The night before the dollar went down, Bitcoin's real turning point was not here

In a new period of financial repression, markets will ultimately determine which assets or markets qualify for “value storage”. 。

Original title: Onchain Data Update + our views on last week's FOMC and the "big picture"

Original by Michael Nadeau, The DeFi Report

Original: Bitpush News

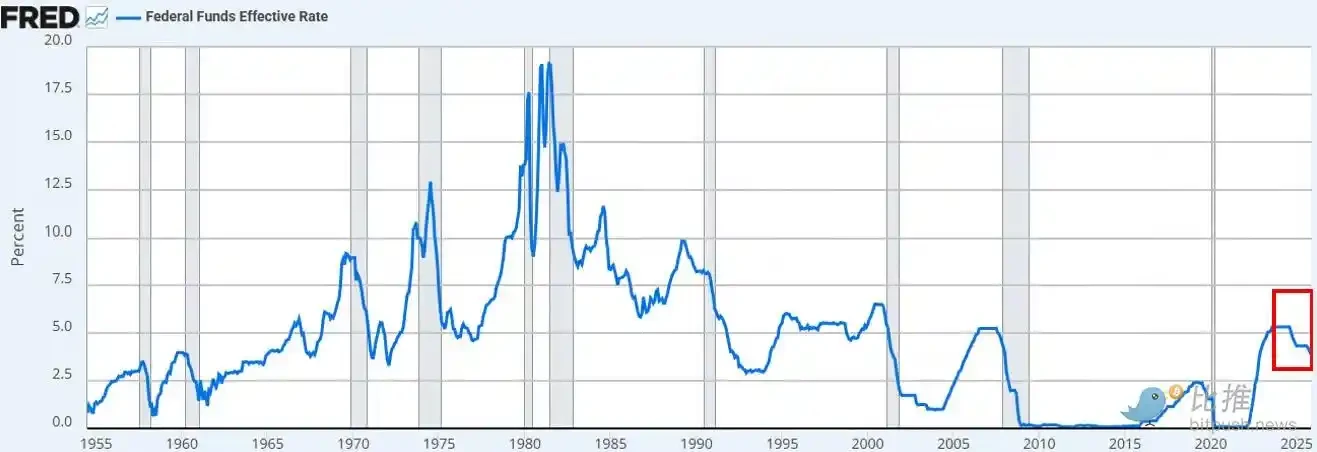

Last week, the Federal Reserve lowered interest rates to the target range of 3.5 per cent – 3.75 per cent — a move that has been completely absorbed by the market and is largely expected。

The real surprise to the market is that the Fed announced that it would buy $40 billion a month in short-term national debt (T-bills), which was quickly posted by some people."Light QE (QE-lite)@Leaves: #Feb14。

In today's report, we will analyse in depth what this policy has changed, and nothing has. In addition, we will explain why such a distinction is essential for risk assets。

Let's get started。

1. "short-term" layout

The Fed's interest rate fell as scheduled. This is the third time this year, and the sixth since September 2024. Total interest rates have been reduced by 175 basis points, bringing federal funds interest rates to a minimum of about three years。

In addition to the interest rate cuts, Powell announced that the Federal Reserve would start in December with the "Reserve Management Purchases" short-term national debt at $40 billion a month. This initiative is fully anticipated, given the continuing strain on the buy-back market and the banking sector。

THE CONSENSUS VIEW OF THE MARKET (WHETHER ON PLATFORM X OR ON CNBC) IS THAT THIS IS A "DOVE" POLICY SHIFT。

The debate over whether the Fed's announcement is equivalent to "printing" or "QE" or "QE-lite" immediately took over the social media timeline。

Our observations:

As a "market observer" we find that the psychological state of the market still favours "risk-on". In this state of affairs, we expect investors to “overcompartment” the policy headline, trying to collide the logic of rising, while ignoring the specific mechanisms by which policies are translated into real financial conditions。

