Three points on the river? Alliance DAO founders' statements detonated the encryption ring

Rather than worrying about the moat, it might be more appropriate to think about how encrypted money can meet the real needs of more market users faster, cheaper and easier。

Original / Odaily Daily@OdailyChinaI'm not sure

Author / Wenser@wenser2010I'm not sure

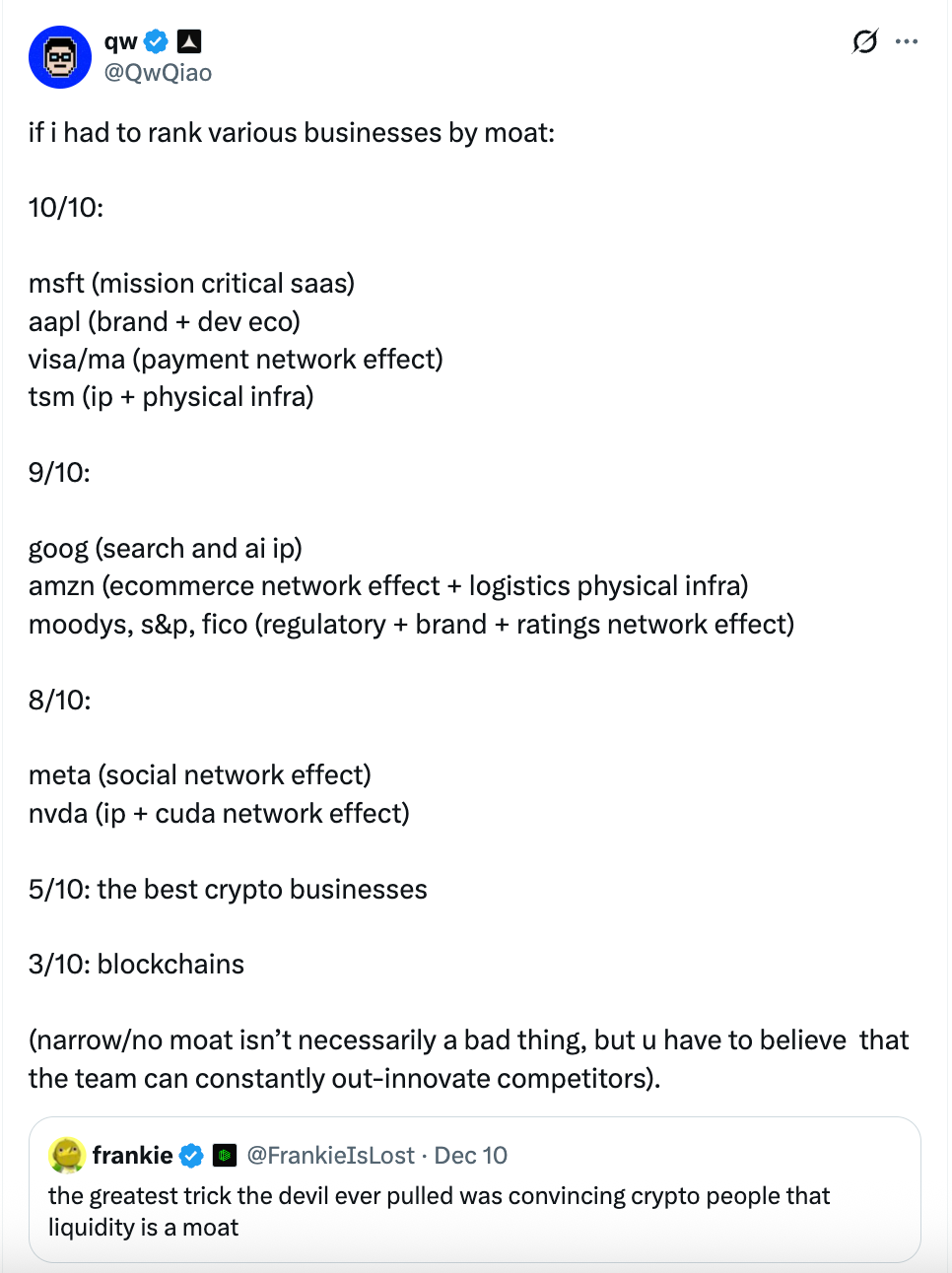

Recently, alliance DAO founder qw (@QwQiao“STRENGTH CHAIN MOATS ARE LIMITED” AND THE L1 COLLAGE IS RATED AS ONLY 3/10。

