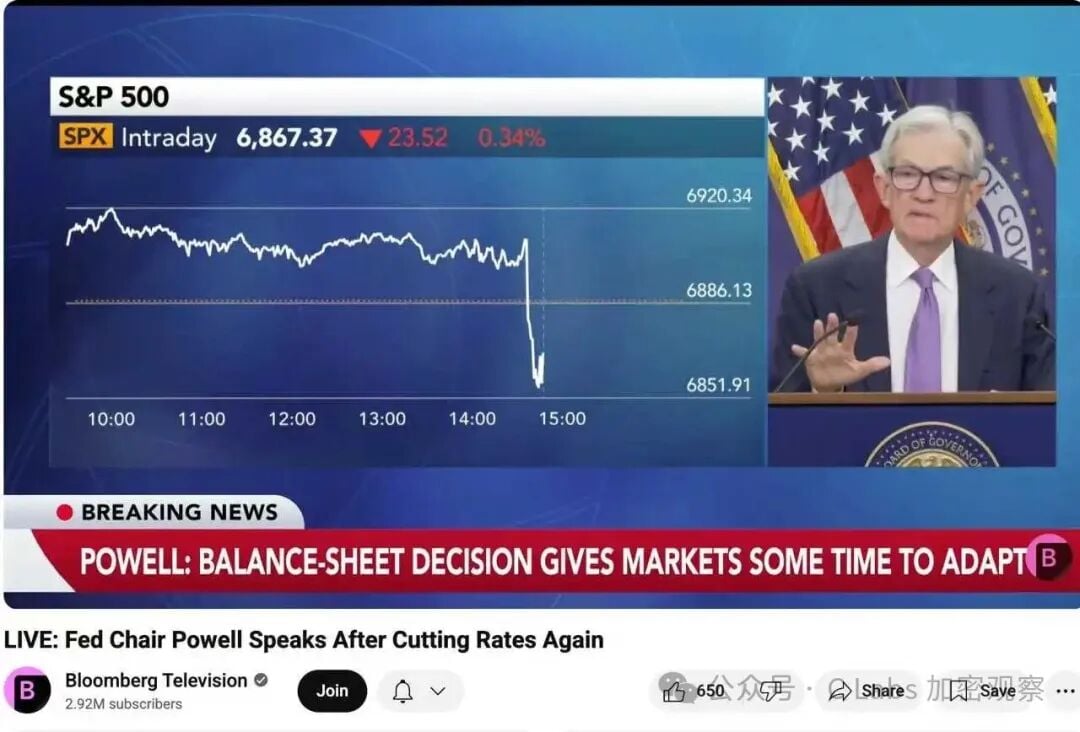

in the early morning hours of beijing time, the fed announced — — 25 basis points of interest reduction, and reduced the interest rate range of the federal fund to 4.00% & ndash; 4.25%。

AT THE SAME TIME, THE FED ALSO INDICATED THAT QUANTITATIVE AUSTERITY (QT) WOULD OFFICIALLY END ON 1 DECEMBER。

this should, as a matter of course, be & ldquo; good & rdquo; interest rate reduction, end abbreviation, expected improvement in liquidity. but the result is that many wonder why the stock market, the encrypted currency, and even the gold have not gone up, but have fallen

01, market &ldquao; good expectations &rdquao; already overspent

In fact, the market was already in &ldquo early this month; bet ” this was a drop. According to CME Fedwatch data, before the meeting the market considered that:

The probability of a 25bp reduction is as high as 95%, while about 40% of investors expect the Fed to announce the start-up of QE immediately。

as a result, the fed chose only &ldquao; moderate &rdquao; interest rate reduction。

In other words:

this reduction is not &ldquao; new interest & rdquao; but &ldquao; lower than expected & rdquao。

When expectations are met but no surprises are forthcoming, markets tend to choose to end up profitable. This is typical of &ldquao; buy the news, sell the facts &rdquao; practice。

02, stop abbreviation ≠ start watering

Many people saw “ QT end ” thought it meant “ pour water & rdquo; coming. In fact, this statement by the Fed is very cautious:

& ldquo; we will close the abbreviation, but no new asset purchase plan is initiated. ”

That is:

from “ water collection ” phase, to “ watch ” phase。

In the language of financial markets, it's called:

Mobility has not deteriorated, but it has not improved。

and the investment market is going up, light & ldquo; crash & rdquo; not enough — &mdquo; incremental & rdquo; that is the biggest gap at the moment。

03, interest rate reduction was not transmitted to “ real capital rate ”

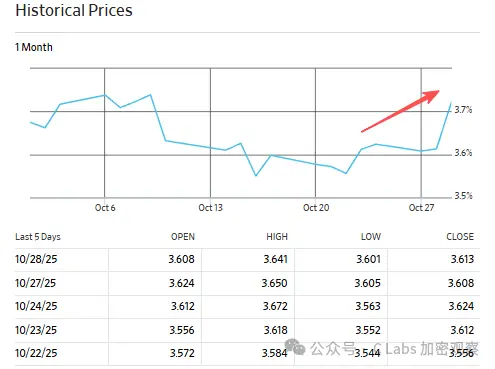

in theory, interest-rate reductions reduce short-term interest rates and drive down financial costs. however, the situation was somewhat unique; — although nominal policy rates fell by 25 points, medium- and long-term financial costs did not decline simultaneously。

For example, the five-year rate of return on national debt rose from 3.6 per cent to 3.7 per cent:

The ten-year rate of return on national debt rose sharply to over 4 per cent:

what does that mean? this indicates that real liquidity in the market remains tight, and &ldquo is not felt by investment agencies; money is becoming more ” the fed's interest rate is still at “ on the mouth ” no real “ flowing to market &rdquo。

04, &ldquao; interest rate reduction &rdquao; the concern behind it: the downward pressure on the economy remains high

from a more macro point of view, the fed's interest rate was actually & ldquo; defensive operation & rdquo; recent us economic data indicate that:

- Real estate, manufacturing, negative growth for two consecutive quarters

- (a) The slowdown in the employment market, with unemployment rising again to 4.6 per cent

- The growth of corporate profitability has almost stalled。

this means that between &ldquo, &rdquo, &ldquo, inflation control, &rdquo, the fed has opted for a slight easing of monetary policy to cushion downside risk。

But it also sends a signal:

the united states economy may have entered “ slow life &rdquo。

In such cases, the market prefers to lock on profits rather than simply stowage risky assets。

05. summary: interest rate reduction ≠ in cattle markets, mobility is the core variable

The market response to this drop in interest rates gives the clearest logic:

short-term policy relaxes ≠ liquidity ≠ increases in assets。

WHAT REALLY DRIVES THE STOCK MARKET, AND THE ENCRYPTED MARKET, IS A RE-LAUNCHING OF ASSET EXPANSION (QE) BY CENTRAL BANKS, OR FISCAL STIMULUS COUPLED WITH LARGE-SCALE CAPITAL INFLOWS。

until then, the interest rate was only “ neutral ” — — and stable confidence, but not enough to start a new round of cattle。

The market does not want a 25-point drop, but a real discharge。

before that, &lsquao; risk asset & rsquao; all have to wait。