Our view is that the new US Federal Reserve policy is beneficial to the Financial Market PipelineBut it's not good for risk assetsI don't know。

What's the difference between us and the market

Our views are as follows:

:: Short-term public debt purchases

The Fed purchases short-term treasury bills (T-bils) rather than long-term debt service bonds (coupons). This did not remove the interest rate sensitivity of the market (long term)。

:: Long-term rates of return are not suppressed

While short-term purchases may slightly reduce future long-term bond issues, they do not help to compress term premiums. About 84 per cent of national debt is now issued with short-term instruments, so the policy has not substantially changed the long-term structure that investors face。

:: Financial conditions are not fully relaxed

These reserve management purchases, which aim to stabilize the buy-back market and bank liquidity, do not systematically reduce real interest rates, the cost of enterprise borrowing, mortgage rates or discount rates. Its effects are partial and functional, rather than broad monetary easing。

SO, NO, IT'S NOT QE. THIS IS NOT FINANCIAL REPRESSION. IT NEEDS TO BE MADE CLEAR THAT ABBREVIATIONS ARE NOT IMPORTANT, AND YOU CAN CALL THEM BANKNOTES AT WILL, BUT THEY ARE NOT DELIBERATELY DESIGNED TO CURB LONG-TERM YIELDS BY REMOVING A LONG PERIOD OF TIME – A CONSTRAINT THAT FORCES INVESTORS TO TURN TO THE HIGH END OF THE RISK CURVE。

THIS HAS NOT YET HAPPENED. THE PRICE TRENDS OF THE BTC AND NASDAQ INDICES SINCE LAST WEDNESDAY CONFIRM THIS。

What will change our minds

WE BELIEVE THAT THE BTC (AND, MORE BROADLY, RISK ASSETS) WILL HAVE THEIR BRIGHT MOMENTS. BUT THAT WILL HAPPEN AFTER QE (OR HOW THE FED CALLS THE NEXT STAGE OF FINANCIAL REPRESSION)。

The moment comes when:

• The Fed is artificially inhibiting the long end of the yield curve (or sending signals to the market)。

• Lower real interest rates (due to anticipated inflation)。

• Reduced cost of enterprise borrowing (enabled the Technology Unit/Nasdac)。

:: Deficient term premium compression (reduced long-term interest rate)。

• A decrease in the stock discount rate (the risk asset forcing investors to enter longer periods)。

• Declining interest rates on mortgages (driven by long-term interest-rate disincentives)。

Investors will then smell "financial repression" and adjust their portfolios. We are not yet in that environment, but we believe it is coming. While timing is always difficult to grasp, our baseline assumption is that volatility will increase significantly in the first quarter of next year。