The statement quickly detonated the encryption ring abroad, prompting a lively discussion between the encryption VC, the public chain builders and KOL. Dragonfly Partner HaseebI'm so angry with the generalIt's ridiculous to say that the block chain is 3/10, even though the founder of the industry, Aave, who is dissatisfied with gambling, Santi, never thought that the block chain was "no moat."。

the debate over block chains and the meaning, value and business model of the encrypted currency is always recurring in the cycle. the encryption industry is shaking between idealism and reality: people miss to be centralized, and they yearn for the status and recognition of the traditional financial industry, while they are embroiled in self-doubt that “is it just a packaged casino?” the source of all of this conflict is perhaps the volume – the total market value of the encryption industry has been hovering around $3-4 trillion, and the traditional financial giants, which are small compared to the hundreds or hundreds of trillions of dollars in size。

As practitioners, we all have a ambivalence of arrogance and inferiority – a spirit of de-francoization and decentrization that has prevailed since the beginning of the chain – and that the encryption industry has indeed become an emerging financial industry that has gradually gained the attention, acceptance and participation of mainstream forces; and a point of inferiority, which seems like a poor boy who feels that his work is not very gloomful, with blood, tears, pain, and pain. In sum, the limitations of the size of the industry have given rise to such cyclical identity anxiety, self-doubt and self-denial。

today, we use the topic of qw's moat rating to talk about the current problems and core advantages of the encryption industry。

The debate begins: Is mobility the moat of encryption

This industry debate about the existence of a moat in the encryption industry was originally from Paradigm Team Research member, FrankieOne sentence proposed– “The devil's greatest trick is to convince encrypted money users that liquidity is a moat.”The greatest trick the devil ever pulled was convincing crypto people that freedom is a moat.I'm not sure

As can be seen, VC, which is pure bloodline, Frankie is a bit repulsive about the industry that today highly values "mobility is everything." After all, for an investor with financial and information advantages, investment experts often want to spend their own money on projects and operations that are supported by real operations, that generate real cash flows and that continue to provide them with financial returns。

This view was shared by many in the comment section:

- Multicoin Partner Kyle SamaniDirectly“+1”

- member of the etherwood foundation, binjiI think it's..“Trust is the true moat, and mobility will always be where it is trusted, even if it may flow with opportunity in the short term.”

- Chris Reis of Arc's public chain teamAlso noted"TVL ALWAYS APPEARS TO BE THE WRONG ARCTIC STAR INDICATOR (OPERATIONAL GUIDANCE TARGET)

- Justin Alick of Aura FoundationI'm just saying"Migration is like a woman who can leave you anytime."

- DeFi Researcher Defi penielDirectly“On the basis of mobility alone, it is not a moat

And, of course, there's a lot of people who argue that..

- DFDV COO and CIO ParkerComment"WHAT ARE YOU TALKING ABOUT? THE USDT IS THE WORST STABLE CURRENCY, BUT IT'S ABSOLUTELY DOMINANT. BITCOIN IS THE WORST CHAIN OF BLOCKS, BUT IT'S DEFINITELY DOMINANT."

- Former Redwood investor, current Folius Ventures investor KDI gave you a question"Isn't it?"

- Fabric VC Investor Thomas CrowNote“In an exchange, mobility is a moat — the more mobile the better the user experiences; this is the most important feature of this vertical industry, without exception. That is why the main innovation in the trade in encrypted assets focuses on addressing the problem of insufficient mobility, which leads to poorer user experience. For example, Uniswap through LP for long tail asset liquidity and Pump.Fun through standardized contracts and joint curves to attract currency pre-launch liquidity.”

