Author:no, no, no, no, no

Photo by Tim

More than a dozen projects in Solana are being repurchased, but:

- Who's doing 100% repurchase

- Who's destroying the token after the repurchase

Solana's ecological repurchase book is read in full。

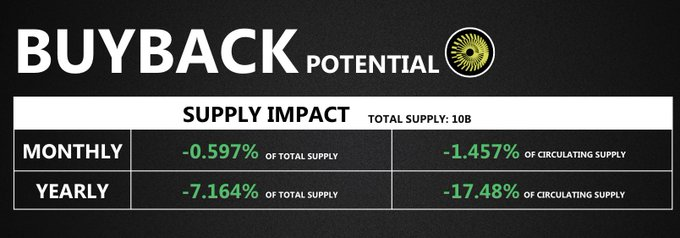

1. DeBridge

deBridge was using 100 per cent of its income for the repurchase of its own currency, and the specific processing options for the repurchase were still pending。

To date, they have repurchased 3 per cent of the coin supply. At this rate, they will be able to repurchase nearly 20 per cent of the supply within a year。

2. Marinade

Marinade spends 50 per cent of its income on the repurchase of MNDE coins each month。

The annualized income of Marinade amounts to $170 million, which could lead to a huge buyout for coins with a market value of only $140 million。

THE FUTURE USE OF THESE BUYBACKS WILL BE DETERMINED BY DAO。

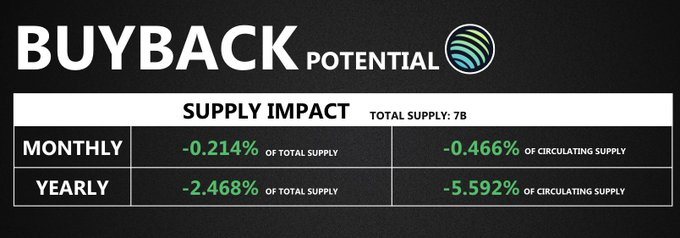

3. Jupiter

Jupiter is using 50 per cent of its agreed income to buy back his own currency。

They transferred the currency bought back to the destruction site. To date, Jupiter has repurchased 95 million JUPs, or 1.37 per cent of the total supply。

Tomorrow, we will discuss the disposition of the repurchase of tokens。

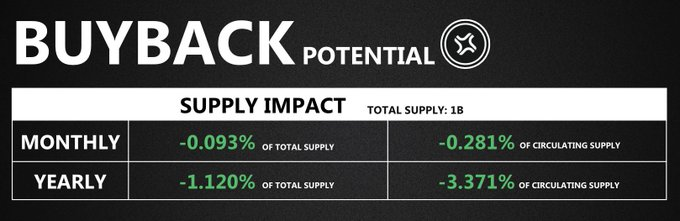

4. Jito

The Jito platform will use 1.5 per cent of TipRouter costs for periodic buyback of JTO coins and subsequent destruction。

AT CURRENT MARKET PRICES, THIS WILL RESULT IN THE BUY-BACK AND DESTRUCTION OF MORE THAN 11 MILLION JTOS PER YEAR (1.1 PER CENT OF THE TOTAL SUPPLY)。

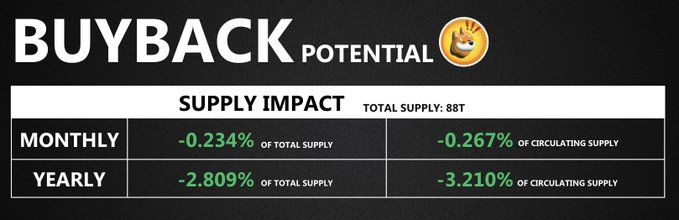

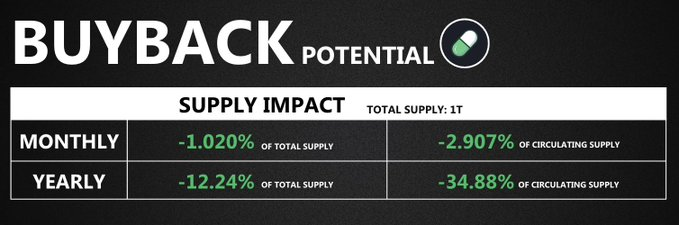

5. Bonk

Bonk has introduced a number of currency buy-back and destruction measures。

In this case, I will limit my presentation to LetsBONK。

The LetsBONK project spent 50 per cent of its revenue on the repurchase and destruction of BONK coins from the open market。

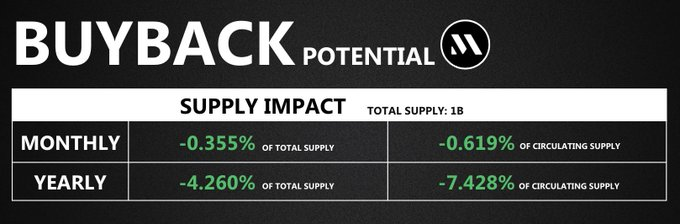

Metaplex

FIFTY PER CENT OF THE AGREED REVENUE WILL BE ALLOCATED TO DAO EACH MONTH, EARMARKED FOR THE REPURCHASE OF MTPLX COINS。

Within the last 30 days, the Metaplex agreement generated income of $1.56 million, of which 50 per cent, or $780,000, was used to repurchase approximately 3.5 million MPLX coins for Metaplex DAO, or more than 0.3 per cent of total supply。

7. Raydium

The annual circulation of Raydium coins is extremely low, at 1.9 million (total supply 555 million)。

Raydium charged 12 per cent of the transaction costs to buy RAY back。

This brings the repurchase rate to 5 per cent of current supply。

8. Pump Fun

The Pump.fun platform still earns more than $1 million per day and spends 100 per cent of its revenue on the repurchase of tokens。

IN SEPTEMBER, THEY BOUGHT BACK $55 MILLION WORTH OF PUMP COINS, AND IN ONE YEAR THEY COULD BUY BACK ABOUT 30 PER CENT OF THEIR CURRENT SUPPLY。

9. Streadflow

Thirty-nine per cent of the income from the StraamFlow agreement is being used to repurchase the STREAM token and distribute it to the pledge。

IN JULY 2025, FOR EXAMPLE, THIS MEANT THAT 39 PER CENT (OR $96.33 MILLION) OF THE INCOME OF $247,000 IN THAT MONTH WOULD BE USED FOR THE REPURCHASE OF STREAM COINS AND PLEDGE INCENTIVE ALLOCATIONS。

In the recent past, Magic Eden has also initiated a currency buy-back mechanism, which has repurchased 111,000 MEDs and will be fully used for pledge incentives (a further expansion is expected), and Step Finance has similarly invested all of the Platform ' s revenues (including business proceeds such as Solarafloor and Remora Markets)。