That is what we believe is a short-term pattern。

2. Magnificent situation

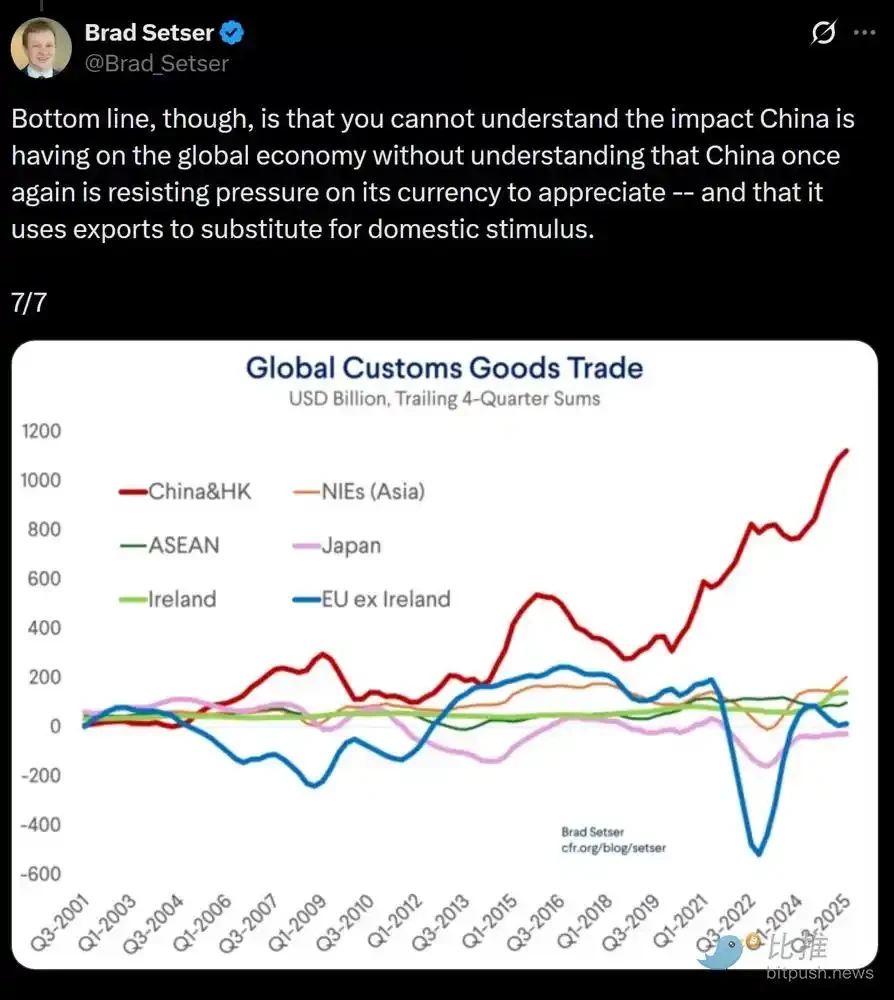

The deeper problem lies not in the Fed’s short-term policies, but in the global trade war (currency war) and the tension it creates at the heart of the US dollar system。

Why

THE UNITED STATES IS MOVING TOWARDS THE NEXT PHASE OF THE STRATEGY: A RETURN OF MANUFACTURING, A RESHAPING OF GLOBAL TRADE BALANCES AND COMPETITION IN STRATEGICALLY NEEDED INDUSTRIES SUCH AS AI. THIS OBJECTIVE IS IN DIRECT CONFLICT WITH THE ROLE OF THE UNITED STATES DOLLAR AS THE WORLD RESERVE CURRENCY。