- Pantera investor Mason Nystrom relayed and commented, "liquidity is definitely a moat." It then gives different examples: in the public chain, the leadership of the Taifeng today is due to DeFi ' s mobility (and developers); the currency of the CEX, Coinbase, etc.; Aave, Makerdao in the lending platform; USDT in the stabilization currency; Uniswap in the DEX, Pancakeswap。

And then there was the qw of the Allance DAO foundermoat rating tweet:

In his viewThe block chain (the public chain) itself has a very limited moat with only 3/10 ratings。

- In its view, Microsoft (Key SaaS), Apple (brand + Development Ecology), Visa/Mastercard (payment network effects), and PB (IP + Physical Infrastructure) could be rated up to 10/10 (the strongest moat)

- Google (search and AI IP), Amazon (electrical network effects + logistics infrastructure), Moody's, Pipes, FICO, etc., rating agencies (regulatory drive + brand + rating network effects), large cloud computing (AWS/Azure/GCP, etc.) can score 9/10

- Meta (social networking effect), Yvda (IP + CUDA network effect) rate 8/10

- The best encryption operation in the encryption industry is rated at 5/10

- the blockchains rate is only 3/10 (a narrow moat)。

qw further stated that the lower rating of the moat was not a bad thing, but it meant that the team must be able to continue to lead the innovation, otherwise it would be quickly replaced. subsequently, it may have been felt that the previous rating had been too hasty, with some additional ratings given in the comment area:

- 3 Basic cloud service providers rate 9/10

- BTC moat rate 9/10 (Odaily Planetian daily note: qw indicates that no one can copy the BTC’s founding story and the “Lindi effect”, but a point is withheld because it is unclear whether it is capable of responding to security budgets and quantum threats)

- Tesla 7/10

- ASML 10/10。

- AAVE may score more than 5 points in the moat (10 out of 10), and the reason given by qw is: “As users, it must be believed that their smart contract security tests are adequate and do not lose your money”。

of course, seeing qw so well as being a "sweet critic," the comment section, in addition to the debate about the moat system, has also made irrelevant sarcasm about qw's statements, or even about someAnd it says, "What about those lousy launching platforms you invested in?"(Odaily Daily Planet Note: & nbsp;i don't knowAfter & nbsp; Alliance DAO's subsequent investment of a key currency platform (e.g. Believe) did not perform well, even he did not want to rate himself)

It was with such a strong gunpowder focus that Dragonfly Partner Haseeb subsequently suffocated。

OS: I've never seen anyone so brazen

The moat rating system for qw, Dragonfly Partner HaseebHe's angry"What? ♪ Block chain moat: 3/10? This is a little ridiculous. Even Santi doesn't think the public chain "no moat."。

The Ether's been going onTen years of dominancePosition, hundreds of challengers raised over $10 billion to try to take market shares. After 10 years of competitors trying to defeat it, the Ethera has succeeded in keeping the throne. If that doesn't mean there's a moat in the Ethern, I really don't know what the moat is."

in the comment section of this tweet, qw also gave his own perspective: “all you say is a review of the past (`the last decade') and a mistake of fact (the taifaf no longer occupies the throne on multiple indicators”)

and then, "what is the moat?" and the "is there a moat in the ether""The moat" in his own mind is actually a profitI don't know. However, Haseeb then gave a reverse example - OpenSea, Axie, BitMEX, and so on, while having a high income, there is no moatThe true moat should focus on: "Can it be replaced by a rival?"I don't know。

Abra Global, director of administration, Marissa, tooJoin the discussion“Approves (Haseeb).” It's a little strange to say qw -- toggle costs and network effects can be solid moats -- solana and Ethera, which I think will be stronger over time than other public chains. They all have strong brand names and develop ecosystems and are clearly part of the moat. Perhaps he means other chains that do not have the above advantages.”

Haseeb continues to mock and fill: "qw is just trying to justify himself."

