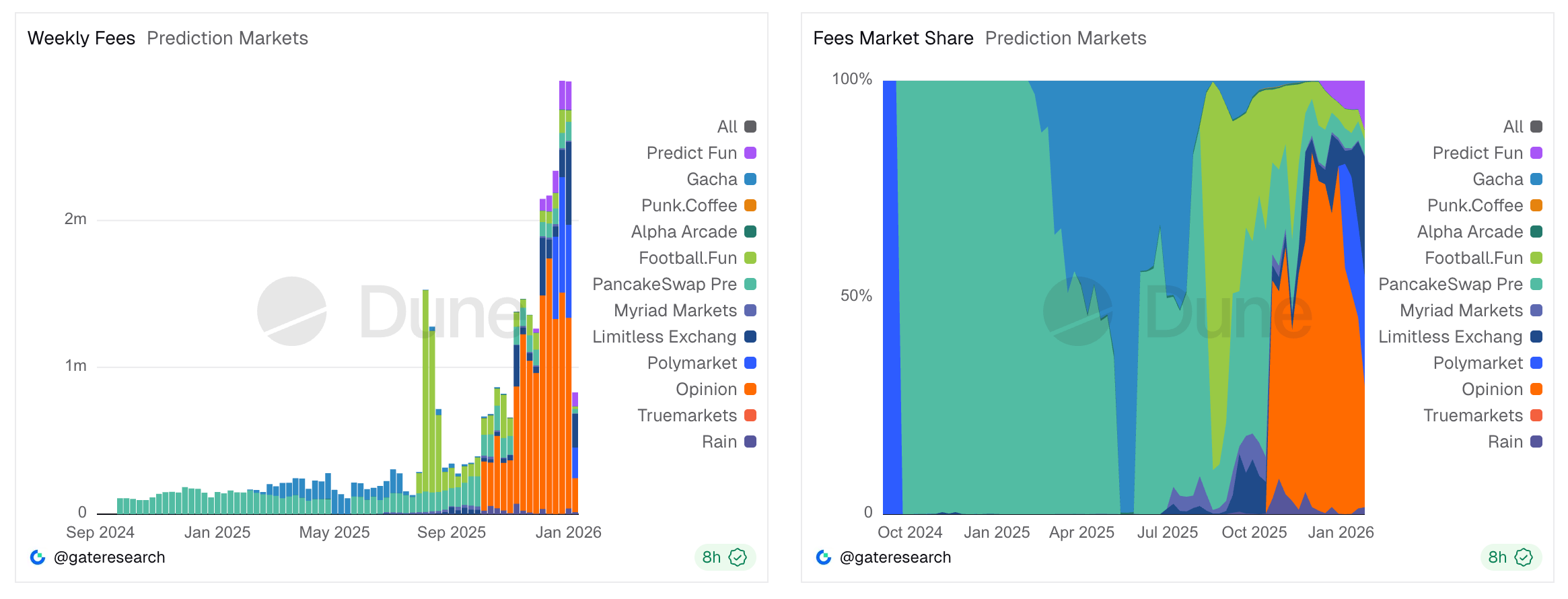

First, look at the most intuitive level of revenue from handling fees. Based onGate ResearchThe data compiled on Duna has been collected since the start of the feePolymarket has accumulated some $2.19 million in fees and fees, and on average $730,000 per week - a static extrapolation of this data, which is expected to generate approximately $38 million per year in Polymarket, while the volume of relevant market transactions and the structure of the transaction remain unchanged。

It’s not surprisingPolymarket must not be limited to the category “15 Minutes of Encrypted Currency Rising and Decline”。Since the formal charging of fees to this category of markets, Polymucket has long maintained a completely free model and has had to pay for market liquidity, and at the end of last year Coplan himself admitted that Polymucket was operating at a loss... But we have seen too many such “burn money” stories in the Internet market, and it is not surprising that, as Polymarket’s user habits and market position become more secure, future charges to more markets will be imposed。

- Odaily note: For the collection of Polymark, see Odaily's previous tea session columnOdaily Editorial Tea Club (7 January)I don't know。

It is assumed that Polymark will continue to apply the current rates in other markets in the futureWe may be able to look at the theoretical ceiling of Polymarket under the current level of transactions by comparing the volume of the 15-minute encrypted currency that goes up and down with the total volume of the entire platform -- the higher the charge market, the higher the natural rate。

According to Odaily's data, the total trade volume in Polymarket's 15-minute encrypted currency has been about $159 million over the past week(BTC for US$ 114 million, ETH for US$ 3.029 million, SOL for US$ 8.93 million and XRP for US$ 5.73 million of the four major coins) I don't knowBased on this proportion of static calculations, a similar fee model is expected to generate an annual revenue of $418 million for the platform at the current level of transactions and in the structure of transactions if Polymarket introduces a similar fee model in all markets。

It is important to note that all of the above are Odaily extrapolations based on historical data, and that the reality of Polymarket's collection will inevitably lead to errors in multiple variables - one is that only three weeks have passed since Polymarket's fees were levied, and the sample size remains small; the other is that Polymarket will not necessarily follow similar tariff mechanisms in other markets, and that differences in user trading practices in different markets will lead to differences in the final cost results under the dynamic rate mechanismThirdly, and most critically, Polymarket is still in a strong growth dynamic, and it is expected that the volume of platform transactions will continue to grow in the future as the concept of markets is projected to become more widespread, along with the potential flashpoints of the 2026 World Cup and the mid-term elections。

But even considering the above uncertainties, one trend is quite clear – Polymarket is proving the revenue potential of predicting a whole new business in the market, which is no longer an innovative concept, but a truly sustainable blood-making business that benefits from an imaginative space。