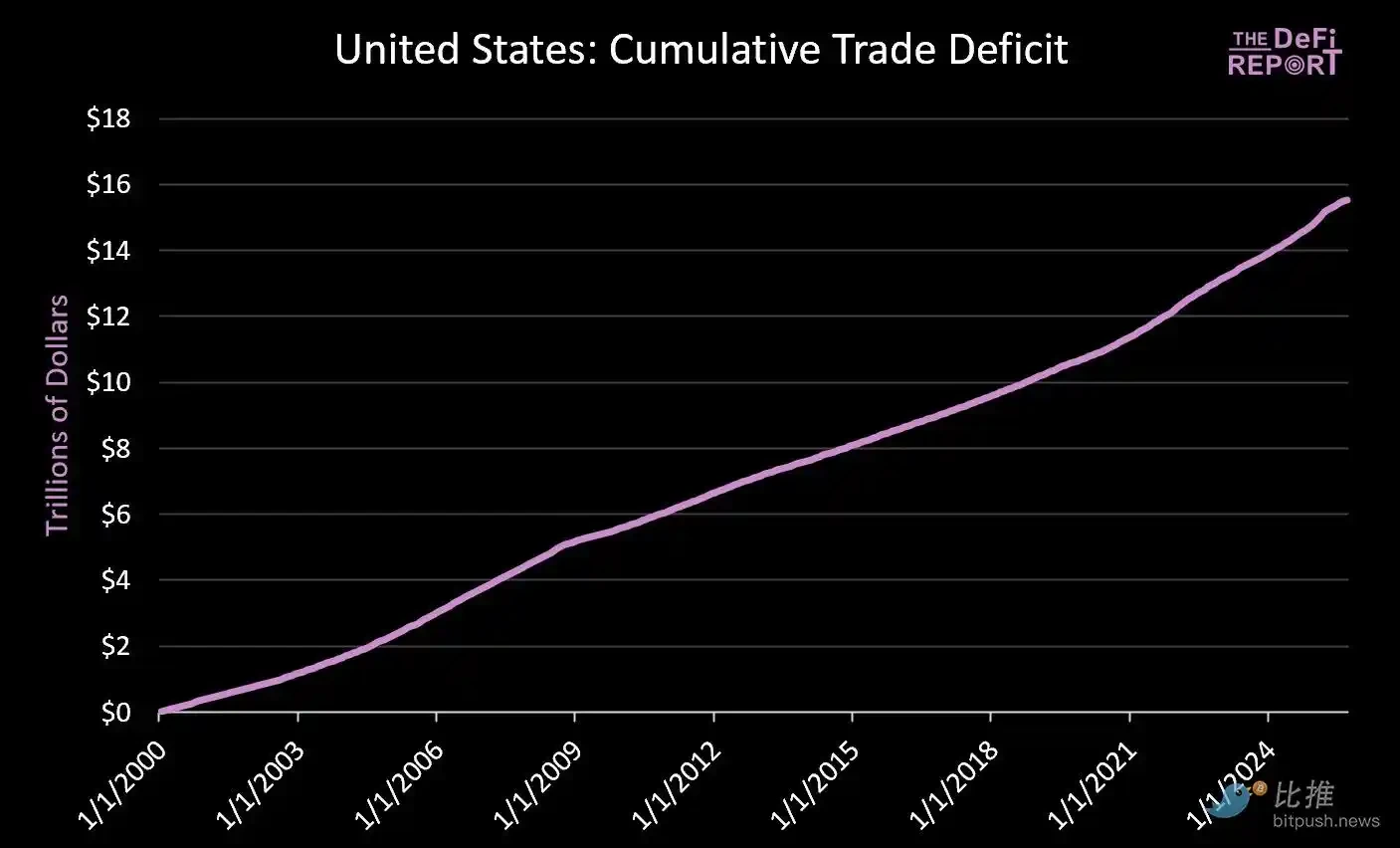

The reserve currency position could be maintained only if the United States continued to run a trade deficit. Under the current system, the United States dollar is sent overseas to purchase goods and then revolving back to United States capital markets through national debt and venture assets. This is the essence of Triffin's Dilemma。