Based on these discussions, perhaps we should dismantle what the “real moat” of the public chain in the encrypted money industry really entails。

Main components of the public chain river: from character to business, from origin to network

in the author's view, the qw's “maritime rating system” is somewhat unconvinced by the fact that:

First, the rating is based only on the position of the current industry and the revenue received, while ignoring the multiple dimensions. Whether infrastructure such as Microsoft, Apple, Amazon Clouds, or Visa, MasterCard and others pay giants, the main reason for qw’s high scores is the pattern of strong revenue from their business, which clearly homogenizes and shallowizes the moats of a giant company’s business, not to mention the fact that Apple’s share of global markets is not at the ruling level, and so on。

Second, it ignores the complexity and uniqueness of the public chain and encryption projects as distinct from traditional Internet operations. As a challenge to the French monetary system, the technology of encrypted currency and block chains and the subsequent emergence of public chains, encryption projects are based on the natural “hiddenness” and “nodalization” of decentralised networks, which are often unattainable by traditional income-driven operations。

On this basis, individuals consider that the moats of the public chain operations are mainly in the following seven areas, including:

1. Technical concepts。This is also the most powerful and differentiated feature of the Bitcoin network, the ETA network, the Solana network, and countless public-chain projects. The real need to decentrize the network persists as long as humans are vigilant about centralised systems, authoritarian governments, and French-currency systems, accepting sovereign individuals and related ideas

2. Charms of the founders。After the discovery of Bitcoin and ensuring the smooth functioning of the Bitcoin network, he disappeared, with tens of billions of dollars of assets in his possession, and was not moved; Vitalik, a co-founder from a gamer who was “abused” by a gamer world that was sorely abused by a gamer company, was determined to start his de-centralized mental journey; Solana's founders, Toly and others, were the elites of American factories, but did not hesitate to stop, thereby opening the way for their “capital Internet” construction, not to mention the great public chains created by Move's language to the legacy of the Meta Libra network, whose personal charm and appeal were particularly important in the encryption industry. This is also the case of thousands of encrypted projectors favoured by the VC because of their founders, community admirers, and financial resources, but also because of the departure of their founders and their unexpectedness. A good founder is a public chain and a true soul of an encryption project

3. Network of developers and users。On this point, as is emphasized by the Metcalf effect and the Lindy effect, the stronger the network effect, the longer it exists, the more sustainable it can be. Developers and user networks are the cornerstones of the public chain and of many encryption projects, since developers can be described as the first users and the longest users of an encrypted public chain or project

Application of ecology。A tree has only its roots and no leaves, and it is difficult to survive, as is encryption. It is therefore essential that applications that are rich and capable of self-closing and creating synergies be applied. Public chains such as the Ether and Solana continue to survive the winter, with applications that have always been built. In addition, the more ecological the application becomes, the more sustainable it is to make blood and to turn back the chain

5. Market value of tokens。If all the preceding references are to the interior and base of a moat, the market value of the coin is the external form and brand image of a public chain and a encryption project. Only when you “look expensive” will more people believe that you “have a lot of money”, that you are a “field of gold”, that is so for individuals, and so for projects

6. Openness。In addition to building their own internal cyclic ecology, encryption projects, such as the public chain, need to maintain openness and the operationalization and exchange of value with the outside environment, so that openness is essential. In the case of public chains such as Taifa, Solana and others, the ease and scale of their access to traditional finance, user funds and the ability of industries to bridge through windows such as payments, loans, etc.

7. Long-term road map。A truly solid moat must not only provide support in the short term, but must also be constantly updated, new and sustained over the long term. For the public chain, the long-term road map is both an arctic star indicator and a powerful enabler of continuous ecological growth and innovation. The success of the Pacific is linked to the planning of its long-term road map。

On the basis of the above elements, a common chain can move from zero to zero, from nothing, gradually through a long period of barbarism to maturity. And the corresponding fluidity, the adhesive nature of the user。

Concluding remarks: The encryption industry has not yet reached the stage of "characterization"

In recent days, with the successful landing of the Maur route in the name of the Chinese version of Inweida, a milestone of $30 billion was achieved on the first day of the market; then, in just a few days, its stock prices soared, reaching todayOver $40 billion in market valueAnother amazing breakthrough。

In a matter of days, the Moor route passed the first seven times, and the encryption industry was a little bit more obscurant than a trillion-dollar giant。

Again, it must be lamented that today, when the scale of funds and the number of users are much smaller than in the traditional financial and Internet sectors, we are far from a “grateful talent”。The only thing that hurts now is that we do not have enough people, that we do not attract enough funds and that we are not involved in a wide range of industries. Rather than worrying about the macro, large and complete moats, perhaps we should think more about how encrypted money can meet the real needs of more market users faster, cheaper, and easier。