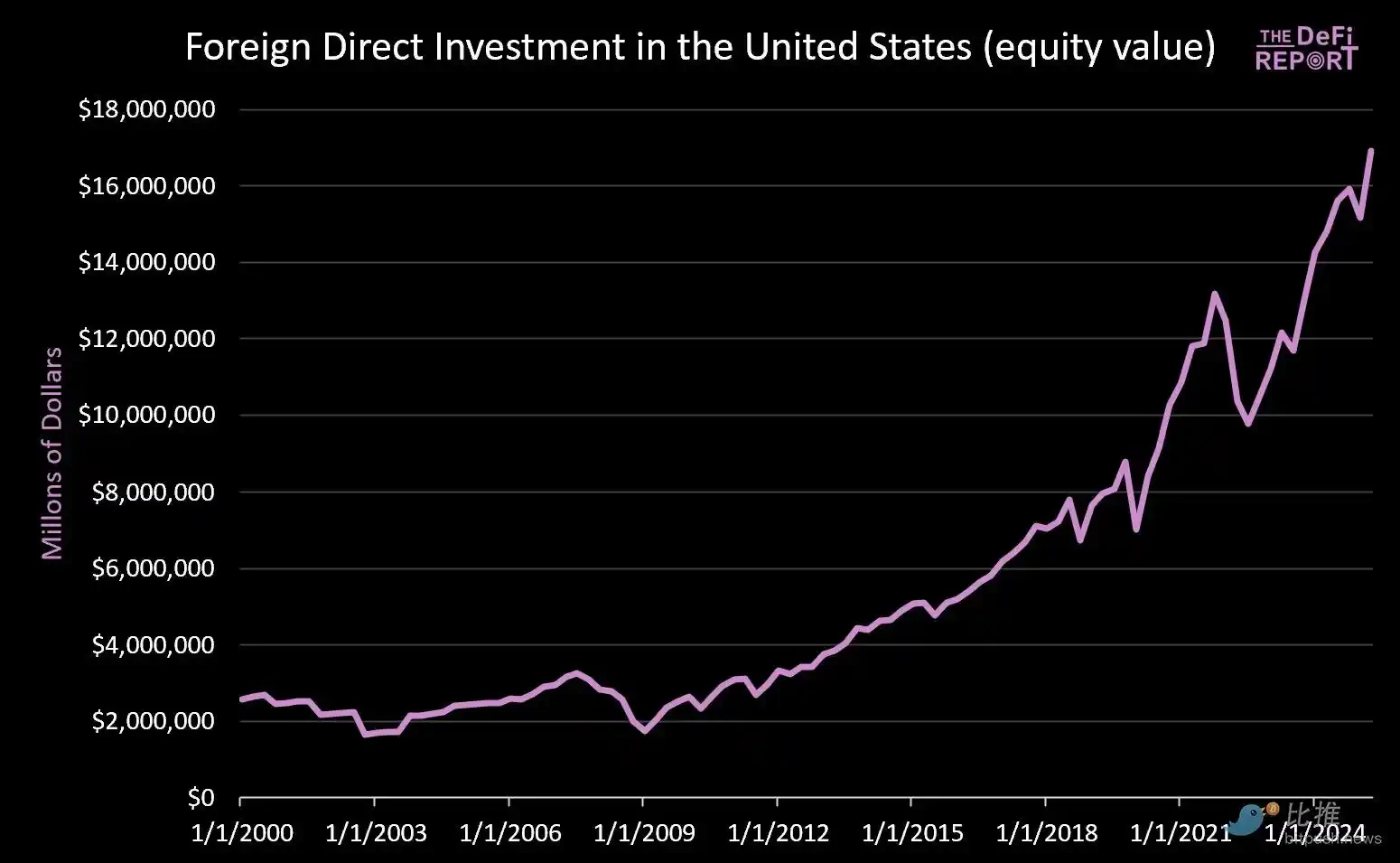

• Since 1 January 2000: US capital markets have inflowed over US$ 14 trillion (which is not yet accounted for by the $9 trillion in bonds currently held by foreigners)。

• At the same time, about $16 trillion went overseas to pay for commodities。

Efforts to reduce the trade deficit will inevitably reduce the flow of revolving capital back to the United States market. While Trump has advocated the commitment of countries such as Japan to “invest US$ 550 billion in US industry”, he has not explained that Japanese (and other countries) capital cannot be found in manufacturing and capital markets simultaneously。

We believe that such tensions will not be resolved smoothly. On the contrary, we anticipate higher volatility, re-pricing of assets and eventual currency adjustments (i.e. the depreciation of the United States dollar and the contraction in the real value of the United States Treasury debt)。

The core view is that China is artificially lowering the RMB exchange rate (which gives its exports an artificial price advantage), while the United States dollar is overestimated by foreign capital investment (which leads to relatively low prices for imported products)。

We believe thatTo address this structural imbalance, a mandatory depreciation of the United States dollar may be imminentI don't know. In our view, this is the only viable way to address global trade imbalances。

In a new period of financial repression, markets will ultimately determine which assets or markets qualify for “value storage”。

The key question was whether the United States Treasury debt would continue to play the role of global reserve asset when everything was settled。

We are convinced that Bitcoin and other global, non-sovereign storage vehicles of values, such as gold, will play a much more important role than they are today. This is because they are scarce and do not depend on any policy credibility。

This is what we see in the macro-formulation。